Author: Zhao Qirui

Editor: Zhao Yidan

In this article, we will focus on how the International Operation Center for Digital Renminbi, established on September 24, unveils the internationalization infrastructure strategy of the digital renminbi, truly activating the unique advantages of "onshore control" in Shanghai and "offshore innovation" in Hong Kong, aiming to illustrate the unique geopolitical financial advantages being constructed.

Part Three: Synergy of Three Major Platforms and Construction of Internationalization Infrastructure

3.1 mBridge: Reconstructing the International Settlement "Highway"

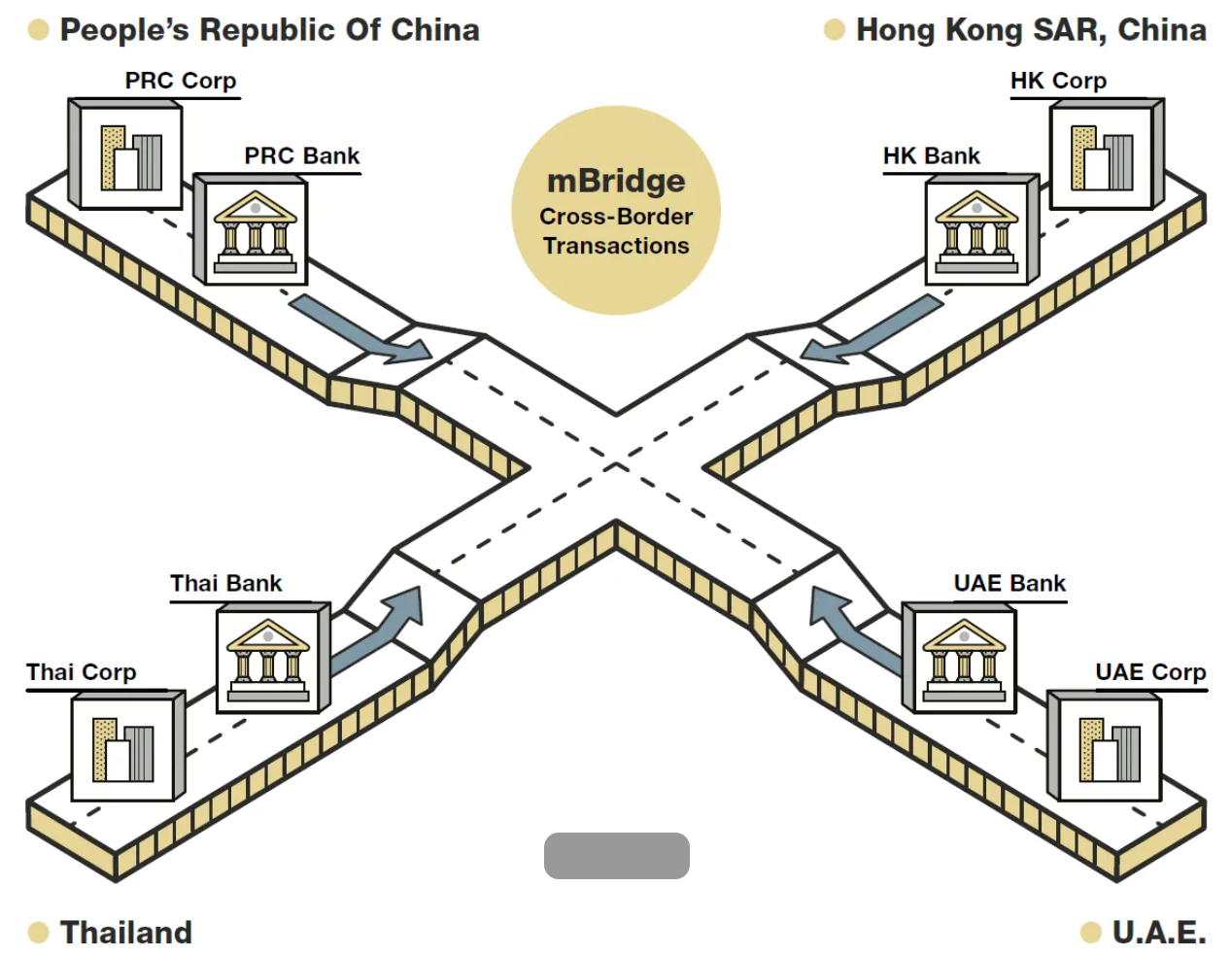

In June 2024, the multilateral central bank digital currency bridge (mBridge) project announced its entry into the "Minimum Viable Product" (MVP) stage and officially welcomed the Central Bank of Saudi Arabia as its sixth official member. These two closely connected developments mark that this global cooperation project, deeply participated by institutions such as the Bank for International Settlements (Hong Kong) Innovation Hub, the Digital Currency Research Institute of the People's Bank of China, the Hong Kong Monetary Authority, and the Bank of Thailand, has completely moved beyond the realm of technical experimentation to become a quasi-operational system with real commercial transaction capabilities, beginning to have a substantial strategic impact on the global financial landscape.

mBridge systematically dismantles the "indispensability" of the old system by constructing a multilateral, decentralized (among participating central banks) wholesale central bank digital currency (wCBDC) network. The direct challenge is not the messaging technology of SWIFT, but the layered, nested network of correspondent banks dominated by a few global clearing banks.

The "slowness" and "high cost" of traditional cross-border payment systems stem from the inherent structural flaws of the correspondent banking model. Each time funds pass through a correspondent bank, new time delays, cost expenses, and settlement risks are incurred. mBridge is built on a shared distributed ledger technology (DLT) platform, allowing central banks and commercial banks from multiple jurisdictions to directly conduct peer-to-peer wholesale central bank digital currency (wCBDC) exchanges on the same network. Its core technical architecture follows the three principles of "lossless, compliant, and interoperable," and through a "decentralized" underlying design, nodes are deployed among all participants.

