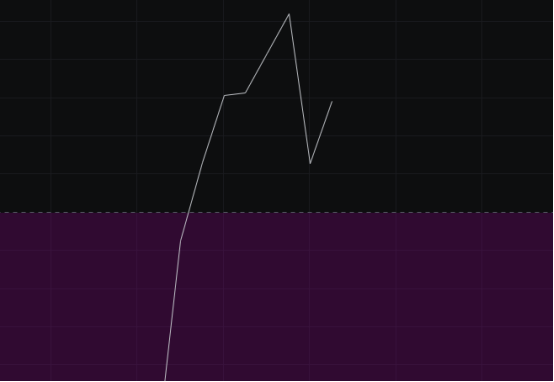

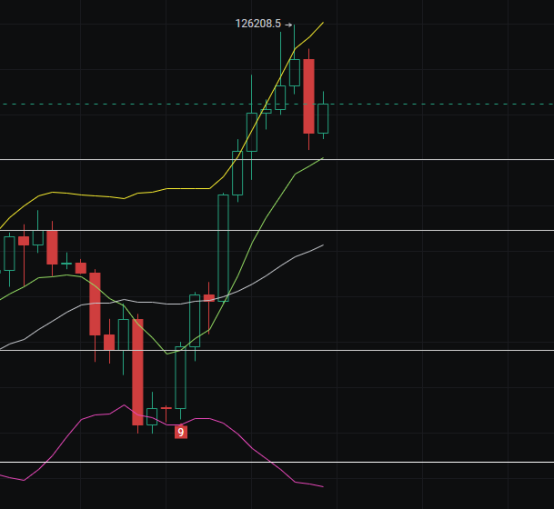

Yesterday, during the decline, we kept encouraging the bulls not to rush to exit, and today we started to see an increase, which basically aligns with our expectations. Here we define this as an adjustment after a rally, as a pullback of two or three points after a continuous rise of more than ten points is acceptable. Our target for the bulls yesterday was to not break 121,000; although it briefly broke below, it was recovered later, indicating that the bulls are still strong, and we continue to look bullish.

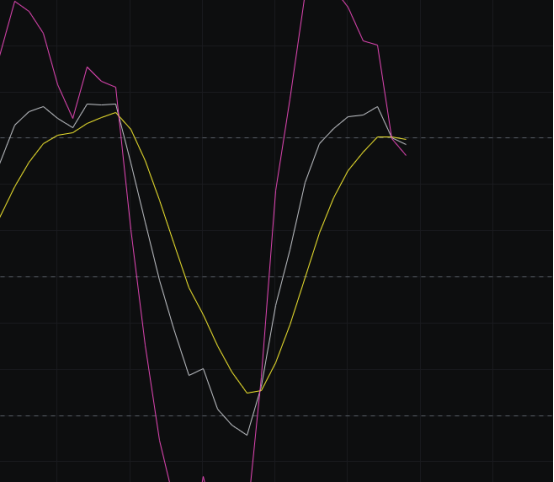

From the MACD perspective, with yesterday's decline, the energy bars have decreased, but it hasn't affected the overall situation significantly, so we need to continue observing the market.

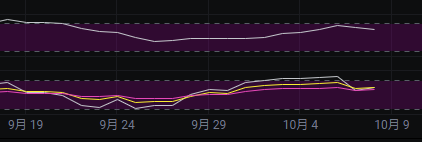

From the CCI perspective, the CCI is still above 100, maintaining a bullish stance.

From the OBV perspective, with yesterday's decline, the OBV has seen a certain pullback, but it hasn't damaged the OBV pattern, so we are looking at an adjustment here.

From the KDJ perspective, with yesterday's bearish candle, the KDJ death cross has completed. We are bullish but also need to be cautious of risks. We will look at the specific movement of the KDJ to see if it moves directly upward after the death cross or adjusts downward.

From the MFI and RSI perspectives, both indicators are in the neutral zone, so we will see the choice of the market makers. However, the price has dropped from above, and we haven't seen any bearish signals like divergence, so the probability of a direct drop here is relatively low.

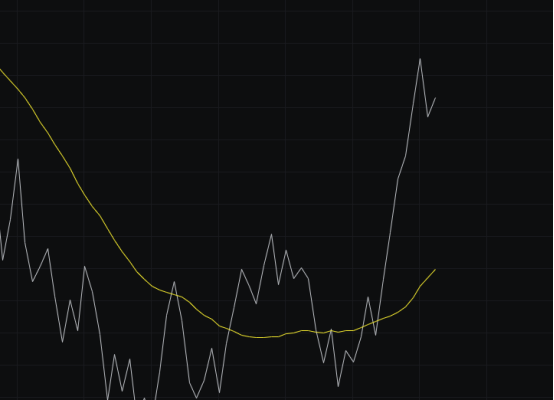

From the moving averages perspective, the price is above the moving averages, and several moving averages are also trending upward, indicating a bullish pattern, so we continue to look bullish.

From the Bollinger Bands perspective, with yesterday's decline, the lower band has flattened, and we will continue to observe whether it continues downward, levels off, or moves upward, while also considering the upper and middle band patterns to judge the market.

In summary: We define yesterday's decline as an adjustment, and whether the adjustment is complete still needs to be observed in the following movements. After all, both the daily and 4-hour levels have shown a bearish engulfing pattern, so further adjustments are also possible, and the bulls need to be cautious of risks. To negate this bearish engulfing pattern, the price should ideally rise above 124,600 in the next couple of days. Today's target for the bulls is to rise above 123,000, with support at 120,000-117,000 and resistance at 123,500-124,600.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。