Original Author: Tanay Ved

Original Translation: AididiaoJP, Foresight News

Key Points:

- Tether remains the leader in the global stablecoin market, anchoring dollar acquisition channels in emerging markets and driving demand for U.S. Treasury bonds through its reserves.

- As new regulations and competitive dynamics reshape the stablecoin market, with differentiation in compliance and yield distribution, the dominance of USDT is declining.

- The roles of Ethereum and Tron in USDT activity are evolving, with Tron maintaining a lead in high-frequency, low-cost payment areas, while decreasing fees and increased liquidity on Ethereum are driving broader retail and settlement applications.

- Emerging channels are bringing new growth opportunities, with USDT 0 and networks focused on stablecoins (like Plasma) expanding Tether's distribution to more networks and use cases (such as payments).

Introduction

Tether's USDT is undoubtedly the leader in the global stablecoin market, holding about 60% of the approximately $300 billion market. USDT has evolved from being primarily a trading tool to a key channel for emerging economies to acquire dollars, gaining increasing geopolitical importance in the U.S. domestic market. Meanwhile, Tether has become one of the most profitable companies in the industry, with quarterly profits reaching billions of dollars and is undergoing a $20 billion financing round that could make it one of the most valuable private companies globally.

However, regulation and intensifying competition are reshaping the stablecoin landscape, and Tether's next chapter depends on its ability to maintain its network effects and extend its long-term dominance. Based on our recent observations of the dynamics in the stablecoin space post-GENIUS Act, we examine Tether's market position as it balances its current dominance with an increasingly competitive future. We explore how USDT's market share is evolving, how its activity differs across blockchains, and how emerging channels will shape its role in the next phase of stablecoin growth.

Tether's Market Position and Importance

Tether's USDT circulation stands at $178 billion, making it the largest stablecoin with a significant advantage (approximately 2.4 times larger than Circle's USDC and about 3.6 times larger than the total of all other stablecoins). Its scale and liquidity make it an important tool for protecting savings, providing economic stability, and facilitating transactions, especially in regions with limited banking infrastructure or countries where local currency inflation exceeds 5%.