The disruptive nature of this transformation lies not merely in enhancing efficiency but in structurally eliminating the intermediary role of correspondent banks, fundamentally dismantling the profit base and power structure of the old system.

In the traditional correspondent banking model, there are many transaction links and high fees, with transaction costs reaching as high as 6.38% of the transaction amount. These costs are the source of power collected by Western financial oligarchs through "tolls." The mBridge project achieves a "zero intermediary cost" model by facilitating direct peer-to-peer transactions, reducing intermediaries, and is expected to save nearly half of the costs. This economic disruption represents a complete business model disruption of the existing correspondent banking business model, fundamentally undermining the economic rationale for the existence of the "vassal network."

At the same time, mBridge provides the capability for "Real-Time Gross Settlement" (RTGS). Statistics from the Bank for International Settlements indicate that processing a payment through the currency bridge platform can be completed in "6 to 9 seconds," achieving "payment upon settlement." This leap in improvement is a "technological disruption" of the old inefficient controls, clearing away the implicit control of the old system over global capital flows, making it a rational and inevitable choice for international trade participants to bypass the old system based on efficiency considerations.

The existing cross-border payment system is dominated by developed countries (such as the SWIFT system), and the control of information flow is a tool for them to impose sanctions and regulations. mBridge, through distributed ledger technology, achieves a foundational design of equal participant identity and transaction information privacy control. Cross-border transaction information is only visible to the participants, while the platform can provide end-to-end transparency and real-time limit monitoring for participating central banks, thus reclaiming the control of capital and information flows from hegemonic centers and returning it to the sovereign participants in the transactions.

According to the BIS report on the mBridge project ("Project mBridge: Connecting economies through CBDC," Oct 2022), mBridge can reduce the settlement time for cross-border transactions from several days to seconds while lowering transaction costs by nearly 50%.

More importantly, its atomic "payment versus payment" (PvP) settlement mechanism completely eliminates the counterparty risk (such as Herstatt risk) inherent in traditional models, providing unprecedented certainty for global trade.

Based on this, the growing attractiveness of mBridge is forming the prototype of a "new economic alliance" based on common interests. The long-term unilateral jurisdiction of a single country over the world financial system, coupled with the increasingly prominent risks and efficiency bottlenecks of a single currency system, has led to this "club" model involving multiple central banks, which inherently possesses the political correctness of "decentralization." It reflects the emerging economies' long-standing grievances and their quest to reduce dependence on SWIFT-centered international payment facilities in response to increasing uncertainties in the international environment, confirming the common demand of major global economies for more diversified, efficient, and autonomous financial infrastructure.

The formal inclusion of Saudi Arabia is the strongest geopolitical signal of this trend. As the world's largest oil exporter and a cornerstone of the "petrodollar" system, Saudi Arabia's participation provides an unprecedented, efficient, and independent technical channel for exploring direct settlement of global commodity trade in "oil-renminbi" or other currencies. This is not merely an expansion of membership but a potential, profound structural challenge to the existing international monetary order. As of now, we are gradually recognizing the importance of this system amid the increasingly turbulent international situation.

By mid-2024, with the inclusion of the Central Bank of Saudi Arabia, the number of project observation members has increased to 31, covering central banks and international organizations from multiple countries. In the 2022 pilot, 20 commercial banks from four countries and regions successfully completed 164 cross-border payment and foreign exchange synchronization transactions, with a total value exceeding 22 million USD.

Moreover, the project's choice of "wholesale" rather than "retail" demonstrates high strategic wisdom. It precisely targets the largest and most critical clearing links between countries while avoiding touching on the retail payment habits of various nations, thereby minimizing political sensitivity and promotion resistance.

Recent applications have further demonstrated its scalability potential: for example, the multilateral central bank digital currency bridge business of Sinochem Finance has surpassed 10 billion RMB, and the Bank of China Shantou branch has completed a single cross-border payment of 6.33 million RMB using mBridge for enterprises, while a key supply chain enterprise in Shenzhen has completed a single large cross-border trade payment settlement of 68 million RMB, essentially achieving real-time arrival. Meanwhile, the total amount of currency bridge transactions in Suzhou reached 438 million RMB in the first half of 2024, growing more than 40 times compared to the entire previous year.

As the project enters the MVP stage and opens participation to the global private sector, this "new channel" for reconstructing global capital flow rules is no longer a theoretical concept. It is actively providing a highly competitive "new global financial public product" with significant contributions from China in an open and pragmatic multilateralism stance.

