Trading Card Games (TCG) have developed over more than thirty years since the launch of Magic: The Gathering in the early 1990s, gradually evolving into a global industry that combines entertainment, collection, and investment attributes. Currently, the total number of circulating cards has reached hundreds of billions, with the global player and collector base continuously expanding.

Source: zionmarketresearch, pokebeach, Gate Ventures

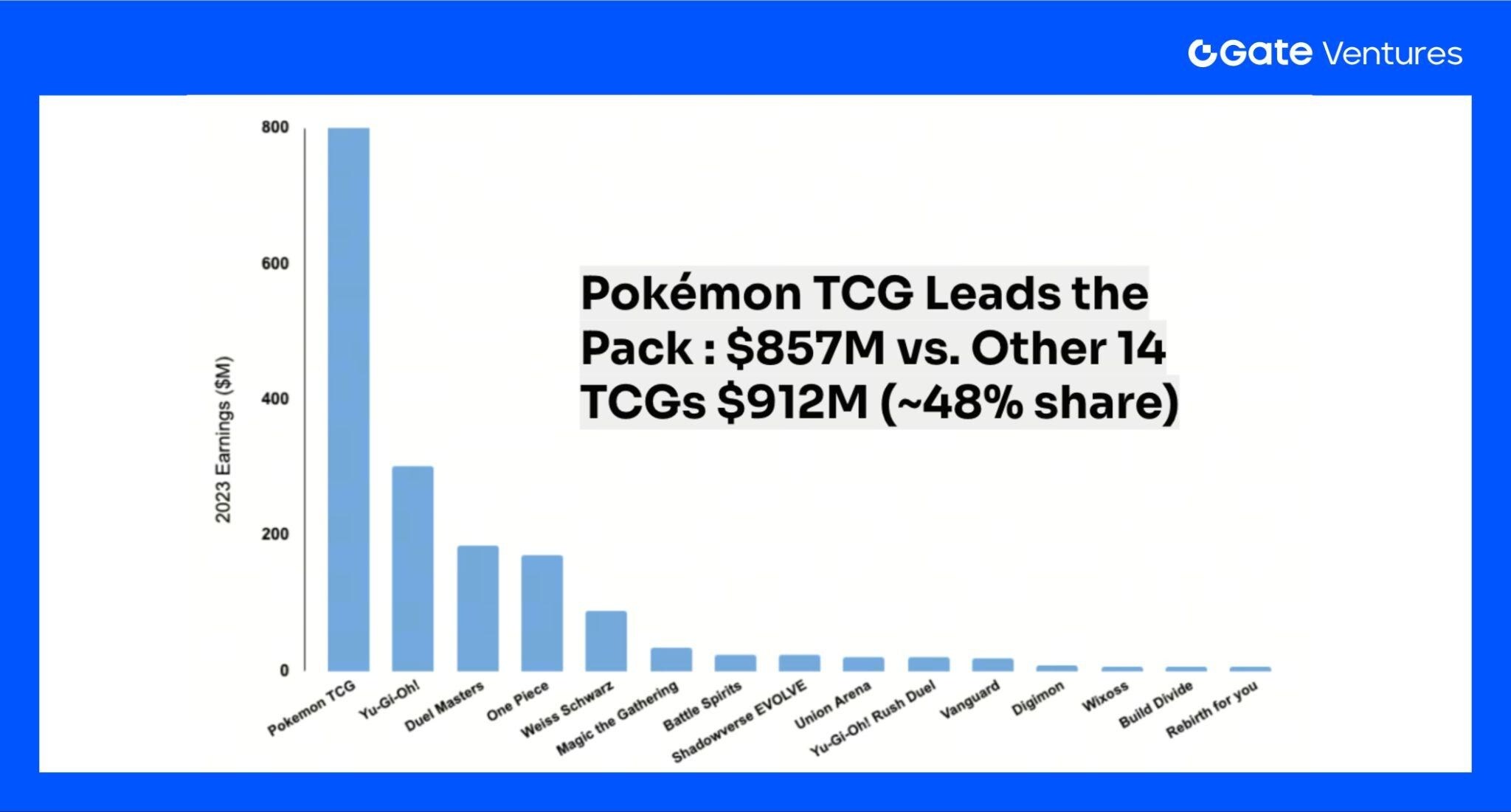

Among all TCG brands, Pokémon TCG undoubtedly holds a dominant position. As of 2023, over 52.9 billion Pokémon cards have been produced globally, covering 14 languages and nearly 90 countries and regions, far surpassing other competitors in both audience reach and revenue scale. Its success stems not only from the strong IP appeal of Pokémon games, animations, and movies but also from its design that combines playability and collectible value.

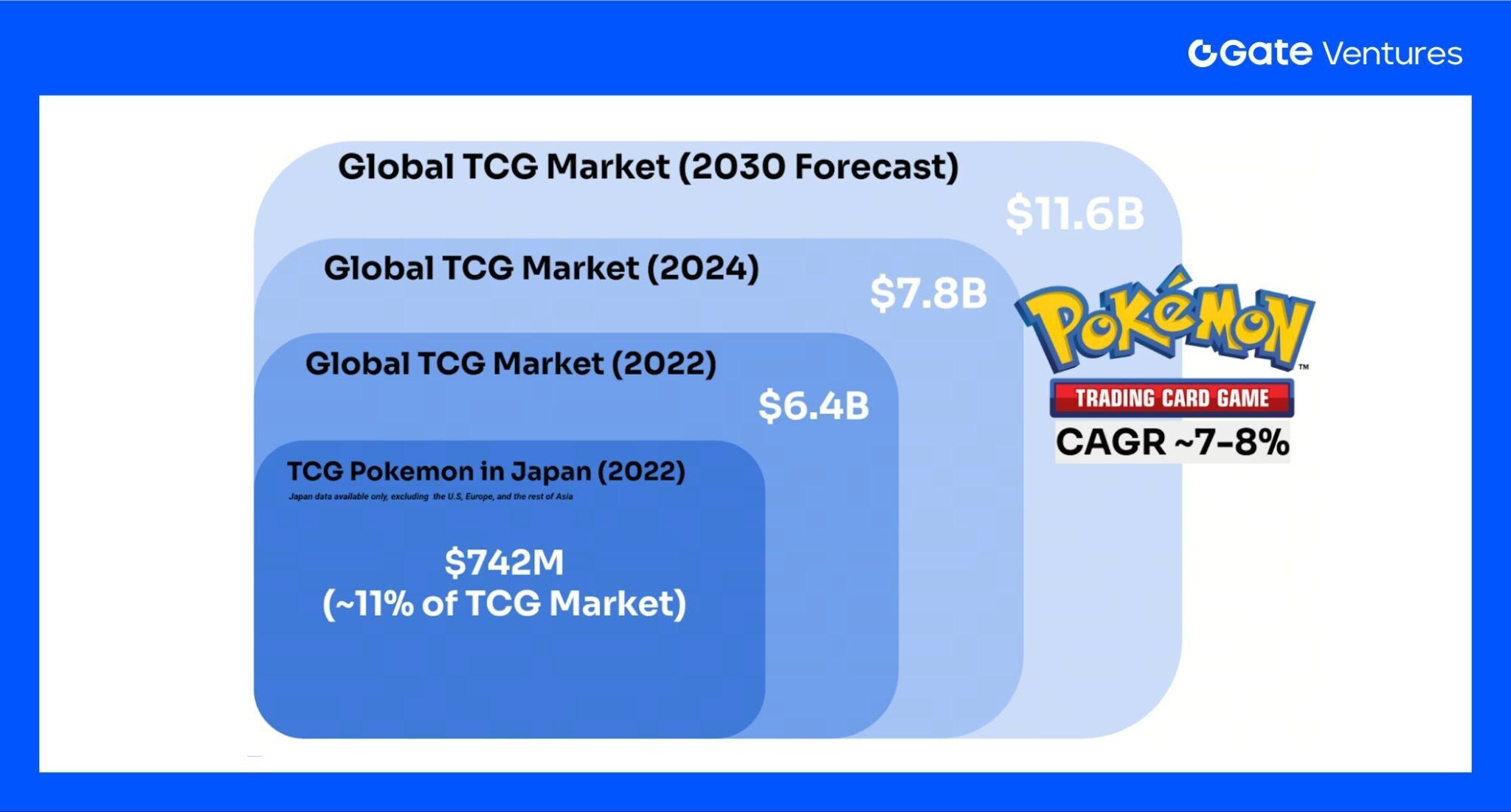

According to public data, Pokémon TCG's position in the global TCG market is exceptionally prominent. In 2022 alone, its revenue in Japan accounted for 11% of the global TCG market size. Looking ahead, forecasts suggest that the global TCG market is expected to grow to $11.6 billion by 2030, with a compound annual growth rate of about 8%. This growth is driven not only by the rise of collector culture but also by the continuous expansion of digital channels and secondary markets.

Source: pokebeach, Gate Ventures

In terms of regional distribution, North America and Europe are the most mature markets, with stable player bases and well-established tournament systems; Japan, as the birthplace of Pokémon, has maintained strong demand for a long time. In 2023, Pokémon TCG's revenue in Japan was equivalent to the total of 14 other TCGs, with a market share close to 50%. Meanwhile, the Southeast Asian and Latin American markets are rapidly expanding, showing significant incremental potential.

