Author: Ye Kai

Introduction

Before the festival, during a dinner with friends from PetroChina in Hong Kong, we discussed the differences between oil, petrochemicals, and energy electricity, based on the framework of the previous article "Electricity Renminbi." This discussion particularly focused on the recent regulatory dynamics surrounding stablecoins and RWA in Hong Kong. Subsequently, I organized this article as a supplement to "Electricity Renminbi" for reference.

Main Text

In the current context of the fatigue of the "Petrodollar" and the exploration of "Electricity Renminbi," if the international use of the Renminbi is limited to clean electricity, it will miss a more profound industrial pivot with global breadth: the real-world assets (RWA) of oil and chemicals. The so-called "Petro-CNH Stablecoin" (abbreviated as CNHP) is not a mere replication of the Petrodollar's single commodity standard, nor is it equivalent to the "Electricity Renminbi" anchored in energy electricity. Instead, it is based on the large-scale, auditable, priceable, and liquid RWA of China's petrochemical industry chain, reconstructing the pricing and settlement methods of commodity trade through compliant stablecoins and cross-border clearing networks.

Why "Petro-CNH"

Let’s start with availability and liquidity. The value of electricity is immense, but asset realization relies heavily on long-term operations, regional grids, and protocol allocation, resulting in cash flows that are "slow variables." In contrast, the asset forms of the petrochemical industry are closer to "fast variables"—from the billable warehouse receipts of crude oil and refined oil in transit to accounts receivable and pre-purchase contracts in refining, trading, and terminal sales, and to daily sales returns from gas station networks, measurable tolls from pipelines and storage facilities. Extending to downstream refining scenarios, these naturally possess attributes suitable for RWA standardization and dynamic pledging, such as high-frequency trading, divisibility, and ease of valuation and regulatory penetration. Unlike pricing based on "one kilowatt-hour," petrochemical RWA forms an asset pool of "multiple varieties—multiple terms—multiple entities," which can provide immediate settlement media and support medium- to long-term financing.

Next, consider coverage and network effects. Oil and chemical products are among the most densely traded and diverse commodity groups globally, involving upstream resource countries, shipping and storage, refining and trading, terminal retail, and industrial users, with mature supporting derivatives, bonded, and factoring systems. Digital settlement units anchored in this ecosystem do not need to struggle to "find scenarios"; they are inherently embedded in a vast array of cross-border contracts and credit instruments. China is the world's largest producer and consumer of petrochemical products, with major players like PetroChina, Sinopec, CNOOC, Sinochem, China National Chemical Corporation, and the State Energy Group, possessing the capability to feed back financial rules with industrial strength.

Of course, this also raises a macro-sensitive question: will it fall into a mirror of the "Triffin Dilemma"? The Petro-CNH does not require China to endlessly export physical goods in exchange for international liquidity; rather, it is supported by a "verifiable RWA asset pool + offshore Renminbi fund pool" for issuance, maintaining stability through transparent collateral ratios and redemption mechanisms, and exporting a verifiable value standard and settlement infrastructure. Holding CNHP essentially means holding a claim to a basket of audited petrochemical assets and Renminbi reserves, rather than betting on a single commodity or a specific geopolitical cycle.

Boundaries and Complementarity with "Electricity Renminbi" and "Petrodollar"

The biggest difference from "Electricity Renminbi" lies in the underlying cash flow and asset transferability. Electricity has public utility attributes and strong regional regulation, and "tokenization" on-chain resembles a value mapping of physical power supply; petrochemical RWA, on the other hand, centers on warehouse receipts, in-transit cargo rights, long-term purchase contracts, and terminal network returns, naturally adapting to the international trade bill system and financial structural tools, facilitating the formation of "bankruptcy isolation" arrangements that can be executed across multiple jurisdictions. However, the two are not mutually exclusive: electricity is suitable as a "base anchor" in the digital economy era, while petrochemicals serve as a "liquidity anchor" in global trade. The coupling of the two will create a dual-anchor system of "stable base—broad liquidity."

