On October 11, 2025, this date will be etched into the annals of cryptocurrency history. Influenced by U.S. President Trump's announcement to restart the trade war, global markets instantly entered panic mode. Starting at 5 AM, Bitcoin began a nearly unsupported cliff-like drop, and the chain reaction quickly spread throughout the entire crypto market.

According to Coinglass data, the total liquidation across the network reached a staggering $19.1 billion within the past 24 hours, affecting over 1.6 million people—both the amount and the number of people set new historical records for cryptocurrency contract trading in the past decade. Some people spent the night sleepless, while others saw their accounts wiped out overnight, as the crypto world once again staged a "doomsday reboot" amidst the tumult.

However, why was this liquidation so severe? Has the market hit the bottom? Rhythm BlockBeats compiled the views of several market traders and well-known KOLs, analyzing this epic liquidation from the perspectives of the macro environment, liquidity, market sentiment, and more, for reference only.

CZ: Buy the Dips

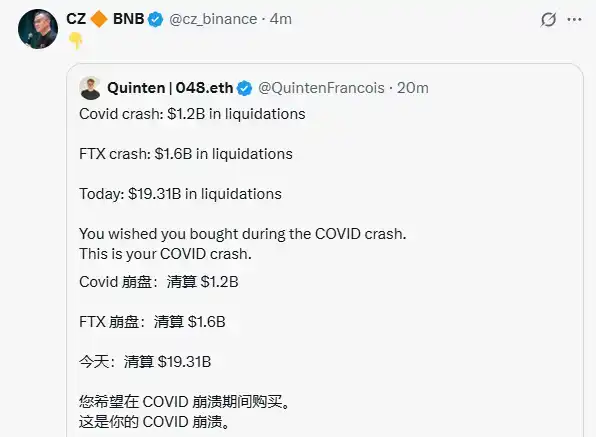

On October 11, CZ retweeted the views of Quinten, co-founder of weRate, on social media:

"During the COVID crash, $1.2 billion was liquidated; during the FTX crash, $1.6 billion was liquidated; today, $19.31 billion was liquidated. People hope to buy in during this crash just like they did during the COVID crash."

Yili Hua (Founder of Liquid Capital)

On October 11, Yili Hua, founder of Liquid Capital (formerly LD Capital), stated that the institution has not yet bought the dip and needs to patiently wait for the situation to clarify, as the drop far exceeded previous expectations. This is the first time since calling for ETH that they have fully liquidated (on-chain disclosure); previously, they only borrowed leverage. There are several reasons to mention:

- First, Bitcoin reached a new high resistance level and needed to correct without significant positive breakthroughs.

- Second, U.S. stocks hit new highs, and AI and semiconductor companies played a capital game that could not sustain.

- Third, with Japan about to change its Prime Minister, the risk of interest rate hikes has increased, and rates have been rising.

- Fourth, altcoins in the crypto space have been declining, and MEME frenzy has drained liquidity.

Vida (Founder of Equation News)

On October 11, Vida, founder of Equation News, posted on social media: "A friend told me recently that there is a risk-free arbitrage opportunity now, which is to do USDE circular loans on Binance, with an annualized interest rate of about 26%. An institutional friend he knows turned $100 million USDT into $500 million USDE through circular loans on the Binance trading platform."

Vida explained that this massive liquidation is speculated to have occurred under adverse market conditions with low liquidity:

- The circular loan positions of USDE arbitrageurs were forcibly liquidated.

- This led to a drop in USDE prices.

- Resulting in a decrease in the collateral capacity of USDE as a unified account collateral.

- Triggering more positions of market makers using USDE as margin to be forcibly liquidated.

- Causing assets like BNSOL and WBETH to also hit liquidation thresholds.

Although assets like BNSOL and WBETH have high collateral rates, their value is entirely determined by the market, and under those conditions, no one was there to support them, leading to price collapses and further liquidations. It can be inferred that many unified accounts used by market makers also faced liquidation, which is why many small coins experienced extremely drastic prices.

