Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

On September 30, the full-stack on-chain exchange Flying Tulip, created by the "former DeFi king" Andre Cronje (AC), officially announced that it has completed a $200 million private placement financing and plans to raise an additional $800 million in a public offering at a $1 billion valuation, aiming to build a comprehensive platform that integrates native stablecoins, lending, spot trading, contract trading, and on-chain insurance.

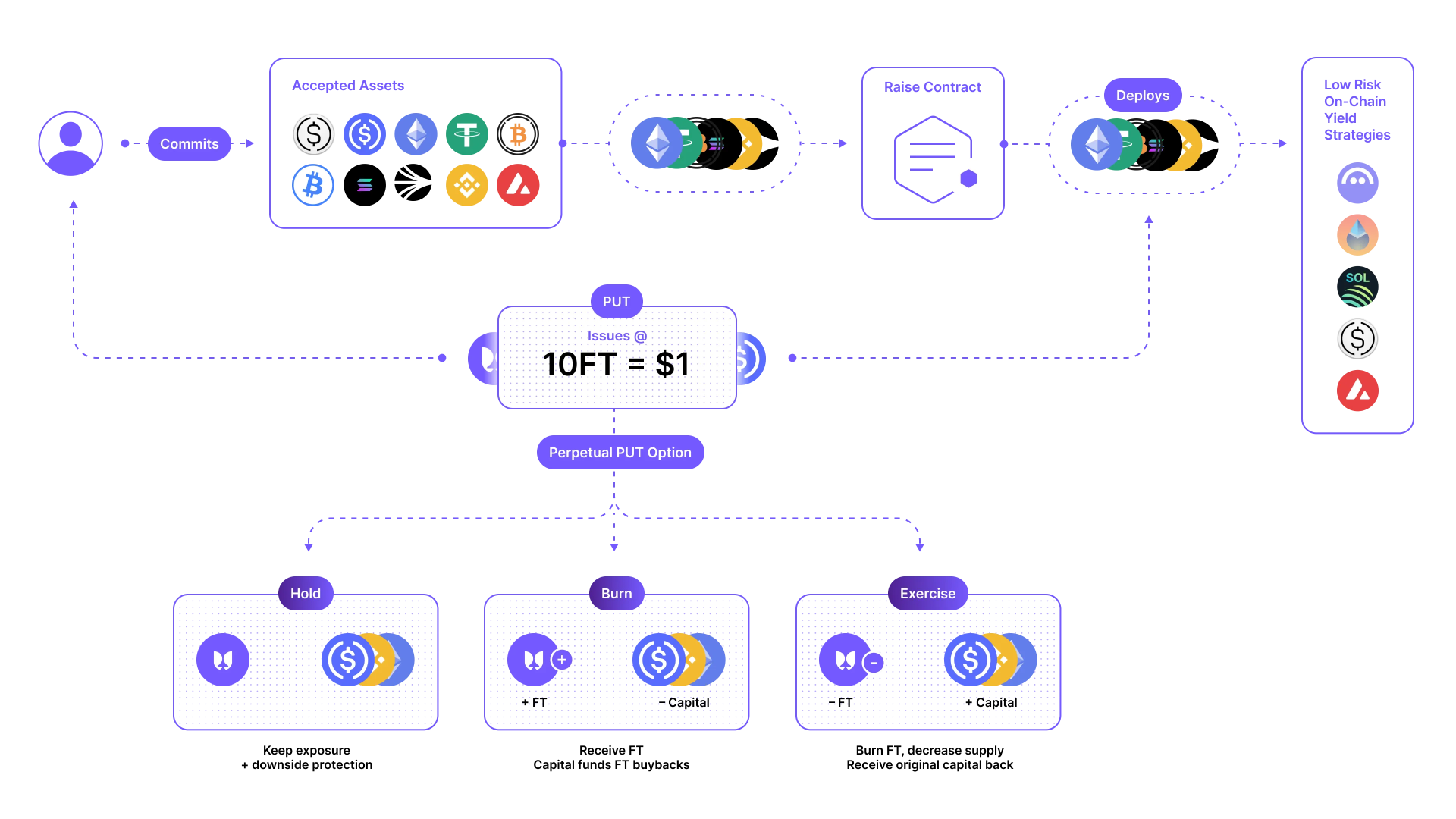

In the financing announcement regarding Flying Tulip, the most striking aspect, aside from the massive financing target of "$1 billion," is that Flying Tulip will adopt a fundraising method that is entirely different from traditional private or public offerings — specifically, Flying Tulip will provide all investors with a reversible "redemption" option through perpetual put options, allowing investors to destroy FT tokens at any time and redeem their principal in the invested assets (such as ETH).

