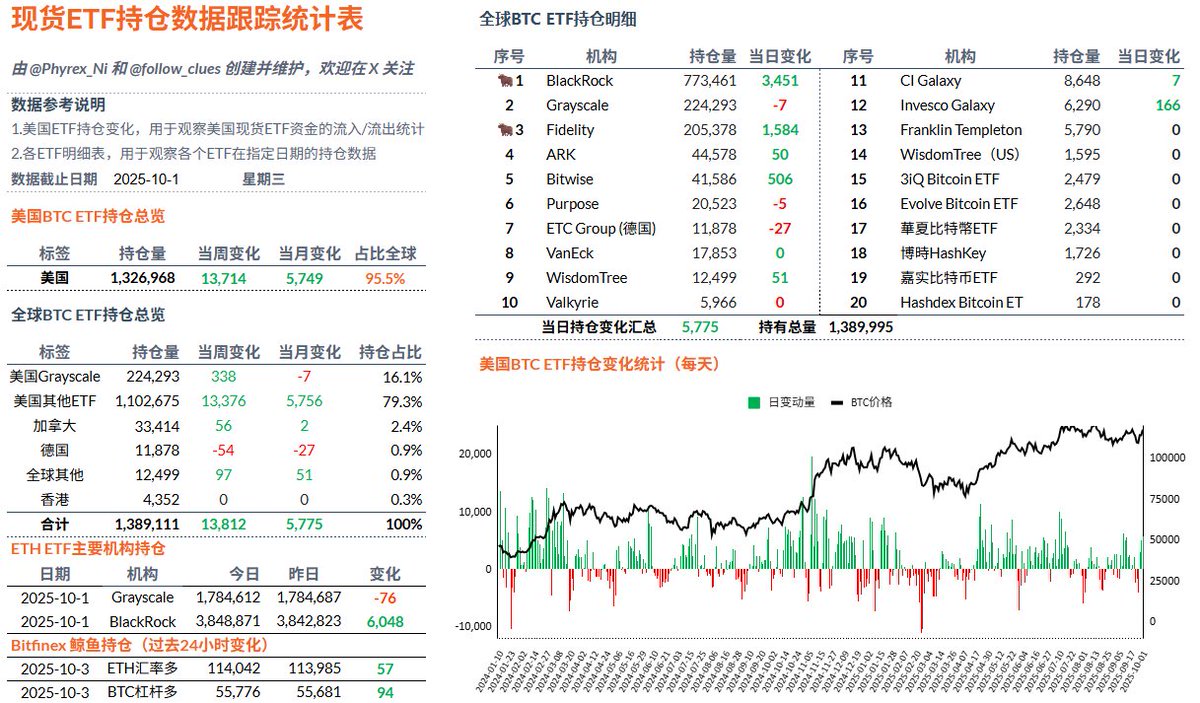

As the price of $BTC rises, the net inflow of spot ETFs continues to increase, with over 5,000 Bitcoins flowing in over the last 24 hours, which is already a good figure recently. Both BlackRock and Fidelity have seen four-digit inflows, and aside from Grayscale experiencing single-digit outflows, there have been no other institutions with outflows; the data looks good overall.

If I’m not mistaken, it should be the increased probability of the Federal Reserve cutting interest rates in October due to the government shutdown that is stimulating the market, and it is very likely that it’s not just October; the probability of a rate cut in December is also increasing. After all, if Trump really intends to implement permanent layoffs, the duration will last at least two months or more.

Today, the Senate Republican leader stated that the chances of the Senate voting over the weekend are slim, which clearly indicates that the Republicans are stalling for time.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。