The main distinction from the "Petrodollar" lies in governance logic. The "anchor" of the Petrodollar is the trading system and military-political backing; the "anchor" of Petro-CNH is a verifiable combination of "industry RWA + transparent reserves + stability mechanisms," relying on compliant audits, smart contracts, and the sustainable operation of cross-border clearing networks, rather than a single geopolitical arrangement. Its goal is not to replace any currency but to provide a more efficient, lower-cost, traceable, and programmable settlement option within a more decentralized and digitalized global trade structure.

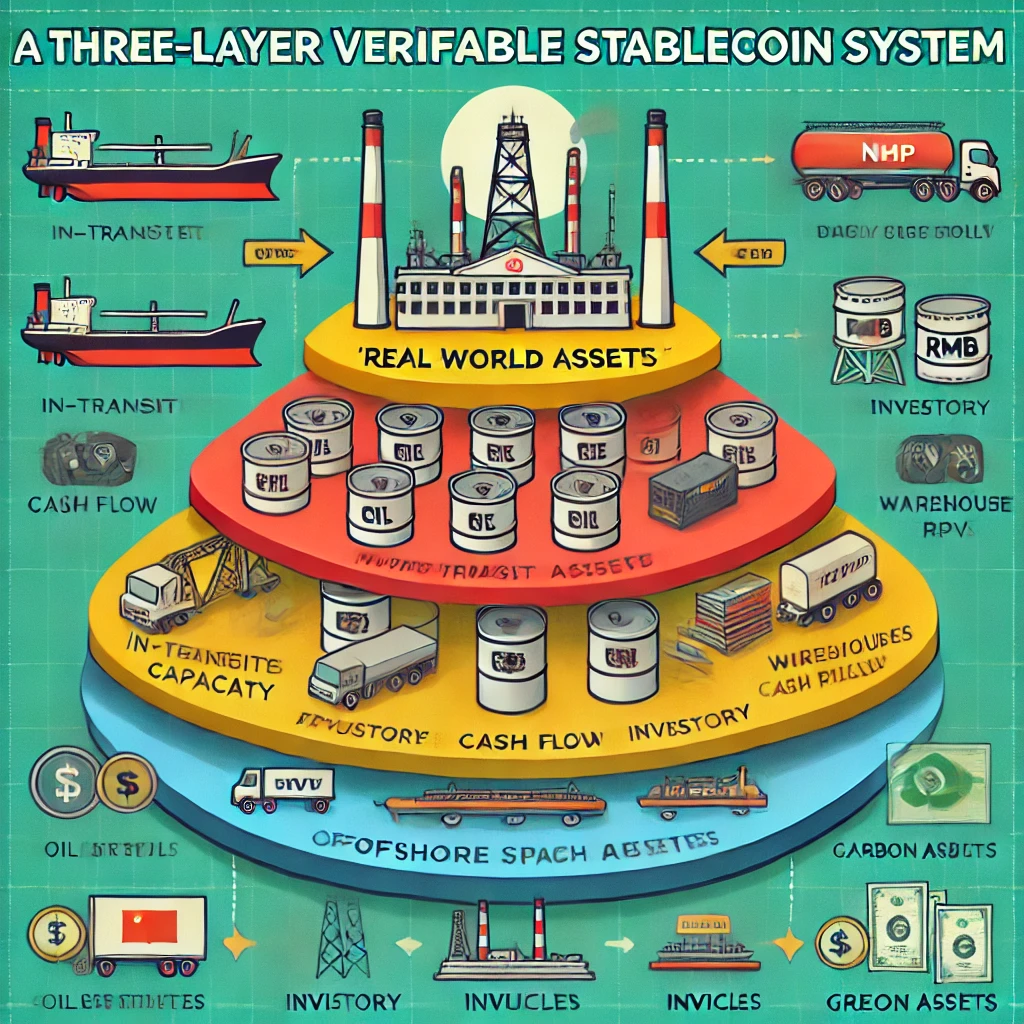

System Design: A Three-Layer Integrated "Verifiable Stability"

