Written by: Will A-Wang

Commercial bank money is key to building a safer tokenized economy

— Oliver Wyman & JP Morgan

According to the JPM Kinexys official website, deposit tokens are electronic payment tools issued by banks that represent funds deposited by customers. They can be deployed on public or private blockchain networks and can be transferred between the issuing bank's direct customers and their eligible clients.

Deposit tokens can support various use cases, just like today's commercial bank money, including domestic and cross-border payments, trading and settlement, as well as providing cash collateral. Their tokenized form also brings new functionalities, such as programmability and instant, atomic settlement, thereby accelerating transaction speeds and automating complex payment operations. By supporting these use cases, deposit tokens are expected to become an important part of a broader tokenized asset ecosystem; this ecosystem is anticipated to have a significant impact on financial services and will require payment solutions provided by trusted institutions.

Although stablecoins have been an important financial innovation in recent years, driving the growth of the digital asset ecosystem, the increase in on-chain transaction activity in scale and complexity may pose challenges to financial stability, monetary policy, and credit intermediation when applied on a large scale.

By drawing on existing practices and regulatory frameworks for traditional commercial bank deposits, deposit tokens can be positioned as tools to address certain risks posed by stablecoins approaching systemic importance, thereby alleviating pressure on stablecoin issuers and preventing instability in this field. Furthermore, deposit tokens may also achieve a more seamless connection with traditional payment rails and banking services, a feature that is highly attractive to financial institutions and commercial counterparties.

JP Morgan believes that deposit tokens will become a widely used form of currency in the digital asset ecosystem, just as today's commercial bank money (in the form of bank deposits) accounts for over 90% of circulating currency. Their tokenized form will benefit from the traditional banking infrastructure and regulatory protections that have supported commercial bank deposits.

This article, leveraging research from Oliver Wyman & JP Morgan, focuses on deposit tokens, exploring their definition, use cases, and advantages. Through this focused discussion, JP Morgan aims to articulate deposit tokens as a unique type of digital currency, providing reference for current policy discussions regarding different forms of digital currency, and offering informational support to stakeholders as the industry and regulators jointly envision the role of commercial banks in the future digital currency landscape.

I. Deposit Tokens

1.1 Definition

The ongoing advancements in blockchain technology for commercial applications are giving rise to a demand for "blockchain-native cash equivalents"—assets that serve as liquidity payment means and value storage tools in a blockchain-native environment. So far, stablecoins have largely met this demand.

However, it is foreseeable that as blockchain technology is increasingly used for complex commercial transactions (including institutional-level activities), attention is turning to a question: What form of digital currency is needed to continue supporting blockchain payments on a large scale? In this context, deposit tokens and central bank digital currencies (CBDCs) have particularly become the focus when discussing the optimal forms of future digital currencies.

According to the Oliver Wyman & JP Morgan 2023 report, deposit tokens refer to transferable tokens issued on the blockchain by licensed deposit-taking institutions, representing a deposit claim against the issuer.

Recently, the Swiss Bankers Association (SBA) collaborated with PostFinance, Sygnum Bank, and UBS Group to conduct a proof-of-concept project aimed at assessing the feasibility of blockchain-based deposit tokens. Legally, this deposit token is constructed as a digital representation of a payment instruction under Swiss law, avoiding complex legal structures such as ledger-based securities or claims transfer.

It does not constitute a new form of currency, nor does it belong to crypto assets; rather, it is a standardized, programmable payment instruction used to trigger traditional deposit transactions, enabling credit or debit to accounts. Its role is not to independently carry value but to coordinate payment execution between recognized participating banks and their customers.

Similarly, according to the JPM Kinexys official introduction, deposit tokens are electronic payment tools issued by banks that represent funds deposited by customers. They can be deployed on public or private blockchain networks and can be transferred between the issuing bank's direct customers and their eligible clients.

(www.jpmorgan.com/kinexys)

Given that deposit tokens exist as a new technological form of commercial bank money, they can naturally integrate into today's banking ecosystem and are applicable under the current regulatory and supervisory framework for commercial banks. This includes existing minimum capital and liquidity requirements for banks, as well as other technical risk management regulations and supervisory requirements that control the prudential risks and operational risks faced by deposit business and related banking activities.

1.2 Deposit Tokens on the JP Morgan Kinexys Platform

(www.jpmorgan.com/kinexys)

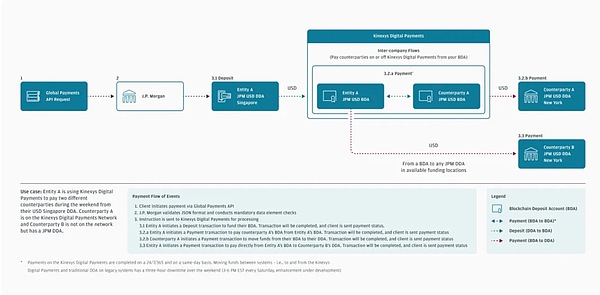

JP Morgan has launched its deposit token—JPMD—on its tokenization platform Kinexys, marking a continuation of Kinexys's ongoing innovation in the digital currency space since 2019. Initially, Kinexys launched the "Kinexys Digital Payment Blockchain Deposit Account" on a private permissioned chain, while JPMD is the first product offered by JPMorgan on a public blockchain, aimed at providing institutional clients with a digital cash solution distinct from stablecoins.

How does JPMD differ from the Kinexys blockchain deposit account? The Kinexys blockchain deposit account operates on Kinexys's own private permissioned chain and is only available to JP Morgan's institutional clients. JPMD, on the other hand, is designed for external blockchains (including public chains) and can be held by qualified downstream clients of JP Morgan's institutional clients in the future. Currently, the platform has already processed over $15 trillion in transaction volume, with approximately $2 billion in daily transactions.

What distinguishes JPMD from stablecoins? JPMD and the broader category of "deposit tokens" inherit the prominent features of stablecoins—especially the programmable peer-to-peer payment capability—resulting in a high degree of overlap in application scenarios. However, deposit tokens differ from stablecoins in key aspects such as interest calculation methods and deposit characteristics: clients can treat JPMD as a regular deposit product on their balance sheets (specific accounting treatment needs to be confirmed with auditors). Additionally, JPMD is deeply integrated with JPMorgan's traditional banking system, helping to eliminate clients' liquidity silos.

JPMD enables JPMorgan's institutional clients to participate in public blockchain transactions using an on-chain cash solution that seamlessly integrates with their existing banking infrastructure. In terms of payments, JPMD breaks through the limitations of traditional financial infrastructure, providing 24/7/365 cross-border settlement and supporting automated transaction triggers, significantly enhancing efficiency.

