Written by: Jiang Zhuoer

It has been a long time since I talked about cryptocurrencies. Today, the crypto market experienced the largest liquidation in history, which deserves a separate article.

I. Liquidation Timeline

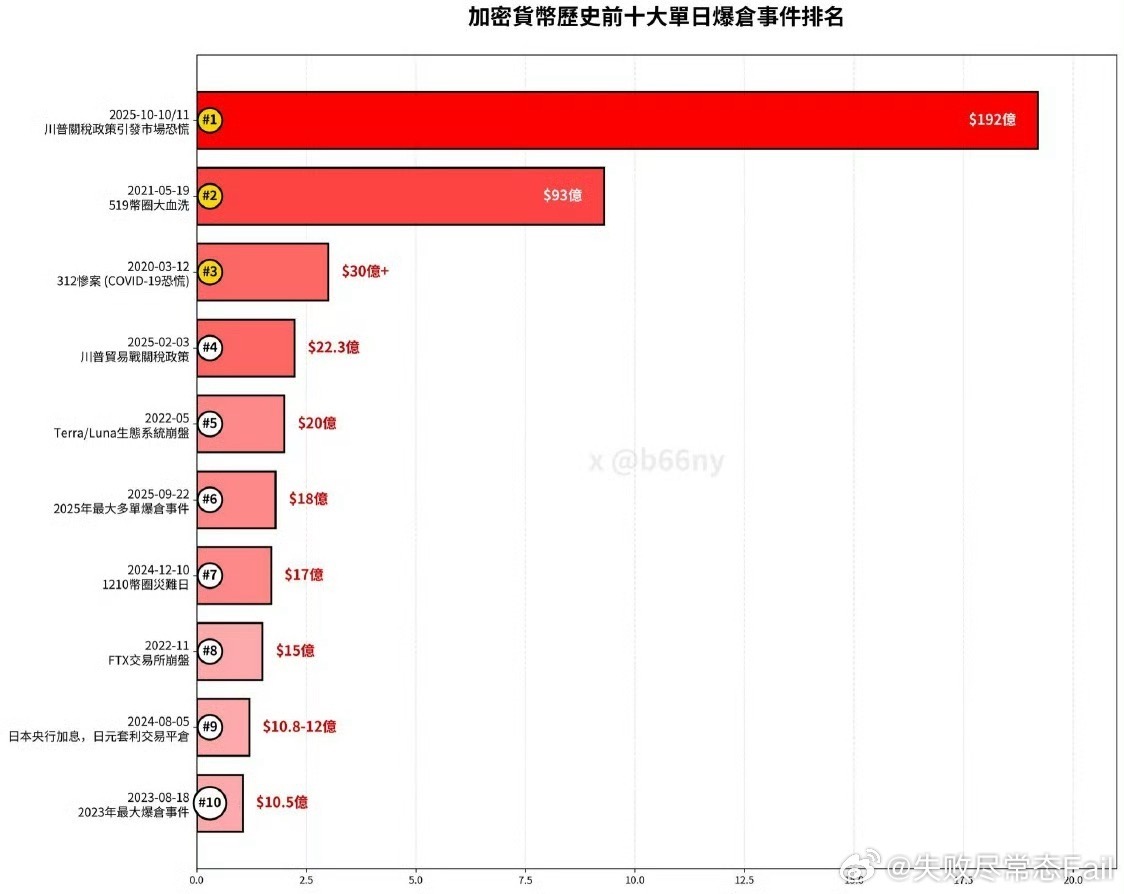

The scale of this liquidation is greater than the 519 crash in 2021 (19.2 billion USD vs 9.3 billion USD), but the daily maximum drop for BTC and ETH is less than that of 519. BTC dropped 30% (519) vs 16% (this time), and ETH dropped 44% (519) vs 21% (this time). This indicates that the influx of capital into the crypto market has further increased, leading to a decrease in volatility and an increase in the leverage ratio of crypto traders.

The steps of this liquidation are:

On October 9, China retaliated against the recently amended U.S. defense authorization bill regarding chip licensing and the new shipping fee policy effective in October by increasing long-arm jurisdiction on rare earth exports.