Kyle (Researcher at DeFiance Capital)

On October 11, Kyle, a researcher at DeFiance Capital, posted on social media that based on current market sentiment, the last time such a situation occurred was during the FTX or Celsius crashes. This drop can essentially be considered a "cycle-ending event," yet BTC and ETH surprisingly remained stable. The evolution of the crypto industry complex is indeed astonishing, but altcoins are clearly repeating the same tragedy—despite my repeated warnings over the past few months, I did not expect it to be this severe.

In summary, this is not the "best" time to buy the dip, but it is definitely a time when one "should" buy the dip. Extreme panic has been released, and the market is building a bottom, although there may still be room for further declines. Looking at the bigger picture, we are definitely closer to the bottom than to the top. Choosing assets at this moment is crucial, as many projects may never recover.

Benson Sun (Crypto KOL, Former FTX Community Partner)

On October 11, crypto KOL and former FTX community partner Benson Sun posted on social media that many altcoins dropped over 60% early this morning. In the past, extreme liquidation events typically ranged from $1 to $2 billion, but this time the scale expanded tenfold. It is reasonable for the crypto market to follow the decline of U.S. stocks, but the massive short-term evaporation of market value in altcoins is unusual and does not resemble a normal liquidation caused solely by excessive leverage.

It is more akin to large market makers actively withdrawing liquidity, causing the market to suddenly fall into a deep vacuum. The decline in altcoins was even more severe than during the 312 and 519 events. This round of deleveraging is arguably the most thorough in the cycle. The market bubble has been completely squeezed out, and risk leverage has returned to zero. I remain optimistic about the fourth-quarter trend and will spend about a month implementing a phased investment strategy.

@ali_charts (Crypto Analyst)

On October 11, crypto analyst @ali_charts published a market analysis stating that today we witnessed the largest liquidation event in cryptocurrency history, which can only be described as a total flash crash. Approximately $19 billion in positions were liquidated in one day, affecting around 1.66 million traders. Many assets saw significant intraday declines, followed by some rebounds, but the scale of this sell-off raised serious questions about the market's position in a broad cycle.

By digging into historical data, the most recent similar event occurred during the tail end of the bull market in late 2021, shortly after Bitcoin reached its peak of $69,200. The flash crash in December 2021 wiped out over 24% of market value in a single daily candlestick, which later proved to be the beginning of the subsequent bear market. Today's daily candlestick for Bitcoin shows a maximum drop of about 17%, astonishingly similar in scale and context to the 2021 bull market crash. The similarities in both cases, where the market was at a local high, with an excessive leveraged long position wave and a chain of liquidation events, are hard for traders to ignore. While this rebound may be seen as a buying opportunity, caution is crucial. Such large-scale liquidations often signify a shift in market structure rather than a temporary decline. This event may represent a market top, after which deeper retracements may begin. If holding long positions, strict risk management is essential, and traders should ensure that stop-loss orders are activated and position sizes are controlled.

Mindao (Founder of DeFi Protocol dForce)

On October 11, Mindao, founder of the DeFi protocol dForce, posted on social media that this crash is similar to the Luna incident in that both occurred when major trading platforms began accepting illegal stablecoins as high LTV collateral, allowing risks to penetrate between trading platforms. Back then it was UST, today it is USDe; "stability" combined with high staking rates has confused most people.

When introducing illegal stable assets as collateral, the worst combination is to use market price feeds while allowing high collateral rates; coupled with the fact that CEXs do not have a fully open arbitrage environment, leading to low arbitrage efficiency, the risks are further amplified. LSD-type assets face the same problem. These assets are essentially volatile assets disguised as "stability."

Haotian (Crypto Researcher)

To be honest, the black swan event on October 11 made me, an originally optimistic industry observer, feel a sense of despair.