II. Global Digital Currency Landscape

2.1 Evolution of Digital Payment Systems

To meet the on-chain demand for stable and liquid value, various digital currency solutions have emerged, presenting different forms in terms of issuers, rights claims, reserve characteristics, and regulatory requirements. The "digital currency" referred to in this article mainly includes the following categories:

Blockchain-Based Deposits, which are deposits issued by licensed deposit-taking institutions based on distributed ledgers, including deposit tokens, and are a form of commercial bank money;

Stablecoins, which aim to maintain value stability relative to external reference assets and provide alternative value storage means for blockchain-native payments and liquidity needs;

Central Bank Digital Currencies (CBDCs), which are the digital form of national currency issued by central banks, belonging to central bank money.

As more institutions consider tokenization, other alternative digital currency solutions suitable for different scenarios may emerge, such as tokenized money market funds. This article does not exhaust all emerging alternatives but points out that the comparable considerations proposed herein are also applicable to examining other proposed digital currency alternatives.

2.2 Blockchain-Based Deposits

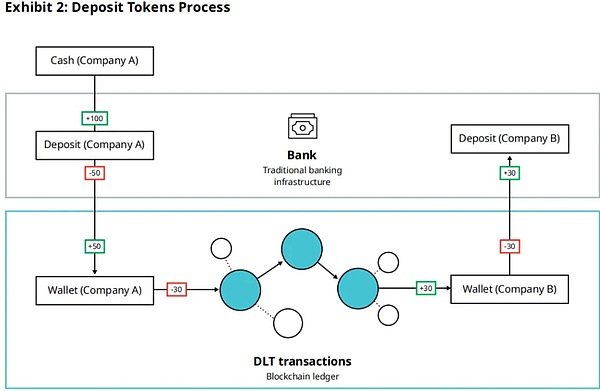

Blockchain-based deposits refer to deposit claims against licensed deposit-taking institutions recorded on the blockchain, with a specified amount. They are assets recorded in a new form, economically equivalent to existing deposits, and can be used for payments, digital asset trading settlements, and are generally used as a means of value storage and exchange on blockchain ledgers.

Utilizing blockchain technology in this manner allows commercial bank money payments to benefit from programmability, instant and atomic transaction settlements, and higher transparency regarding transaction status. These features help address common pain points in liquidity management and cross-border payments.

The goal of tokenizing deposits is to create programmable currency that can be used within a smart contract framework, enabling more efficient transactions and finer payment control. Depending on the design and structure of tokenized deposits, bank depositors can achieve interchangeability between deposits and digital asset tokens within DLT networks and their participating commercial banks. In a government voucher pilot project, DBS Bank issued digital Singapore dollars in the form of tokenized deposits.

— Monetary Authority of Singapore (MAS), Project Orchid (2022)

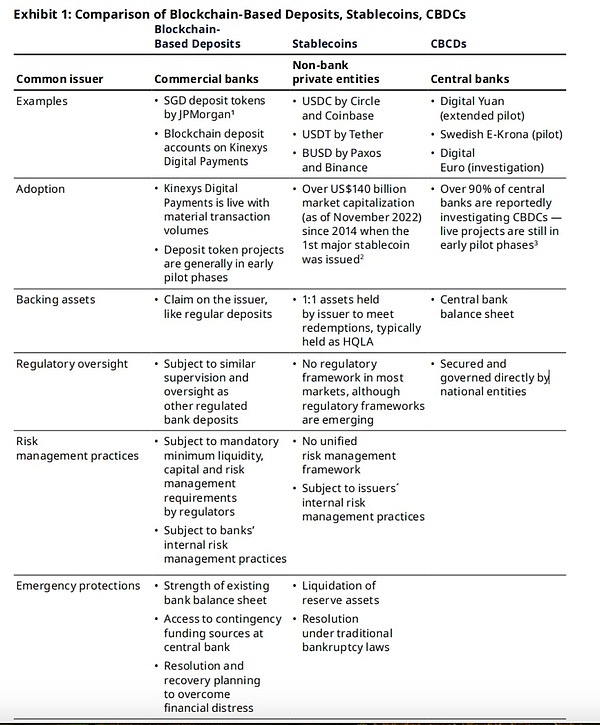

Blockchain technology-supported deposits, stablecoins, and central bank digital currencies (CBDCs) exhibit significant differences in several aspects. First, regarding the issuing entities, blockchain deposits are typically issued by commercial banks, stablecoins are issued by private entities (such as Circle, Tether, etc.), while CBDCs are issued by central banks of various countries. Typical examples include: the Singapore dollar deposit token on JPMorgan's Kinexys platform, USDC issued by Circle and Coinbase, USDT issued by Tether, and the digital renminbi piloted by the People's Bank of China and Sweden's e-krona.

In terms of adoption, most blockchain deposit projects are still in the early pilot stages, while the market size of stablecoins has exceeded $300 billion. Regarding CBDCs, over 90% of central banks are researching related projects, but actual implemented projects remain in the early pilot stage.

In terms of asset backing, blockchain deposits are similar to conventional deposits, representing a claim against the issuing bank; stablecoins are typically backed by a 1:1 asset reserve held by the issuer to meet redemption demands, with these assets mostly being high-quality liquid assets (HQLA); while CBDCs are directly supported by the central bank's balance sheet.

In terms of regulation, blockchain deposits are subject to regulations similar to traditional bank deposits, needing to meet capital, liquidity, and risk management requirements; stablecoins generally lack a unified regulatory framework in most markets, but relevant regulations are gradually being established; CBDCs are directly regulated and controlled by national entities.

In terms of risk management, blockchain deposits must comply with minimum liquidity, capital, and risk management standards set by regulatory agencies; stablecoins primarily rely on the issuer's internal risk management mechanisms, lacking a unified risk management framework; CBDCs are directly regulated by central banks, possessing national-level risk prevention and control mechanisms.

In terms of emergency protection measures, blockchain deposits can rely on the strength of the bank's balance sheet, enjoying deposit insurance and central bank rescue mechanisms; stablecoins depend solely on the liquidity of their reserve assets during settlement; while CBDCs have national-level recovery and disposal mechanisms, allowing access to emergency funding support from the central bank during financial distress.

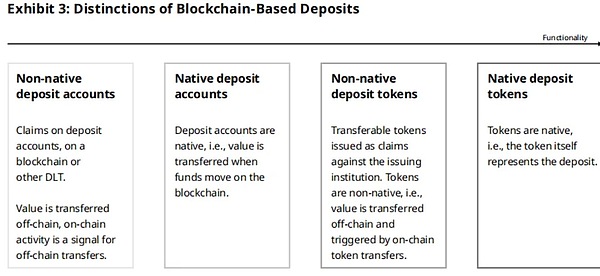

Blockchain deposits can take various forms based on how they utilize ledger technology, their partnerships, and permission requirements. They can be classified along two main dimensions:

- Whether they are account-based or token-based;

- Whether they are "native" on the blockchain.

In this article, "native" refers to value being directly recorded on the blockchain, with the blockchain being considered the primary record; "non-native" refers to value being mirrored from off-chain, with the ultimate authoritative record existing in off-chain systems.