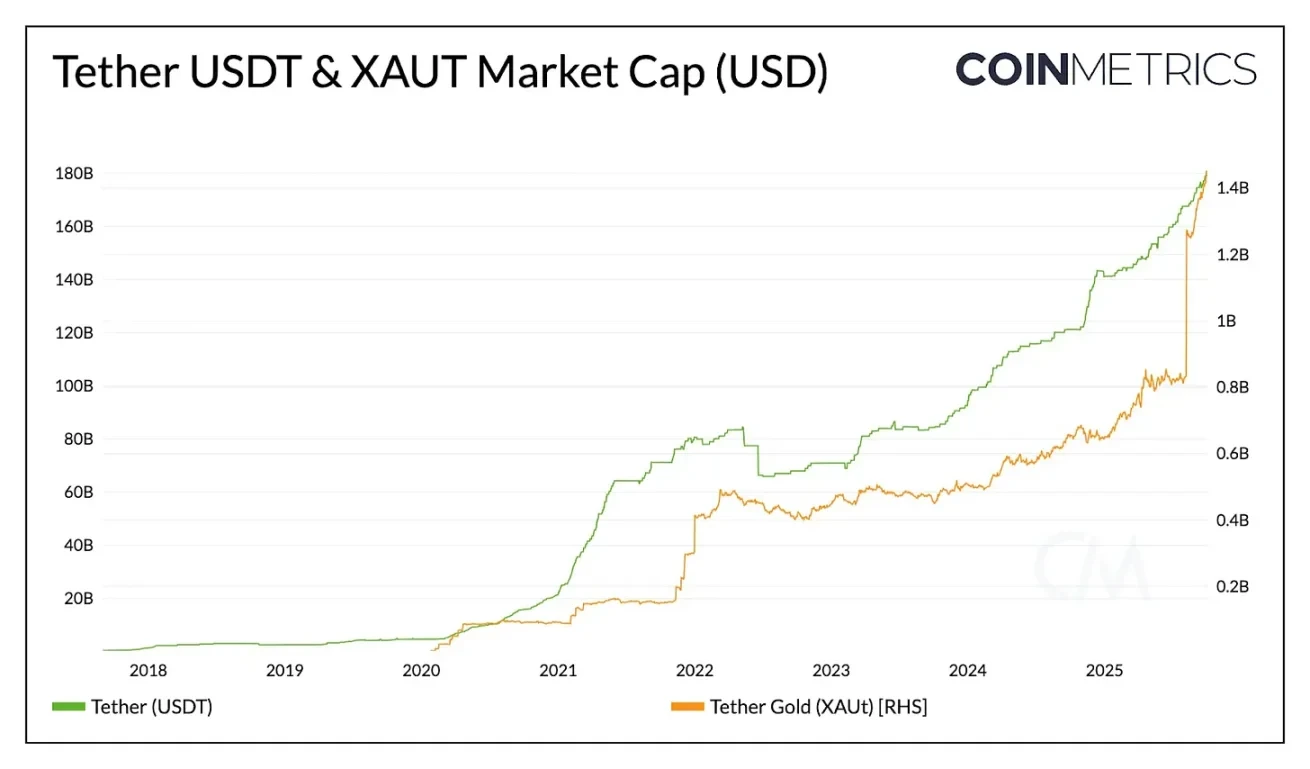

Source: Coin Metrics Network Data Pro

In addition to the dollar, Tether also offers tokenized gold exposure through XAUt, with its market cap growing to over $1.4 billion as demand for alternative value storage rises. Tether appears to be expanding this dual strategy, seeking a $200 million financing round with Antalpha Platform to establish a digital asset treasury that will acquire Tether's XAUt tokens. With further investments in Bitcoin and gold mining, Tether is moving towards integrating different forms of value preservation.

