Finally had some time to completely sort out the entire process of this epic decline, so consider this today's homework. A large-scale popular science article, with a lot of unnecessary talk, not recommended for reading.

PS: All my articles are typed out by me word by word. You can try to find an AI to write my daily output.

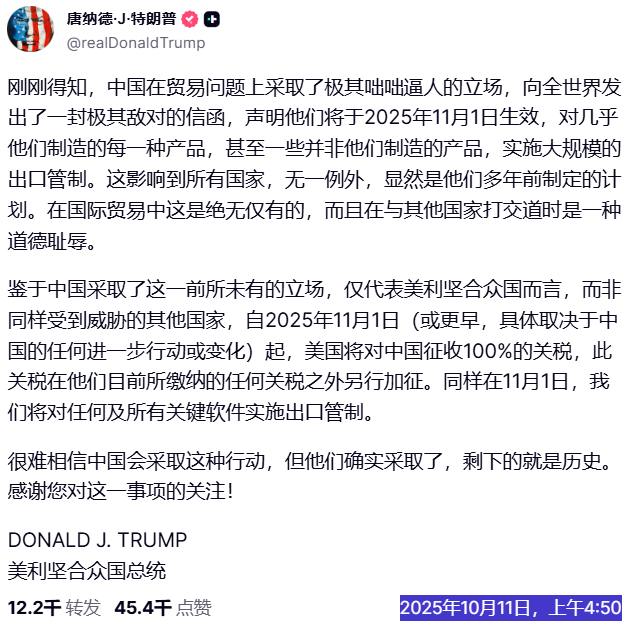

The trigger was Trump's new round of tariffs on China, which added an additional 100% on top of the existing tariffs. So, starting from November 1, the tariffs from the U.S. on China will be between 130% and 150%, and China has not yet made a statement. (I don't know if I missed it)

This event occurred at 4:50 AM Beijing time on October 11. At this time, the U.S. stock market had already closed, and liquidity began to retreat, so the 24/7 cryptocurrency market was directly impacted. The reason was that the market was worried that Trump's tariffs would trigger another tariff war with China, leading to continued inflation in the U.S., and the Federal Reserve would reassess interest rate cuts. This has been said a hundred times.

Then there was the decline and liquidation, including $BTC and $ETH. Many friends believe that the liquidation was caused by the USDe's circular lending. I initially thought so too, but after asking some friends, USDe might be one of the factors, but it shouldn't be the most important one.

The heaviest liquidation this time should be $WBETH, which is the staked form of ETH on Binance. Because the yield on ETH is very low, many friends convert ETH into WBETH to earn a 3% annual yield. The same reasoning applies to $BNSOL.

An important point about these two tokens is that many holders are reluctant to sell their positions but need money for arbitrage or other short-term trades, so collateralized lending is the best choice. The net annualized rate for these two tokens is 5.56%, but since they both have yields, for example, WBETH has a 3% ETH yield, the actual interest rate is 2.56%, which is quite low.