Source: Wall Street Journal

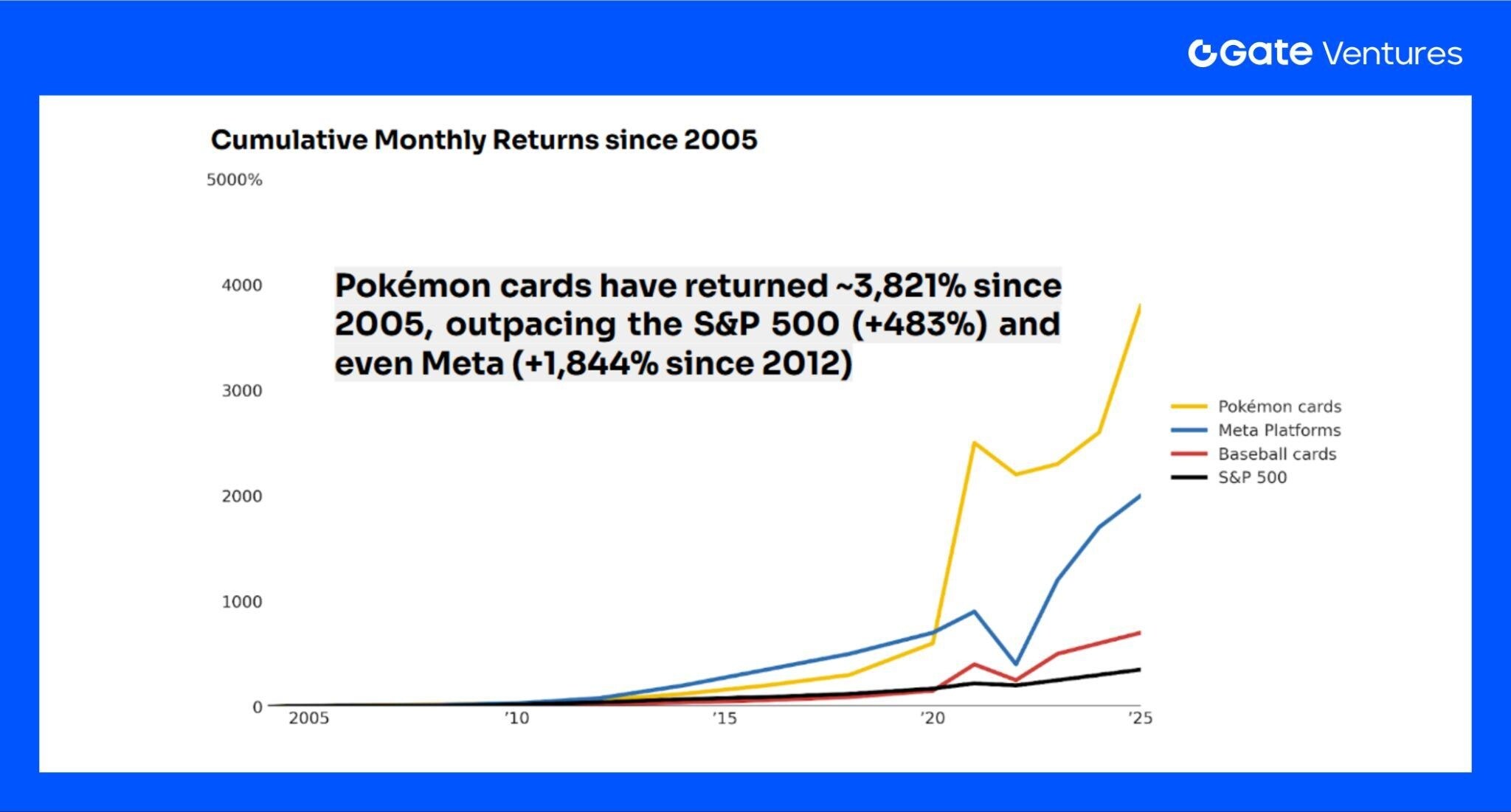

With the development of online trading platforms, the spread of social media, and the growth of cross-cultural fan communities, Pokémon cards are gradually evolving from mere entertainment consumer goods into global assets with both collectible and investment attributes, further solidifying their core position in the TCG ecosystem. The investment value of Pokémon cards has long been underestimated, but data shows that their returns over the past 20 years have even surpassed those of the S&P 500 and Meta, highlighting their unique investment properties.

Pokémon TCG Worldview

Before understanding the market of on-chain Pokémon TCG, it is essential to grasp the operational model of its industry.

Source: Gate Ventures

Send cards to the vault (or have the grading agency send them directly to the vault); complete link registration, take photos for records, and verify certificates; maintain constant temperature and humidity for storage. Custody Entry:

Vault sends Certification/Grading: PSA/CGC/BGS grading; after grading is completed, the cards are returned to the vault for entry, updating certificate numbers and image data.

On the market connected to the vault Listing for Sale:/Auction house listing; set a fixed price or reserve price; the system directly calls images and certificate data from the vault.

Buyer pays → Platform funds escrow → Vault ledger transfer (ownership transferred to the buyer). Transaction and Settlement:

Delivery Method (Choose One):

・Vault Transfer (・Physical Extraction: Buyer requests shipment; the vault arranges insured transportation, with costs borne by the buyer. Vault-to-Vault): Buyer continues custody, ownership is transferred within the vault. The custodian updates ownership in their ledger.

Can continue to resell in the vault, consign for auction, or (under compliance conditions) fractionalize; the vault's statements and link records can serve as traceable proof of origin. After-sales/Asset Management:

Synergy Between Pokémon TCG and Web 3

Pokémon TCG has established a mature ecosystem and business model, laying a complete infrastructure for its on-chain version. The next step is to consider: In what aspects will the synergy between Pokémon TCG and Web 3 manifest?

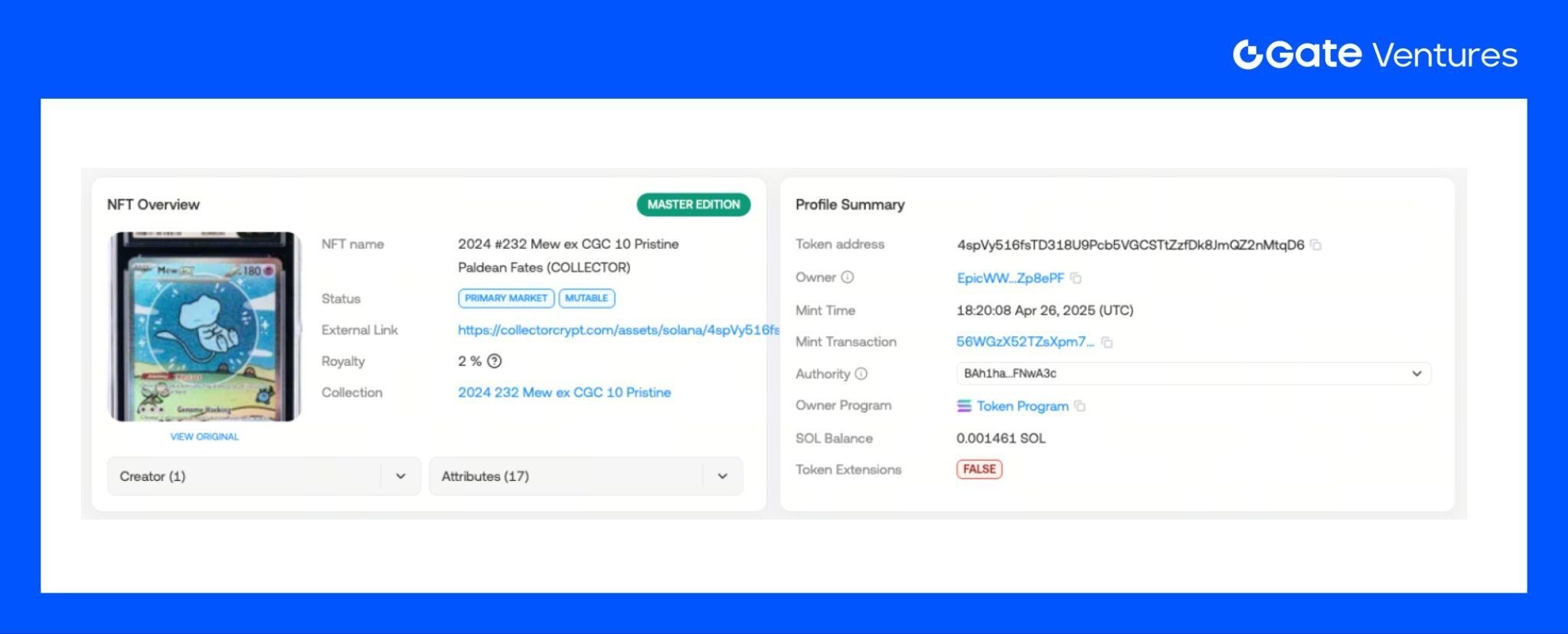

Source: SolScan

: Each card, after being minted into real rarity and verifiable NFTs, will leave a permanent record on the blockchain, including rarity and authenticity information, achieving on-chain confirmation of ownership and global free circulation. NFTs, as digital ownership certificates, correspond to a unique Token Address and come with a minting timestamp and complete transaction history, ensuring the authenticity and traceability of the cards.

: After cards complete cross-platform free trading and liquidity, NFTs become blockchain assets that can be freely traded across different markets, significantly enhancing liquidity. With the development of on-chain TCG, platforms like Collector_Crypt and Courtyard.io have provided 24/7 trading support. Compared to traditional physical cards that can only be traded through specific channels or privately, NFT cards achieve global circulation 24 hours a day, significantly lowering transaction barriers and friction costs.

: Traditional lower transaction fees TCG trading platforms (like eBay) have fees over 13%, resulting in higher costs for sellers; while on-chain platforms like Courtyard charge about 6%, and Collector_Crypt even charges only about 2% (which will be compared in detail later), showing a clear advantage in fees and gradually attracting more users to shift to on-chain trading.

Source: DexScreener

Its investment attributes cannot be ignored, but for investors unfamiliar with the Pokémon ecosystem, entering this field often presents a high barrier. The Beta Effect of Pokémon TCG: The core value of Web 3 lies in the rapid realization of value presentation; any asset or information with a premium can be represented in tokenized form, gradually forming the on-chain Beta of TCG Pokémon. Several projects benefiting from Pokémon premiums have emerged on-chain, such as $CARD, which achieved a tenfold price increase, or the Phygital project $PKMN, which is preparing to launch an airdrop, providing investors with new alternative investment targets.

Overview of the On-chain TCG Market

Source: Gate Ventures

The core functions of on-chain TCG platforms are mainly divided into two categories:

Card Packs (Gacha): Users obtain digital cards randomly through on-chain blind boxes or card packs, enhancing gamification and entertainment. For example, Courtyard's blind box mechanism allows players to experience the surprise of opening packs while ensuring that all cards correspond to real assets stored in a professional vault.