Market Share and Growth Pressures

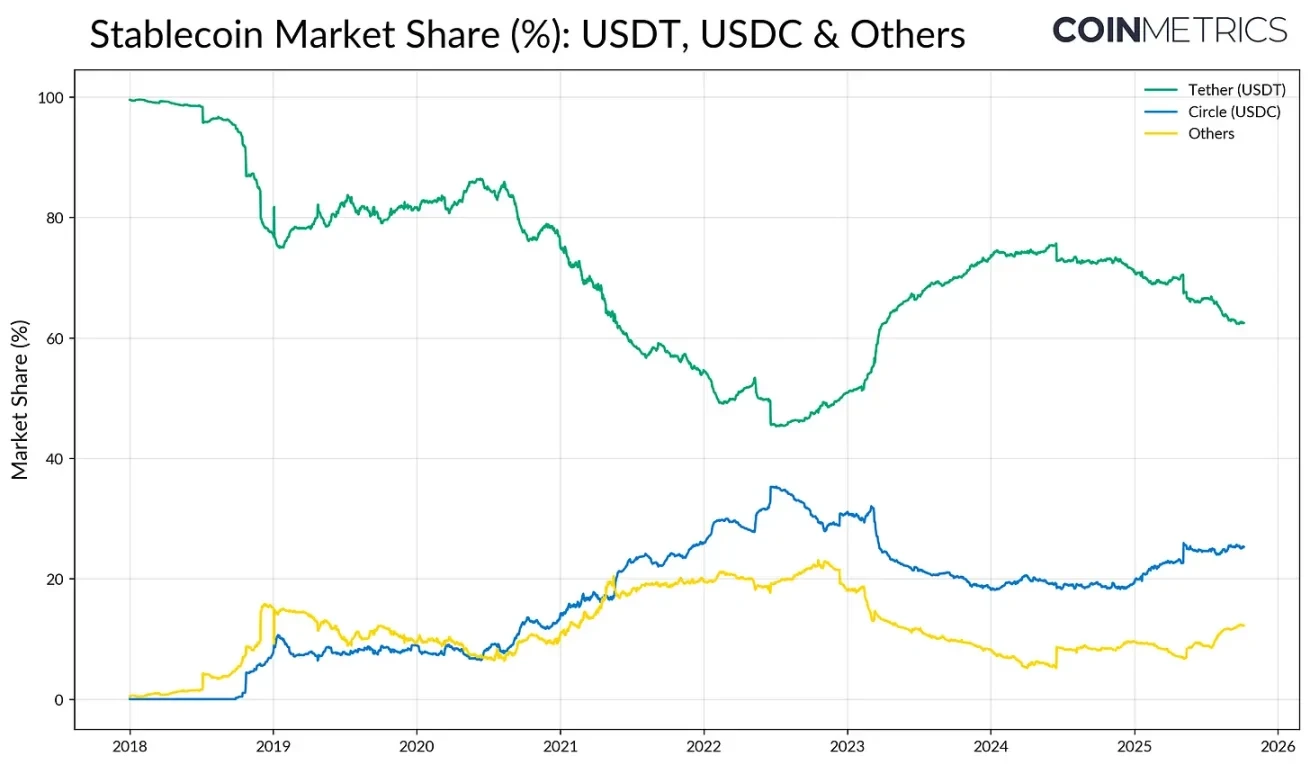

USDT's first-mover advantage and deep liquidity on exchanges provide it with a strong "network effect." In the early stages of the industry, USDT's market share exceeded 80%, but the rise of USDC and BUSD has brought its dominance down to nearly 50%. The collapse of Silicon Valley Bank (SVB) in 2023 quickly reversed this trend, with capital fleeing competitive issuers. However, since 2024, and with the impending passage of the GENIUS Act in 2025, USDT's share has shown signs of pressure again.

Source: Coin Metrics Network Data Pro

Circle's USDC has gradually regained its footing, driven by domestic regulatory momentum, while "other" stablecoins, primarily interest-bearing alternatives like Ethena's USDe, Sky's USDS, and tokenized money market funds, are gaining market share. The market currently seems to be in a transitional