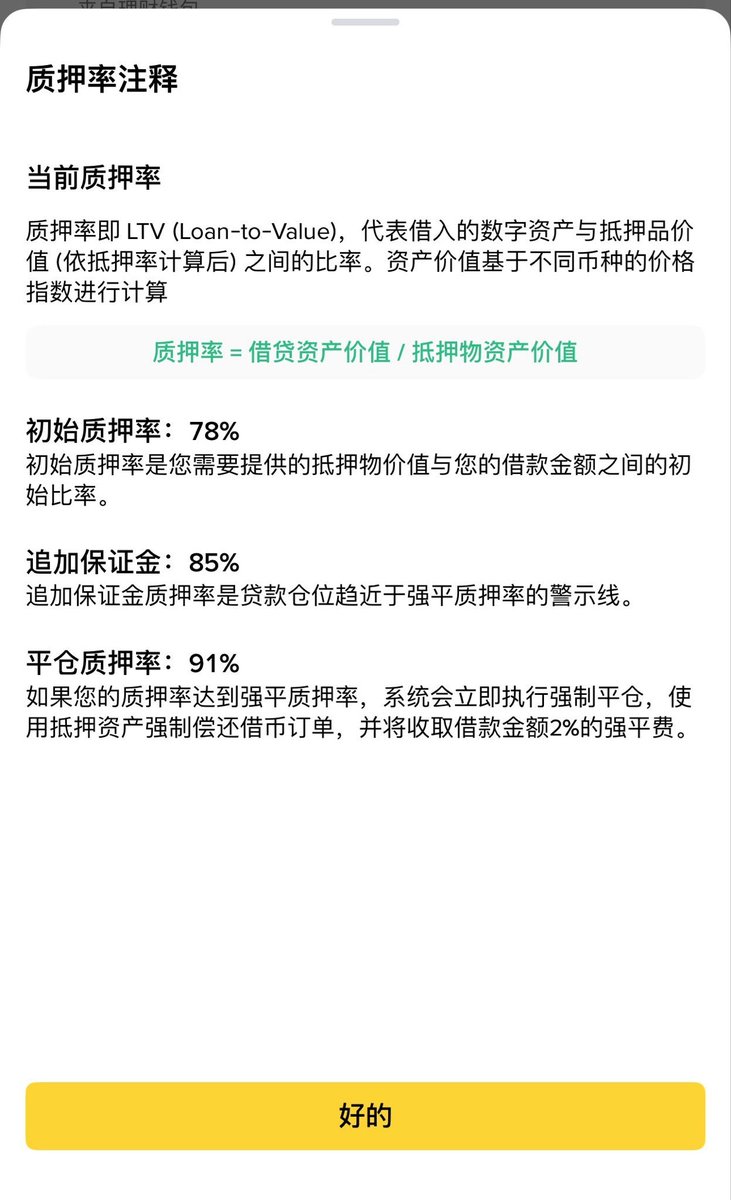

The standard initial collateralization rate is 78%, which means if you have $100,000 worth of WBETH or BNSOL, you can borrow up to $78,000. Do you think liquidation will only happen when it falls to $78,000? That's a misconception. In fact, liquidation will occur when the collateralization rate reaches 91%, and you will also be charged a 2% fee.

This means that when your collateral drops from $100,000 to $78,000 / 0.85 = $91,765, you will receive a margin call.

When the collateral drops to $78,000 / 0.91 = $85,714, liquidation is triggered, and a 2% forced liquidation fee on the borrowed amount will be charged: $78,000 × 2% = $1,560.

Ultimately, your remaining amount = collateral asset value - loan - fees

= $85,714 - $78,000 - $1,560 = $6,154

Therefore, you can only receive assets worth $6,154 at the time of your collateral. When the lending agreement ends, you will have received a total of $78,000 + $6,154 = $84,154, but this is just theoretical data; in reality, it can be much worse, and this was one of the most important links in the liquidation caused by this decline. Because triggering liquidation also takes a few seconds, if the price of the collateral has already dropped below $85,714 during that time, your remaining amount will decrease until it reaches zero, and any negative amount after zero will have nothing to do with you.

So to be safer, for example, I operate at a 50% loan-to-value ratio, meaning that for $100,000 worth of assets, I only borrow $50,000. This means that my collateral must drop by 55% before I get liquidated. This is possible, but generally, it doesn't happen all at once.

Having rambled on about these basic concepts, let's return to this liquidation. The decline in BTC caused by Trump naturally led to declines in other ALT assets. Why is that? It's a bit complex, so let me explain simply:

The vast majority of cryptocurrency valuations, capital flows, and trading pairs are priced based on BTC or USDT. In terms of trading structure, many altcoins (ALTs) are not directly traded against USD but rather against BTC. So when BTC drops against USD, even if ALTs remain stable against BTC, they will still drop against USD.

In terms of investment structure, institutions or large holders generally use BTC as a position benchmark. When BTC's price declines, they will reduce their entire crypto portfolio. In algorithmic trading, quantitative strategies often use BTC as a "beta reference," and the price models of ALTs will automatically follow BTC's fluctuations.

So when Bitcoin drops, the prices of other ALTs will also drop. This is a safe operational mechanism. At the same time, BTC has the best depth and liquidity in the market, while many small coins lag significantly. For example, selling $1 million worth of BTC in the market might cause a 0.01% drop in BTC's price, but selling the same amount in ALTs might lead to a 1% drop. This is the difference in depth.

Especially this time, the explosion occurred not only after the U.S. stock market closed but also on the weekend, which is when liquidity is the worst. Therefore, investors estimated that this could lead to a large-scale correction, increasing the selling pressure, and it all happened at the same time, so ALTs faced much greater pressure than BTC.

As mentioned earlier, collateral worth $100,000 would likely be liquidated when it reaches around $85,000, meaning that when it drops by 15%, the highest portion of the loan-to-value ratio will be sold off, and the sale will be executed at market price. This is very unfriendly for friends in the Asian time zone because it happened while they were sleeping, around 5 AM, with a significant drop continuing until 5:26 AM, lasting a maximum of 36 minutes.