Secondary Market (Marketplace): Users can freely trade or sell the cards they obtain on the on-chain platform. Some platforms even offer a buyback guarantee mechanism, such as Courtyard supporting users to sell unsatisfactory cards back to the platform at 85%-90% of the original price, ensuring basic liquidity and reducing user participation risks.

Source: Dune Analytics

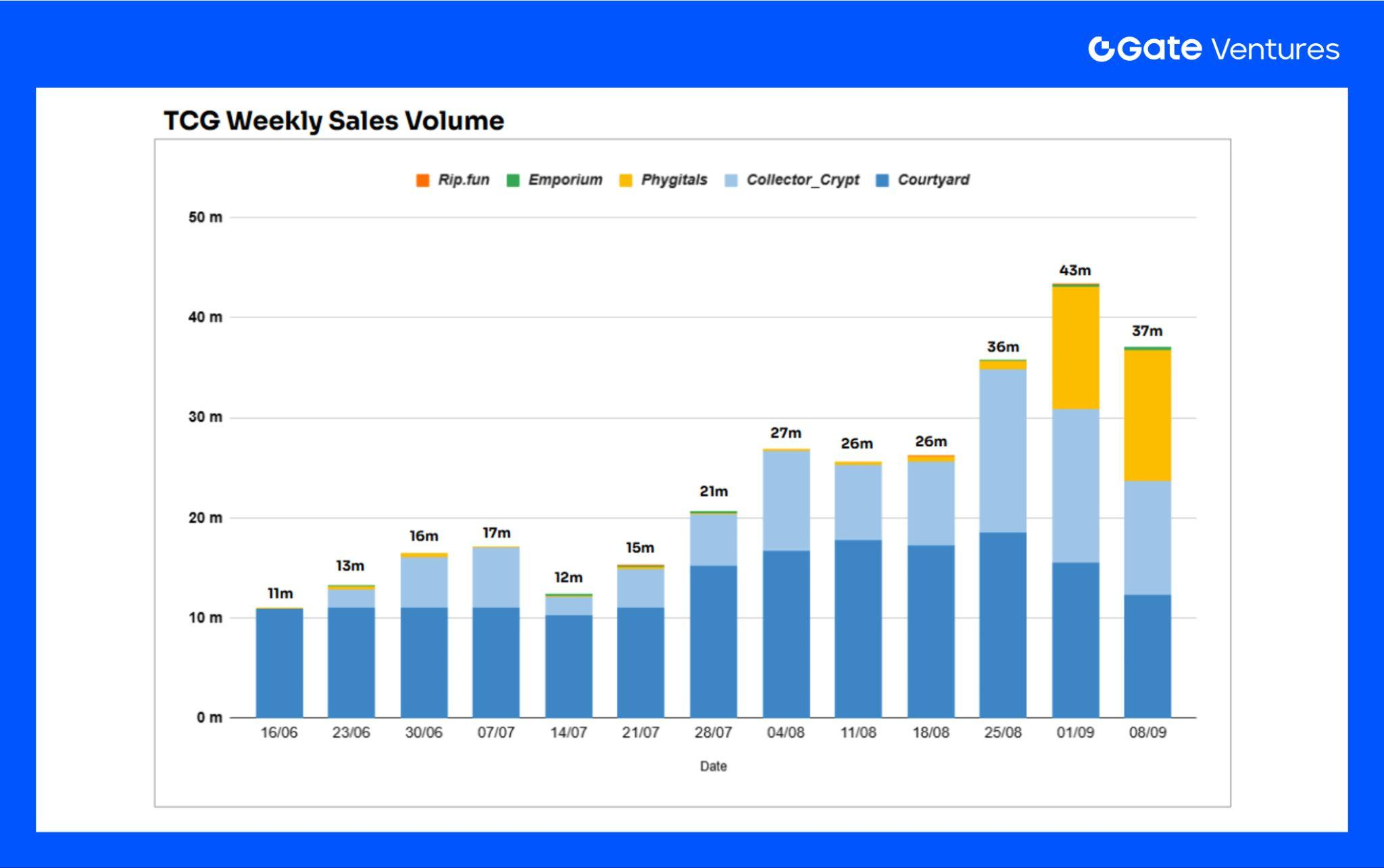

According to data from the past two months, the trading volume in the TCG market has shown a continuous upward trend: increasing from about 10 million in mid-June to about 40 million in September, nearly a fourfold increase. Initially, the market share was almost entirely occupied by Courtyard.io, but with the addition of new platforms like Collector_crypt and Phygitals, as well as various airdrop expectations stimulating user activity, the shares of these platforms are gradually expanding.

Source: Dune Analytics

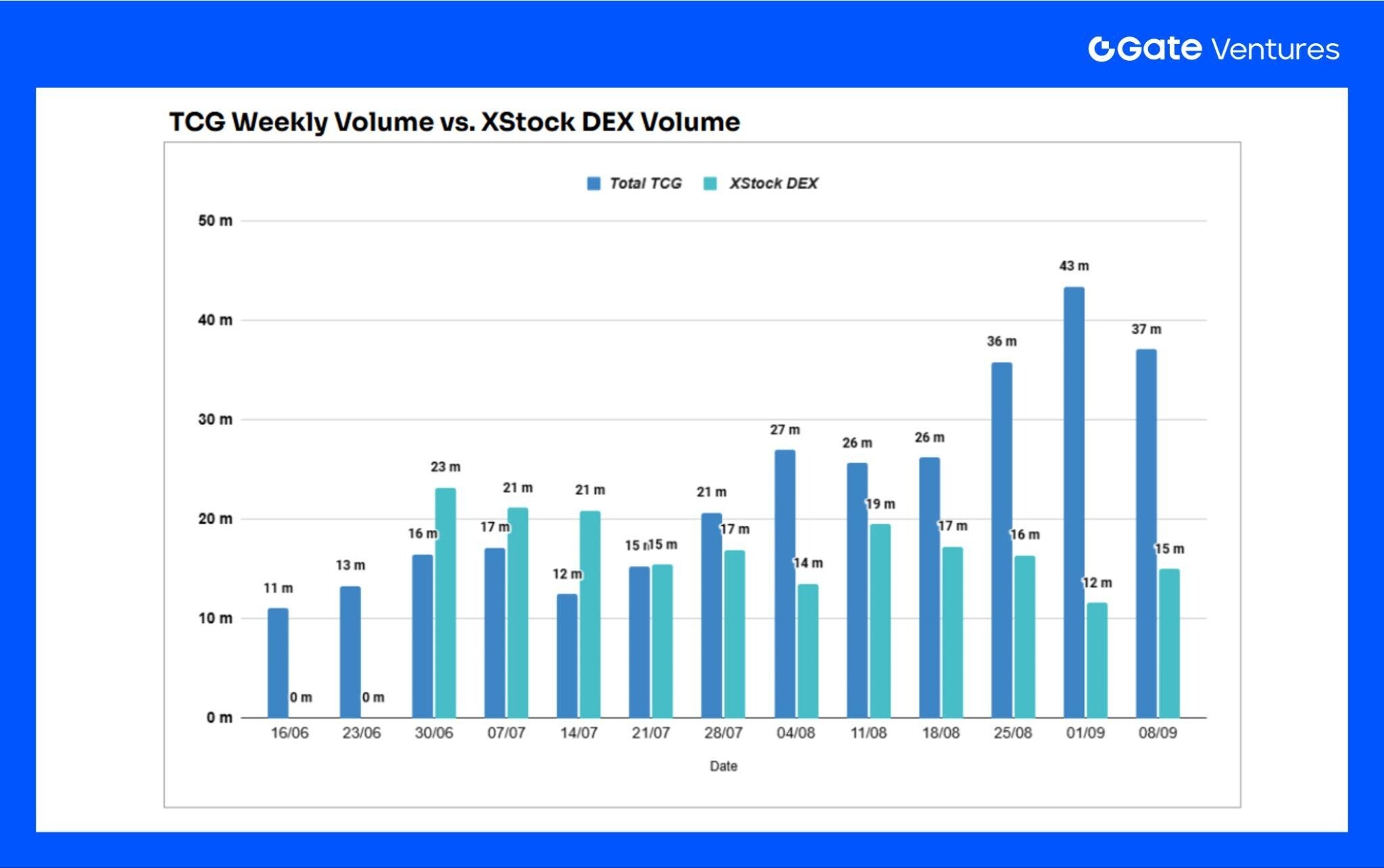

So, what level of trading volume has the on-chain TCG market actually reached? As part of the on-chain RWA track, xStock had a trading volume comparable to TCG from mid-June to early July. However, starting from early August, TCG's trading volume significantly climbed, and by September, it had gradually outpaced xStock, reaching more than three times its scale. When considering "which assets are more suitable for being on-chain," on-chain TCG demonstrates stronger appeal compared to on-chain stocks, further confirming its high compatibility with blockchain.