1. Value Anchoring Layer: Petrochemical RWA Asset Pool

The core consists of diverse, decentralized, and valuably assessable assets. This includes property certificates and policies for crude oil and refined oil in maritime transit, bonded warehouse receipts, and regulatory warehouse receipts; cash flows mapped from measurable capacity and utilization rates of refining facilities and chemical parks; daily sales returns from gas station networks, and rights to access and lease pipelines and storage; accounts receivable and future returns associated with long-term purchase contracts; and qualified carbon assets formed from energy-saving and carbon reduction transformations, CCUS, and hydrogen projects. Each sub-category of assets is assigned independent valuations and discount coefficients, scored comprehensively across four dimensions: "price transparency—liquidity—legal enforceability—environmental liabilities," forming dynamic LTV and concentration limits. All assets enter an offshore SPV/trust for genuine sale and bankruptcy isolation, subject to supervision by cross-border qualified auditing firms, third-party valuation companies, and custodial banks.

2. Issuance and Mechanism Layer: Compliant Stablecoins and Clearing Network

A licensed issuing entity will be established in Hong Kong, applying for a "1:1 redeemable" offshore Renminbi pricing model, named CNHP. The reserves will be anchored by "Renminbi cash and high-liquid assets + discounted petrochemical RWA," with the cash side covering daily redemptions and the RWA side providing value support and smoothing returns. Major market makers and redemption window mechanisms will be introduced, along with stable funds and repurchase arrangements to address extreme volatility. Technically, a dual-track architecture will be adopted, utilizing "alliance chains for large B2B settlements + public chains to enhance interoperability," providing on-chain proof of reserves (PoR), redemption queuing and SLAs, risk thresholds and circuit breakers, and gray information disclosure. Compliance modules will embed KYC/AML, sanction screening, and travel rules, ensuring compliance operations through whitelist accounts and traceable transfers. Cross-border clearing will connect with mBridge/RTGS and major custodial banks, supporting gateway interoperability with digital Renminbi (e-CNY) in specific scenarios.

3. Ecological Application Layer: From Trade Settlement to Asset Financing

In trade settlement, import and export contracts will use CNHP as the pricing and payment medium, achieving T+0 settlement, low-cost cross-border clearing, and reducing agency banks and exchange rate losses; in supply chain finance, holding companies can pledge CNHP to regulated on-chain/off-chain financing tools for quick liquidity; in derivatives and risk management, structured hedging and yield enhancement tools will be formed based on warehouse receipt indices, refining price spreads, cracking spreads, and refined oil baskets; in foreign engineering and park cooperation, CNHP can serve as a unified settlement unit for EPC progress payments, operation and maintenance fees, and spare parts procurement; in carbon finance linkage, audited energy-saving and emission reduction benefits can be mapped as RWA sub-pools, forming a "green settlement closed loop" integrating energy and carbon.

(AI-generated image)

Governance Framework: Industry Self-Regulation + Financial-Level Risk Control

At the industry level, it is recommended that the petrochemical industry association take the lead in establishing a special committee for digital assets and RWA, aggregating core members from PetroChina, Sinopec, CNOOC, Sinochem, China National Chemical Corporation, and the State Energy Group, along with large banks, brokerage investment banking departments, custodial banks, auditing and law firms, compliant exchanges, and clearing institutions, forming a closed loop of "standards—audits—custody—issuance—market making—clearing."

Governance will implement a three-layer structure of a council + risk committee + technology and audit committee; the risk side will introduce tiered margin requirements, concentration and term mismatch thresholds, stress testing, and a blacklist for re-pledging; the information side will disclose quarterly reserve composition, LTV ranges, maturity gradients, stress scenario NAV, and redemption performance.