Even if you have money, if you don't repay within those 30 minutes, you might get liquidated. So why did ETH and WBETH decouple?

As mentioned earlier, many friends converted ETH to WBETH because of its higher yield. Therefore, the lending used is WBETH instead of ETH. During the liquidation sale, WBETH was not converted back to ETH before being sold; it was directly sold to the market, causing WBETH's price to drop sharply in a short time. Moreover, it's important to note that ETH is a network-wide asset, while WBETH is unique to Binance.

Thus, in terms of depth, WBETH cannot compare to ETH. Therefore, during the sale, WBETH's price will be lower than ETH's, leading to the decoupling. Of course, when decoupling occurs, there will inevitably be bots coming in to pick up bargains, especially since WBETH is a 1:1 stake of ETH, re-pegging is just a matter of time. So picking up bargains is the safest move, but unfortunately, when an avalanche occurs, the speed of the bots picking up the bottom cannot keep up with the speed of the sell-off.

As a result, it turned into a cycle of explosions, starting from a 15% drop and continuing downwards. For example, this time WBETH dropped to a low of $800, representing an 80% decline, meaning that borrowers with $100,000 in assets borrowing over $20,000 were all liquidated, and it can even be said that the vast majority of borrowers were liquidated.

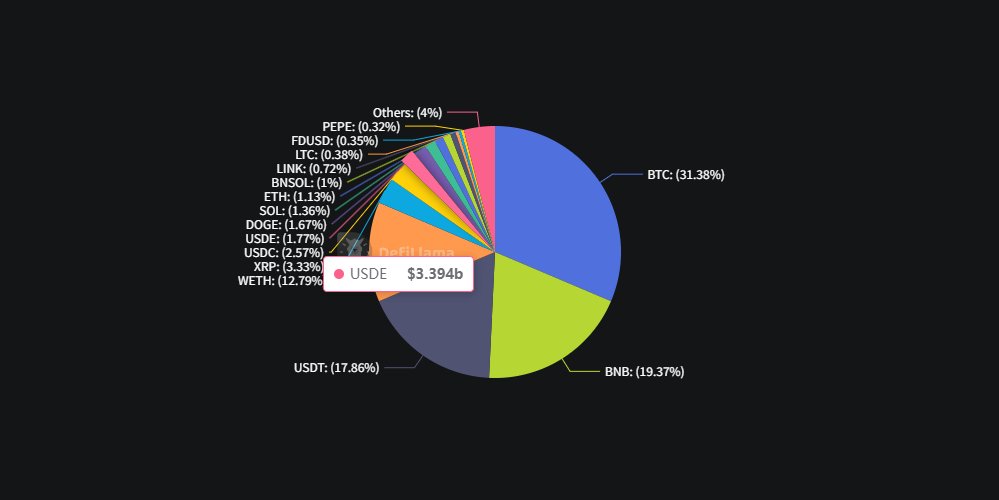

Some friends might say, "Yes, it's these people who went for USDe's circular lending, which led to the liquidations." First of all, USDe does not occupy a large share on Binance, peaking at only $4.7 billion, which is less than 2%. Although I don't know all the data, compared to a 1% monthly yield, more staking would have other options, such as Booster offering yields exceeding 17%.

Moreover, this time's trigger must be due to circular lending. If it were just staking to obtain USDe, it would be hard to consider it circular lending. Also, USDe in lending does not enjoy the 12% interest, so you cannot use USDe as collateral to borrow more USDe. In other words, USDe already in lending does not enjoy the 12% interest, so if you want to earn 12%, you cannot obtain more USDe through USDe's circular lending.

So I think the issue lies more in the infinite circular lending of other shell assets. For example, borrowing $50,000 against $100,000 of WBETH, then continuing to buy WBETH, and borrowing another $30,000 to buy more WBETH. This cycle maximizes WBETH's yield, equivalent to spot leverage, and then using the last borrowed funds to hedge against the risk of spot declines is a relatively popular circular lending scheme.

In essence, this phenomenon is normal and unavoidable. It can only be said that the current market is highly consistent with the macroeconomic market in the U.S. A single statement from Trump can turn the risk market upside down. It is estimated that when the U.S. stock market opens on Monday, it will also decline, although the sentiment may be a bit better. However, cryptocurrencies are on the front line of the impact, and the leverage in lending will not disappear. It may scare many investors in the short term.

But over time, people will forget the pain after healing the scars.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。