Source: Documentations from each platform

Key Points of This Section – Overview of On-chain TCG Platforms

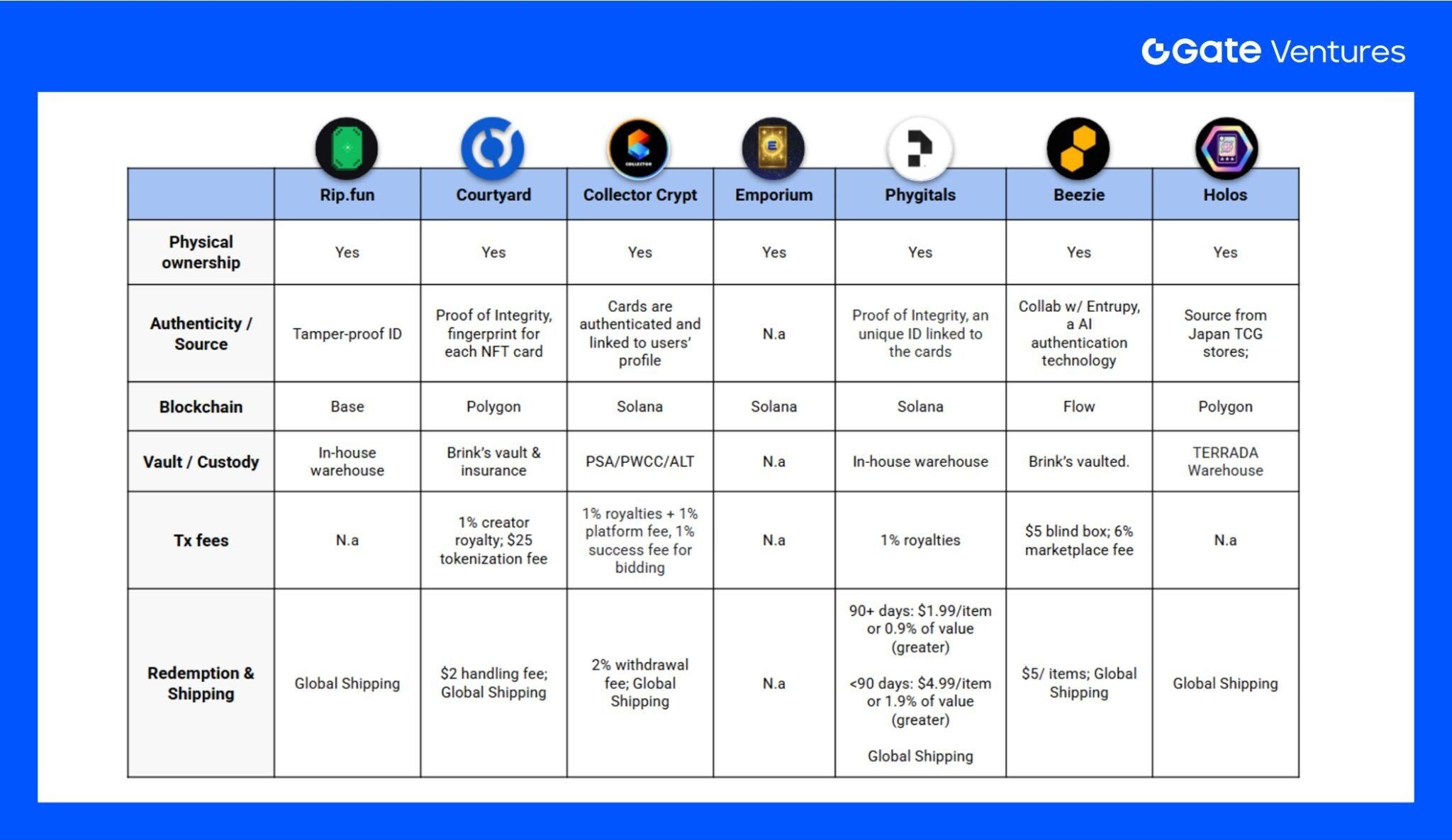

The NFT cards issued by various platforms generally correspond to physical ownership and are equipped with different authenticity verification mechanisms.

Deployed on chains such as Base, Solana, Polygon, and Flow, they share the common characteristics of low fees and fast transactions, providing advantages over traditional platforms.

Transaction fees are generally lower than those of traditional platforms like eBay, while also supporting royalty sharing, benefiting creators and holders.

Global shipping is supported, with customs duties applicable in some regions, and a few platforms have additional withdrawal or storage fees.

Case Analysis - Collector_Crypt

Collector is currently the leading platform in the TCG collectible asset market, with its core business focused on the sale and circulation of card assets based on Solana. The overall mechanism is:

Source: Collector_Crypt

Physical cards are stored → Minted into redeemable NFTs → Users can open "electronic packs" or trade on the secondary market at any time.

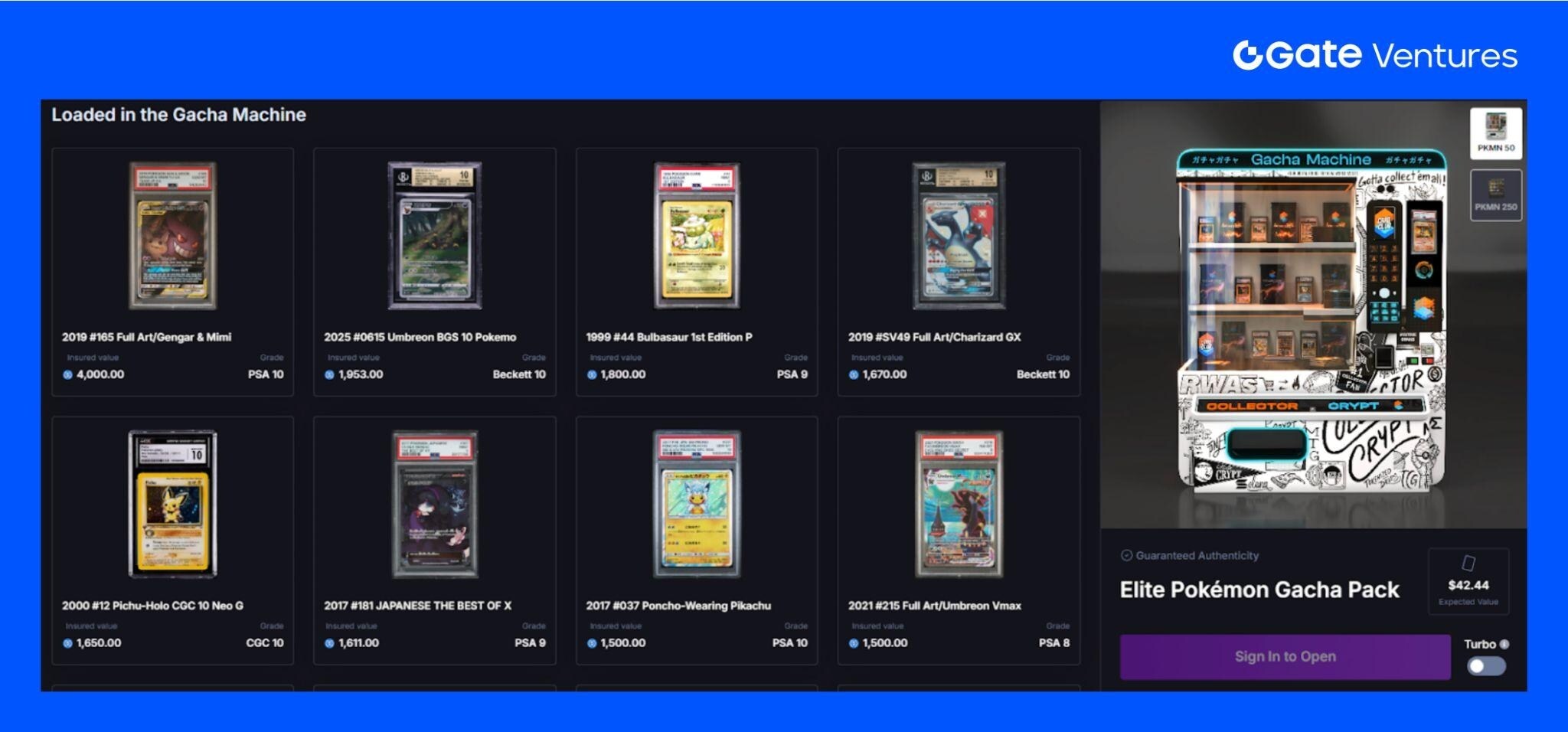

The platform has introduced a GACHA capsule toy card drawing mechanism, which not only provides a highly realistic pack-opening experience but has also become the main source of revenue for Collector_crypt. From the official website, the prices are set at 50 USDC and 250 USDC, respectively.

Source: Collector_Crypt

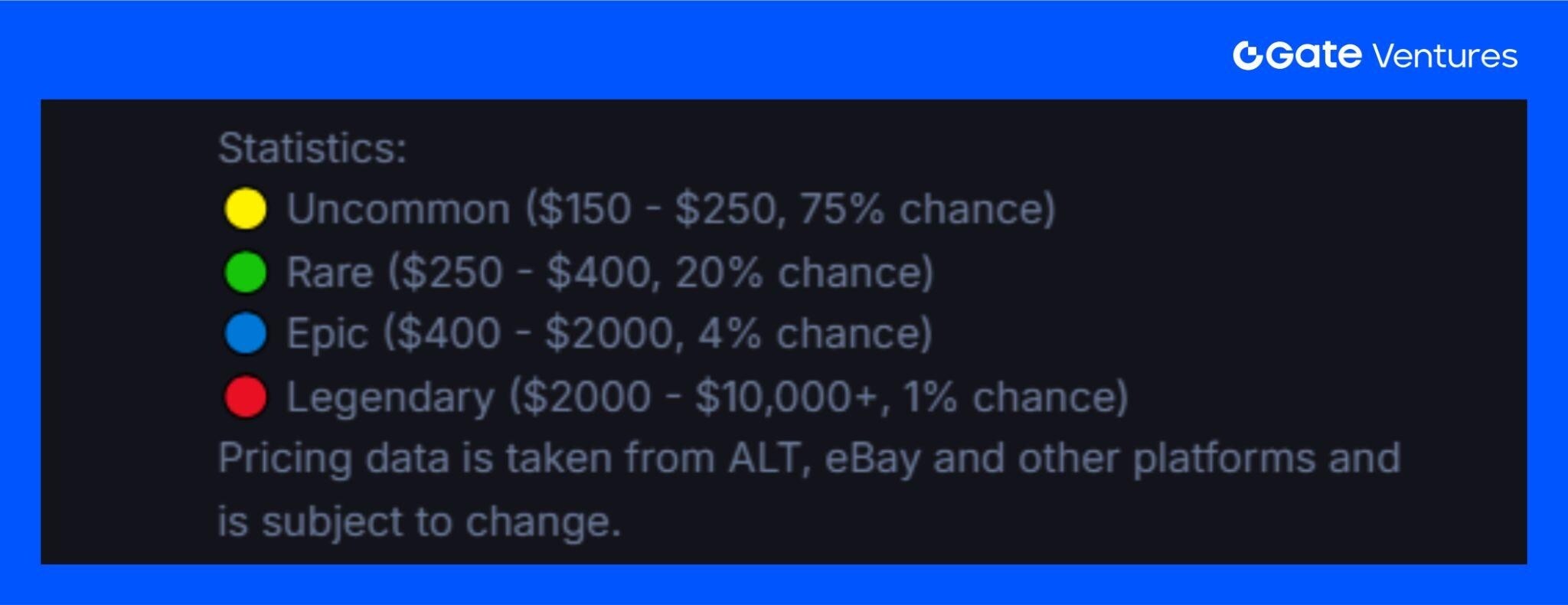

According to the official probability distribution and market pricing calculations, Collector's Gacha model possesses positive expected value characteristics. The expected value of a single card draw is approximately $258.89, exceeding the cost of $250. This means that participants, on average, can expect positive returns over the long term, with most users able to draw cards close to the cost to reduce loss risks, while in rare cases, there are explosive upward potentials (Epic and Legendary cards can yield several times or even tens of times returns). Combined with instant settlement and buyback mechanisms, Collector effectively transforms the entertaining card-drawing experience into a positive EV investment behavior.

