In the past decade, the blockchain industry has taken a highly experimental path of development. People have been searching for nails in various fields with a hammer. We have witnessed the DeFi craze, the technological arms race for public chain scalability, and the rise of new narratives like RWA and DePIN. However, at every stage, the focus of blockchain has always revolved around users and enterprises, attempting to meet the needs of certain groups. Yet, after the crypto-native community reached tens of millions of users, the growth rate significantly slowed, and a ceiling gradually became apparent.

The development of blockchain can be roughly divided into three stages. The DeFi Summer of 2020 is considered a watershed moment for the industry, with decentralized exchanges, lending, derivatives, and other financial applications emerging in droves, marking the first large-scale demonstration of blockchain's unique value outside traditional industries. The second stage is the narrative of scalability and performance. When ETH gas fees soared to hundreds of dollars, the industry realized that performance had become a bottleneck for large-scale adoption. Developers then initiated a wave of efforts to enhance throughput, leading to the rise of L2 solutions like Solana, Optimism, and Arbitrum. Subsequently, as growth in the crypto-native market began to slow, people started to think about bridging on-chain and the real world. RWA attempts to tokenize traditional assets like bonds, real estate, and gold, while DePIN allows physical infrastructure such as computing power, bandwidth, and energy to enter the blockchain.

At this moment, Sign elevated the narrative to another level, not by competing for "a certain user group" or "a specific vertical," but by directly targeting "the state," the largest and most core demand side.

Countries have billions of people, the most complex social governance systems, and the largest asset and currency circulation. These are precisely the potential best application scenarios for blockchain. Sign's ambition is to provide a set of blockchain infrastructure at the level of national sovereignty, enabling governments to gradually migrate core functions—whether it be currency issuance and settlement, identity authentication and management, public resource allocation, or social governance and public services—onto the blockchain.

In other words, Sign is not just serving individuals or enterprises; it aims to become the foundation of a "digital nation." This means that Sign's narrative goal is no longer financial innovation for millions of users, but rather sovereign transformation for billions of users.

From confrontation to integration: Why do countries need blockchain?

For a long time, blockchain has been equated with decentralization, and its narrative has often been linked to de-nationalization. However, over time, this confrontational narrative has gradually revealed its limitations. For countries, the value of blockchain has never been about de-nationalization, but rather about enhancing governance capabilities and reducing the costs of social operation.

Looking back at the history of blockchain development, its origin stems from distrust of the existing financial system. BTC was born against the backdrop of the financial crisis, carrying strong connotations of de-nationalization and decentralization. But over a decade later, people have gradually realized that the ideal of de-nationalization cannot solve most of the real problems in social operation.

On one hand, countries cannot relinquish their dominance over finance and credit. Whether it is currency issuance, tax collection, or social welfare distribution, these core functions determine that the state must maintain governance initiative. Any attempt to bypass the state will ultimately face regulatory resistance. On the other hand, social operation requires stability and order. The expansion of decentralized systems inevitably involves compliance, identity, and other issues. Without the participation of the state, these problems cannot be resolved.

A blockchain world without state participation lacks identity systems, legal protections, and public services, making it difficult to establish large-scale connections with real society. Even within the crypto industry, development has gradually encountered bottlenecks. Once the user base exceeds tens of millions, growth stagnates, and the narrative heat of trends like DeFi, NFT, and GameFi often can only be maintained for a short period, failing to reach the billions of ordinary people. So, what is the true ultimate application scenario for blockchain?

Blockchain is not against the state; it is meant to help the state.

The characteristics of blockchain—openness, transparency, immutability, and programmability—make it inherently suitable as a national-level infrastructure, serving key areas such as currency issuance, identity authentication, social governance, and public resource allocation.

And this is precisely Sign's positioning.

Sign is not a traditional "application layer" innovation; it directly cuts into the sovereign level, building a set of blockchain infrastructure that can be directly adopted by the state. Its goal is not limited to millions of crypto-native users but is aimed at billions of citizens.

