⚡️After reviewing this month's major events, I found that the rhythm in October is crucial, with data and regulations exerting dual pressure—

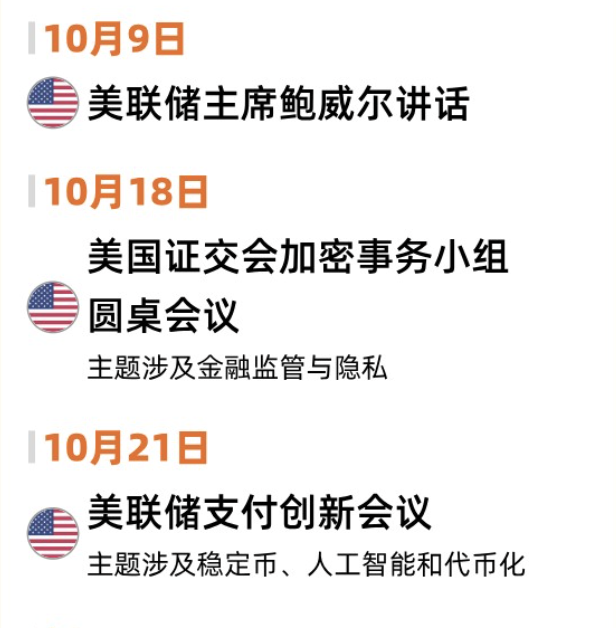

1⃣October 9: Federal Reserve Chairman Powell's speech.

We are only looking for two key signals:

Whether he mentions "economic slowdown/labor market cooling" more frequently;

Whether he emphasizes "data dependence + meeting-by-meeting".

If ① provides "weak data" and the wording is dovish → the market will preemptively trade for "easing at the end of the month";

If ① is vague/contradictory and the wording is hawkish → the outcome will be revealed at the end of the month, with increased volatility.

2⃣October 15: U.S. September CPI. This is the key data that will determine the tone at the end of the month.

3⃣October 18: U.S. Crypto Affairs Task Force roundtable meeting, focusing on financial regulation and privacy.

4⃣October 21: Federal Reserve Payment Innovation Conference, focusing on stablecoins, artificial intelligence, and tokenization.

Items 3 and 4 reflect trends well; the simultaneous discussion of stablecoins, tokenization, and AI indicates that Crypto is being integrated into the mainstream financial system, suggesting that the Federal Reserve's compliance framework is being accelerated.

5⃣October 29: Federal Reserve interest rate decision.

The non-farm payrolls on October 3 and the CPI on October 15 will determine whether the interest rate decision on the 29th can transition from "verbal easing" to "substantive easing".

Currently, the probability of a 25bp rate cut this month is 96%, indicating that the shift in liquidity has begun.

GM! A refreshing day, and I believe October will bring us good results!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。