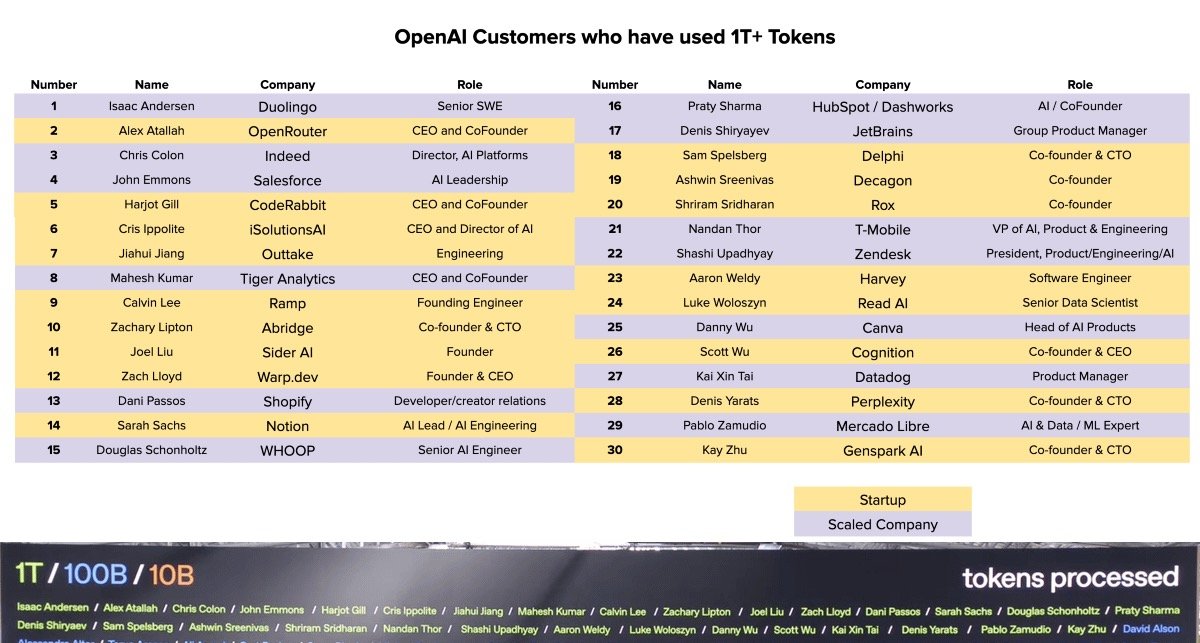

Today, the #OpenAI released this "Token Consumption Big Spender List," and I can responsibly tell you that it is a treasure map for the 2025 #AI profit route, especially in the Chinese market, replicating the logic of such companies often presents a great entrepreneurial opportunity and idea!

As an investor who has long been focused on #AI investment opportunities, after reading that list, my mind started to boil with excitement and eagerness. If I were five years younger, I would definitely gather a group of ambitious partners and start a business. This list is not about technology; it is about "who is really making money in the #AI application scenarios."

🧭 This list actually reveals two core profit rules. After reviewing it, I summarized two very essential directions:

1️⃣ "Seizing the Entry Point": Whoever occupies the high-frequency entry point for users can reap the largest traffic dividends.

This point is actually identical to the logic of the early internet. Let's recall that Baidu dominated the search entry, WeChat took the social entry, and Taobao captured the consumption entry. The current #AI landscape is the same—whoever is closest to the user's "workflow" has the best chance to monetize.

For example:

Salesforce + email assistant, locking in the enterprise sales process;

Indeed's recruitment AI, positioned in the high-frequency HR recruitment scenario;

Browser Sidebar AI (like Monica, Perplexity plugins), directly embedded in the user's browser;

OpenRoot serves as the central model for developers, firmly integrated into the engineers' daily environment;

PlayCity, a conversational search engine, directly replaces the original information retrieval methods.

