It feels like today's homework is much easier to write. Although I overslept, I woke up to find that the market is starting to warm up. The US stock market not only recovered the losses from yesterday but also broke through historical highs again during the trading session. If the US stock market is doing well, then cryptocurrency shouldn't be too bad either. $BTC has rebounded back above $123,000, and even the long position I opened out of FOMO is starting to profit.

I believe many friends want to know the reason for the rise. I dug into the minute-level data; the blue line represents Nasdaq futures, and the orange line represents Bitcoin. It's clear that the two have a high degree of correlation. The Nasdaq started to see an increase in trading volume from the opening, and it continued to rise, which corresponds to BTC as well. During this period, there were no significant positive news or data.

From my personal perspective, it seems that US investors have moved past the data from the New York Fed yesterday, and it really is US investors because Nasdaq futures have been trading since the daytime. You can see that investor sentiment in the Asian and European markets is still not high, and only after the US stock market opened did things start to improve significantly.

Today, the Republican bill failed to secure enough votes in the Senate to end the US government shutdown, so the shutdown will continue. According to data from Kalshi, US investors believe the shutdown will extend to 24 days, which would perfectly miss the CPI and PPI data, and the Federal Reserve at the end of the month will enter a "blind guessing" phase.

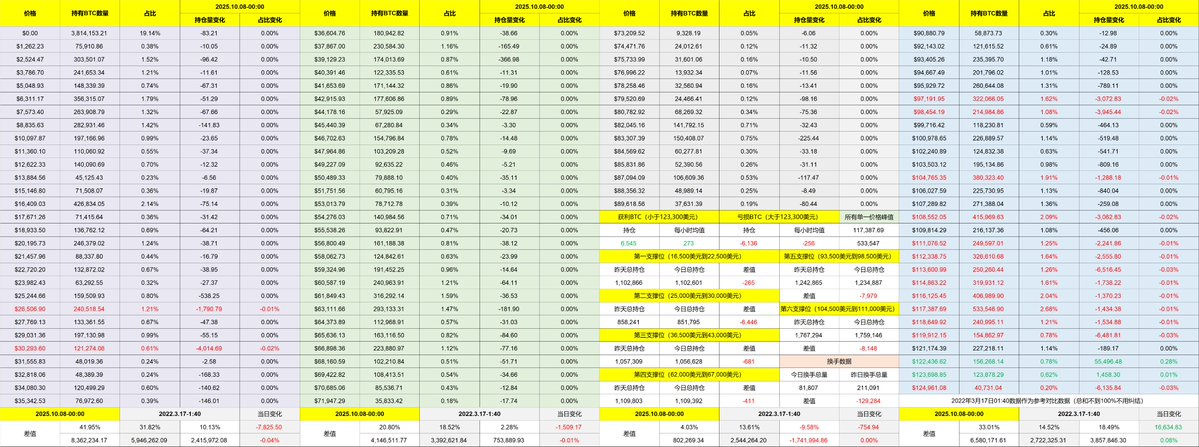

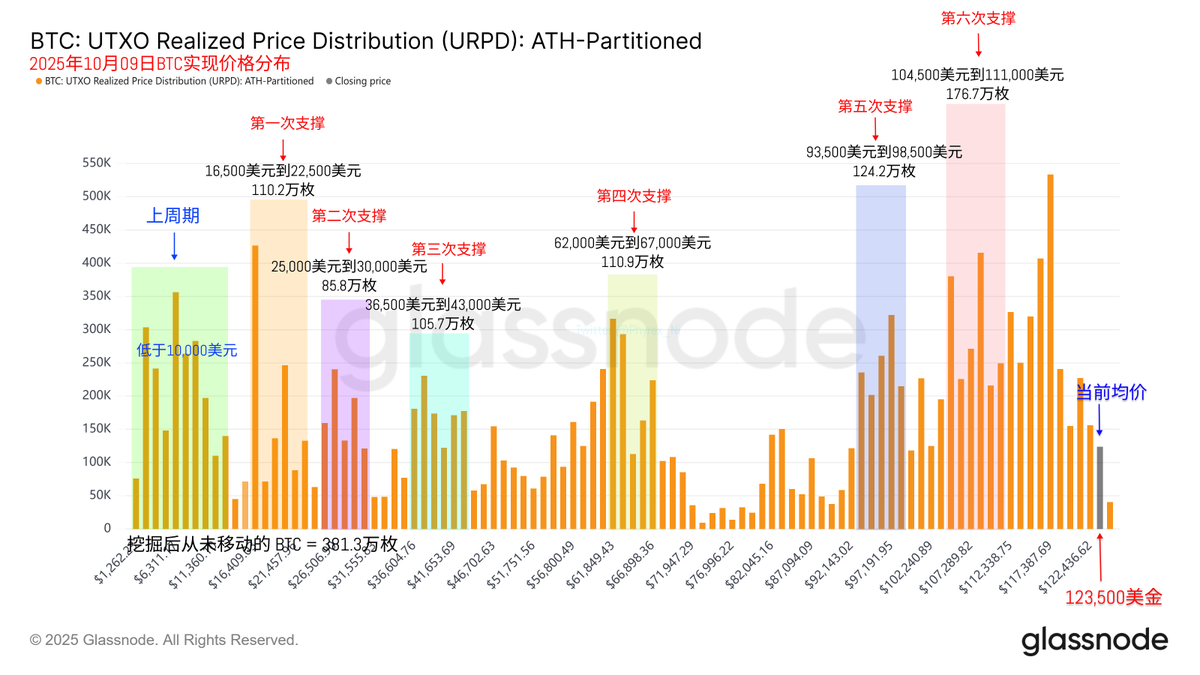

Looking back at Bitcoin's data, today's turnover isn't very high, possibly related to data adjustments. I'll take a closer look tomorrow, but it is clear that BTC has reached a point where low prices no longer make investors capitulate. Instead, low prices are often the best time to buy the dip. The panic selling is mostly from short-term investors, while long-term investors have remained in a wait-and-see mode.

The restructured chip distribution remains very stable. Even with yesterday's drop of over 2%, we did not see a large-scale exit of losing investors. Instead, investors above $120,000 are very indifferent. Now, to trigger a large-scale drop in $BTC, it would likely require systemic negative news.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。