We are celebrating the National Day and Mid-Autumn Festival, while the US stock market continues to hit new highs, #BTC also reaches a new high, and gold sets a new record as well. It seems everything is harmonious, but something important happened in the past two days that hasn't been widely reported in the news. Two American automotive-related companies have gone bankrupt! One is called #FirstBrands, and the other is #Tricolor. Many investment banks are involved, including UBS and JPMorgan Chase. Although the amounts are not huge, it is a rather strange event amidst prosperity!

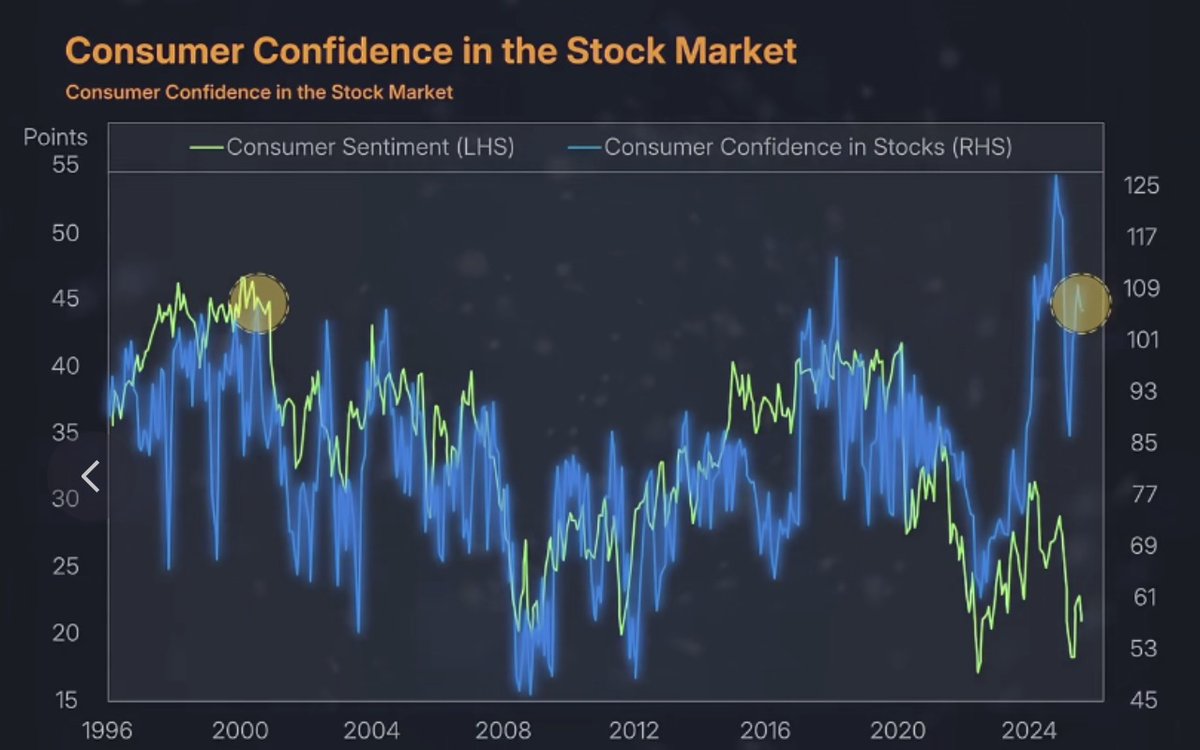

Previously, we discussed that the delinquency rate for auto loans in the US exceeding 90 days has reached a new high of 5%, similar to the levels during the pandemic lockdown and the 2008 financial crisis. Auto consumption is the largest personal expenditure after housing, and we must understand that the US is a country supported by consumption. At this moment, the collapse of these two companies could very well be a signal of the undercurrents in the US financial system.

1️⃣ First, let's talk about what these two companies actually do!

Tricolor is in the used car business, one of the top ten used car retailers in the US, operating 65 retail centers. Founded in 2007, it has gone through two rounds of financing, raising over $130 million, with participation from investment banks like BlackRock and JPMorgan Chase.

Its business model is quite unique; #Tricolor does not sell cars in the usual way. It specializes in selling cars to people with poor credit and those in special circumstances—such as illegal immigrants and low-income groups.

Its strategy is simple:

• Sell cheap cars, typically ranging from a few thousand to ten thousand dollars;

• Pair it with a high-interest loan with an annual interest rate of up to 20%.

These customers generally cannot afford to buy cars with cash and must rely on loans, and #Tricolor profits from these high-interest rates. Doesn't this sound a bit like the subprime mortgage model of 2008?—Yes, it's the subprime version for cars.