phase, with USDT continuing to lead in liquidity and adoption but facing increasingly fierce competition from existing payment networks entering the market and alternatives distributing yields.

Profitability and Compliance Path

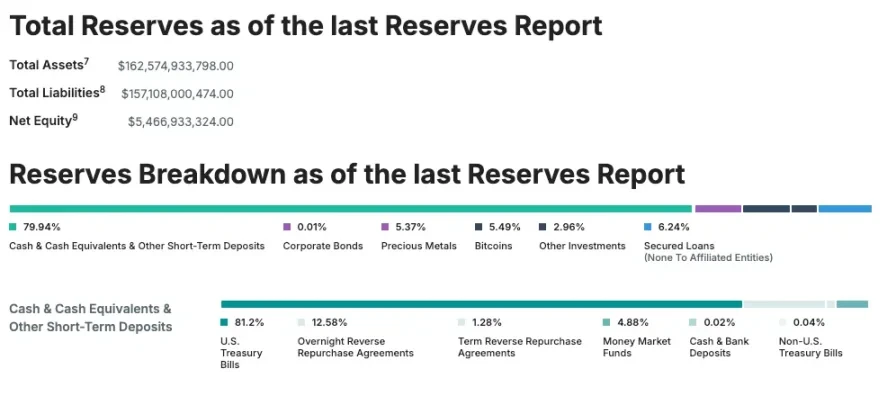

Despite the intensifying competition, Tether remains the most profitable stablecoin issuer, achieving a net profit of $4.9 billion in Q2 2025. This is thanks to its $127 billion U.S. Treasury reserve, making it one of the largest holders of U.S. government debt globally. However, Tether has been an offshore issuer based in El Salvador, with some of its reserves including non-compliant assets such as precious metals, Bitcoin, and secured loans. To address this issue, Tether plans to launch USAT, a fully compliant stablecoin established in the U.S., to strengthen its domestic growth strategy and its role in U.S. debt demand.