Account-based blockchain deposits refer to deposits held by traditional deposit institutions, recorded as account balances in a blockchain-based ledger system, where the deposit institution bears liability to the account holder for that account balance; while token-based blockchain deposits are transferable tokens issued by the deposit institution on the blockchain, representing a claim against a specific amount of deposit with that institution, where the issuing institution bears the obligation to redeem the token holders for the corresponding fiat currency amount.

Native blockchain deposits use the blockchain as the primary accounting ledger, and in cases of record discrepancies, the blockchain record serves as the final authority; non-native blockchain deposits treat the blockchain as a mirror of off-chain ledgers, and in cases of discrepancies, the off-chain record serves as the final authority.

Currently, several banks and banking alliances are working on developing deposit tokens. For example, JPMorgan is piloting the issuance of Singapore dollar (SGD) deposit tokens in collaboration with the Monetary Authority of Singapore's "Project Guardian," as well as the USDF coin—this coin is planned to be launched on a public blockchain under licensing conditions for internal trading among approved bank alliance members.

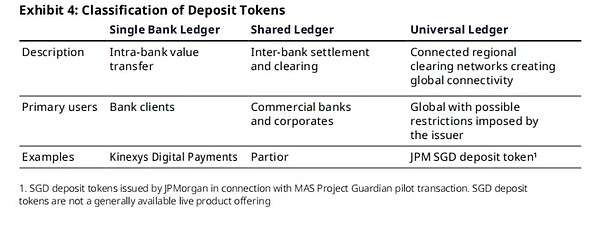

Deposit tokens can operate on ledgers with varying degrees of "access permissions" and "interoperability." If financial institutions wish to launch blockchain deposits, they can generally choose from three types of ledger designs:

- Single-bank ledger

- Shared ledger

- Universal ledger

JPMorgan's Kinexys Digital Payments is a vivid example of a single-bank ledger: this ledger is operated by JPMorgan itself, providing accounting and payment channels specifically for dollar balance transfers between its participating clients. Compared to traditional systems, single-bank ledgers (like Kinexys Digital Payments) can offer higher operational efficiency—by extending business hours and accelerating transfer speeds, even transferring funds between different accounts of the same institution globally can significantly improve the cross-regional and cross-system flow of funds.

Shared ledgers connect multiple institutions to the same network, allowing participants to interact seamlessly based on a unified set of digital assets and operational protocols, enjoying higher transparency regarding transaction statuses; however, this also requires network members to reach consensus on common standards and governance mechanisms and to maintain ongoing coordination.

Universal ledgers refer to public blockchains, maximizing interoperability by opening access to a large number of participants, but their "permissionless" nature also forces regulated financial institutions to establish additional compliance controls to create a trustworthy environment for fund transfers.

In exploring blockchain, financial institutions may operate multiple types of ledgers simultaneously. JPMorgan's deposit token concept represents the next stage in the evolution of its blockchain deposit products: previously, the bank had provided blockchain deposit accounts on a single-bank ledger through Kinexys Digital Payments and participated in co-creating the Partior shared ledger system, and now it is moving towards a new stage of deposit tokens.

Like traditional deposits, deposit tokens represent a claim against the issuing deposit institution. Therefore, they should be subject to the liquidity requirements and risk management standards set for banks that accept deposits today—these standards are designed to ensure the safety and soundness of deposits recorded in non-blockchain ways. Additionally, if the deposit institution is included in the deposit insurance system and the product meets the requirements of the insurance program, token holders can also enjoy the same deposit insurance protection.

We already have an efficient form of digital currency; we just need to adapt it to the new environment. Over the past century, the actions of central banks have created a well-functioning banking and payment system. If so, why not leverage this system to issue tokenized deposits?

Commercial banks hold deposits for customers in the form of fractional reserves, avoiding liquidity being locked up. These bank deposits support the banks' lending to the real economy and the transmission of monetary policy. Bank deposits also possess a series of other attractive characteristics: they are issued by regulated financial institutions and are protected by deposit insurance (up to $250,000), making them extremely safe. Additionally, banks assist in implementing policies aimed at reducing the risks of criminal activities (such as money laundering).”

— Staff of the New York Fed, "The Future of Payments is Not Stablecoins" (2022)

III. Use Cases for Deposit Tokens

Deposit tokens can improve many uses of commercial bank money in traditional payments and liquidity management by introducing advanced programmability features, the ability to perform atomic swaps with other digital assets, and transferring commercial bank funds on shared or universal ledgers (which can provide higher transaction transparency and 24/7 transfer services).

Whether in public chain or permissioned chain environments, deposit tokens can serve as a practical alternative to stablecoins and can be naturally launched within the regulatory and commercial frameworks applicable to modern banking. Their design goal is to meet the large-scale demand for blockchain payment technology within the established banking regulatory system (providing clarity for banks and their customers), achieving faster, lower-cost, and more advanced functional solutions. Major use cases include:

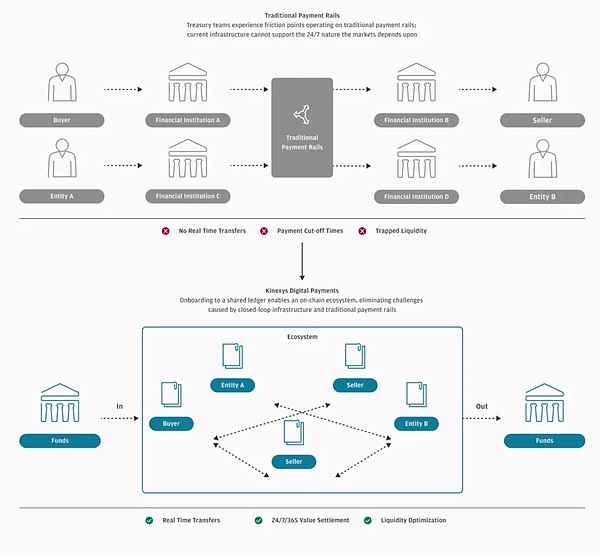

3.1 Payments

The current operational model for fund transfers separates "information flow" from "value flow," with financial institutions acting as intermediaries. Different banking systems typically need to sequentially relay instructions to facilitate the movement of funds, with the information flow always arriving at each intermediary node before the value flow. This process relies on a network composed of numerous intermediaries connecting the institution where the payer's account is located with the institution where the payee's information is held.

Deposit tokens merge the information and value transfer in payment instructions. Therefore, when deposit tokens are deployed on a shared blockchain infrastructure that connects payers and payees, it can reduce reliance on traditional third-party intermediaries—who would otherwise need to reconcile the separated value and information flows across multiple banking systems.

By eliminating the intermediary step, deposit tokens enable direct peer-to-peer transfer of funds, including interbank transfers, ultimately benefiting off-chain customers. In this peer-to-peer model, the role of banks shifts from "directly mediating and settling each transaction" to "embedding control measures in the design of deposit tokens and, where applicable, building a trustworthy fund transfer environment in their chosen issuance context."