The core logic of Sign is to provide a complete Sovereign Infrastructure for Global Nations (S.I.G.N.), helping countries migrate key data, identities, and assets onto the blockchain to establish a verifiable and auditable governance system.

National Sovereignty Infrastructure: Sovereign Chain, Asset Distribution System, and On-Chain Credit System

The first step in building national sovereignty infrastructure is to create a sovereign chain. This means that blockchain is no longer just a grassroots experiment but can be directly adopted and controlled by the state.

Sign offers two complementary sovereign blockchain solutions, designed for specific regulatory requirements and application scenarios. One emphasizes transparency, external connectivity, global accessibility, and suitability for public services, based on customizable L2 built on mature L1. This is suitable for national stablecoins, payment systems, and even the digitization of assets like land and property, allowing national assets to circulate globally and bring new financial opportunities. The other is a CBDC sovereign private chain based on Hyperledger Fabric, emphasizing privacy and compliance, suitable for interbank settlement or retail payments, fully controlled by the central bank to ensure data security and confidentiality.

The two chains can bridge to form a digital governance network that is controllable by the state and connectable to the outside world. The government can maintain complete control over sovereign currency and the financial system while achieving international connectivity and asset globalization through the public chain.

The sovereign chain architecture provided by Sign helps countries find a balance between privacy and openness, compliance and circulation.

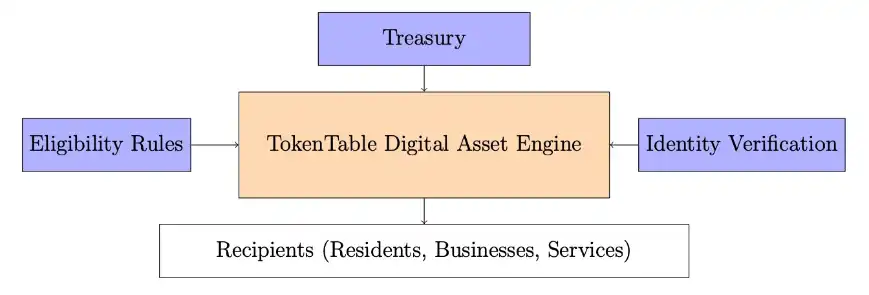

If the sovereign chain is the foundation, then the asset distribution system is the lever that truly integrates blockchain into national operations.

Countries regularly need to distribute public funds such as pensions, welfare subsidies, education allowances, and medical insurance, and even need to issue emergency relief funds during disasters. These fund distributions are often massive in scale and involve many people, making traditional systems inefficient and prone to corruption.

The distribution system provided by Sign offers a truly scalable and implementable solution for national-level applications for the first time. It can achieve large-scale fund distribution, covering millions or even hundreds of millions of users at once, and is designed with programmable logic, allowing funds to be automatically disbursed based on conditions rather than being a simple one-time payment. For example, education allowances can be distributed regularly by semester, pensions can be accurately matched according to age groups and social security data, and even in disaster relief, funds can be directed in real-time to the affected areas.

The flexibility of this system is also reflected in cross-chain adaptability. In retail payment scenarios where privacy needs to be ensured, the system can run directly on the CBDC chain to meet security and privacy requirements. In international aid scenarios that require transparency, it can choose to operate on L2, making the flow of funds clear and traceable. Coupled with digital identity verification through the Sign Protocol, the distribution process can achieve precise targeting, ensuring that every fund truly reaches the intended recipients, thereby preventing fraud and duplicate claims from the source.

Notably, the core module of this system, "TokenTable," has been widely applied in past airdrops, providing over $4 billion in token airdrops and unlocks to 40 million users globally. This demonstrates its capability to handle high concurrency and precise distribution, making it sufficient to undertake national-level asset distribution tasks.