Source: Tether Transparency (as of June 30, verified report)

How USDT Flows Across Different Blockchains

After establishing Tether's market position as an issuer, it is crucial to understand how USDT flows across different blockchains and the channels that support its transfer and settlement. The circulation of USDT is shaped by the capabilities of each network and influences the types of activities and user groups that dominate on each chain. The usage of USDT reflects different types of activities, with the vast majority of issuance concentrated on Ethereum and Tron.

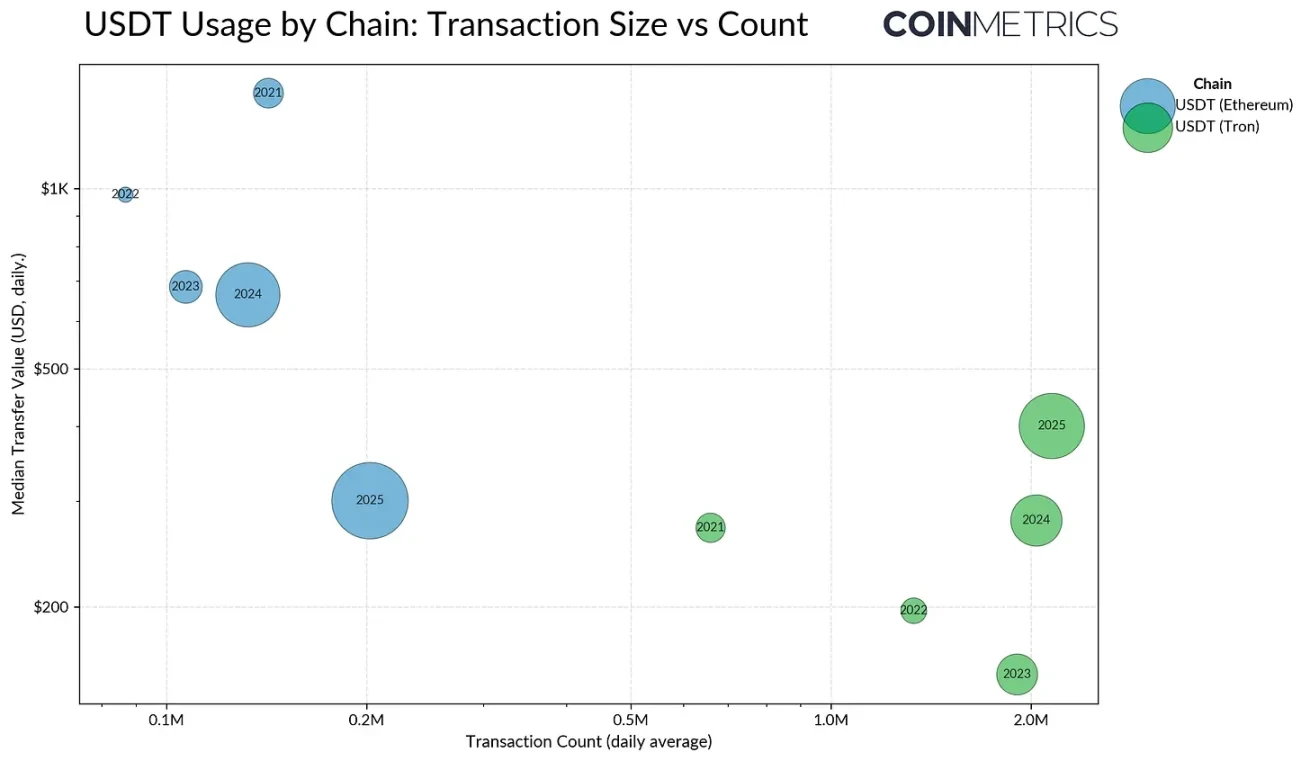

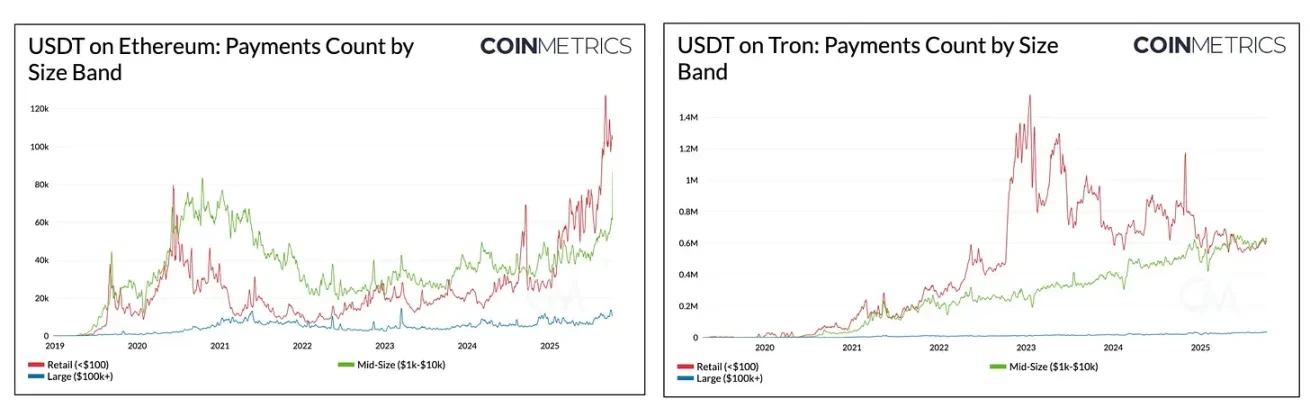

Historically, Tron has been a primary access point for users in emerging markets, favored for its low fees and fast settlements. In 2025, Tron's average daily transaction volume exceeded 2.3 million, making it a highly sticky network for USDT transfers, supporting a continuous, high-speed flow of small, payment-like activities. This pattern aligns with its use in retail and remittance payments, where cost-effectiveness and accessibility are paramount.

