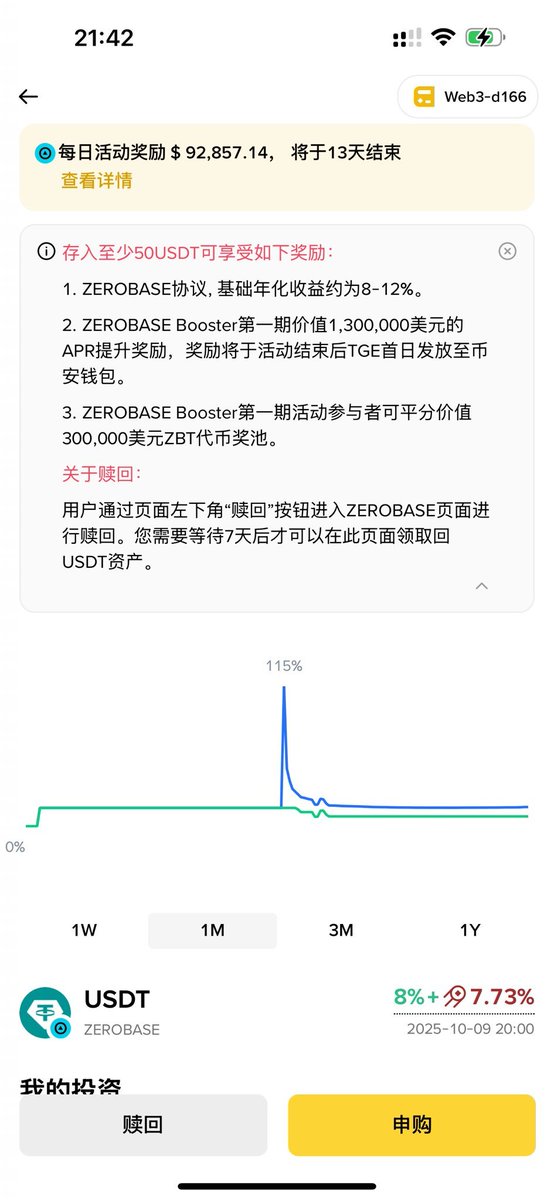

The first phase of the Zerobase staking activity has ended. I roughly calculated that for every $100,000 deposit, it can yield about $331 in interest, with a comprehensive annualized return of 9.3%. Additionally, there was an expected airdrop of about $260 worth of $ZBT. I can't remember the exact number, and I have to complain that I spent about an hour looking for the data from when I staked before, but I only vaguely remember that the last data I saw was around this figure.

The annualized return from this part is about 7.5%. If the repayment goes smoothly, the total return would be around 16%. However, the redemption period is still 7 days, so considering these 7 days, the annualized return would be about 11%, which is still acceptable. I mainly want to see if there’s a chance for ZBT to make a profit.