These projects essentially do one thing: become part of the workflow rather than just a tool. #AI is no longer "I open it when I need it," but "I can't get my work done without it." This is the entry point logic. The closer #AI is to browsers, CRMs, and developer tools, the easier it is to become the "faucet on the pipeline."

2️⃣ "Creating a Closed Loop": Only #AI that can complete tasks deserves to be paid.

The second rule is a trend that is especially evident this year—#AI that can only chat is not valuable. Only #AI that can close the loop is valuable.

What does this mean? General chat models like ChatGPT, Claude, and Gemini are widely used, but it's hard to charge directly for them.

However, the big players on the list, such as:

Harvey (legal AI), helping lawyers review contracts and draft documents;

David AI (AI consultant), capable of executing complex decisions directly;

Jasper (AI marketing team), already able to form multi-agent collaboration, dividing tasks for calls, copywriting, and research;

Shopify Sidekick, which can directly convert natural language commands into code, automatically generating store pages, updating products, and calculating accounts.

The commonality among these #AIs is: moving from "providing information" to "directly completing tasks." More importantly, they can write the execution results back into the system, forming a closed loop. This means #AI is no longer just a "content generator," but an "automated executor." This is the direction that can truly be monetized, scaled, and covered by corporate budgets.

💡 Based on the two rules above, I see three potential tracks to pursue.

As an investor, I would reverse engineer three high-potential tracks from these two rules (entry + closed loop):

🧩 1️⃣ "From Meetings to Outputs": #AI is not just about minutes; it helps you get things done.

Currently, many meeting #AIs are stuck in the "transcription + minutes" stage, such as Fireflies, Abridge, and Read AI. But the real opportunity lies in: "After the meeting, AI helps you execute the next actions."

Here are a few simple examples:

· In the medical field: Abridge automatically generates clinical notes from doctor-patient conversations;

· In business scenarios: Read AI automatically extracts tasks, assigns responsibilities, and updates CRM;

· In education and consulting: AI automatically generates reports, sends emails, and updates documents.

This is essentially the evolution of "AI meeting assistants" into business execution #AI. I believe this is a typical low-hanging fruit, especially in the B2B scenario, where the willingness to pay is very strong.

⚖️ 2️⃣ "Vertical Industry Closed Loop": Choose the expensive, not the many.

Stop thinking about creating "general AI"; vertical closed loops are the way to go.

· Harvey deeply embeds #AI into the legal industry;

· Cresta integrates #AI into call centers;

· EvenUp and Spellbook have annual revenues exceeding ten million dollars in legal text processing.

Why can these #AI companies make millions? Because the pain points in these industries are deep enough, the willingness to pay is strong, and the closed loop is controllable. #AI that can help companies "directly save manpower, improve efficiency, and reduce risks" is the real cash flow business.

🧰 3️⃣ "Developer Toolset": #AI enters the engineer's workflow.

This area is indeed competitive, but the space is also large. Copilot has already validated the market size—Microsoft earned over $1 billion from it this year.

However, there are still many corners in the developer ecosystem that have not been covered: automatic packaging/deployment/testing; code security review; incident review/log intelligent summarization; code understanding and synchronization in multi-person collaboration.

These "low glamour, high necessity" functions are actually the parts that are easiest for companies to pay for. Major domestic and foreign companies are also investing heavily in this area because it directly impacts corporate efficiency and costs.

In summary, my observation is that #AI is transitioning from the "language era" to the "action era." If you are still stuck in applications like "AI chatting, AI copywriting," you are actually using last-generation logic to view #AI. In the coming year, when investing in the #AI field, it is crucial to observe projects that align with these core trends: from "outputting text" → "executing tasks" → "creating results."

This is also why I say that the "Token Consumption List" is a treasure map.

Because it reveals a fact: whoever is truly using #AI to work is genuinely spending money, which means they are truly making money. From 2025 to 2027, the most valuable #AI will not be the smart #AI, but the #AI that can help you get things done. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。