On October 10 at 10:57 PM (Beijing time, same below), Trump claimed on Truth Social that he would significantly increase tariffs on China, causing a sharp drop in U.S. stocks (11 PM to 4 AM) similar to the tariff war in April, with the Nasdaq dropping 3.56% in a single day.

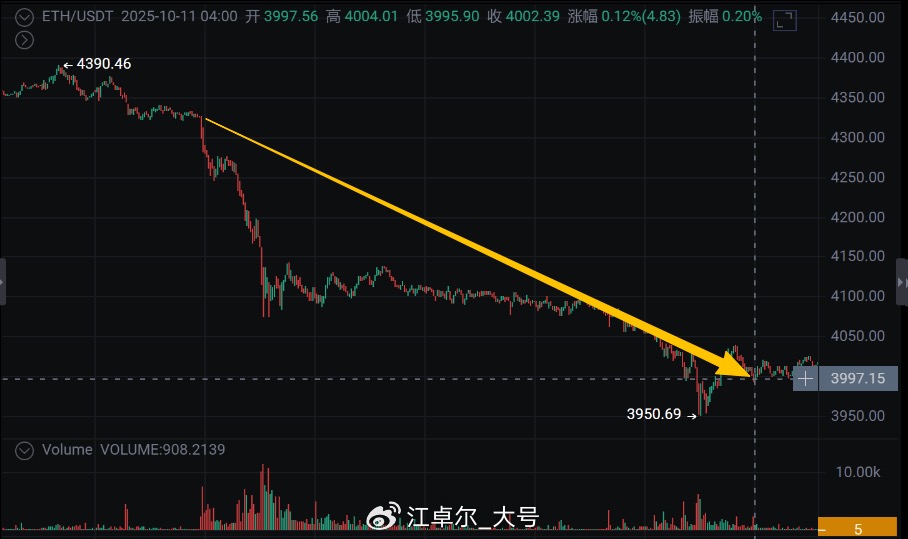

At the same time, BTC dropped 3.77% to 116,661, and ETH dropped 7.58% to 3,998.

- The crypto market stabilized for an hour after the U.S. stock market closed. At 4:50 AM on October 11, Trump officially announced a 100% increase in tariffs on China starting November 1, 2025. BTC and ETH dropped to their lowest points at 5:20 AM, reaching 102,000 (down 15.9%) and 3,435 (down 20.6%), respectively.

Many altcoins also hit their lowest points at 5:20 AM.

- A large-scale decoupling occurred on Binance with USDe, wbETH, and bnSOL:

① USDe/USDt decoupled at 5:20 AM (the lowest point for BTC and ETH) and gradually fell to a low of 0.65 at 5:44 AM. (USDe is a synthetic stablecoin, with a total market cap only behind USDT and USDC, relying on holding ETH + opening equal short positions on exchanges to gain arbitrage profits)

② wbETH/usdt and wbETH/ETH decoupled at 5:43 AM and fell to their lowest points of 0.1045eth (wbETH/usdt) and 0.2012eth (wbETH/ETH) at 5:44 AM.

(wbETH is the collateral token for ETH staking on Binance, and bnSOL is the collateral token for SOL staking)

③ bnSOL also fell to 0.2488SOL at the same time.