3.2 Shanghai's Three Major Platforms: Building a "Central Hub" for Global Operations

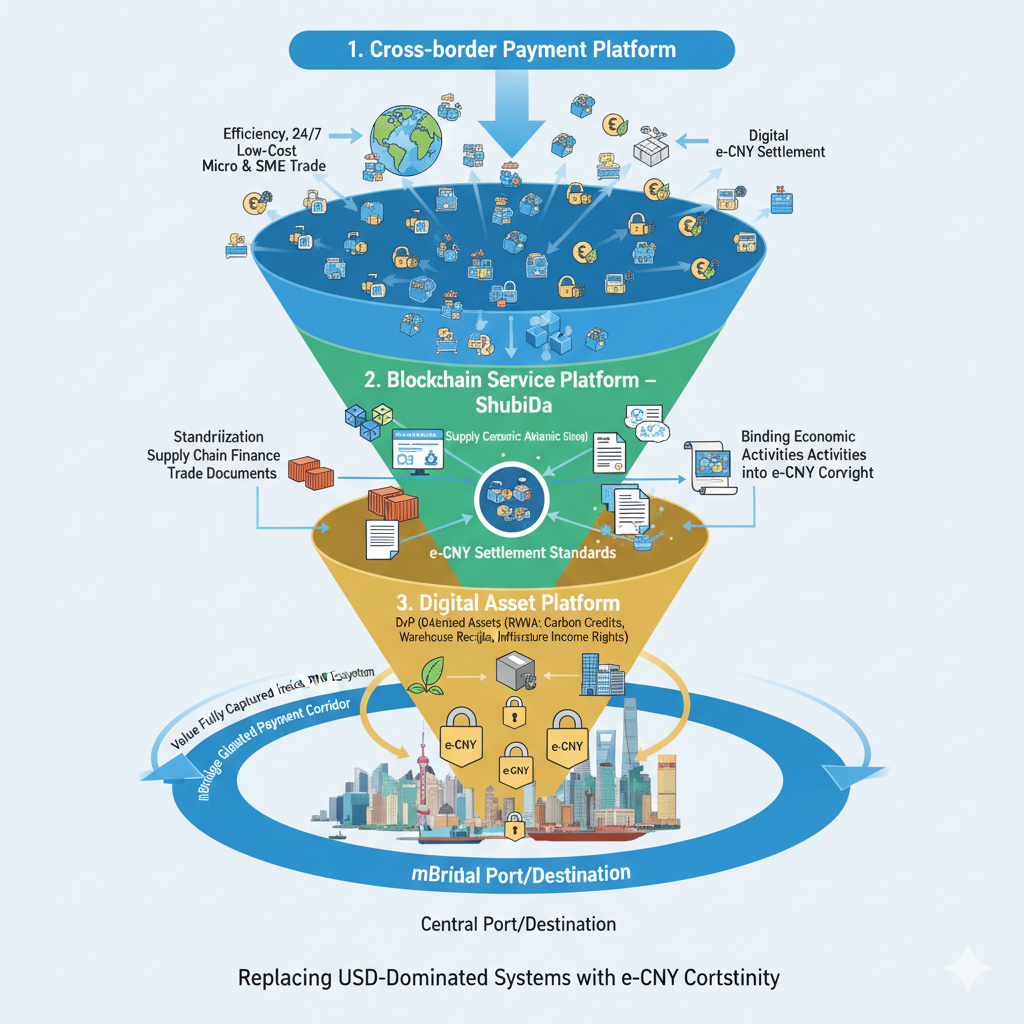

If mBridge constructs a new global channel, then the International Operation Center officially operating in Shanghai in September 2025 and its three major platforms are the only, super "destination port" of this channel. These three platforms—cross-border payment platform, blockchain service platform (named "Digital Currency Bridge"), and digital asset platform—are, in our view, a meticulously designed, layered "three-tier value capture funnel," with the strategic intent of efficiently and compliantly bringing global commercial activities in and ultimately achieving the circulation and accumulation of value within the renminbi system.

First Level: The Funnel Entrance—Using "Efficiency" as Bait to Achieve the Broadest Commercial Reach

The cross-border payment platform constitutes the widest entrance of this funnel. As analyzed earlier, e-CNY targets bulk, large-scale, national-level payment channels. With the launch of this platform, its core objective has been greatly extended: precisely attacking the fundamental pain points of the traditional correspondent banking system in handling small, high-frequency transactions, which are "high cost and low efficiency," maximizing the reduction of the threshold for global small and micro enterprises to access renminbi cross-border payments.

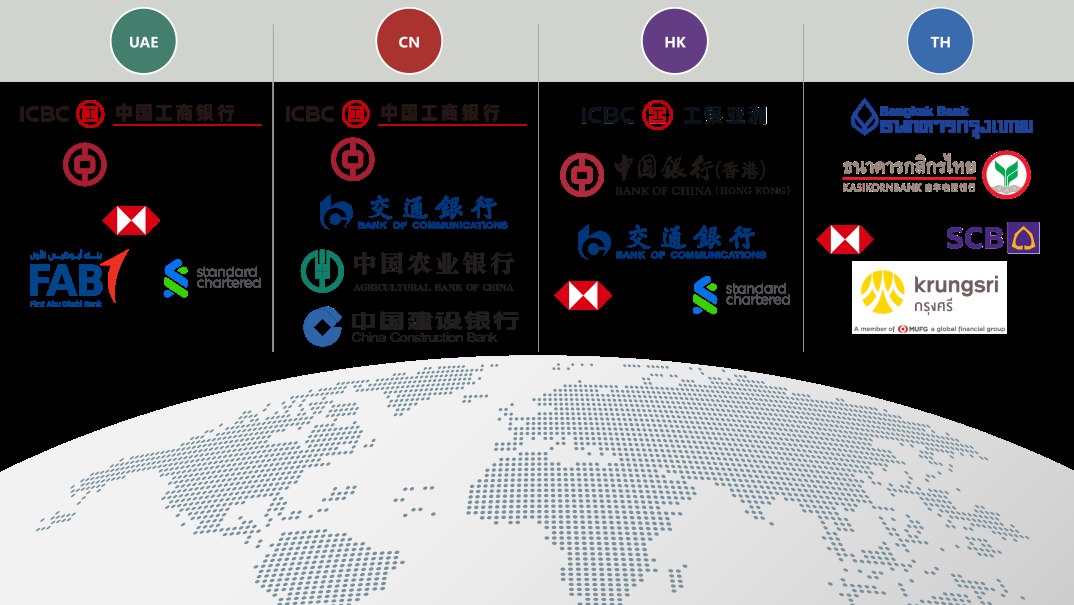

By providing 24/7, nearly zero-cost, payment-upon-settlement inclusive services, this platform offers a commercially attractive alternative for the "capillaries" of global trade. Without disturbing the core large-scale clearing (such as the wholesale business handled by mBridge), the platform establishes the initial network, data foundation, and user stickiness of e-CNY at the most vulnerable retail edge, laying the groundwork for the subsequent "deep dive." Recently, the platform has successfully completed the first batch of small commodity trade settlement tests with some commercial banks in Thailand and the UAE, marking the opening of the funnel entrance and beginning to attract the most active commercial flows globally.