This system means that countries can not only efficiently distribute assets on-chain but also transform the distribution process into a compliant and transparent governance tool. Pensions arriving on time, disaster relief reaching affected populations directly, and education subsidies with zero delays are all direct values of blockchain in national-level applications. From a longer-term perspective, this system also promotes the gradual migration of assets to crypto standards. When welfare, subsidies, and aid funds all operate through on-chain channels, governments can directly manage society and engage in international cooperation under Web3 standards.

In addition, Sign also provides a comprehensive on-chain certification framework based on the Sign Protocol.

Currently, all our activities are fundamentally based on identity and credit. Identification cards represent individuals, while income and tax records reflect personal credit. However, this information is scattered across different departments and databases, making it difficult to circulate and lacking transparency. The value of the Sign Protocol lies in breaking through this critical link. By putting key information on-chain and securely storing it in encrypted form, core data such as passports and identification cards gain verifiability and transferability. At the same time, using advanced cryptographic techniques like zero-knowledge proofs, users can complete authentication without exposing complete information.

As more information is written in, the Sign Protocol can gradually build a verifiable information database, providing foundational data support for national digital governance. During entry and exit management, tourists can quickly pass through customs by presenting on-chain identity credentials. In the public service sector, whether it is pension distribution or targeted disaster relief funding, the system only needs to verify whether citizens meet the qualifications to achieve precise outreach.

Over time, this on-chain system built by the Sign Protocol will evolve into the trust cornerstone of the national sovereign chain. For the future digital society, this will be a core infrastructure as important as the monetary system.

Looking to the future, parallel to SWIFT

Narratives are the entry points for traffic, driving funds and serving as the core of valuation. However, for any narrative to truly land, it must undergo the test from concept to execution.

In the crypto world, publishing a white paper is often seen as a quick way to establish a project and seize market opportunities. However, the significance of Sign publishing its white paper goes far beyond that. This is not a momentary impulse but a long-term strategic layout, a path that has been deeply paved, continuously practiced, and accumulated. The emergence of S.I.G.N. did not come out of nowhere. It has long-term support from core figures and institutions in the industry. Binance founder CZ has publicly stated that he is not only focused on Sign in terms of investment and ideas but has also helped Sign connect with multiple countries.

It is worth noting that CZ himself is a strategic advisor to the Pakistan Crypto Council and also serves as a policy advisor for the National Blockchain and Web3 in Kyrgyzstan. This means he has significant influence when promoting blockchain policies and infrastructure at the national level.

At the same time, YZi Labs' investment in Sign also provides capital and resource support for its long-term strategy. These resources are not limited to funding but also include the ability to establish connections with various governments and institutions. This long-term groundwork is precisely what gives Sign the confidence to directly enter the narrative of "national sovereignty infrastructure" at the white paper stage.

Looking back over the past decade, the early narratives of the blockchain industry were mostly confrontational towards the state. They emphasized decentralization and de-nationalization, hoping to bypass existing power structures through technological means. However, it has been proven that this path cannot truly reach the entire population. Without state participation, the scale and influence of blockchain are destined to be limited. The real social demand is not to confront the state but to help the state govern more efficiently, reduce the costs of social operation, and enhance the transparency of public funds and credit systems. Sign's answer is to build national sovereignty infrastructure.

As more and more countries explore CBDCs and digital governance, the value of Sign will become even more prominent. Through the sovereign chain framework, asset distribution system, and on-chain information and credit system, Sign not only provides a complete set of digital governance tools for countries but also reshapes the narrative of blockchain. Blockchain is no longer synonymous with speculative markets but has become a national-level infrastructure embedded in the governance system of the state.

Furthermore, in the medium to long term, Sign may grow into a system parallel to SWIFT. If multiple countries deploy sovereign chains based on Sign and achieve interconnectivity through unified asset distribution and credit verification protocols, a new international clearing and cooperation network will gradually take shape. This network could not only address the existing shortcomings of SWIFT in terms of efficiency and transparency but also provide emerging countries with a fairer means of access to international finance.

This is not only an opportunity for Sign but also a crucial leap for the blockchain industry to truly move into the mainstream.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。