I originally thought I understood the current "Three Kingdoms" situation in the crypto industry, thinking that the gods were fighting while retail investors could pick up some scraps, but after experiencing this bloodbath, peeling back the layers to reveal the underlying logic, I found it was not the case.

To put it bluntly, I initially thought that the tech side was innovating, exchanges were driving traffic, and Wall Street was laying out capital, with the three parties playing their own games. We retail investors just needed to seize the timing, ride the wave of technological innovation, and when the hot topics arose, we could jump in and benefit from the influx of capital.

However, after experiencing this bloodbath on October 11, I suddenly realized that these three parties might not be competing in an orderly manner at all, but rather are harvesting all the liquidity in the market in the end?

First Force: Exchanges Monopolizing Flow, Holding the Vampire of Traffic and Liquidity Pools

To be honest, I used to think that exchanges just wanted to build large platforms, increase traffic, and expand ecosystems to make money, but the incident of USDe being liquidated in a chain reaction exposed the helplessness of retail investors under the rules defined by exchanges. The leverage levels and obscure risk control capabilities that platforms enhance to improve product service experiences are actually traps for retail investors.

Various rebate activities, Alpha, MEME launchpads, various financial circular loans, and high-leverage contract plays are emerging one after another. While it seems to provide retail investors with many opportunities to make money, once the exchanges cannot withstand the risks of on-chain DeFi chain liquidations, retail investors will also suffer the consequences.

What is chilling to think about is that the top 10 exchanges had a trading volume of $21.6 trillion in Q2, yet overall market liquidity is still declining. Where has the money gone? Besides transaction fees, there are also various liquidations. Who has drained the liquidity?

Second Force: Wall Street Capital, Entering the Market Under the Guise of Compliance

Originally, I was particularly looking forward to Wall Street entering the market, believing that institutional funds could bring greater stability to the market. After all, institutions are long-term players and can inject incremental capital into the market, allowing us to enjoy the industry dividends of the fusion of Crypto and TradFi.

However, before this crash, I saw news of large whales accurately shorting for profit, with several wallets suspected to be Wall Street structures opening massive short positions, making hundreds of millions in profit. There are many similar reports that read like insider information, but occurring during such a moment of panic makes one question why institutions always seem to gain the advantage of "front-running" before black swan events happen.

What are these TradFi institutions really doing, entering the market under the guise of compliance and bringing in funds? Are they using stablecoin public chains to bind the DeFi ecosystem, controlling the flow of funds through ETF channels, and gradually encroaching on the market's discourse power with various financial instruments? They claim it's for industry development, but what is the reality? There are too many conspiracy theories about the Trump family's profit-making that I won't elaborate on.

Third Force: Technological Natives + Retail Developers, the Caught-in-the-Crossfire Cannon Fodder.

I think this is where most retail investors and developers, the so-called builders, truly feel despair. Since last year, many altcoins have been knocked down, but this time they have directly plummeted to zero, forcing us to see the reality that the liquidity of many altcoins has nearly dried up.

The key issue is that there is a pile of technical debt in infrastructure, and the application landing has not met expectations. Developers are struggling to build, but the market simply does not recognize their efforts.

Therefore, I cannot see how the altcoin market will rise again, nor can I understand how these altcoin projects will compete with exchanges for liquidity or how they will match Wall Street institutions in terms of market manipulation power. If the market does not buy the narrative of storytelling, and if the market is left with so-called MEME gambling, it will be a decisive clearing and reshuffling for the altcoin market. Developers will flee, and the structure of market participants will be reshuffled. Is the market destined to return to nothingness? Sigh, it's too difficult!

So…..

Saying too much only brings tears. If the current "Three Kingdoms" situation in the crypto industry continues, with exchanges monopolizing and draining liquidity, Wall Street precisely harvesting profits, and retail tech players being double-killed, it will undoubtedly be a catastrophic disaster for the past cyclical play of Crypto.

In the long run, the market will only leave a few short-term winners and all long-term losers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。