Today's homework is still easy to write, all within expectations, and the Republican Senate leader has also indicated that it is unlikely there will be a Senate vote over the weekend, which directly pushes the game to next week. The longer this drags on, the greater the pressure on the Federal Reserve and the Democrats, while it is favorable for Trump and the Republicans in the short term. The stock market responded positively, and investor sentiment is high; Trump must be smiling from ear to ear.

He would love to continue the shutdown; the last time he presided over a shutdown, it lasted a record 35 days. This time, even if it exceeds two weeks, I would consider it normal. The longer it lasts, the worse the labor data will look, and the Federal Reserve will have to consider the issue of interest rate cuts, which would continue to stimulate the rise of risk markets. Before the shutdown is lifted, the market's expectations for rate cuts should be quite good.

Of course, being overly optimistic is also incorrect. The issue of geopolitical conflict seems to be intensifying; Russia is still very stubborn and has also announced that it is ready to prepare nuclear weapons at any time. Although the market has not reacted yet, I am still worried about the further escalation of war.

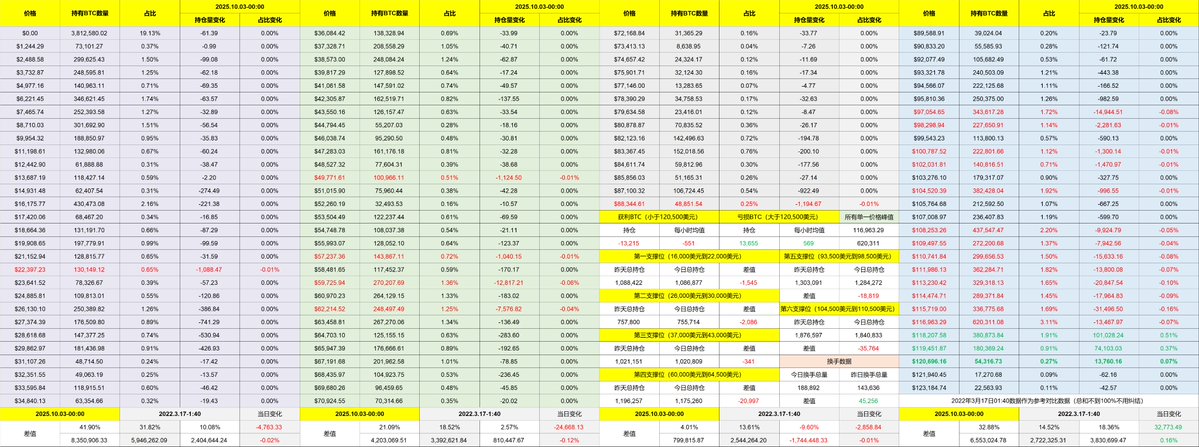

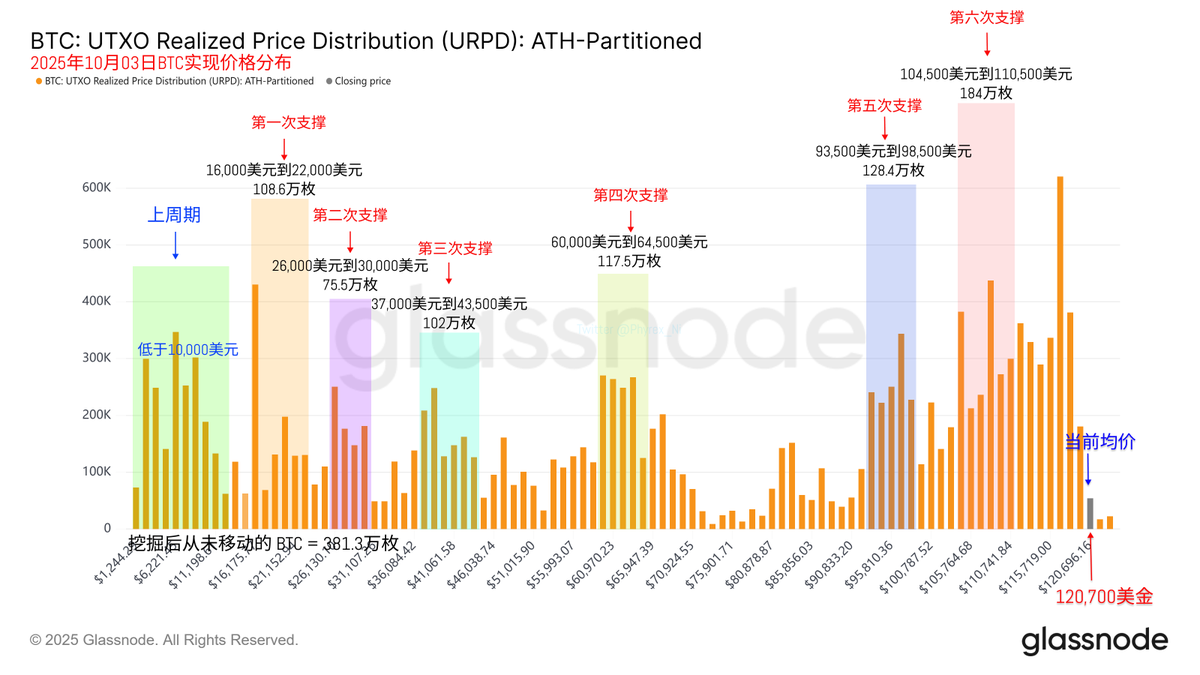

Looking back at Bitcoin's data, the price increase has driven up the turnover rate, and short-term investors are more motivated to sell. The current accumulation basically started from $118,000. Although I feel the price is a bit high, it cannot withstand the real money buying from investors. The spot ETF has exceeded the average purchasing power for two consecutive days, while the trading volume of $BTC spot has not significantly increased.

When the distribution of chips goes above $120,000, it is no longer very balanced. For now, there are still signs of accumulation for BTC above $120,000, but it feels slightly weak at the moment. The key is to see if tomorrow's non-farm payroll can be released. Although the Bureau of Labor Statistics is unlikely to release data during the shutdown, who can say for sure?

The main focus remains on Monday. If there are no issues on Friday, the two days of low liquidity over the weekend might bring another big move.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。