(Kinexys Digital Payments)

For example, in the Monetary Authority of Singapore (MAS) "Project Guardian," JPMorgan executed a foreign exchange pilot transaction on a public blockchain for an affiliate of SBI Digital Asset Holdings (SBI) and issued Singapore dollar (SGD) deposit tokens for this transaction. The tokens and protocols used in this transaction were designed to prevent unknown entities from transacting with the SGD deposit tokens—both the token smart contracts and the transaction protocols were written to interact only with certain known blockchain addresses. Additionally, the deposit token smart contracts required that any authorized party initiating a transfer must include a "verifiable credential" developed by JPMorgan and provided by the issuer.

The pilot of Project Guardian demonstrates that even when providing peer-to-peer transfer tools on a public blockchain, banks can still embed control measures in the fund transfer process. Digital identity tools like the verifiable credential developed by JPMorgan can support these transfers by ensuring that transactions are executed only with verified counterparties.

Moreover, as emphasized throughout this article, the issuing bank and its regulatory environment will continue to play a crucial role in the value stability of deposit tokens—this is no different from any other commercial bank deposit currency today. Replacing the current "layered intermediaries and segmented processes" model with direct fund transfers (including direct transfers between banks) is essential for addressing pain points such as high transaction costs, trapped liquidity, lengthy transaction turnaround times, and a lack of transparency in transaction use cases.

(Kinexys Digital Payments)

Banks issuing deposit tokens are also likely to achieve interoperability between their traditional banking systems and the blockchain ledgers on which the deposit tokens are issued. In particular, institutional and corporate clients will be able to operate more seamlessly between legacy systems and blockchains, optimizing cash management and reducing "trapped liquidity" locked up due to multi-day settlements.

Deposit tokens can further support economic activities in the digital space—especially in the "Web3 economy," where a significant amount of economic activity occurs on shared ledgers, and the transfer of tokenized assets is settled through deposit tokens. The aforementioned direct, instant, and atomic peer-to-peer exchanges will facilitate this digital economy, as they no longer rely on intermediaries to separately arrange the exchange of information and value.

Cross-border payments are particularly an area where JP Morgan expects to benefit significantly from "merging information and value on shared ledgers." In 2020, global cross-border fund flows reached $23.5 trillion, costing $120 billion and taking an average of 2-3 days to settle. JP Morgan estimates that adopting multi-currency central bank digital currencies (CBDCs) could reduce costs by 80%, down to about $20 billion; deposit tokens can also release similar benefits by lowering fees, shortening settlement times, reducing counterparty risk, and enabling more direct fund transfers.

3.2 Programmable Money

The programmable features of deposit tokens can bring innovative solutions to support existing deposit businesses, such as conditional fund transfers based on specific conditions at the smart contract level, and supporting related banking services, such as intraday conditional lending decisions or interest payment disbursements.

When deposit tokens are integrated into the banking system and possess programmability, they can automate manual processes, implement complex transaction logic without human intervention, and reduce the risk of human error or delays, thus bringing new benefits. This automation not only enhances payment execution efficiency but also improves liquidity and collateral management, as well as other processes including account reconciliation. Reducing direct human involvement may also introduce new risks, such as undetected errors due to software defects and certain functional limitations. Therefore, smart contracts should be reviewed and audited, and potential issues should be corrected. Today, banking institutions routinely develop and use complex software in their service provision, and this practice is subject to technical risk management standards overseen by risk management committees. Such expertise and risk management practices also encompass the robust development of programmable solutions, just as with any other software developed or adopted by banks.

3.3 Protocol Interaction

In addition to the programmability of deposit tokens themselves, deposit tokens are also more suitable for interacting with certain smart contract protocols compared to account-based deposits. Recently, a pilot transaction conducted by JPMorgan and SBI under the MAS "Project Guardian" framework demonstrated the feasibility of deposit tokens interacting with smart contract protocols in institutional applications. This transaction utilized a modified decentralized finance (DeFi) protocol to execute a foreign exchange transaction involving SGD deposit tokens issued by JPMorgan and JPY tokenized assets issued by SBI. The use of the protocol may become another avenue for achieving certain advantages of automation and interoperability, especially in multi-party trading scenarios that require the application of common rules.

3.4 Trading and Settlement

As assets can be fragmented, transferred more conveniently, and interoperability between institutions and inter-institutional DeFi protocols becomes possible, the trading and settlement of tokenized assets on the blockchain will become increasingly important, leading to substantial improvements in market efficiency. JP Morgan has observed that the market for tokenized assets, which extends beyond cryptocurrencies, is growing and being widely researched, covering traditional securities, commodities, real estate, and even art, all of which confirm this trend:

JPMorgan's Kinexys digital asset platform has processed over $430 billion in repurchase transactions since its launch in November 2020;

The aforementioned "Project Guardian" explores the tokenization of bank deposits;

The European Investment Bank experimentally issued €100 million in tokenized bonds in 2021;

Some jurisdictions are examining regulatory frameworks to accommodate the use of tokenized assets and distributed ledger technology (DLT) in regulated financial services, such as the EU's "DLT Pilot Regime," aimed at promoting the use of DLT in the issuance, trading, and settlement of digital assets that meet financial instrument standards.

Deposit tokens provide a blockchain-native means to "atomize" transactions using commercial bank money in these increasingly robust tokenized asset markets—meaning settling transactions simultaneously and almost instantaneously—completely eliminating the risk of partially unsettled transactions due to counterparty default or inability to deliver assets. Even if a transaction does not meet the prerequisites for atomic settlement, deposit tokens can still achieve extremely fast or even instant settlements through more efficient channels, as described in the earlier payment section. The combined effect of atomic settlement and instant settlement driven by deposit tokens can shorten the time gap between asset delivery and payment, thereby reducing counterparty risk due to delays and decreasing the need for asset custody and transaction reconciliation.

The natural integration of deposit tokens with the banking industry makes them a convenient payment or settlement tool for large entities to optimize the liquidity of commercial bank money both on-chain and off-chain, allowing users to easily switch between non-tokenized deposits and deposit tokens. This integration with the traditional financial system also enables deposit tokens to be applied in complex, institutional-level scenarios—where trading parties seek high levels of assurance, customer service, and protection provided by the issuer, or where the transaction itself needs to be deeply integrated with other financial services.

JP Morgan acknowledges that for a technology typically associated with the "decentralized finance (DeFi)" movement—which aims to eliminate reliance on institutions—"integration with traditional financial services" may seem like a contradictory factor. Although DeFi is one use of blockchain and has its own active user base, JP Morgan believes that the demand for "centralized financial services that can utilize blockchain" will remain strong: whether these services are driven by considerations of operational efficiency and advanced programmability, or as a "trust anchor" for issuing tokenized assets (including currency-like instruments) on-chain. Institutional client research further supports the importance of integration with traditional finance: respondents indicated an increasing willingness to use digital cash on the blockchain, but also listed "interoperability with existing infrastructure" and "lack of reliable solutions provided by institutions" as primary concerns.