Second Level: The Funnel Core—Using "Standards" as the Core to Achieve Deep Binding of Core Business

Once commercial entities are attracted by "efficiency" and enter the e-CNY payment network, the "Digital Currency Bridge" (digital renminbi blockchain service platform) begins to play its role as the "core of the funnel." Its goal is to upgrade e-CNY from a mere payment tool to the underlying settlement syntax for various on-chain economic activities, namely the "cross-chain bridge."

With "sovereign credit" as the backdrop, by providing standardized e-CNY payment and smart contract interfaces for various blockchain applications such as supply chain finance, trade documents, and digital copyrights, "Digital Currency Bridge" aims to deeply bind the core production and financing activities of external economies with the programmable system of e-CNY. It is evident that this directly counters the "protocol hegemony" and "credit risk" (such as decoupling risk, reserve opacity, etc.) of the US dollar stablecoin ecosystem, as well as the stablecoin protocols in the existing Web3 system (such as ERC-20), which are essentially extensions of the dollar-dominated financial vassal in the digital world.

For example, its cooperation exploration with major domestic ports aims to lock in "electronic bills of lading" and "payment for goods" through smart contracts. Once realized, this will significantly increase the cost for traders to switch to other settlement systems, thereby creating a strong path dependency.

Third Level: The Bottom of the Funnel—Using "Certainty" as Gravity to Achieve Final Value Accumulation

Digital Asset Platform is the final bottom layer of this funnel, aiming to become the "ultimate safe haven" for global tokenized assets (RWA). Its core is to provide an absolutely secure "Delivery versus Payment (DvP)" capability backed by sovereign credit.

In traditional financial markets, the asynchronicity of asset delivery and fund settlement has always been the root of systemic risk. This platform creates an "ultimate certainty" by providing synchronous, instant, and risk-free delivery of assets and funds.

This certainty holds unparalleled appeal for high-value RWAs (such as tokenized carbon credits, warehouse receipts, infrastructure revenue rights, etc.). When the highest quality assets from external economies seek the lowest global risk and highest liquidity, the only rational choice is to register, trade, and settle on this platform that can provide DvP ultimate certainty.

Thus, from the initial payment flow to the core business processes and finally to the value assets, everything has been fully integrated into this system centered on Shanghai and fueled by e-CNY for settlement, completing a closed loop of value capture:

Start: The "Cross-Border Payment Platform" serves as the "retail entry," attracting merchants, small and medium enterprises, and individuals from external economies into the shallow payment ecosystem of e-CNY with its "free and efficient" characteristics. This addresses the cross-border payment difficulties faced by small and medium enterprises and reduces their transaction costs.

Process: Once economic activities begin to be conducted through e-CNY, these transaction data and cash flows settle down. Based on the traceability and programmability of e-CNY, businesses such as supply chain finance and trade financing become highly attractive and secure. These financial activities naturally require standardized and intelligent on-chain settlement, which is the core function of the "Blockchain Service Platform." This platform deeply binds the core production and financing activities of these economies with e-CNY by providing a unified e-CNY settlement syntax.

Lock-in: Ultimately, the most valuable assets of these external economies (such as infrastructure revenue rights, export contracts, trade bills, etc.) will find that the only rational choice to obtain the lowest settlement risk and financing cost is to tokenize and trade through the "Digital Asset Platform." Because only this platform can provide DvP ultimate certainty backed by sovereign credit. At this point, the value creation and circulation process of the economy has been integrated into the e-CNY system, forming a closed loop. The cost of exiting this system, which is centered on e-CNY as the core settlement fuel, will become unbearable.

In short, the three major platforms in Shanghai jointly construct a complete and self-consistent digital financial infrastructure system that spans from retail to wholesale, from payment to asset trading, aiming to achieve an asymmetric and systematic replacement of the existing dollar-dominated financial order through technological certainty.

3.3 Transformation of Financial Paradigms

The globalization layout of the digital renminbi signifies far more than a mere patching of the existing cross-border payment system; it represents a transformation of financial paradigms. It aims to replace the old system, which has operated for half a century based on "institutional centralized trust," with a brand new "protocol-based decentralized trust" mechanism.

The core of the old paradigm is the concentration of power and trust in a few global correspondent banks. Its network is hierarchical, access is permission-based, and the bottlenecks in efficiency and cost stem from its inherent structure rather than technology.

In contrast, the new paradigm constructed by mBridge and the three major platforms in Shanghai is characterized by a decentralized, flattened network structure. Trust no longer relies on the credit of a specific intermediary but is generated from the protocols jointly adhered to and verified by network participants.

This new system aims to achieve the future direction defined by the BIS:

"Instant, cheap, universally accessible cross-border payments with final settlement functionality."

The disruptive nature of this revolution is succinctly captured in the report from the T20 Brazil Summit:

"By enabling direct settlements between local currencies, initiatives like mBridge and Agorá within the BIS may render traditional correspondent banking redundant."

Therefore, the ultimate goal of this system has transcended the competition for "currency share" in traditional geopolitics. Its grander vision is to export a complete, fairer, and more efficient set of "digital financial public products" to the world, especially to the vast developing economies along the "Belt and Road." This represents a fundamental shift from passively "participating in the game" to actively "defining the rules of the game."

The International Monetary Fund (IMF) has repeatedly pointed out that the world is inevitably moving towards a "multipolar currency system." In this grand historical context, China's promotion of this open, multilateral new generation of financial infrastructure is not aimed at building an exclusive closed group but is a responsible strategic choice that aligns with historical trends and actively participates in shaping a more balanced and diversified new global financial order.

Part Four: "Shanghai-Hong Kong Dual City Chronicle"

4.1 Strategic Dualism

Amid the fierce evolution of the global digital financial paradigm, China actively and creatively leverages the institutional flexibility of "one country, two systems," forging it into a unique national strategic advantage to respond to future uncertainties. The parallel development pattern of Shanghai and Hong Kong has transcended simple policy segregation, evolving into a meticulously calculated "risk-hedging investment portfolio" strategy.