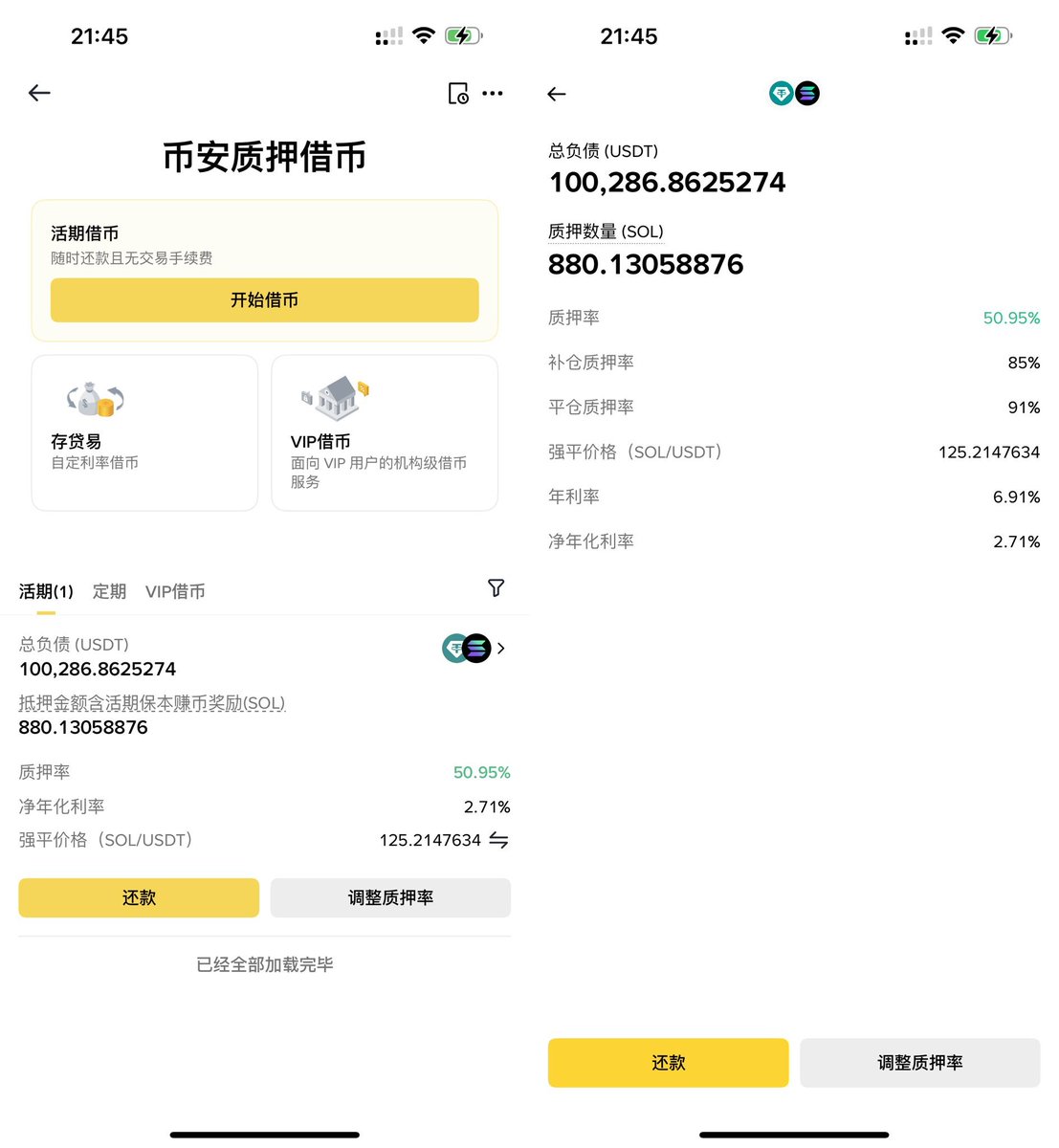

But that's not all, because I want to test whether arbitrage is worthwhile. So, I directly used 880 SOL as collateral to borrow $100,000 with a 50% collateral rate, and staked it in Zerobase. The total interest for 13 days is $286.87, which looks like a profitable business, allowing for an arbitrage of $304.13.

But in reality, don’t forget that the redemption takes 7 days. With an interest rate of 8.05%, the interest for 20 days would be $438.30, so the arbitrage result would only be $152.7. The total return for staking $100,000 for 20 days is $152.7, with a return rate of 2.8%, which feels a bit underwhelming.

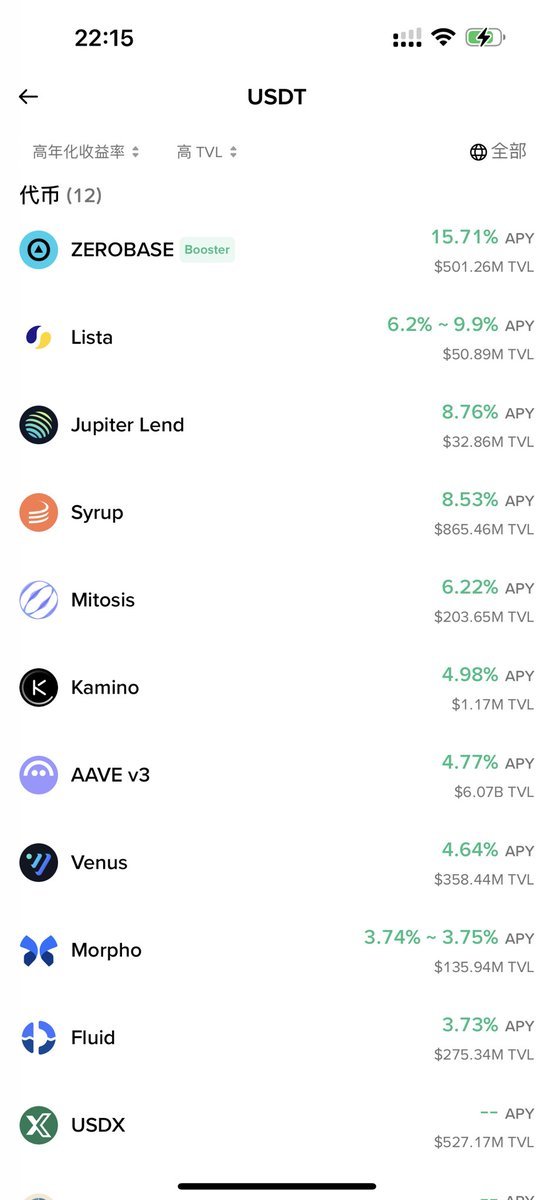

Especially since the price of ZBT is not guaranteed, a slight misstep could lead to losses. However, even so, I see that Zerobase's returns are still the highest. Of course, the collateral on #Binance itself also earns interest; for example, the interest on SOL is about 3%. So it seems there is also an interest subsidy. Overall, if the comprehensive return from borrowing to participate in the deposit activity is less than 10%, borrowing wouldn’t be worthwhile.

Additionally, I took a look, and among mainstream asset lending, SOL has the lowest interest rate, with a comprehensive rate of only 2.7%, while $BTC and $BNB both exceed 6%, and $ETH is at 5.7%. This is also why I chose SOL; the others would lead to significant losses.

In summary, if you have your own funds, participating in Binance's Booster deposit activity is worth a try. However, if you need to borrow, you must calculate whether you will be at a disadvantage. The main gamble is whether there will be a second Aster, haha, I guess I might be overthinking it. But as long as the interest rate is higher than simply earning interest in a savings account, it doesn’t matter much.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。