II. Correction of Liquidation Reasons

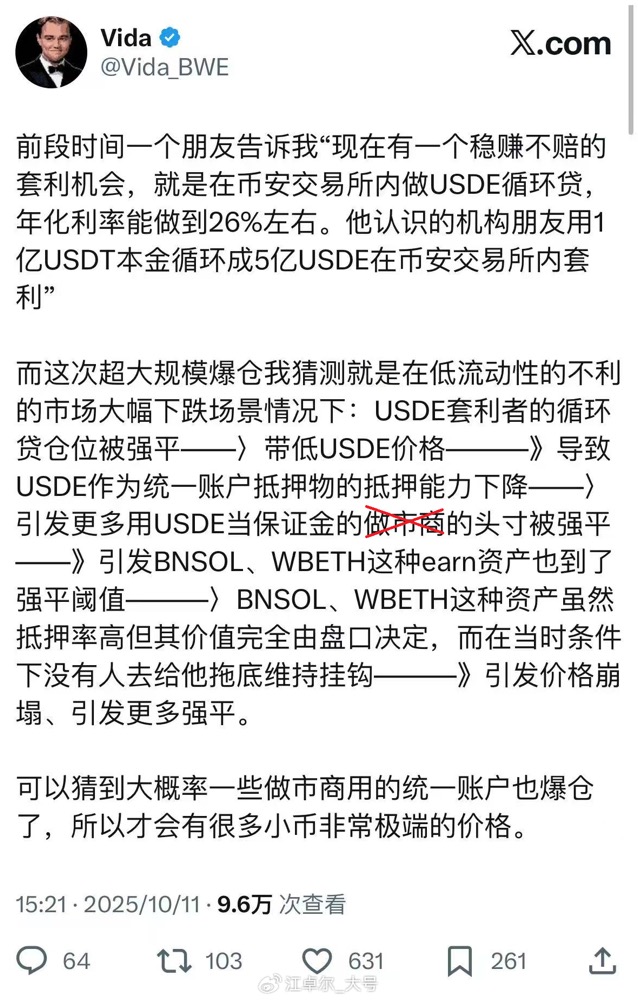

Firstly, the statement by Vida, the founder of Equation News, is incorrect.

From the analysis of the liquidation timeline above, it is clear that the transmission chain is:

- 5:20 AM BTC, ETH, and altcoins hit their lowest

- Transmission 1 → 5:20 AM USDe starts to decouple, hitting its lowest point at 5:44 AM

- Transmission 2 → 5:43 AM wbETH and bnSOL start to decouple, hitting their lowest point at 5:44 AM

The reason for Transmission 1 is that when BTC, ETH, and altcoins hit their lowest, some traders converted their idle U funds in joint margin accounts into USDe to earn interest, leading to market sell-offs of USDe for USDT during the liquidation. (Binance's activity from September 22 to October 22 offers 12% annualized yield on USDe)

After USDe slightly decoupled at 5:20 AM, it further caused USDe circular loan arbitrage traders to sequentially liquidate from high to low leverage. (USDe circular loan arbitrage traders: after converting USD to USDe for interest in the first step, they further collateralize USDe to borrow USDT, and then convert the second step's USDT back to USDe, with a 78% collateralization rate, allowing for up to 4.45 times leverage, but the more cycles, the easier it is to liquidate after USDe decouples)

When USDe hit its lowest point at 5:43 AM, it further caused wbETH and bnSOL to be liquidated, but the liquidation targets were not the market makers/arbitrageurs trading cryptocurrencies.

If it were the market makers/arbitrageurs trading cryptocurrencies, since they all hedge futures against spot, for example, when the funding rate is positive, going long on spot/shorting futures to earn the funding rate, once a large market maker/arbitrageur is liquidated, there would inevitably be abnormal movements in altcoins (reverse movements in spot/futures). However, at 5:43 AM, there were no such movements, as seen in the case of DOGE spot/perpetual futures:

At 5:43 AM, both USDT spot and perpetual futures trading were normal, so there were no large market makers/arbitrageurs trading cryptocurrencies being liquidated. The only possible liquidations that did not cause price fluctuations were from users collateralizing wbETH/bnSOL loans.

Especially those who used ETH/SOL to collateralize wbETH/bnSOL, then borrowed USDT with wbETH/bnSOL, and then exchanged for USDe for circular loans. After USDe dropped to 0.65, the overall collateralization rate was insufficient, leading to forced liquidation of their entire accounts.

This is a very scary situation. You were originally a miner who collateralized ETH to borrow U, and then had a sudden idea to stake ETH on Binance to get wbETH (while earning 2.49% ETH POS staking interest), and then collateralize wbETH to borrow USDT, which significantly reduces the interest on borrowing U.

For example, borrowing 60,000 U against 100,000 ETH (60% collateralization rate), with a 5.5% annual interest rate on 60,000 U = 3,300 U, and the annual yield on 100,000 U of staked ETH as wbETH is 2.49% = 2,490 U, resulting in an actual annual interest of only 3,300 - 2,490 = 810 U = 1.35% annually.

This suddenly reduced the annual interest rate from 5.5% to 1.35%. But young man, what is the cost?

According to Binance's 91% liquidation rate for borrowing U, with 100,000 U of wbETH, borrowing just 11,300 U would lead to liquidation. Remember, every benefit comes at a cost, and every gain carries risk.