The construction of this strategic portfolio aims to perfectly balance the two core objectives of "national financial security" and "global innovation opportunities." Strategically shaping a "mainland strictly controlling risks, Hong Kong embracing innovation" dual prosperity situation. The latest policy deployments clearly confirm this:

The "Ballast Stone" of the Portfolio—Shanghai (Onshore): Its core positioning is extreme stability and controllability. As demonstrated by the People's Bank of China's series of monetary policy operations in 2025, represented by reserve requirement ratio cuts and interest rate reductions, the primary task of financial work in the mainland is to "maintain macroeconomic stability and prevent systemic risks." Under this framework, the digital renminbi (e-CNY) plays the role of a "sovereign credit-backed" "national debt," providing an unshakeable stability anchor for the entire country's financial system.

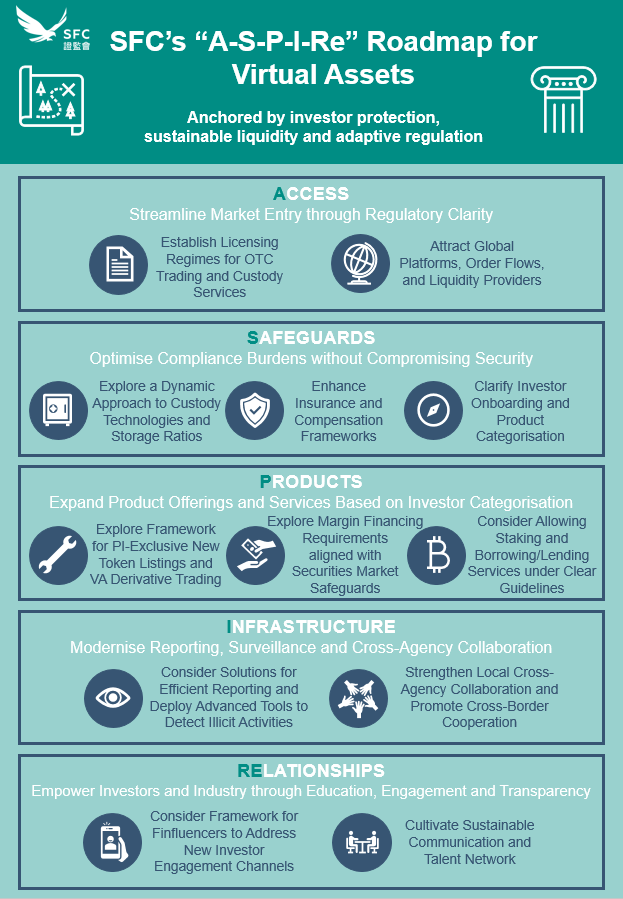

The "Scout" of the Portfolio—Hong Kong (Offshore): Its core positioning is regulated openness and innovation. The "Stablecoin Issuer Regulatory Framework" officially implemented by Hong Kong's financial regulatory authorities in 2025, along with the "Virtual Asset Market Regulatory Roadmap" from the Securities and Futures Commission, is not a "hands-off" approach but is aimed at building a "rule-based innovation ecosystem" that aligns with international best standards. In this portfolio, Hong Kong plays the role of "venture capital (VC)," responsible for exploring the frontier, embracing high risks to seek high returns.

Specifically, when global regulatory bodies such as the International Monetary Fund (IMF) and the Bank for International Settlements (BIS), or traditional financial giants, examine China, their perspective primarily focuses on the onshore financial system represented by Shanghai. In this "collapse" state, China appears as a "responsible, strongly regulated, and systemically stable national actor." The prudent pilot of the digital renminbi in the mainland, the strict "controllable anonymity" principle, and the comprehensive ban on cryptocurrency trading all reinforce this image. Shanghai demonstrates a narrative of "stability" where technology serves national strategy and strictly controls risks through the steady advancement of blockchain technology in areas such as supply chain finance and government services.

However, when global risk capital, Web3 developers, and cryptocurrency innovators observe China, their gaze is directed towards Hong Kong. From this perspective, China "collapses" into an "open economy that embraces innovation, encourages experimentation, and aligns with international frontiers." Hong Kong actively introduces a mandatory licensing system for virtual asset trading platforms (VASP), approves virtual asset spot ETFs, and establishes a clear regulatory sandbox mechanism for stablecoin issuance, showcasing its "opportunity-oriented" approach to embracing digital financial innovation. This proactive stance positions it as a potential global digital asset hub.

This ability to present different "intrinsic states" based on different observers endows China with extreme strategic ambiguity. It makes any containment strategy based on a single ideology difficult to succeed. When the West accuses China of financial repression, China can showcase the market vitality and institutional innovation of Hong Kong; when concerns arise about the financial risks posed by cryptocurrency assets, China can emphasize the strong regulatory framework in the mainland and its zero-tolerance attitude towards systemic risks. China can always present another half of reality as a powerful rebuttal, thus taking the initiative in complex international games.

The Real Function of the "Firewall"

This proactivity is evident in the previously segregated capital account control system between the mainland and Hong Kong. Long regarded as a "firewall" to prevent the transmission of financial risks inward, under new policies and financial measures, it has been endowed with more imagination: it is more of a carefully designed "strategic filter," achieving a highly asymmetric energy exchange.

This wall effectively blocks the risks and ideologies of the global financial market's "Wild West" from disorderly penetrating the mainland system. It firmly isolates the extreme price volatility of private cryptocurrencies like Bitcoin, the "death spiral" risks of algorithmic stablecoins, and the anarchic crypto spirit behind them from the onshore system. By prohibiting cryptocurrency trading, the mainland financial system maximizes its immunity to potential systemic shocks and ideological challenges.