Platform Revenue

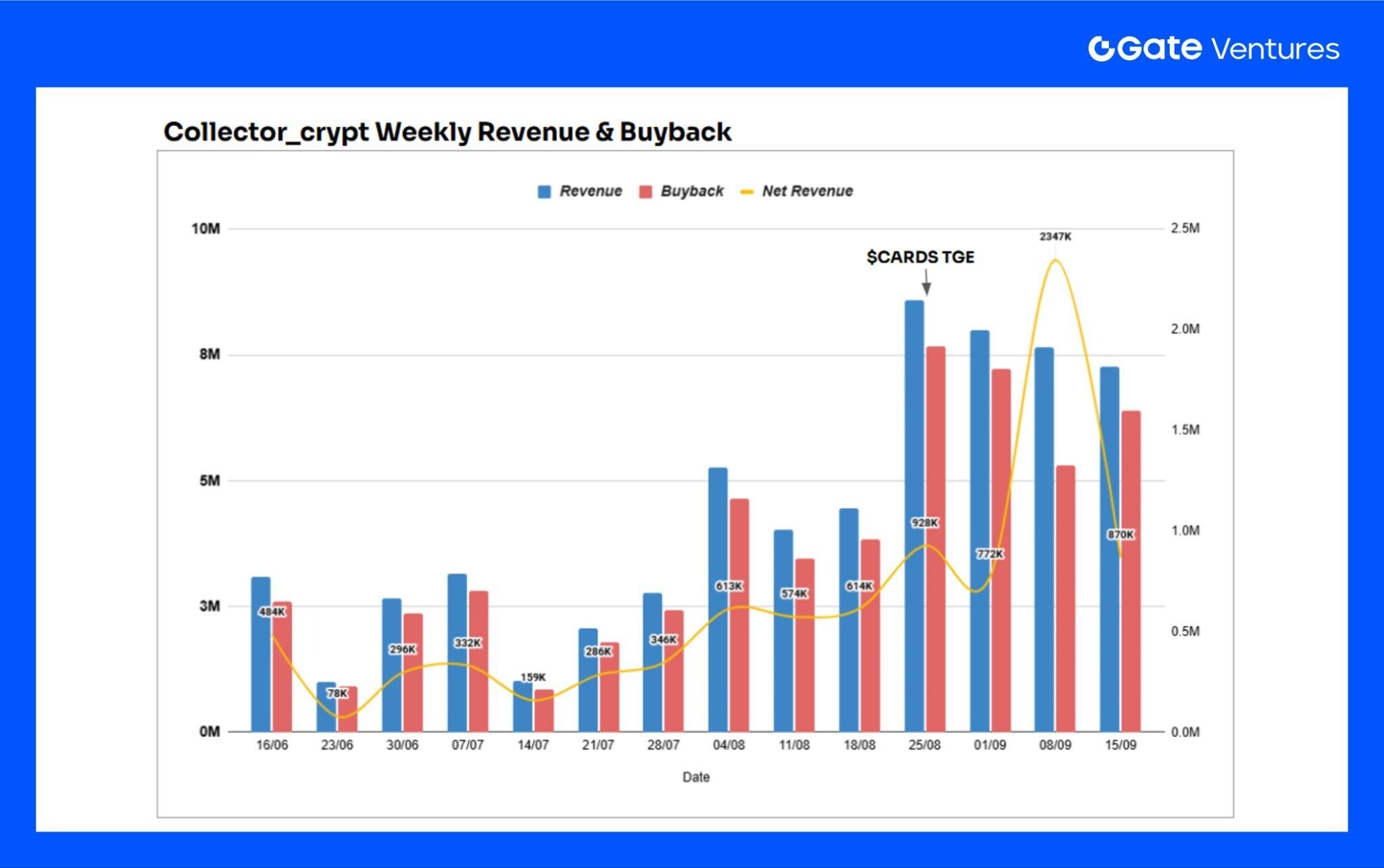

Source: Dune Analytics

The platform's main revenue comes from a 2% fee on Gacha and secondary market transactions, as well as a 2% withdrawal fee, while the primary cost is the buyback of cards at 85%-90%. Driven by the anticipation of the $CARDS token airdrop, the platform performed strongly in August, with revenue nearly doubling compared to July, peaking after the token TGE. In a single week, it achieved a net profit of $2.3 million, with over 120,000 Gacha pack openings, showing a very sharp growth curve.

As of now, the platform has opened nearly 1.5 million Gacha packs, with total trading volume exceeding $180 million.

Token Economics

Source: Collector_Crypt

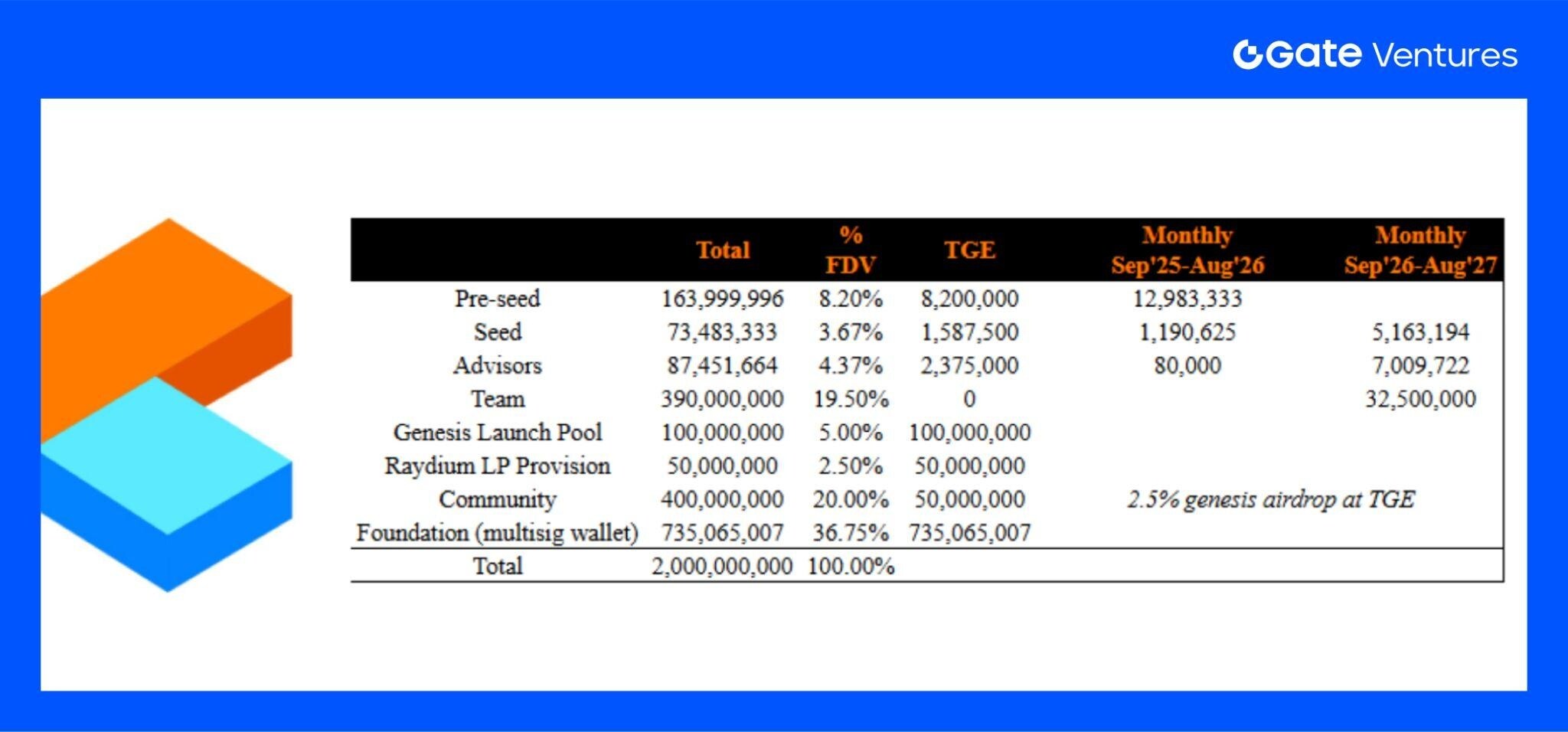

In the distribution of the $CARDS token, about 16% is allocated to early investors, with an initial Launchpool release of 5%, while the team and foundation collectively hold over half. The remainder is used for liquidity and market expansion.

During the early Launchpool phase, funds raised, after deducting issuance and liquidity costs, were 100% used to purchase Pokémon cards, serving as the platform's base inventory for sales. The official team has also stated that more detailed token usage will be announced in the weeks following the TGE. Currently, $CARDS does not yet have clear functional designs, such as payment, staking, or fee discount applications.

However, considering that Collector already has strong cash flow, if it uses part of its profits to buy back $CARDS or continues to purchase rare Pokémon cards to maintain the platform's appeal, it could become an important price catalyst.