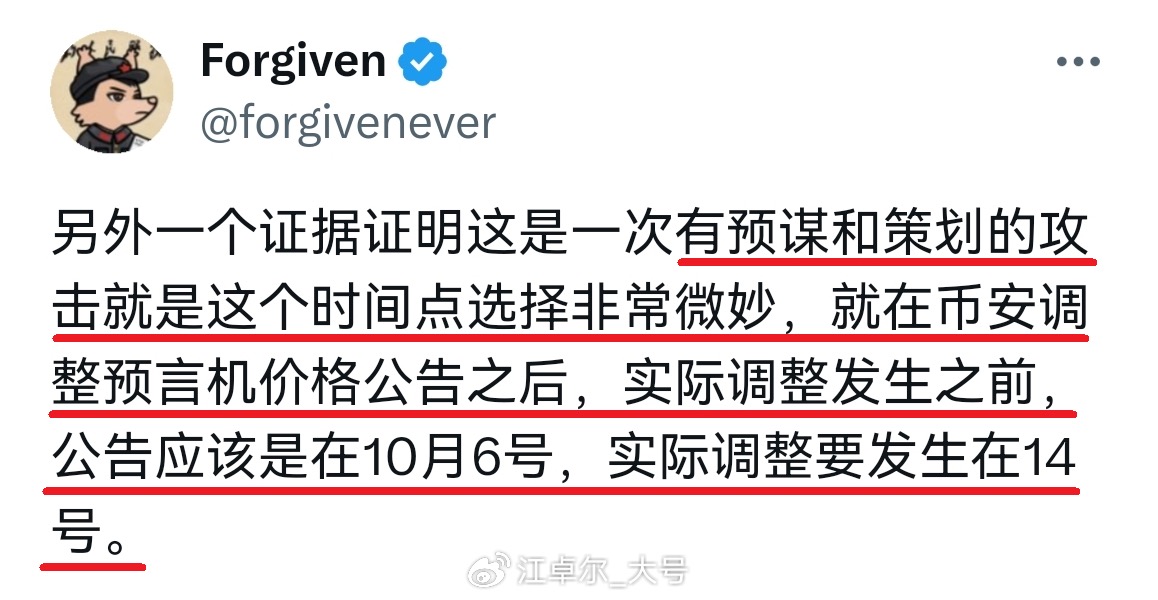

III. Was this crash an attack on Binance and a certain market maker?

This circulating viewpoint is also incorrect.

Before making any judgments, always look at the data, look at the data, look at the data. Vida, the founder of Equation News, mistakenly believes that it was a large market maker's liquidation because he did not look at the minute K-line and did not notice that the altcoin liquidations occurred at 5:20 AM, while the USDe/wbETH/bnSOL liquidations occurred at 5:43 AM. These are two different liquidations.

The error in the above image is that a simple calculation would reveal that wbETH/usdt dropped to 430.65 U/3813.49 U (the price of ETH at the lowest point of wbETH)/1.0808022 (the exchange rate of wbETH to ETH) = 0.1045 ETH.

wbETH/ETH dropped to 0.2012 ETH, and according to the old price index calculation = wbETH/usdt's 0.1045 × 80% weight + wbETH/ETH's 0.2012 × 20% weight = 0.1238 ETH; according to the new price index calculation = 100% determined by wbETH/ETH = 0.2012 ETH.

After the improvement, the wbETH liquidation from borrowing 11,300 U only increased to 18,300 U. These two calculation methods are roughly equivalent, and the fundamental problem remains the insufficient liquidity of wbETH.

IV. Binance's Responsibility

wbETH and bnSOL, as certificates issued by Binance for staking, also share profits (ETH 2.89% POS staking yield, Binance takes 0.5%, users receive 2.39%). Binance has the obligation to maintain their liquidity and peg.

The absurd situation where the exchange rate drops to 0.1x falls under Binance's responsibility. The modification of the price index algorithm (from 80% wbETH/USDT + 20% wbETH/ETH to 100% wbETH/ETH) is merely a minor optimization. The daily trading depth of wbETH/ETH being over 2,000 ETH cannot prevent serious decoupling incidents from happening again.