3.5 Collateral

As another form of commercial bank money, deposit tokens can also become a new tool for providing cash collateral to traditional asset markets and digital asset markets. For example, deposit tokens can be used as collateral to achieve near-instant settlement for various financial instruments (including derivatives) on the blockchain. Such collateral structures can enhance intraday liquidity by "real-time and automatically transferring collateral when relevant transactions are completed within the day."

To stimulate industry thinking on these issues, the Monetary Authority of Singapore launched Project Guardian in May 2022. The project aims to explore whether it is possible to trade tokenized real-world assets and deposits on a public blockchain using DeFi protocols in a compliant manner while maintaining financial stability and integrity.

In the Project Guardian pilot, transactions have been completed in the foreign exchange and government bond sectors: the former used tokenized deposits, while the latter used government bonds, both conducted on a public blockchain network and employing digital identity solutions and logic modified from existing DeFi protocols.

— Oliver Wyman Forum, "Institutional DeFi: The Next Generation of Finance?" (2022)

IV. Policy Considerations

Given the increasing demand for digital payments and the growth trajectory of stablecoins, public policy regarding blockchain-based digital currencies (or currency-like substitutes) should be premised on the assumption that "they may be widely used in the future and play an important role in the financial system." Policymakers and regulators need to further weigh the unique risks and benefits of each new type of digital currency and fully recognize the distinctive characteristics of deposit tokens. The following section presents policy-making considerations for new digital currencies, focusing on deposit tokens and comparing them with non-bank-issued stablecoins where applicable.

4.1 Devaluation and Run Risks

The factors that enable deposit tokens, stablecoins, and central bank digital currencies (CBDCs) to maintain value stability differ. CBDCs are stable due to the exclusive trust in the issuing central bank—namely, the sovereign government—similar to today's cash. The value of stablecoins has historically been rooted in the market's belief that the issuer can redeem them at face value, relying on disclosed reserve information and secondary market liquidity. Deposit tokens, like today's non-tokenized deposits, achieve stable value through multiple factors: the creditworthiness of the issuing bank, the bank's balance sheet and capital reserves, the regulatory environment, operational history, and (in some jurisdictions) the existence of deposit insurance.

If users cannot redeem or trade their digital currency at face value, the market price of that digital currency will fall. Similar to a bank run, once there is an actual or potential redemption risk, users may suddenly rush to redeem the digital currency issued by the institution, creating a "run" on the issuer. This, in turn, exacerbates the devaluation of the affected digital currency, creating a vicious cycle. Additionally, the real-time transparency of on-chain activities (such as redemptions) may amplify the perception of redemption risk by showcasing large redemption behaviors, triggering panic and follow-on redemptions from others.

Although major fiat-backed stablecoins have not experienced such runs, market pressures and uncertainties have forced some stablecoins to de-peg. During the de-pegging of the algorithmic stablecoin UST in May 2022, USDT's price on the secondary market briefly fell to about $0.97, and this de-pegging event itself demonstrated that a crisis of confidence can trigger a redemption run. De-pegging risks typically stem from negative sentiment in the market regarding the issuer's creditworthiness, such as excessive risks on the issuer's balance sheet, insufficient liquidity, deteriorating value of reserve assets, or insolvency of the issuer.

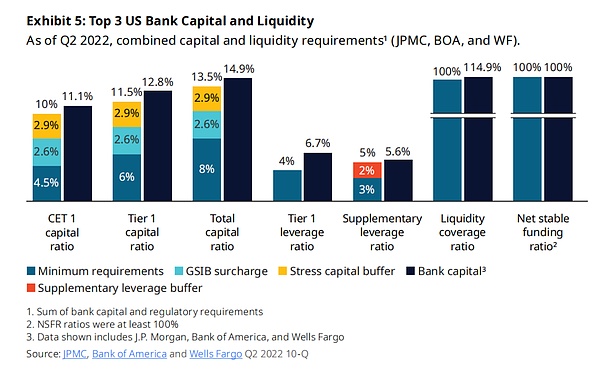

Clearly, different forms of digital currency face and manage devaluation and run risks in various ways. Deposit tokens are issued by banks, which are subject to strict minimum liquidity, capital, and risk management requirements that have evolved over decades to create a stable and reliable ecosystem. This includes:

Current minimum liquidity requirements, such as the liquidity coverage ratio (LCR), net stable funding ratio (NSFR), and multiple internal liquidity stress tests and cash requirements, which adequately consider the different liquidity and behavioral characteristics of various liabilities and asset structures under stress scenarios;

Minimum capital levels, set based on risk-weighting, leverage levels, and stress scenario requirements, serving as a buffer against sudden market and bank-specific risks. Globally systemically important banks must also meet higher minimum capital requirements, providing an additional safety cushion for their operations;

Independent risk management practices to ensure prudence in identifying and managing all financial and non-financial risk exposures;

Other protective and emergency sources, including a large and diversified balance sheet supporting deposit tokens, access to central bank emergency funding (such as the U.S. discount window, Eurozone standing facilities), and (where applicable) deposit insurance programs for deposits below certain thresholds.

Banks must always comply with the above minimum liquidity, capital, and risk management requirements— their operations are subject to regular monitoring by regulators, and violations will face severe consequences. These existing practices will also apply to the business of banks issuing deposit tokens.

Existing bank risk management practices include:

General risk management practices, such as setting concentration limits on funding and loans and implementing diversification, provisioning for credit losses, assessing market risk exposures, and managing operational risks;

Consumer regulation and legislation established by the Consumer Financial Protection Bureau (CFPB);

Conducting stress tests to calibrate capital buffer requirements against severely adverse scenarios;

Strengthening liquidity and overall risk controls, including corporate governance-related rules set by the Financial Stability Oversight Council (FSOC);

Developing recovery and resolution plans to maintain capital adequacy and escape financial distress in adverse conditions;

Granting the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve System "orderly liquidation authority" to legally allocate losses to shareholders and creditors in the event of a bank failure.