However, the initial announcement from Flying Tulip on September 30 did not disclose many details about this mechanism. It wasn't until last night that Flying Tulip officially released the project documentation, which not only covered the specific designs of various product lines such as trading and lending but also explained the specific operational logic of the "on-chain redemption rights" in detail.

The following is a detailed analysis of the project financing based on Flying Tulip's official documentation by Odaily Planet Daily, hoping to provide decision-making assistance to potential investors.

Key Point 1: Total Fundraising Amount and Total Supply of FT

The maximum supply of FT tokens is 10 billion, with a fixed supply, no inflation, and only destruction.

For every $1 invested, investors will receive 10 FT tokens. Flying Tulip will only mint FT based on the actual funds raised — if only $500 million is raised, only 5 billion FT tokens will be minted and distributed; when the fundraising scale reaches $1 billion, the minting of FT will also reach 10 billion, at which point the minting window will close, and there will be no further issuance in the future.

Key Point 2: "Redemption" Rights

According to Flying Tulip's introduction, after investors contribute funds, the corresponding FT will be locked in a "perpetual put option," which will attach a long-term effective "on-chain redemption right" to these token shares.

Based on market conditions, investors will always have three options to manage their token shares — Flying Tulip will not restrict the proportion of user operations, allowing users to freely choose to redeem part of their holdings while maintaining some positions.

- The first option is to simply hold; in simple terms, doing nothing allows investors to retain their redemption rights and wait for FT to appreciate. The "perpetual put option" provided by Flying Tulip has no time limit.

- The second option is to redeem the principal; users can choose to redeem part or all of the exact assets they initially invested. Once the redemption is chosen, the corresponding amount of FT will be permanently destroyed. For example, if FT falls below the issue price ($0.1) after launch, users can fully redeem their principal to avoid losses.

- The third option is to withdraw FT; after withdrawal, users will have full control over their FT tokens, which can be traded on CEX or DEX, or used to participate in various DeFi opportunities. Once the withdrawal is chosen, the corresponding "perpetual put option" will immediately become invalid, and the principal invested in the private or public offering will be released, with Flying Tulip using these funds for protocol operations and FT buybacks.

It is worth mentioning that, aside from the initial investment, any FT purchased on the open market does not include the "perpetual put option," meaning that secondary market participants do not enjoy the same "redemption" rights as initial investors.