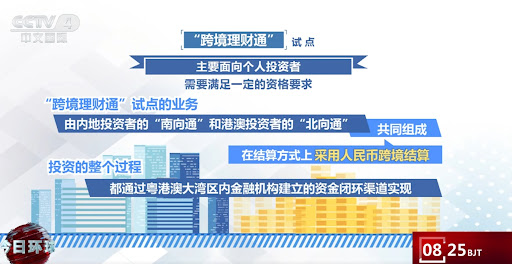

At the same time, this wall is not completely closed but selectively opens specific channels. It allows innovative results, international capital, and talent that have been "purified" and "translated" through Hong Kong to be orderly injected into the onshore system through a series of controllable connectivity mechanisms such as "Shanghai-Shenzhen-Hong Kong Stock Connect," "Bond Connect," and "Cross-Border Wealth Management Connect 2.0," in a manner that aligns with mainland regulatory logic. Hong Kong becomes an ideal "testing ground" and "converter": cutting-edge financial innovations (such as RWA tokenization) can be piloted within Hong Kong's regulatory sandbox, and once the models are mature and risks are controllable, their experiences and models can be referenced by the mainland; international capital can allocate renminbi assets through these regulated channels, aiding the internationalization of the renminbi.

Therefore, we say that the key to energy exchange lies in: it ensures that China can unilaterally and asymmetrically draw from the global financial system what it needs (capital, technology, talent), while maximizing immunity to its harmful side effects (systemic risks, ideological challenges), achieving the strategic goal of seeking benefits and avoiding harm.

The Strategic Essence of the "Shanghai-Hong Kong Dual City Chronicle"

As emphasized multiple times by central leadership, it is necessary to "consolidate and enhance Hong Kong's status as an international financial center," because "'one country, two systems' is Hong Kong's greatest advantage." This clearly indicates that the Shanghai-Hong Kong dual structure is a well-considered strategic choice for China to remain invincible in the changing global financial landscape.

The "dual prosperity" situation of "mainland strictly controlling risks" and "Hong Kong embracing innovation" is essentially a grand strategic layout based on the framework of national sovereignty. The decision-makers act like the most astute macro traders, utilizing and operating the significant "institutional interest rate differentials" that exist within the country.

When the global financial environment is turbulent and external risks are escalating, the strategic focus shifts to "long Shanghai." By strengthening onshore financial regulation, capital controls, and the centralized management of the digital renminbi, the resilience and controllability of the financial system are ensured.

When it is necessary to embrace global financial innovation, attract international liquidity, and promote the internationalization of the renminbi, the strategic focus turns to "long Hong Kong." By promoting Hong Kong to establish a regulatory framework for digital assets that aligns with international standards, developing the offshore renminbi market, and launching a variety of financial products, it ensures that the opportunities of the new financial revolution are not missed.

Ultimately, the strategic essence of the "Shanghai-Hong Kong Dual City Chronicle" is revealed: it is not merely a simple regional division of labor, but rather a clever transformation of the potential institutional contradictions within a country into an unmatched external competitive advantage. Through this meticulously planned internal arbitrage, China can maximize the benefits of global financial innovation while maintaining the bottom line of national security, thus remaining invincible in the global financial paradigm war that concerns the future.

4.2 Onshore Anchor

Focusing on the practice of the digital renminbi (e-CNY) in Shanghai, all its designs and choices must serve the highest mission of Shanghai as China's "stabilizer" and "sovereign fortress."

Understanding this point, and starting from it, allows us to comprehend that the form of e-CNY in the mainland is an inevitable result of serving the highest goal of national financial security. It is this order, defined by national will, absolute and unquestionable, that constitutes the source of power for the entire "Shanghai-Hong Kong dual" system, making Shanghai's role not a passive defense, but an active output of stability and order, providing the source of strength for the entire Shanghai-Hong Kong dual system.

In the unpredictable global financial market, the core product that Shanghai exports to the world is an undeniable set of rules and order backed by national sovereignty.

The centralized management structure of e-CNY is a direct manifestation of this order in monetary form. It ensures the ultimate control over the country's "digital currency issuance rights" and payment settlement system, which "will never go out of control" under any extreme circumstances. As emphasized by the People's Bank of China in the eight measures announced at the Lujiazui Forum in June 2025, strengthening macro-prudential management and systematically collecting and analyzing transaction data is core to maintaining financial stability. Therefore, the centralization of e-CNY is essentially an institutional arrangement that prioritizes national financial security above all else.

The accompanying "dual-layer operational system" serves as a precise "systemic risk isolation wall." It institutionally dismantles the fuse that could trigger "financial disintermediation" risks due to technological innovation, ensuring that any transformation does not impact the stability of Shanghai, the financial heart. The strong regulatory system that constitutes Shanghai can actively "screen and define" what constitutes financial innovation that aligns with national strategic interests.

The "controllable anonymity" principle of e-CNY is a reflection of this proactive regulatory philosophy. It delineates clear boundaries for all onshore digital financial activities while meeting the rigid requirements of international AML/CFT compliance. More importantly, regulation actively shapes the direction of innovation through the guidance of application scenarios. For example, the Shanghai municipal government is vigorously promoting the construction of blockchain infrastructure and integrating the digital renminbi into it. In the field of government services, it has begun exploring the use of smart contracts for "special support funds for sci-tech enterprises" to ensure that fiscal funds are "used for their intended purpose." This clearly indicates that in Shanghai, regulation is not an obstacle to innovation but a "guiding stick" that ensures innovation serves the real economy and national strategy.

Shanghai is not only the source of e-CNY technology, standards, and talent—demonstrated by its role as the core of the Yangtze River Delta digital financial integration, dedicated to building a unified and secure regional "internal circulation" system—but also the ultimate credit guarantor for Hong Kong's offshore innovation. The reason Hong Kong dares to embrace the waves of the global virtual asset market is solely due to the backing of an absolutely stable "ballast stone" that can provide unlimited liquidity support and ultimate credit backing at any time.

The establishment of the digital renminbi international operation center in Shanghai is a clear example.