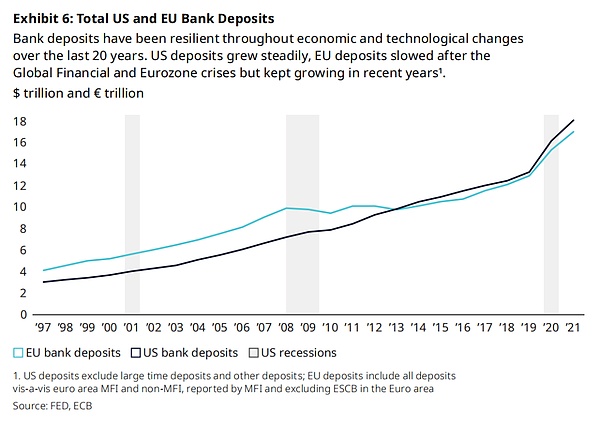

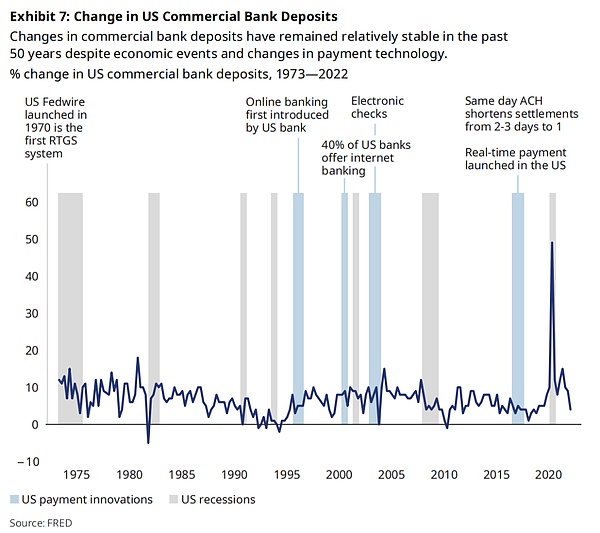

Deposit tokens are still in the early stages of development, so there is insufficient data to demonstrate their behavioral characteristics. However, they are designed as an extension of traditional deposits on the blockchain, as the tokens themselves represent a deposit claim against the issuing bank. Analysis of historical data shows that despite low or even negative interest rate environments, and innovations such as real-time full settlement and fast payments accelerating payment speeds, traditional deposits have remained a stable and reliable source of funding for commercial banks throughout the economic cycle.

Over the past 20 years of economic and technological changes, bank deposits have shown resilience. U.S. deposits have continued to grow; EU deposits slowed in growth after the global financial crisis and the eurozone crisis but have maintained an upward trend in recent years. The following chart shows the total amount of bank deposits in the U.S. and the EU.

The above chart shows the changes in deposits at U.S. commercial banks. Over the past 50 years, despite experiencing economic events and payment technology transformations, the fluctuations in U.S. commercial bank deposits have remained relatively stable.

Deposit tokens may exhibit different behavioral characteristics from traditional deposits due to new functionalities and adoption by specific user groups. For example, their programmability and instant settlement features are likely to result in a higher turnover rate for deposit tokens compared to traditional deposits. However, an increase in turnover does not necessarily change the liquidity demand for the issuing bank. In an ecosystem rich in tokenized commercial bank money use cases and enhanced technological efficiency, deposit tokens may become the de facto means of payment, store of value, and working capital, and may frequently switch wallets in the on-chain economy with little conversion back to fiat currency.

Like traditional deposits and other bank liabilities, the current liquidity, capital, and risk management framework requires banks to:

Conduct thorough analysis of potential redemption behaviors of deposit tokens under stress scenarios;

Maintain prudent and sufficient funding and liquidity buffers.

Additionally, institutions recognized as globally systemically important banks (G-SIBs) by the Basel Committee on Banking Supervision must hold additional capital to absorb losses. The recent consultation paper released by the Monetary Authority of Singapore also echoes the view that "existing bank regulations are sufficient to cover the issuance of deposit tokens," proposing that:

No additional reserve or prudential requirements should be imposed on banks issuing deposit tokens;

Existing regulations on capital, liquidity, anti-money laundering/anti-terrorist financing, and technology risk management are adequate to protect banks and customers.

In June 2022, the Japanese Diet passed a legal framework for stablecoins; the Financial Services Agency of Japan is drafting rules under the new law that allow banks to issue stablecoins in the form of deposits, explicitly stating that banks are already subject to prudential regulation and that stablecoin holders will enjoy deposit insurance just like traditional depositors. Staff at the Federal Reserve Bank of New York have also noted that in the U.S., tokenized deposits may become an attractive form of digital currency, leveraging the well-functioning existing banking and payment systems.

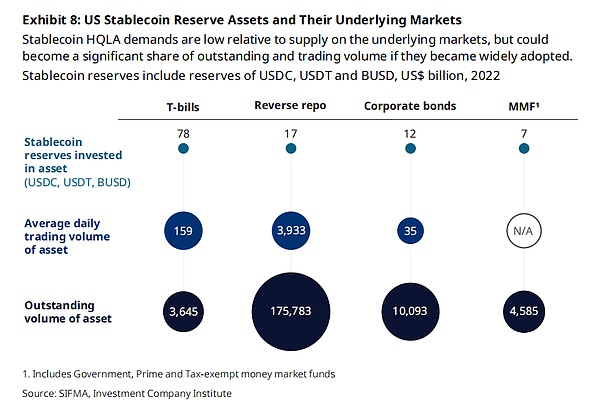

Currently, there are no uniform standards globally regarding the composition of stablecoin reserves, the frequency of reserve information disclosure, and the redemption rights of holders. As a result, practices among different stablecoin issuers vary widely, and regulatory requirements differ across regions. These practices may be insufficient to address potential risks when facing stablecoins that could reach systemic importance and have widespread geographical impacts. Even in cases where best practices are adopted, these standards must be maintained during periods of tight liquidity stress or as the scale of stablecoins expands.

Although there is currently a lack of universally accepted regulatory standards, stablecoin reserves are increasingly being audited on a periodic but voluntary basis. Meanwhile, some markets have begun to push for the establishment of stablecoin regulatory standards, such as the stablecoin guidelines recently proposed by the Financial Stability Board (FSB), the related consultation paper released by the Monetary Authority of Singapore (MAS), the proposed "Stablecoin Act" by the Financial Services Agency of Japan, and the ongoing "Markets in Crypto-Assets Regulation" (MiCA) in the European Union.

4.2 Risk Transmission

If there is a run on a stablecoin issuer or deposit token, and the issuer does not have enough cash to meet liquidity demands, it may be forced to sell assets on a large scale to obtain cash, thereby disrupting traditional markets.

Compared to non-bank institutions, globally systemically important banks (G-SIBs) are less likely to face a run that triggers asset sell-offs when issuing deposit tokens, due to their large and diversified balance sheets, access to central bank emergency funding (such as the Federal Reserve's discount window), and deposit insurance programs in some jurisdictions. If a bank issuing deposit tokens faces sudden and massive liquidity demands, the aforementioned buffer mechanisms can reduce the likelihood of being forced to take emergency measures that could trigger cascading market shocks.

If the shared ledger on which digital currencies operate experiences a disruption, it may also raise broader concerns about financial stability. Any digital currency issuer must establish control measures for interacting with the blockchain environment (including public chains and other shared ledgers) to prevent these new platforms from being exploited to undermine the financial system.

Historically, banks have safely evolved and adopted significant new technologies multiple times, minimizing the operational risks that new technologies pose to the institutions themselves and the systems they operate within. Given the profound impacts of past technological leaps, banks possess ample capacity to continue modernizing to adapt to emerging technologies. The internet and the transformation to "open banking" are two relevant and significant examples: the internet brought new forms of connection and communication for payment clearing and settlement, leading to the ongoing evolution of online banking and digital payments, a trend further accelerated by the COVID-19 pandemic; in recent years, financial institutions have had to adapt to new paradigms of information sharing related to "open banking," especially under the mandatory requirements of the European Payment Services Directive (PSD2).