Source: Coin Metrics Network Data Pro

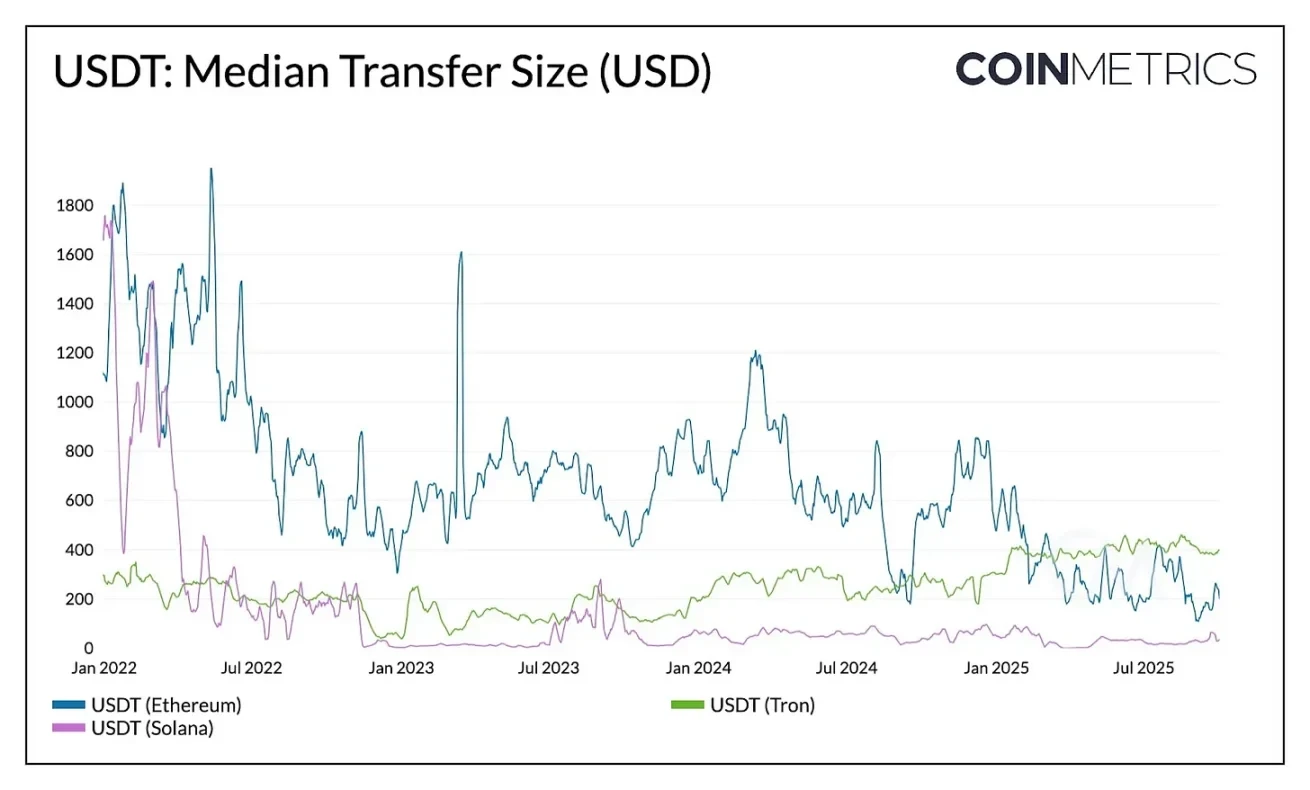

In contrast, Ethereum has traditionally handled larger value, lower frequency transfers, reflecting its role as a settlement and liquidity hub for DeFi and institutional activities. However, this dynamic is changing.

After the Dencun and Pectra upgrades, Ethereum's average transaction fees have dropped below $1, increasing the frequency of small transfers. The median transfer amount on Ethereum has decreased from over $1,000 in 2023 to about $240 in mid-2025, while the median amount on Tron has increased. This dynamic brings Ethereum closer to the types of activities that were once unique to Tron.

Source: Coin Metrics Network Data Pro

This behavioral shift is also occurring alongside a redistribution of supply. In August 2025, the USDT supply on Ethereum ($96 billion) surpassed that on Tron ($78 billion), indicating that lower fees and deeper liquidity are attracting activity back to Ethereum.

Source: Coin Metrics Network Data Pro (USDT on Ethereum, USDT on Tron)

This trend is also evident in the composition of cross-blockchain USDT payments. On Tron, as medium-scale traffic momentum increases, the gap between retail payments and medium-sized transfers has narrowed. On Ethereum, since 2024, the number of retail ($100) and medium-sized ($1,000 - $10,000) payments has surged, while large ($100,000 - $1 million) transfers have remained stable. This indicates that as the network becomes more accessible, the use of USDT is diversifying towards smaller-scale activities.

Expanding USDT's Dominance Through Emerging Channels

The evolution of USDT on chains like Tron and Ethereum highlights how settlement speed, cost, and liquidity shape user behavior. Looking ahead, Tether is strategically expanding its reach through new distribution channels and settlement layers.