It is precisely because this "ballast stone" ensures the solid foundation of the ship that Hong Kong, as a "lookout tower" and "vanguard," can boldly explore unknown new routes without worrying about the strategic space being overturned by momentary storms. Shanghai's "stability" ultimately transforms into Hong Kong's "innovation" confidence. Understanding this allows one to grasp the core of power in interpreting the entire Shanghai-Hong Kong dual strategy.

4.3 Offshore Pioneer

Under the absolute stability provided by the aforementioned "ballast stone," Hong Kong can play its core role as an "offshore pioneer."

The outside world often interprets Hong Kong independently, viewing its recent open measures in the virtual asset field as radical free market experiments.

In August 2025, Hong Kong Monetary Authority Vice President Chen Weimin spoke at the 7th Guangdong-Hong Kong-Macao Greater Bay Area Financial Development Forum. In June 2025, the Hong Kong government’s "Hong Kong Digital Asset Development Policy Declaration 2.0" clearly stated the intention to integrate digital assets with the real economy and financial markets, "bringing substantial benefits to the real economy and financial markets."

Hong Kong's identity as a "special administrative region" is firm, and a series of disciplined and targeted strategic explorations are underway. Therefore, its role in the national digital financial strategy can be precisely defined as a "dual-functional strategic special zone."

First, Hong Kong is the "risk firewall" for the mainland. It utilizes its independent legal and tariff systems to establish a crucial risk isolation zone for the mainland. The "Stablecoin Issuer Regulatory Framework," which officially took effect on August 1, 2025, with its strict licensing, capital, and 100% high-quality reserve requirements, clearly indicates that Hong Kong's innovation is a "selective opening" under "strong regulation." Its purpose is to ensure that the waves of global financial innovation can be effectively "filtered" and "purified" before being prudently assessed.

Shortly thereafter, on September 17, 2025, Hong Kong Chief Executive John Lee delivered the 2025 Policy Address, announcing that Hong Kong would accelerate the establishment of an international gold trading market.

A strong, renminbi-denominated gold market serves as the hardest value anchor for offshore renminbi, while also absorbing the potential severe shocks from the future virtual asset market, especially from stablecoins pegged to fiat currencies (non-U.S. dollar stablecoins, such as renminbi stablecoins, which are still in their infancy). By achieving connectivity with the Shanghai Gold Exchange, Hong Kong is building a hard asset ecosystem that connects domestic and foreign markets, denominated in renminbi. The Hong Kong Monetary Authority is also promoting tokenized gold investment products.

"Offshore Renminbi Asset Shelf"

Under a series of policy deployments in Hong Kong, a clear strategic goal emerges: to carefully create a comprehensive "asset supermarket" for global renminbi holders, ranging from traditional to cutting-edge, thus greatly enriching the international use scenarios of the renminbi.

The Foundation of the Shelf (Traditional Assets): The "Fixed Income and Money Market Development Roadmap" jointly released by the Hong Kong Securities and Futures Commission and the Monetary Authority, along with the aforementioned international "gold market" construction, aims to firmly provide the offshore renminbi with the safest, most mainstream, and most liquid traditional asset harbor. This is another important measure to attract global large institutions and sovereign wealth funds to allocate renminbi assets.

The Frontier of the Shelf (Innovative Assets): At the same time, the active exploration of licensed stablecoins, compliant virtual asset trading platforms (VASP), and real-world asset tokenization (RWA) is providing the offshore renminbi with the highest growth potential and most imaginative innovative asset testing ground.

This comprehensive asset shelf, covering everything from "gold and bonds" to "RWA and stablecoins," is a key step in advancing the renminbi from a single "trade settlement currency" to a more functionally rich "global investment and reserve currency."

Gaining Core Financial Power for the Future

Secondly, Hong Kong is the "super converter" connecting the globe. Its core mission is to create an indispensable standard and liquidity conversion hub for the future connection between the "renminbi ecosystem" and the "global mainstream financial ecosystem."

In the collision with global Web3 innovation forces, Hong Kong's comprehensive and professional "Stablecoin Regulations," spanning 269 pages, stands out. The digital asset regulatory and technical standards that have been market-tested and align with international standards while serving Chinese interests can benchmark against global standards from organizations like the FSB and BCBS, exploring regional financial autonomy while providing important channels for mainland enterprises to participate in the global digital asset market under compliance.

For example, as the first region in the country to issue tokenized government green bonds, the "Project Ensemble" is its flagship project for building next-generation financial infrastructure.

This project provides a secure and efficient underlying settlement infrastructure for the tokenized market through wholesale central bank digital currency (wCBDC)—which precisely addresses the biggest pain point in the current global RWA and tokenization market. Notably, its strong ecosystem participants include not only traditional financial giants like HSBC, Standard Chartered, and Bank of China Hong Kong but also top tech forces like Microsoft and Ant Group.

One can imagine that by further expanding on the existing cooperation with e-CNY, such as through products like "Cross-Border Wealth Management Connect 2.0," Hong Kong can easily lower barriers and increase the types of investable assets, delivering the highest quality tokenized assets denominated in offshore renminbi to mainland investors through controllable channels, thereby gaining one of the core powers of the future: asset allocation rights.

As an offshore pioneer, Hong Kong consistently emphasizes leveraging its status as an international financial center to promote cross-border use of the renminbi, renminbi pricing, and settlement. With the continuous deepening of Web3 innovation, the future possibility of developing a "Hong Kong version of the renminbi stablecoin" will significantly strengthen its role as an experimental ground for the internationalization of the renminbi.

In summary, Hong Kong's "openness" is a highly self-disciplined "instrumental openness" that serves the overall interests of the country. Through its dual roles as a "firewall" and "converter," it has constructed a "firewall" based on the gold and fixed income markets, following the engineering logic of "building the foundation first, then raising the high building," while ensuring that risks are controllable. At the same time, it imposes constraints through strict "compliance screening" via the Stablecoin Regulations and VASP licensing system.