Since the first wave of internet proliferation, which marked the end of slow and rigid communication methods, banks and their regulators have accumulated increasingly profound experience regarding the impact of new technologies on innovation and risk management, continuously adapting, maturing, and reinforcing their infrastructures in the process of synonymous evolution of digital technology and modern banking. The adoption of blockchain technology is a natural continuation of banks applying internet-driven innovations to information exchange (including tokens—merely another form of information representing ownership and value exchange).

Using decentralized blockchain ledgers as payment infrastructure may also require the industry to innovate in protocol governance. At both the infrastructure and application layers, decentralized protocols rely on majority consensus to integrate changes. Certain decisions in public protocols, if passed by a majority, may conflict with the preferences of specific institutions, thereby affecting other assets, protocols, and users. In this regard, banks also have a track record of developing and operating key governance infrastructures: for example, the core infrastructure for cross-border payments, SWIFT, is a cooperative organization driven by internal governance from its financial institution members.

For example, the U.S. "Real-Time Payments (RTP) Network" was established in 2017 by The Clearing House (TCH), a banking association and payment company. RTP is an important infrastructure that processed 45 million transactions in the third quarter of 2022, marking the first new core payment infrastructure built in the U.S. in over 40 years. Its development was driven by collaboration among 25 shareholder banks under TCH and is open to all U.S. deposit-taking banks.

In contrast to non-bank stablecoins, it can be observed that current large U.S. dollar-pegged stablecoins primarily rely on reserve assets to address redemption risks. During times of stress and large-scale redemption scenarios, they can only meet demand by liquidating reserve assets, which may put pressure on broader markets. Although their scale is not yet sufficient to trigger such risk transmission effects, if stablecoin reserves remain concentrated in a few safe assets, as their scale expands, it may still exert pressure on the limited assets they depend on. The European Central Bank has estimated that if Meta's now-terminated Libra stablecoin project were to materialize, the required A+ rated short-term government debt in the eurozone could exceed the total market supply.

These risks can be gradually mitigated through regulation and industry practices, such as allowing stablecoin reserves to diversify into other assets (including bank deposits) and requiring issuers to hold additional capital beyond the reserve value. However, there may be trade-offs between broad diversification of reserve assets and their stability, potentially leading to unintended consequences.

4.3 Credit Intermediation and Monetary Policy

The impact of different forms of digital currency on credit intermediation and monetary policy is a core issue that must be carefully weighed before scaling innovations. The key lies in two points: the source of new funds and the asset portfolio to which these funds are directed.

Potential funding may come from three sources: physical cash (banknotes), commercial bank deposits, and other cash equivalents. The ultimate scale depends on the extent to which digital currencies are viewed as substitutes or superior options to existing tools. As the economy becomes more digitalized, the application of digital currencies is expected to partially replace circulating banknotes.

The choice of what assets the issuer invests reserve funds in is another key factor in assessing the impact of digital currencies on credit intermediation and monetary policy. Reserve assets can be categorized by liquidity, credit rating, and maturity: central bank reserves, ultra-short-term high-liquidity quality assets (such as treasury bills), longer-term high-liquidity quality assets, and longer-term bonds and loans.

As an extension of traditional deposits, deposit tokens are not backed by specific assets on a one-to-one basis but rely on banks maintaining tiered reserves according to risk management frameworks to balance redemption risks and credit intermediation. Customers converting non-tokenized deposits into deposit tokens from the same bank only change the structure on the bank's liability side, while the asset side remains unchanged.

Banks still need to maintain an equivalent level of liquid assets for deposit liabilities and continue to provide long-term funding to the public sector, private sector, and consumers, thereby connecting savers with borrowers, supporting economic growth, and transmitting monetary policy. Research indicates that banks issuing tokenized deposits under a fractional reserve model have a neutral to positive impact on credit supply.

Non-bank stablecoins, due to their different reserve asset compositions, may have a different impact on credit intermediation compared to deposit tokens. Currently, the largest reserve-backed stablecoins primarily allocate cash-like instruments and ultra-short-term government securities, which reduces redemption run risks but may lead to credit disintermediation. If a large amount of deposits flows into such stablecoins, funds will shift from private and consumer investments to merely purchasing short-term government bonds, resulting in a neutral to negative impact on long-term government and private investments, and potentially raising long-term borrowing costs.

Therefore, JP Morgan believes that in scenarios already covered by commercial bank deposits, deposit tokens are a more attractive option than non-bank stablecoins due to their natural integration with banks and financial services. They tend to enhance rather than disrupt existing payment infrastructures and can complement existing fast payment and real-time gross settlement systems (using central bank money). Banks can utilize these systems to settle off-chain debts arising from holding tokens from other banks and improve the efficiency of dormant central bank reserves.

In terms of central bank digital currencies (CBDCs), the development of deposit tokens is progressing more rapidly and can provide references for CBDC design, improving existing payment systems before CBDCs are implemented and laying an efficient path for future interoperability between CBDCs and a broader digital currency ecosystem.

JP Morgan also points out that digital currencies interoperating with central bank payment systems are expected to enhance the effectiveness of monetary policy liquidity injections, as digital currencies can increase the velocity of money—i.e., the number of times a unit of currency is used to purchase goods or services within a given period. Current wholesale payment systems experience settlement delays, preventing central bank funds from being used by banks' end customers during interbank settlement periods, while digital currencies can alleviate this inefficiency.

4.4 Singleness and Substitutability of Currency

The benefits of deposit tokens can be optimized through design choices that enhance their substitutability with other bank-issued deposit tokens and non-tokenized forms of currency. The so-called "Singleness of Currency" refers to users being able to view the same currency from different forms as equivalent—i.e., cash, non-tokenized digital currency, and various tokenized currency-like assets of the same denomination should be regarded as interchangeable assets of equal value, differing only in technical attributes, which is crucial for the stability and broad acceptance of currency. In the current banking system, this economic substitutability is facilitated by the central bank acting as a trusted clearing institution, with private currencies issued by commercial banks settled through the central bank.

The German Banking Industry Committee proposed a model to achieve substitutability between deposit tokens: commercial banks grant credit lines to each other and settle payments in central bank money. This model could also enable substitutability between a deposit token from one bank and a non-tokenized deposit from another bank. JP Morgan believes this could be an acceptable approach, especially for banks operating within the same domestic clearing system. Another approach is to develop a network similar to agent banks, where banks are willing to exchange tokens issued by each other while assuming the credit risk of the counterpart institution.