As for the other company, #FirstBrands, its history dates back to the 1980s, making it quite established, with 112 independent subsidiaries. Its core business is as a leading supplier of global automotive aftermarket parts. Its products mainly enter the secondary market through retail stores, wholesalers, and independent repair shops to meet vehicle maintenance and repair needs. The main products include the following brands, which dominate their respective automotive segments:

• Filtration: Fram filters and Champion Laboratories (Champ Labs)

• Braking: Raybestos brake pads, Centric Parts, and StopTech

With #FirstBrands' bankruptcy, as a major automotive parts supplier and a link in the upstream automotive industry chain, this could lead to a significant reduction in parts availability in the US automotive aftermarket, potentially driving up repair costs, which will ultimately be passed on to consumers, exacerbating the decline in automotive consumption.

2️⃣ The logic behind #FirstBrands' collapse: the explosion of off-balance-sheet financing

This company has relied on two methods to borrow money:

Inventory loan: using inventory as collateral to borrow money;

Invoice financing: using future receivables as collateral.

This method seems clever, allowing for short-term cash flow, but if your customers are slow to pay or inventory doesn't sell, these debts can quickly become bombs. Even more absurd is that this debt is not recorded on the balance sheet. It's like being deeply in debt but appearing healthy on paper. Then one day, when all the creditors come knocking, you realize: oh, I was already bankrupt.

Later, it was discovered that First Brands' off-balance-sheet debt exceeded $10 billion. Investors were stunned—yesterday it was rated AAA, and today it plummeted to CC. Bond prices fell from $1 to $0.01 in a single day, collapsing by 99%.

Does this scene seem familiar? Yes, it resembles the 2008 Lehman Brothers scenario. Back then, a bunch of AAA-rated bonds ended up as worthless paper.

3️⃣ The collapse of #Tricolor: the real fracture in American consumption

Now let's talk about #Tricolor. It actually serves as a "barometer" for the lives of ordinary Americans. Think about it, the two most important consumer expenditures for Americans are housing and cars. With current high-interest rates making housing unaffordable, cars have become the "last bastion of consumption."

What happened? #Tricolor went bankrupt, and #CarMax (the largest used car company in the US) saw its profits plummet by 40% this year, with its stock price getting crushed. What does this indicate? The purchasing power of lower-income American consumers has completely collapsed.

As mentioned earlier, the proportion of auto loans overdue by more than 90 days has exceeded 5%, now teetering on the red alert line, with many ordinary people unable to keep up with their car loans. As a "wheel-driven country," the US has a strong demand for cars; if people can't even keep up with car loans, it suggests that the entire consumption system may be in trouble.

4️⃣ Why the bankruptcies of these two companies should raise alarms

I believe the frightening aspect of these two bankruptcies lies in their symbolic significance.

First, they represent a breaking point in American consumption. When ordinary people can no longer afford to buy cars, it marks the beginning of a shaky consumption system. Additionally, they represent a breaking point in the financing chain. Off-balance-sheet financing, private debt, and invoice collateral have been used by many companies in recent years. Once the first company collapses, private institutions will begin to scrutinize and tighten funding, draining liquidity from the entire chain, which can easily trigger a domino effect. Ultimately, their collapse resembles the prelude to 2007. Back then, it also started with small companies and small mortgage lenders, leading to a series of domino effects that ultimately triggered the collapse of Lehman, AIG, and Wall Street.

In short, the current situation is that the crust is shifting, the volcano is rumbling, and everyone is still singing and dancing. But the temperature underground is already rising. Therefore, at this moment of apparent prosperity, we must calmly observe every move in the market, treading carefully as if walking on thin ice; one misstep could lead to a "capital avalanche."

Finally, I want to share my personal view. First, I am not bearish on the US; I am merely observing the essence behind the phenomena. Although various signs indicate that we are still far from a breaking point, especially with this round of corporate profits supported by #AI, which can indeed sustain the booming US stock market. However, we must also be vigilant about several signals:

• Consumer spending is already overextended. The American way of living on credit has reached its limit.

• Off-balance-sheet debt risks are high. Many companies are playing the "looks healthy" financial report game.

• High interest rates have persisted for too long. Long-term high rates make it only a matter of time before many small and medium-sized enterprises face cash flow crises.

• US stock valuations are outrageous. Even Powell has warned that "stock valuations are too high."

In the short term, the market may continue to maintain a "beautiful bubble prosperity"—because #AI, tech stocks, and buybacks are supporting the indices. But the cracks in the underlying economy are beginning to show.

Therefore, in terms of investment strategy, I always advise my followers to adhere to the "three no" principle: no leverage, no contracts, no borrowing money. Now, I would add: "Do not chase highs, focus on liquidity!"

The bankruptcies of these two automotive companies may just be the prologue; the real crisis often begins with such little-noticed news, just like we discussed earlier regarding BlackRock's Q4 investment strategy outlook, which emphasized that "living in the moment is more important." 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。