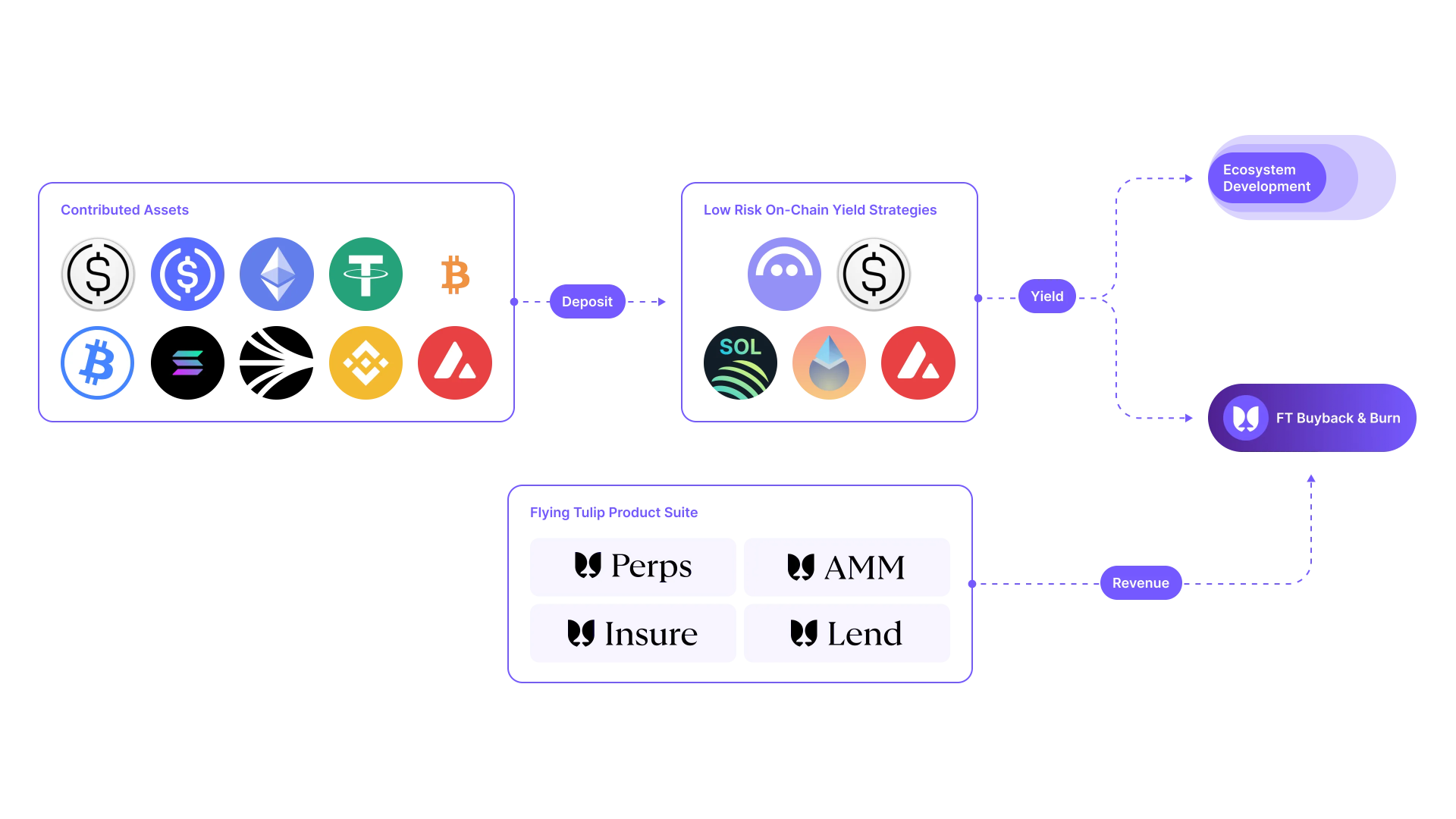

Key Point 3: Use of Fundraising Proceeds

Although Flying Tulip promises not to use the funds raised for financing, in practice, during the existence of a "perpetual put option," the corresponding financing amount will be allocated by Flying Tulip to low-risk on-chain yield strategies (not involving leverage or cross-chain) to ensure timely responses to investors' redemption demands — objectively, this is a major risk point for Flying Tulip, but the risk level is relatively low.

Flying Tulip provided examples of how some major supported cryptocurrencies will generate yield during financing: mainstream stablecoins will be deposited in Aave, ETH will be staked as stETH, SOL will be staked as jupSOL, AVAX will be natively staked, and USDe will be staked as sUSDe.

As for the income generated from these funds, Flying Tulip stated that the primary use is to fund the ongoing development of the ecosystem, infrastructure, and operations. After meeting the ecosystem budget, the remaining income will be used for continuous buybacks and destruction of FT.

It should be clarified that this income is not directly tied to the incentives of the Flying Tulip team. The income of the Flying Tulip Foundation and team only comes from the revenue generated by the project's full product line (lending, trading, etc.), and the related income will be distributed in a ratio of 40:20:20:20 to the foundation/team/ecosystem/incentives.

Key Point 4: How to Participate in Financing

Flying Tulip has disclosed in its official documentation that financing will support five chains — Ethereum, Solana, Sonic, BNB Chain, and Avalanche.

- Supported cryptocurrencies on the Ethereum chain: USDC, ETH, USDT, USDe, USDS, USDtb, WBTC, cbBTC;

- Supported cryptocurrencies on the Solana chain: USDC, SOL;

- Supported cryptocurrencies on the Sonic chain: USDC, S;

- Supported cryptocurrencies on the BNB Chain: USDC, BNB;

- Supported cryptocurrencies on the Avalanche chain: USDC, AVAX;

The specific start time for financing has not been disclosed; further details can be followed on Odaily Planet Daily. Additionally, Flying Tulip recently stated on its official X that due to strong demand from institutional investors for public offerings, if the amount users plan to participate exceeds $25 million, they can contact the official for customized custody solutions.

Personal Strategy: Go for It

To put it directly, I personally tend to participate with a significant amount.

Firstly, because 100% of FT will be minted at the same price in either private or public offerings, meaning all investors have equal costs; secondly, the "perpetual put option" provides ample downside protection when the FT price is below or equal to $0.1, and even when above $0.1, the potential downside protection offers strong psychological support to holders; thirdly, Flying Tulip has designed multiple FT buyback mechanisms, which may benefit potential price increases.

Opportunities in the industry to "preserve capital while seeking returns" are rare; rather than asking "should I participate," perhaps the real question after the public offering opens will be "can I grab a quota."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。