Source: X @Moonbirds

Currently, Collector primarily focuses on Pokémon cards, but as a popular on-chain TCG platform, it has enormous potential for future expansion. Almost all types of TCGs, including sports cards and other anime or movie IPs, can be sold on-chain like Pokémon. Recently, the platform will also collaborate with the well-known Web 3 NFT project Moonbirds to launch physical collectibles and issue corresponding on-chain certificates on Collector.

This "off-chain physical + on-chain certificate" model, leveraging the inherent advantages of blockchain in transaction efficiency and authenticity verification, is likely to become a new trend in the collectibles market and will further promote the development and expansion of Collector.

Case Analysis - Phygitals

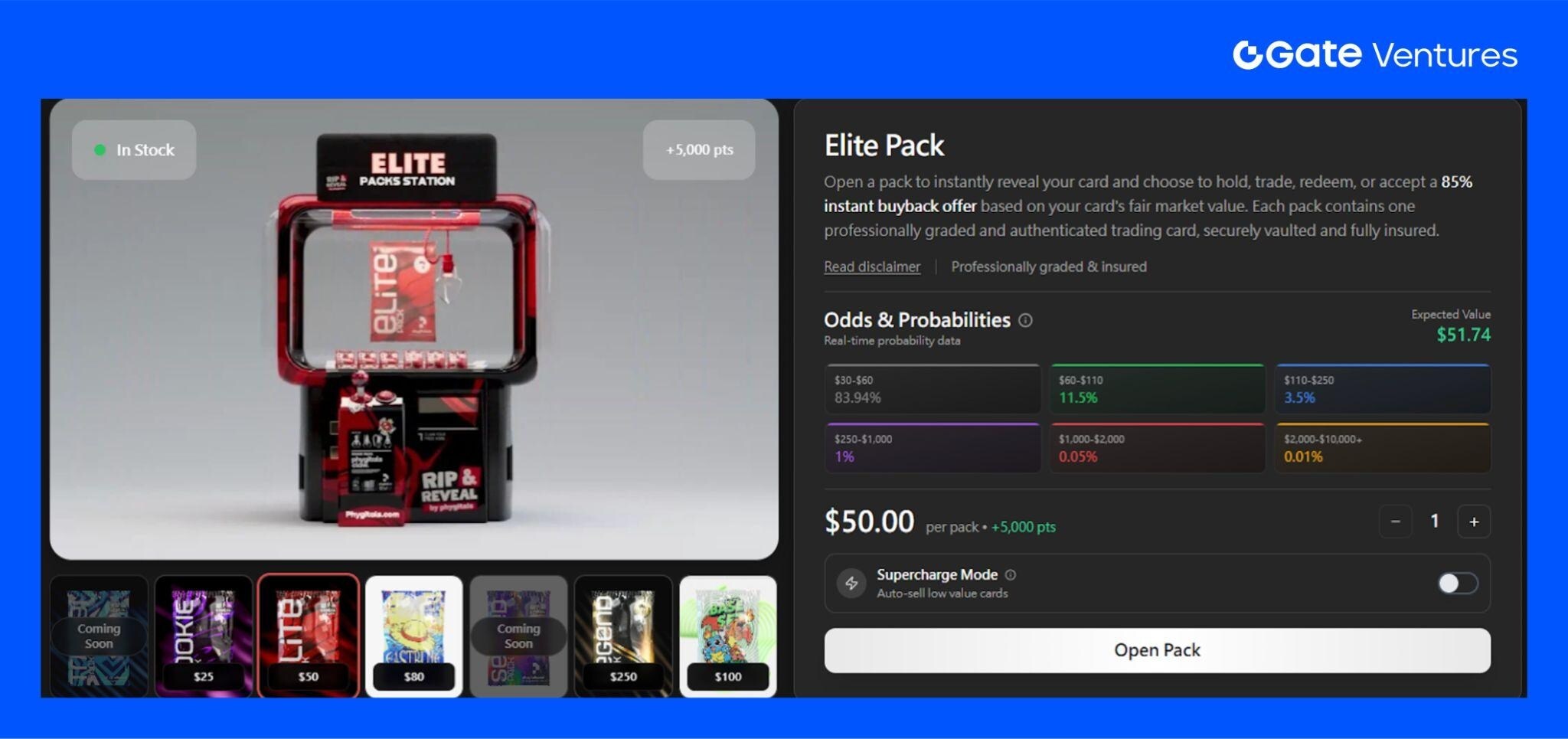

Phygitals operates similarly to Collector, with the core gameplay involving purchasing card packs and opening cards of varying values. Users can choose to hold, trade on the secondary market, or sell back to the platform at about 85% of the market price. The pricing range for card packs includes $25, $50, $80, $250, and $500, with different price points corresponding to varying rarity and potential value. In addition to Pokémon cards, the platform has also introduced other popular IPs like One Piece, expanding the variety of collectibles and audience base.

Source: X @phygitals

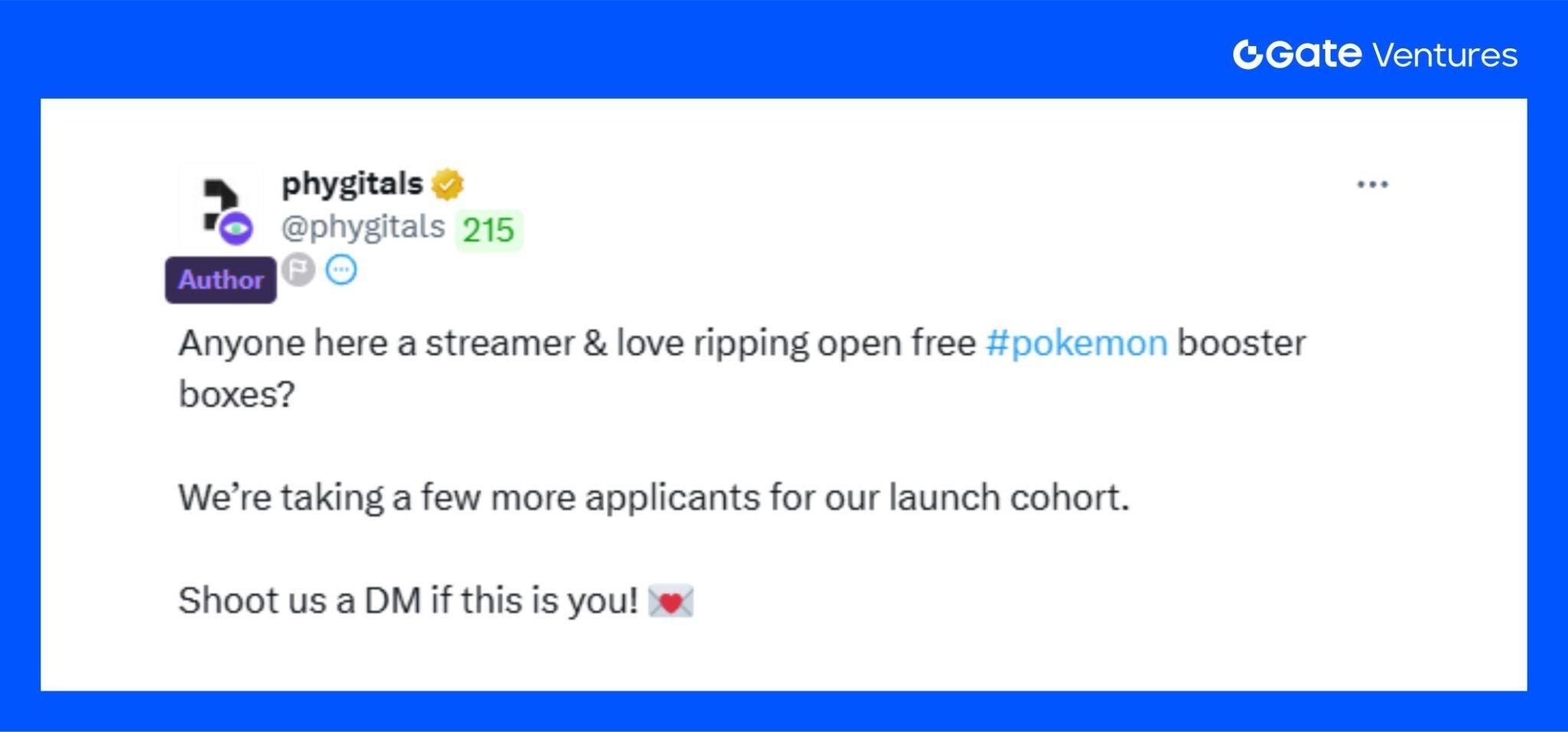

One major highlight for Phygitals in the future is the upcoming launch of a live pack-opening feature. Drawing on the successful experience of live token issuance on pump.fun, the platform aims to create a trend phenomenon similar to youth subculture through a "live + asset issuance" model. This highly interactive and entertaining gameplay is gradually becoming a new narrative direction, expected to bring higher user engagement and topic popularity to the platform.

Additionally, Phygitals will soon implement free custody and withdrawal services (excluding shipping costs). The platform will fully integrate with a single custody partner and has also achieved pricing advantages compared to other platforms.