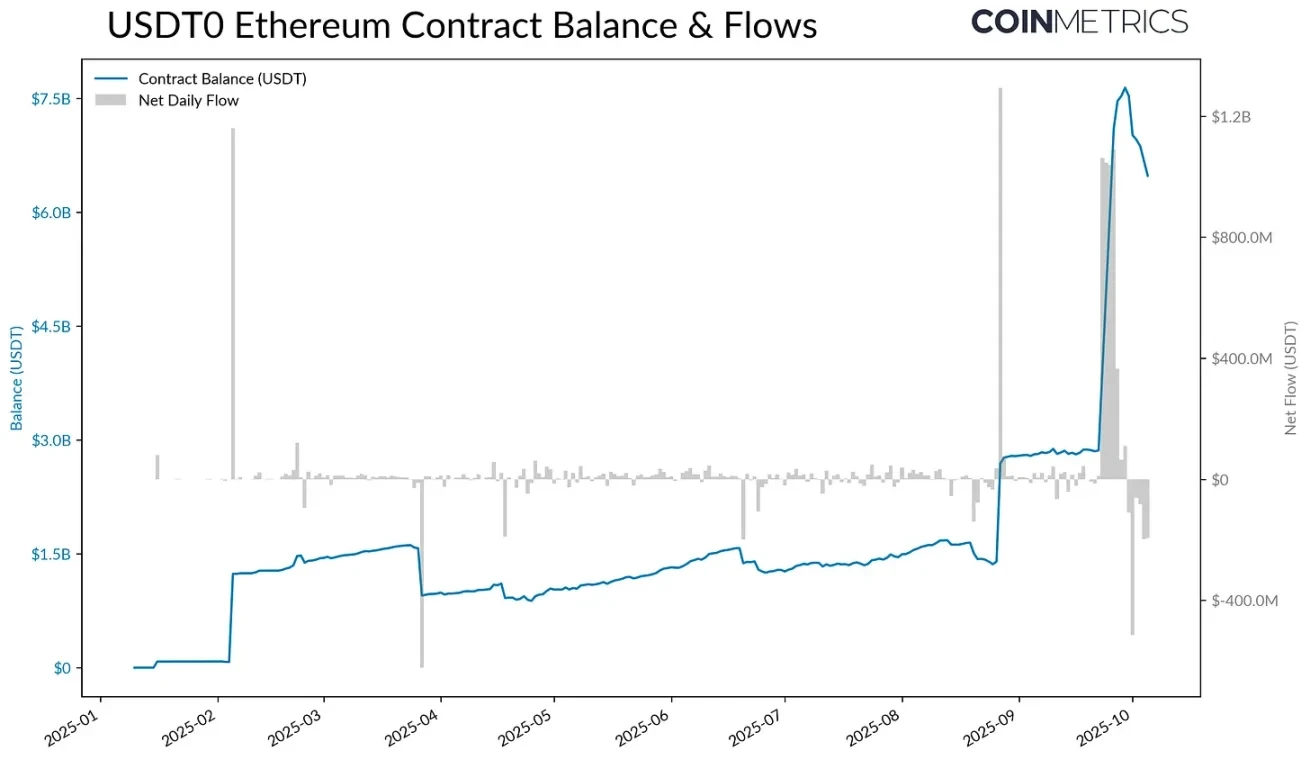

For example, USDT 0, launched based on the LayerZero standard for omnichain fungible tokens (OFT), achieves seamless cross-chain transfers by locking USDT on Ethereum and minting equivalent tokens on the target chain, maintaining a 1:1 backing.

Source: Coin Metrics ATLAS

After the launch of Plasma (a Layer-1 blockchain optimized for stablecoins) on September 25, the USDT supply locked in the USDT 0 Ethereum contract surged from $2.8 billion to $7.7 billion. With zero-fee USDT transfers, stablecoins as fuel fees, and high throughput design, Plasma quickly attracted over $6 billion in USDT 0 supply, currently stabilizing around $4.2 billion.

While its long-term sustainability will depend on the adoption of payment and savings use cases, Plasma represents a new class of complementary channels for USDT, similar to how Tron and Ethereum serve different activities today. USDT 0 and Plasma together illustrate how Tether is expanding its distribution to a broader set of networks that can support a variety of needs, from high-value settlements to payments, DeFi, and retail activities.

Conclusion

As stablecoins become the global payment infrastructure, Tether's next chapter will unfold against a backdrop of intensifying competition and increasing regulatory clarity. Its ability to maintain dominance will depend on whether it can evolve from an offshore issuer to a multi-chain, compliant infrastructure provider without undermining its core advantages in liquidity and distribution. The emergence of omnichain USDT and networks focused on stablecoins (like Plasma) signals a future of more diversified settlements and payments. Whether Tether expands its network effects or loses ground to competitors will ultimately define the next phase of evolution in the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。