From the perspective of spot data, the trading volume of $ETH is still lower than that of $BTC. Although the increase is acceptable, the strength is significantly lacking, which is also the reason why ETH experiences greater volatility; the stability of investors is too poor.

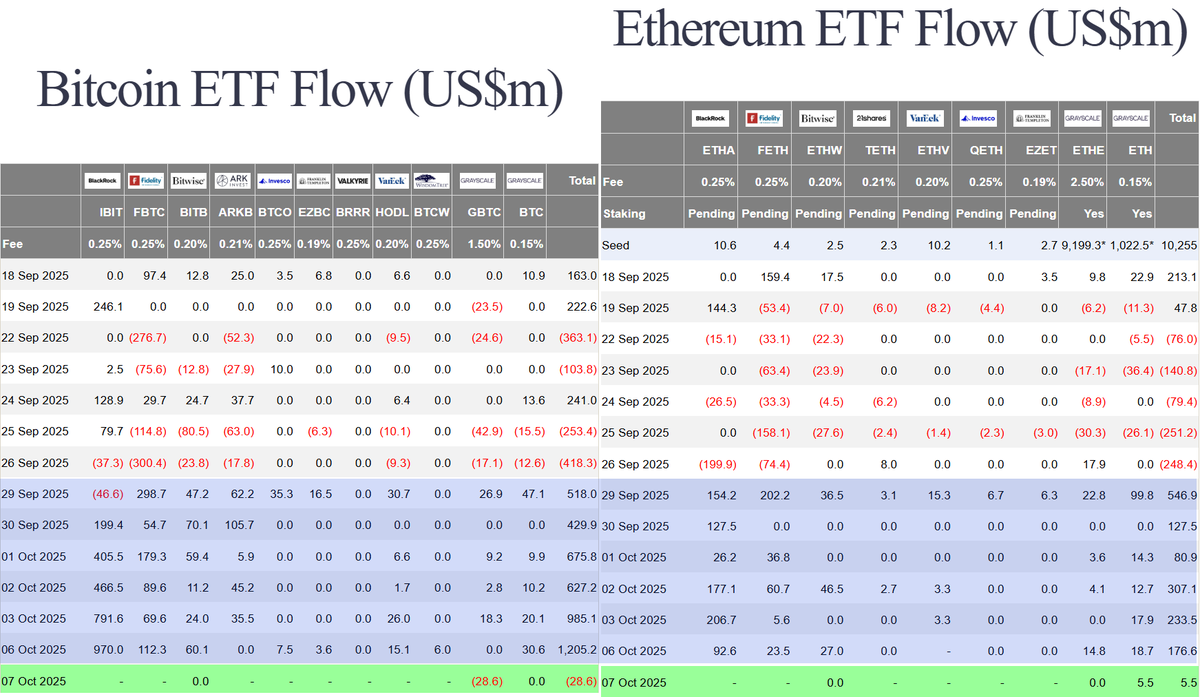

The primary and secondary markets for ETFs have improved compared to the previous week. In the primary market, nearly 300,000 ETH were added in the past week, while last week there was a net outflow of 200,000 ETH. This indeed looks good, and the secondary market for ETFs has also seen an increase in trading volume. Although it is not very high, it is still noticeable that investors are becoming more active.

However, when comparing the details of the capital amounts, it is different. It is clear that investors still prefer BTC, with the capital amount for ETH being more than three times lower than that of BTC.

Therefore, at this stage, if one wants to continue bottom-fishing, BTC will be stronger and more stable. This is the effect of capital, and of course, the key is that macro sentiment needs to be stable; otherwise, this capital will still be suppressed by panic sentiment.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。