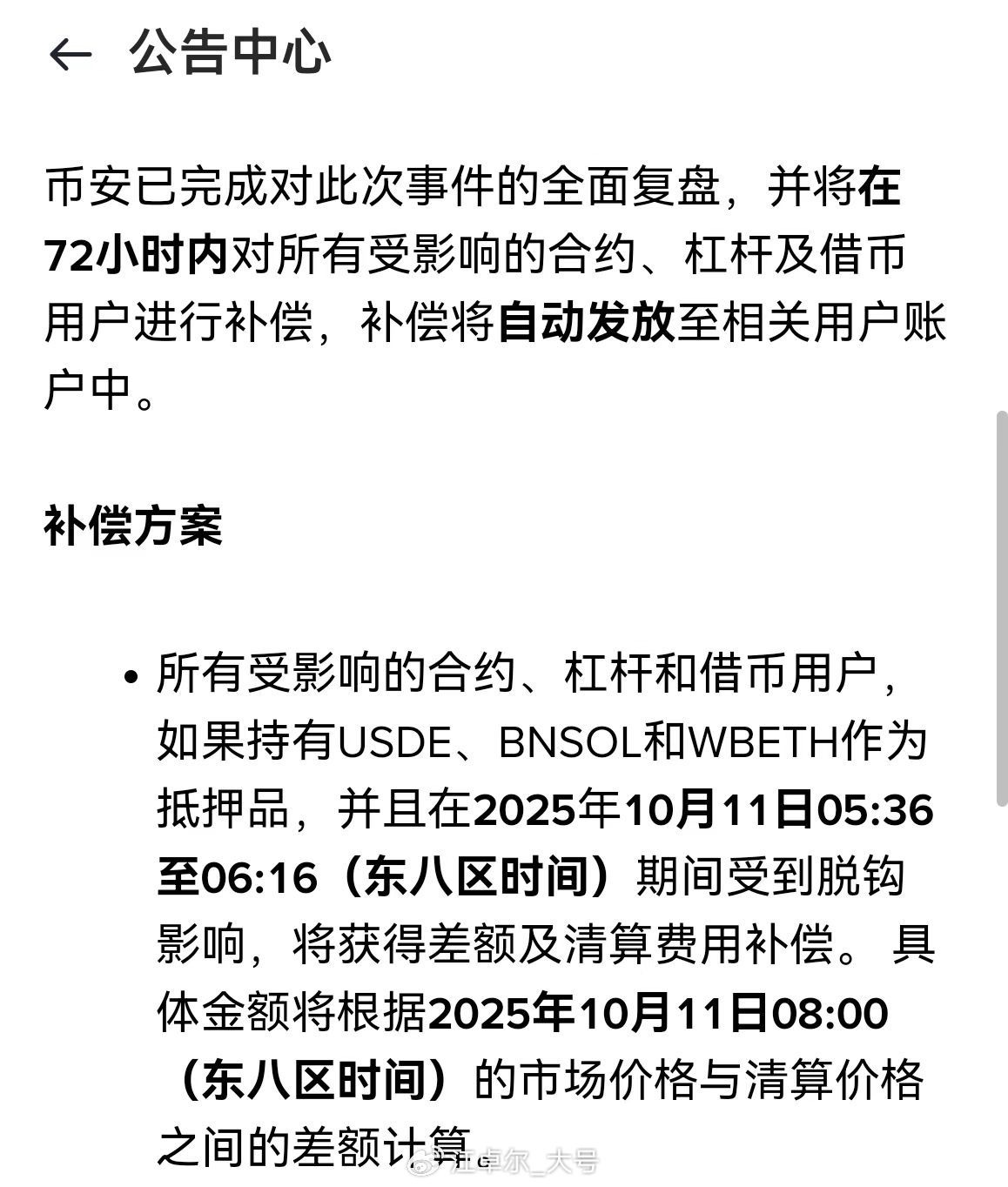

Binance's compensation for the losses from abnormal trading of USDe, wbETH, and bnSOL (compensating the difference between the low selling price and the trading price at 8 AM on the 11th) is commendable, but the measures taken are not sufficient to completely prevent future decouplings. It is recommended to set a hard floor for the ETH/SOL exchange rate when calculating value (for example, 0.8).

V. Market Outlook

It's too late, I need to sleep. I'll write more tomorrow. :)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。