Platform Revenue

Source: Dune Analytics

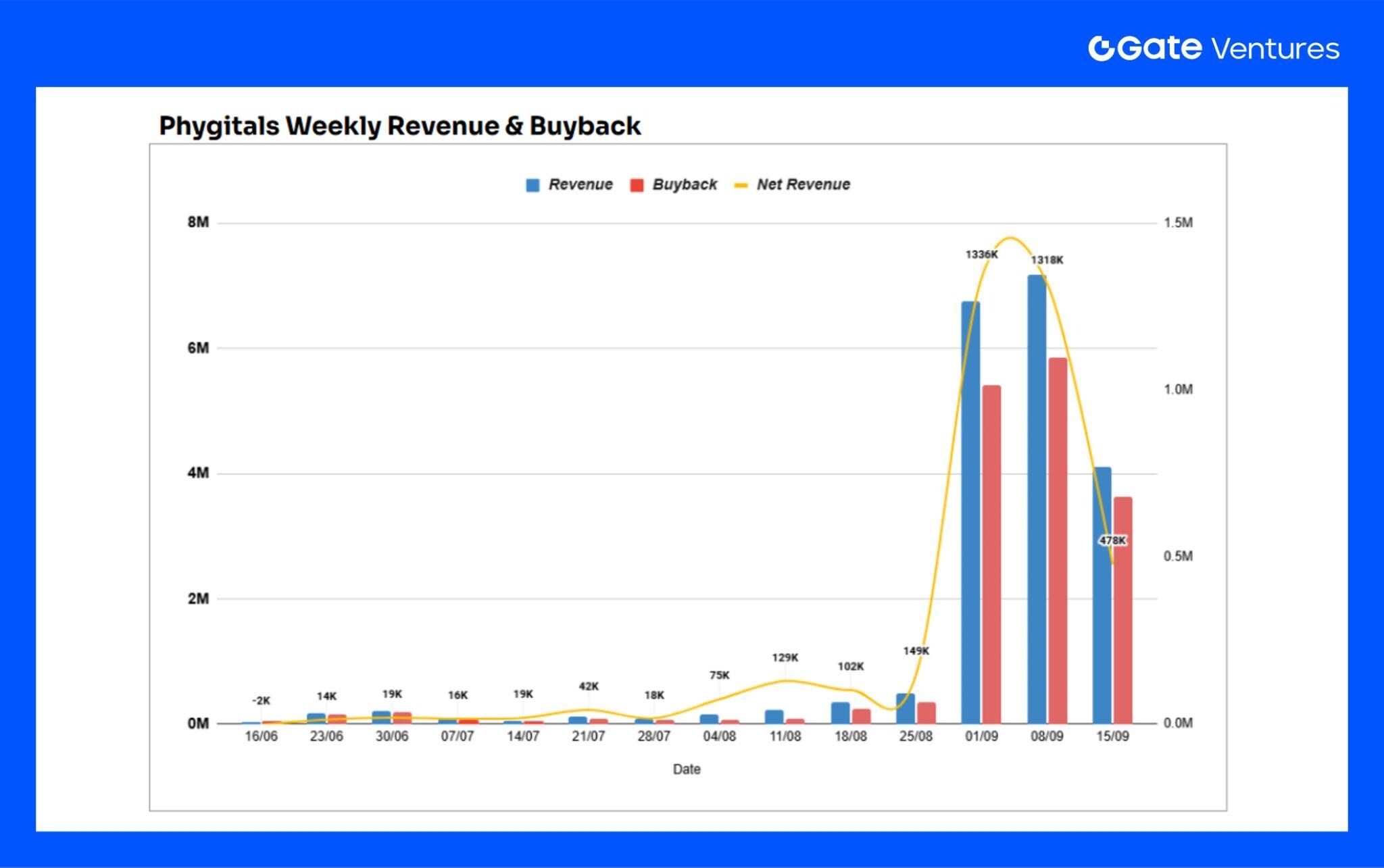

Before the TCG concept gained immense popularity, Phygitals' trading volume had been relatively flat. It wasn't until the first wave of excitement around $CARDS heated up the market that funds began to seek "second-tier tracks," with premiums gradually penetrating the next batch of TCG platform tokens with airdrop expectations.

Source: X @phygitals

Currently, Phygitals has officially announced that it will conduct a token auction on Hyperliquid, with the token code $PKMN, indicating that it will rely on the HL ecosystem for issuance. After the announcement, a large number of airdrop players flocked to the platform to open packs, pushing its weekly net income to exceed $1.3 million, with approximately 170,000 pack openings.

Source: X @phygitals

At the same time, the project has also engaged with the lending protocol HypurrFi in the HL ecosystem on X, hinting at future DeFi services such as lending and perpetual contracts centered around Pokémon cards. This not only highlights the value attributes of Pokémon cards in the on-chain RWA space but also showcases their potential integration with the DeFi world.

Track Scale Forecast

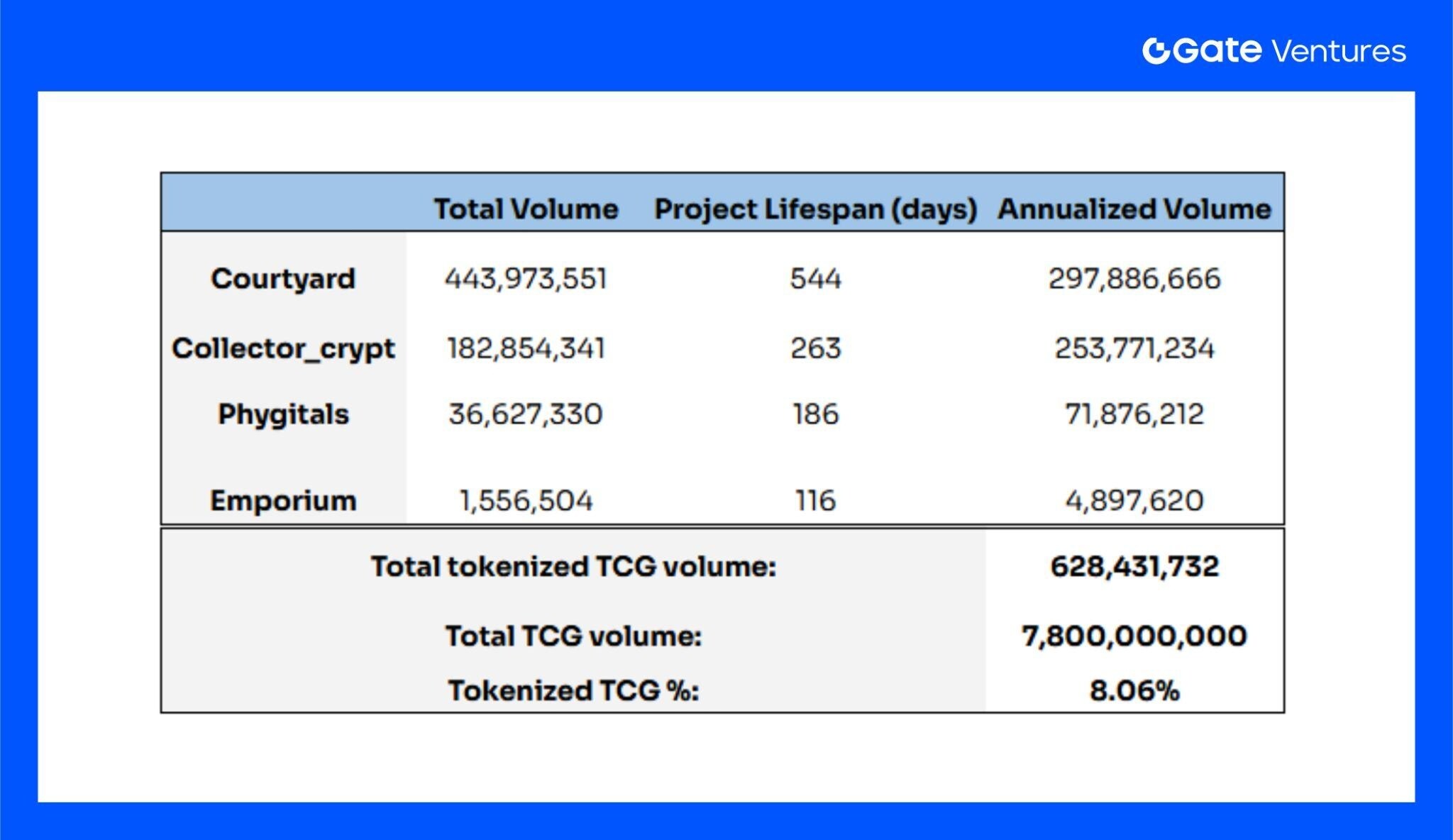

Source: Dune Analytics,zionmarketresearch

Data shows that the current trading volume of the on-chain TCG market is approximately $630 million, accounting for about 8% of the global TCG market size. As the market gradually recognizes the advantages of on-chain game cards and their natural compatibility with blockchain in terms of circulation efficiency and transaction attributes, this proportion is expected to continue to increase.

