Written by: BitPush

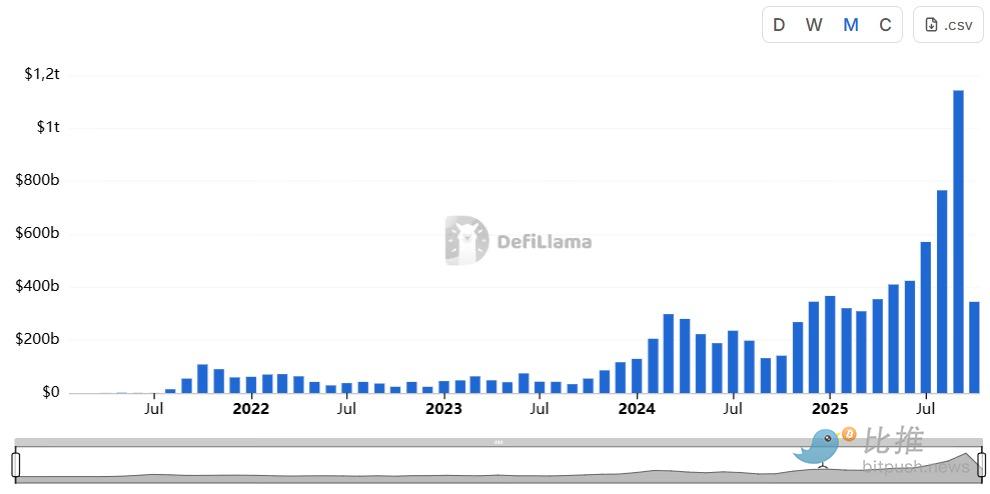

In September 2025, the monthly trading volume of decentralized perpetual contract exchanges (Perpetual DEX) surpassed $1 trillion for the first time, marking another significant milestone in the development of decentralized finance (DeFi).

This figure not only reflects the explosive growth of on-chain derivatives trading but also indicates that DeFi is entering a new phase of "perpetual dominance."

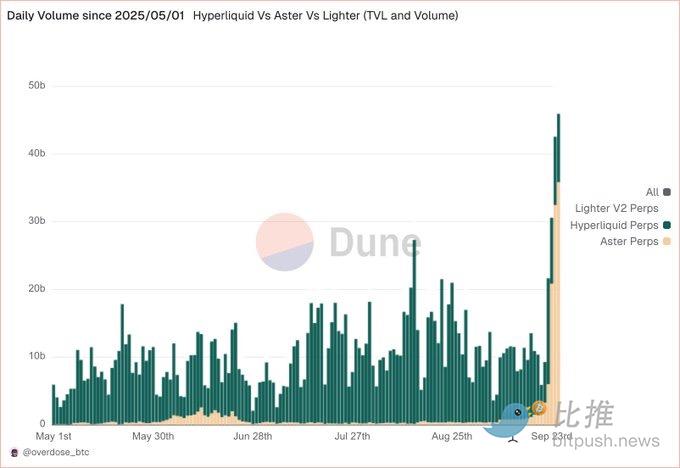

At the same time, the market landscape is rapidly changing—established players like Hyperliquid are facing direct competition from emerging platforms such as Aster, Lighter, and others, making the competition in the perpetual DEX space increasingly intense.

The Rise of Challengers like Aster, APEX, and Lighter

In the past month, the perpetual DEX market has witnessed an unprecedented wave of competition. Besides the still-dominant Hyperliquid, new platforms like Aster, APEX, Lighter, and Pacifica have quickly emerged.

Among them, Aster is undoubtedly the most eye-catching challenger.

The platform has achieved explosive growth in a short period, with trading volume at one point accounting for 14% of the overall market, and it is seen as a potential "heavyweight" player due to support from Binance and CZ.

Aster's technological innovations have also garnered attention—the introduction of the Hidden Orders mechanism effectively reduces MEV (Miner Extractable Value) and front-running risks, providing a fairer execution environment for professional traders.

Meanwhile, Lighter has made a strong entry with its "zero-fee" strategy, charging no fees for either Makers or Takers. This aggressive pricing approach has attracted a large number of high-frequency trading and arbitrage users in a short time. Although the current high trading volume is mainly driven by "wash trading" and "airdrops," Lighter's product smoothness and trading speed have also gained some user recognition.