Regulatory Path: Compliance First, Foreign Implementation First

Issuance and clearing should prioritize jurisdictions like Hong Kong with high standards for digital asset and payment regulatory frameworks, applying for stablecoin issuance and stored value payment licenses, with custody adopting account segregation and daily reconciliation; simultaneously, assess multi-jurisdictional licenses and "mutual recognition—equivalence" routes in jurisdictions like Singapore MAS and Abu Dhabi ADGM. In mainland China, it is essential to adhere to "controllable pilot projects under capital items" and "compliance technology penetration" in free trade zones, treating on-chain identification, travel rules, and traceable audits as resilient safeguards. Cross-border connections will interface with the mBridge multi-central bank cooperation platform, exploring onshore electronic letters of credit and cross-border trade financing linkage interfaces with pilot zones, ensuring that "on-chain code" and "off-chain law" are mapped, executable, and implementable.

Implementation Steps: From Small Closed Loop to Large Network

In the initial phase of Petrochemical RWA, it is advisable to select a single clear scenario to form a replicable model—such as constructing the first batch of RWA asset pools based on daily sales returns from gas station networks and long-term purchase contracts with designated refining facilities, which are controllable in scale, stable in data, and simple in legal relationships, facilitating quick audits, rapid redemptions, and fast reuse; within the Hong Kong regulatory sandbox, issue small-scale CNHP to several whitelist foreign trade partners for cross-border settlement of refined oil and basic chemical products, streamlining the entire "issuance—settlement—redemption" chain.

Subsequently, expand to nodes in the Middle East and ASEAN, integrating bonded warehouse receipts and maritime cargo rights, incorporating in-transit cash flows into the asset pool to enhance turnover efficiency and coverage breadth.

Once mature, collaborate with Electricity Renminbi to form a division of labor between "base anchor + liquidity anchor": the former will handle stable base load payments for long-term, public utility, and computational energy, while the latter will serve the high-frequency settlement and financing needs of global trade and industrial chains; the two tracks will interconnect at the mBridge and major custodial bank levels, achieving controllable swaps between e-CNY and offshore Renminbi pools.

Practical Value for the Industry

For enterprises, Petro-CNH compresses lengthy, expensive, and fragmented cross-border settlement processes into programmable, auditable, low-friction payment and financing channels; for trade partners, it provides a compliant alternative outside the US dollar, reducing exchange rate and agency bank costs, and enhancing cash turnover efficiency; for the industry and the nation, it establishes a financial infrastructure based on industry, transforming "pipelines, facilities, warehouse receipts, and terminals" into "standards, credit, liquidity, and pricing," providing a broad, high-frequency, and strong demand carrier for the internationalization of the Renminbi.

Conclusion

"Electricity Renminbi" provides a long-term and digital era "base anchor" for the internationalization of the Renminbi, while "Petro-CNH" offers a "liquidity anchor" for trade and finance through the scale and high liquidity of petrochemical industry RWA. For a stablecoin to transition from narrative to system, the key lies not in the old or new technology, but in industry verifiability, legal enforceability, and financial sustainability. With CPCIF at its core, the industry self-regulation and standard system, high-standard jurisdictions like Hong Kong as external circulation hubs, and major players like PetroChina, Sinopec, CNOOC, Sinochem, China National Chemical Corporation, and the State Energy Group as dual levers for assets and applications, there are ample conditions to develop "Petro-CNH" into a "physical—asset—code—rule" four-dimensional Chinese solution.

When warehouse receipts and in-transit cargo rights can be machine-readable, when every return from a gas station can form a pledgeable micro cash flow, when a long-term refining contract can maintain stable discounts in offshore systems, and when a stablecoin can achieve second-level clearing on mBridge—then the internationalization of the Renminbi will not merely be a numerical share in the foreign exchange market, but a tangible manifestation of industrial dominance at the financial level. In this sense, Petro-CNH provides a more solid and more Chinese main path for the global trade and payment network of the next decade.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。