Both of these methods have precedents in today's banking system. In each case, the exposure risk of a bank to another institution can be mitigated by extending existing risk management practices—these practices have long been used to manage interbank credit risk and operational risk in non-blockchain environments. JP Morgan also notes that when institutions wish to settle their exposure to deposit tokens from other banks in central bank money, wholesale central bank digital currencies (CBDCs), especially tokenized CBDCs, can play an important and ideal role in promoting adoption. Compared to traditional off-chain operations, such CBDCs can provide faster, more transparent, and technically more interoperable solutions.

The ability of banks to settle their exposure to deposit tokens from other banks in central bank money also helps reduce price differentiation between deposit tokens issued by different institutions due to differences in credit risk perception. This, combined with a clear interoperability path with existing payment infrastructures when redeeming these deposit tokens, will help maintain the singleness of currency.

This dual-layer system also has the added benefit of preserving the important role that central banks play in today's wholesale settlements. Settling central bank funds through real-time methods such as blockchain CBDCs may actually enhance the existing system, as using non-real-time methods could undermine the benefits of the availability of central bank funds in settlements.

Deposit tokens will also effectively possess substitutability with non-tokenized deposits from the same bank, as they both represent a claim against that institution. Users can convert deposit tokens into non-tokenized deposits, allowing funds to interact with the traditional banking system in normal business processes.

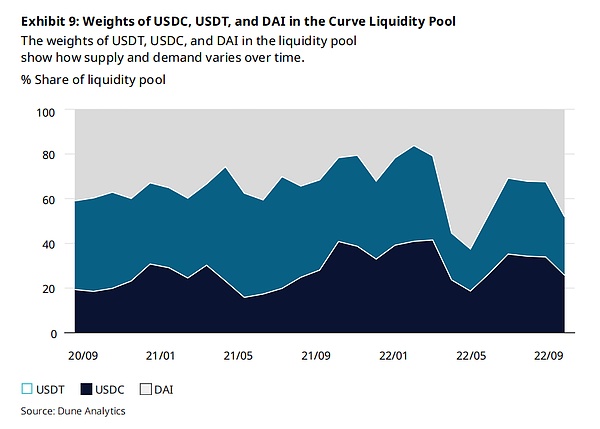

Stablecoins also face similar sustainability issues. Their market performance reflects their credit risk and supply-demand dynamics. For example, in the Curve protocol on Ethereum—a popular stablecoin exchange protocol—one liquidity pool contains different amounts of USDC, USDT, and DAI. The uneven weights of these stablecoins in the pool reflect supply-demand differences driven by various factors, including the popularity of each stablecoin in other DeFi protocols and market perceptions of their risks. For instance, when users exchange one stablecoin for another that they perceive as safer, the former's proportion in the pool will increase. Nevertheless, large liquidity pools like Curve still allow users to easily exchange between stablecoins, thereby achieving substitutability among stablecoins through market rates. For example, in October 2022, the total assets in the USDC/USDT/DAI Curve pool exceeded $760 million, with a daily trading volume of $60 million.

Just as on-chain decentralized finance protocols manage liquidity between different stablecoins, liquidity pools specifically established for deposit tokens may also emerge in the future. As long as these on-chain liquidity pools for deposit tokens are voluntarily provided by token holders on decentralized trading platforms and as long as such pools continue to exist due to meeting actual demand (for example, achieving substitutability between different deposit tokens through market mechanisms), the tokenization process itself should not lead to pricing discrepancies. On the contrary, these liquidity pools should reflect the substitutability of deposit tokens as financial assets.

4.5 Technical Interoperability

If there is insufficient technical interoperability to enable actual exchanges between different forms of currency, then the "economic substitutability" between deposit tokens or between deposit tokens and off-chain deposits loses significance.

The most natural technical interoperability will first appear between deposit tokens issued by the same bank and their non-tokenized deposits, as banks will inevitably integrate the redemption process with their core banking systems; this can then extend to cash and other payment channels accessible through non-tokenized deposits. The real interoperability challenge will primarily manifest in the exchange between tokens from different issuing institutions or in scenarios where non-issuing banks redeem tokens for non-tokenized currency.

While a "universal ledger" provides the highest level of interoperability between interbank systems and brings corresponding benefits, a structurally simpler "shared ledger" faces less resistance to adoption by regulatory bodies and is already a significant upgrade over existing systems. The shared ledgers being developed aim to accelerate payment clearing and settlement in environments where governance is clear and the identities of all banks within the system are known.

The industry needs to establish token standards and carefully select issuing chains and cross-chain bridging solutions to promote technical interoperability between different banking systems through industry-wide standards and best practices. If banks are to issue deposit tokens or provide related services, they must be familiar with the tokens and their underlying technologies and seek efficient connection points between traditional services and new blockchain services.

In cross-chain operations, stablecoins and deposit tokens will face similar challenges, and stablecoins have already experienced these issues:

Stablecoins are often "bridged" to different blockchains or "wrapped" when networks are not interoperable;

Since issuers typically do not natively support all demand chains and do not provide official bridging protocols, bridging and wrapping are often implemented by third-party smart contracts, introducing additional operational and technical risks.

The success of deposit tokens will depend on network effects beyond their own ecosystem, which requires:

Interoperability between traditional financial systems and blockchain;

Interoperability between different blockchains;

Interoperability with other assets on the same chain;

Any advancement must be centered on "responsible and informed innovation" and grounded in the high technical and operational risk management standards applicable to banks today.

5. Conclusion

As digital transactions continue to grow in scale and complexity, deposit tokens are expected to become a solid foundation for digital currency and an important part of a broader tokenized asset ecosystem. Their technical characteristics, high compatibility with established banking regulatory frameworks, and natural integration with banking and financial services give deposit tokens the potential to serve as a "stable anchor" in the digital currency space, while leading commercial bank money—the most widely used form of currency globally—into a new era of enhancement.

Importantly, the existence of deposit tokens does not need to come at the expense of excluding other innovations. The digital currency landscape is still evolving, and multiple forms of currency will coexist and compete in the future to serve different use cases. Deposit tokens can play a valuable role in the overall ecosystem. For example, they can form a symbiotic relationship with blockchain-based wholesale central bank digital currencies (CBDCs), further strengthening today's dual banking system and providing a natural bridge for CBDCs to integrate into the banking sector. Deposit tokens can also help stabilize the entire blockchain digital currency space by absorbing the growing partial demand for emerging areas globally and supporting different markets (including certain niche markets that some stablecoin issuers may not intend to serve).

Banks, policymakers, and regulators should assess the unique risks and benefits of different forms of digital currency one by one. Deposit tokens are rooted in existing bank deposit operations and are not homogeneous products with non-bank stablecoins or CBDCs; innovation and regulatory frameworks should fully recognize these distinctions. For deposit tokens to build a productive connection between traditional banking systems and blockchain, they must be designed and regulated as extensions of the traditional system.

Deposit tokens are well-positioned to help the digital currency landscape move toward stability and maturity. Therefore, they deserve independent and in-depth consideration from banks seeking innovation, regulators hoping to establish suitable regulations to shape this evolving space, and a broader range of financial system participants looking to interact with digital currencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。