In contrast, Hyperliquid still maintains a solid leading foundation. Its average daily trading volume over the past month reached $9.19 billion, with total open interest (OI) soaring to $13.1 billion, far exceeding its competitors. However, with the rise of new platforms, its market share has dropped from 56.1% to 13.7%.

Analyzing the Competitive Landscape through Open Interest, Ratios, and Strategies

In the perpetual DEX market, trading volume is often seen as an intuitive indicator of activity, but its authenticity is greatly influenced by incentives and airdrops.

In comparison, open interest (OI) and the OI/Volume ratio better reflect the platform's real capital retention and user stickiness.

From these two indicators, Hyperliquid remains the only platform with "real depth" (Dune data):

Hyperliquid: OI currently stands at $14.2 billion, with an OI/Volume ratio of 1.4. This level indicates that traders hold a large number of long positions on the platform, with high capital participation and active trading that is not purely driven by wash trading.

Lighter: Average daily trading volume is $539 million, with OI at only $1.37 billion, resulting in an OI/Volume ratio of 0.18, showing that capital retention time is short, and trading is mainly driven by arbitrage and incentive participation.

Aster: Although trading volume has grown rapidly, its OI/Volume ratio is only 0.014, indicating a clear "light capital high-frequency" model.

This gap illustrates that while Aster and Lighter have experienced short-term surges in traffic, Hyperliquid still holds an overwhelming advantage in capital retention and trader trust. In other words, Hyperliquid is a "capital retention venue," while other platforms remain in the "traffic explosion venue."

Additionally, the strategic focus and product structure of each platform show significant differences:

Hyperliquid centers on performance, depth, and user experience, relying on its self-developed high-performance matching engine and liquidity pool to create a trading experience similar to centralized exchanges (CEX).

Aster emphasizes innovative mechanisms and capital support, focusing on front-running defense and multi-chain compatibility at the technical level.

Lighter opts for a low-fee extreme strategy, attracting a large amount of short-term capital through zero fees, aiming to quickly establish market influence.

This differentiation means that the current competition in perpetual DEX is no longer just a battle of product experience, but a multi-dimensional game of capital efficiency, incentive design, and long-term trust mechanisms.

Can Hyperliquid Maintain Its Dominance? Will the "Zero-Fee Era" Arrive?

Based on current data and trends, Hyperliquid is likely to maintain its industry-leading position for the foreseeable future. Its technological maturity, capital depth, market maker network, and brand effect create a significant moat. However, the rapid rise of new platforms like Aster and Lighter also exposes two major risks that Hyperliquid may face:

Erosion of Market Share. If Aster can continue to retain users and improve its OI/Volume ratio after the airdrop ends, its growth momentum may persist. Especially with the backing of capital and upgrades in trading experience, it may attract some professional trader groups.

Fee Competition Pressure. Lighter's "zero-fee" model may trigger a wave of fee reductions across the industry. Historical experience shows that once zero fees become the new norm in the market, other platforms will find it difficult to retain users while maintaining high fees.

Whether the "zero-fee era" will truly arrive remains uncertain. In the short term, low fees can indeed attract traffic; however, in the long term, this model needs to sustain platform operations through alternative revenues such as capital fees, market-making spreads, and liquidation fees. If Hyperliquid can lower user costs without sacrificing profitability or achieve "de facto fee reductions" through more flexible incentive mechanisms, it still has the potential to solidify its position.

It is worth noting that the competition among perpetual DEXs is also continuously driving improvements in industry efficiency. Platforms are beginning to focus on matching performance, on-chain settlement speed, and risk management capabilities, which will further narrow the experiential gap between DEXs and CEXs. Meanwhile, security and compliance remain key variables influencing the industry landscape.

Conclusion

With a strong technological foundation and market trust, Hyperliquid remains the "price setter" in this space; however, the emergence of challengers like Aster and Lighter is forcing the industry to evolve rapidly.

The future winner may not necessarily be the one with the highest trading volume, but rather the platform that can maintain capital depth, safety, stability, and long-term trust in the face of waning incentives, declining fees, and stabilizing users. The battle for perpetual DEXs has only just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。