This model aims to harness the immense energy of global Web3 innovation to secure the country's future standard-setting rights, asset allocation rights, and global pricing rights in digital finance, thereby prudently advancing the internationalization of the renminbi. It opens up new imaginative spaces and pathways for the internationalization of the renminbi.

4.4 Differentiation from "Valves" to "Interfaces"

As the strategic focus of the digital renminbi (e-CNY) shifts from domestic pilots to international operations, its interactive relationship with Hong Kong, the world's largest offshore renminbi center, becomes a key variable determining its global prospects.

Smart Valves

To understand the future of Shanghai-Hong Kong collaboration, one must first deconstruct the underlying operational principles of its existing "connectivity" mechanisms. These mechanisms function like a precisely designed "pump," with the core function of achieving asymmetric capital flows.

The "pipeline system," represented by "Stock Connect," "Bond Connect," and the upgraded "Cross-Border Wealth Management Connect 2.0," continuously expands the depth and breadth of capital flows. For example, the newly revised "Implementation Rules for the Pilot Program of Cross-Border Wealth Management Connect in the Guangdong-Hong Kong-Macao Greater Bay Area" (i.e., "Cross-Border Wealth Management Connect 2.0") has significantly increased the individual investment quota from 1 million to 3 million renminbi and included higher-risk investment products (public funds rated R1 to R4) and brokerages as participants.

The quotas and qualification reviews jointly controlled by the regulatory authorities of both regions serve as "smart valves" to ensure smooth "northbound" inflows and prudent "southbound" outflows. According to the "Flash Report" on the Bond Connect official website, in July 2025, the trading volume of "Northbound Connect" (i.e., foreign investors entering the mainland through Bond Connect) reached 957.6 billion renminbi, with an average daily trading volume of approximately 4.16 billion renminbi.

The "Action Plan for the Coordinated Development of the Shanghai-Hong Kong International Financial Center," signed in June 2025, represents a significant upgrade blueprint for this "pump" system. This plan historically lists "cross-border clearing" and "new application scenarios for cross-border renminbi payments" (clearly referring to e-CNY) as new areas of cooperation, indicating that decision-makers not only aim to strengthen existing channels but are also determined to install entirely new "e-CNY pipelines" and "RWA pipelines" suitable for the digital age.

Vision for Future Interfaces

In the era of digital assets, how to handle the highest value and riskiest crypto asset flows is the core issue that this "pump" must solve. Hong Kong's compliant stablecoins could theoretically serve as a "bridge" between e-CNY and the global crypto world, but their operational mechanism is far from a simple technical connection; it resembles a sophisticated "customs and quarantine system," aimed at achieving "controllable currency exchange" between the renminbi and the global crypto world.

We can envision a possible future scenario:

A USDC originating from the global crypto market intends to invest in an RWA project in Shanghai. It must first enter Hong Kong, a "customs special regulatory zone," where it undergoes "quarantine and disinfection" (AML/CFT review) within a licensed VASP institution and is exchanged for a compliant Hong Kong dollar stablecoin. Subsequently, this "purified" capital will be exchanged for digital renminbi through a regulated "transit channel." Notably, **the People's Bank of China and the Hong Kong Monetary Authority have made progress in the interconnectivity of e-CNY and Hong Kong's local *Fast Payment System (FPS)*, providing practical technical validation for this "transit" concept. Ultimately, only funds existing in the form of e-CNY will be allowed to enter Shanghai's digital asset platform through controlled "valves," injecting capital into the real economy.

The "controllable docking" mechanism envisioned here has profound strategic value: it not only constructs an effective financial firewall but, more importantly, perfectly achieves the ultimate goal of transforming the most active global crypto liquidity into renminbi capital that serves the development of our real economy after stripping away all risks.

Asymmetric Advantages Under Differentiation

We believe that the collaborative development of Shanghai and Hong Kong is likely to lead not to the "integration" of systems and markets but to an extreme "functional differentiation." This positioning is rooted in the fundamental framework of "one country, two systems" and is the core strategy for building asymmetric advantages in global financial competition.

This is because complete institutional integration poses a strategic trap for Hong Kong. If Hong Kong's financial system completely converges with the mainland, it will lose its unique value as an "offshore firewall," "institutional testing ground," and "buffer for international capital," and the entire "valve" system will cease to operate due to the loss of potential energy between onshore and offshore.

The highest realm of collaboration is differentiation. The true goal of Shanghai-Hong Kong collaboration is not to make each other more similar but to make each other more distinct, thereby forming perfect functional complementarity.

Shanghai as the "safe deposit box" for global capital. Shanghai will further strengthen its stability, centralization, and regulatory certainty as an onshore financial center, becoming the ultimate "safe deposit box" for global capital seeking safety and large-scale allocation.

Hong Kong as the "arena" for global risks. Hong Kong will become more open, more offshore, and more aligned with international mainstream rules, transforming into an "arena" for trading, pricing, and hedging risks of global innovative capital and venture capital.

In fact, this is already the case. As the neon lights of the Bitcoin Conference 2025 and the Global RWA Summit illuminate the night sky over Victoria Harbour, they herald the grand prologue of "Crypto dancing with RWA, AI blending with finance"; on the other side of the Huangpu River, a more profound and grand century transformation is brewing in calm waters.

It does not need to make noise; it only needs action to send the most powerful declaration to the decaying financial system filled with leveraged bubbles and cyclical crises.

It announces the arrival of a new era: a new world financial pole, armed with unshakeable national will and protected by an indestructible financial Great Wall, is rising from the eastern horizon, its brilliance sufficient to redefine the flow of global capital and the future order.

We believe that this advantage will not diminish due to various misunderstandings or rumors; it will only shine more resolutely in practice.

This is the deepest and most difficult-to-replicate strategic advantage of the Shanghai-Hong Kong dual city model.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。