Source: Gate Ventures

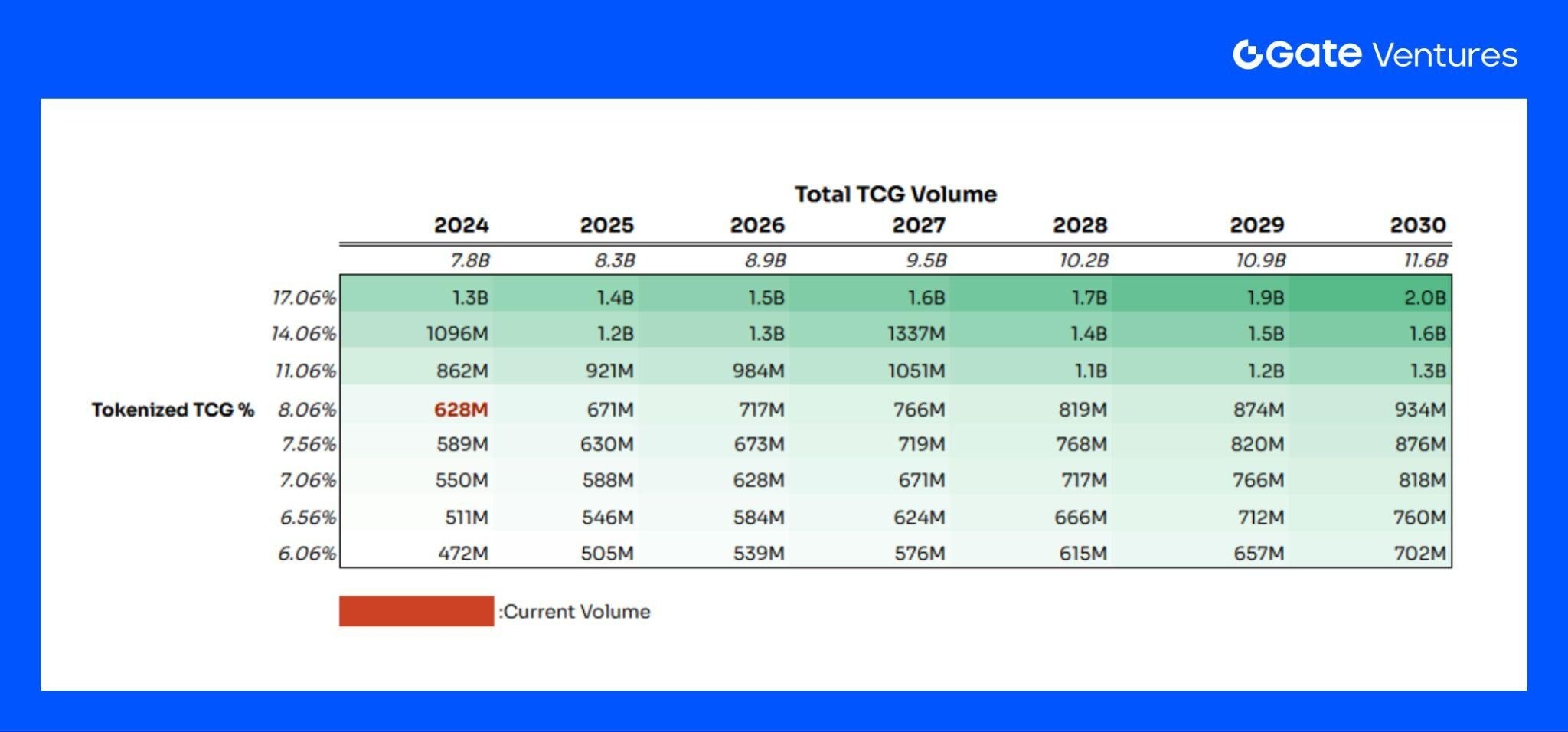

To this end, we conducted a sensitivity analysis: the growth rate of the global TCG market's trading volume refers to forecasts from research institutions, which predict it will reach $11.6 billion by 2030. Regarding the share of the tokenized TCG market, based on an optimistic assessment of the track, we assume an increase of 3% and a decrease of 0.5%.

The analysis results show that in the most optimistic scenario, if the global TCG market and the tokenized TCG market expand simultaneously, the market share of tokenized TCG is expected to rise to about 17% by 2030, corresponding to a trading volume of $2 billion, which represents an increase of about 300% compared to the current level.

Catalysts

- Strong IP Empowerment

Pokémon is the most profitable entertainment IP globally, with cumulative revenue nearing $100 billion, covering the entire industry chain including games, animation, cards, movies, and merchandise. Additionally, its card segment has already formed a global collectible ecosystem, boasting a large community of players, collectors, and investors, with users having a high emotional and value recognition for scarce cards. This strong IP reduces the "education cost," as users enter the market not for blockchain but due to familiarity with the brand and emotional connection.

Moreover, Pokémon cards have long had substantial trading volumes and transparent pricing on platforms like eBay, TCGPlayer, and Heritage Auction. This mature price anchoring mechanism, combined with on-chain tokenization, allows NFT/tokenized cards to directly inherit the value consensus of the real market. The foundation of user trust does not stem from Web 3 technology but from the existing mature market offline.

Pokémon is just an entry case, proving the feasibility of transitioning from traditional collectibles to on-chain assetization. In the future, this can quickly expand to:

- Sports cards (the new generation after NBA Top Shot)

- Other anime/manga IPs (such as One Piece, Naruto cards, etc.)

- Movie/game derivative IPs (Star Wars, Marvel, Nintendo)

The trading and collecting culture in these markets is also vibrant, and the user base has a high overlap with Web 3.

Equally important is its cultural penetration and network effect. Strong IPs inherently possess the ability for "cross-cultural communication," allowing them to break into the mainstream player and collector circles beyond the niche of pure crypto users. The secondary dissemination effects of the IP itself (social media topics, celebrity collections, news reports) can further bring sustained user growth and capital attention. Therefore, IP is the most critical lever for the on-chain TCG market to break out quickly.

- New Narratives and Compatibility After Asset Tokenization

On-chain NFTs correspond one-to-one with physical cards, and the information is transparent and verifiable, solving common issues of authenticity and trust gaps in traditional markets. Users can not only confirm the source of the cards but also track complete transaction and custody records.

Additionally, in terms of liquidity and immediacy, mainstream platforms offer 85%-90% guaranteed buyback + second-level settlement, allowing users to quickly realize cash. In contrast, traditional platforms like eBay require a settlement period of 7-14 days and face issues of transaction opacity and difficulty in arbitration. The on-chain mechanism significantly improves transaction efficiency.

On-chain TCG also has cost and price advantages. Traditional platforms like eBay typically charge transaction fees exceeding 14%, while on-chain platforms like Collector_Crypt and Courtyard have lower transaction costs and clearer structures. Furthermore, with each resale, the original cardholder can still earn revenue through the on-chain royalty mechanism. This means:

- Users pay lower transaction fees.

- Original holders can share transaction value over the long term.

As users gradually become aware of this price advantage and value return mechanism, the habits of ordinary TCG traders are likely to gradually shift from traditional platforms to on-chain.

- New Financial Play

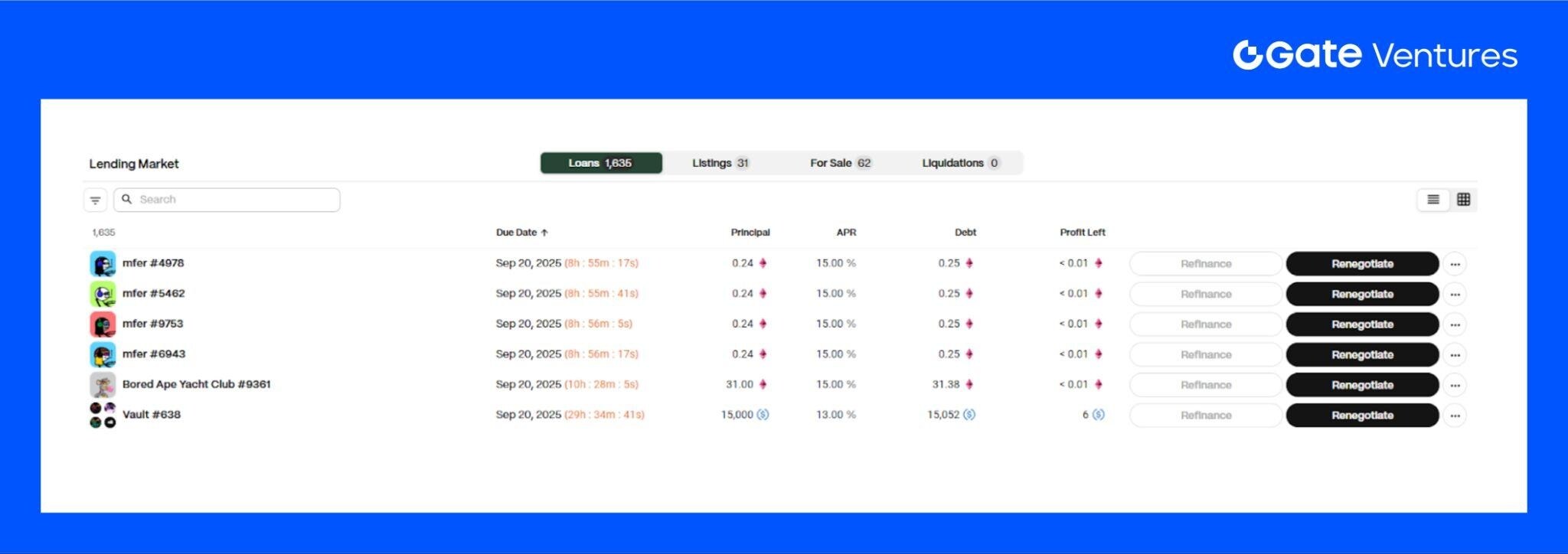

Based on high-value cards, developers are exploring the use of NFTs as collateral, leading to the emergence of lending, perpetual contracts, staking, and other DeFi services, gradually forming what is known as "Collectibles-Fi." This not only introduces a new financial narrative to the collectibles market but also allows cards, which were originally limited to collecting and trading, to gradually evolve into RWA with financial asset attributes.

Moreover, the advantage of Web 3 lies in its efficient value transfer mechanism. By issuing tokens related to card releases, investment opportunities can be further expanded, making TCG-related tokens the Beta assets of this track, providing investors with new participation paths beyond physical cards and NFTs.

Source: GONDI

The integration of TCG and DeFi is not a new concept. Early Web 3 saw the emergence of NFT lending tracks, such as Blur Lending, which had a peak TVL exceeding $100 million, and Gondi also reached about $60 million. At that time, blue-chip NFTs like CryptoPunks and BAYC indeed supported a considerable lending market. However, its fatal flaw lies in the instability of the underlying asset value; once NFT prices plummet significantly, the entire lending market collapses rapidly.

TCG also faces systemic risks, but compared to pure NFTs, physical assets like Pokémon cards have a deeper foundation:

- Nearly 30 years of history and ecology, with a relatively mature market price formation mechanism.

- Long-term cultural influence and emotional value, with users often growing up alongside their assets, leading to a stronger sense of asset recognition.

Therefore, the stability of the underlying assets and cultural stickiness of TCG may provide a more solid support for DeFi integration than blue-chip NFTs, and we hope the TCG market can develop into an ecosystem similar to the former NFTfi track and continue to thrive.

Risks

Particular attention needs to be paid to the sustainability of card supply. Taking the Pokémon TCG as an example, some series of card packs have been speculated in the secondary market due to long-term supply shortages. For on-chain TCG platforms, ensuring a continuous and stable supply will be a long-term challenge. For instance, Collector_Crypt's Legendary Gacha series has already shown signs of supply shortages; if replenishment is delayed, it will significantly weaken user stickiness and consumption habits, making this issue worthy of ongoing attention.

Conclusion and Outlook

The rise of on-chain TCG has validated the logic that collectibles on-chain = tradable + financializable. Pokémon is the beginning of this trend, but not the end.

From a market size perspective, the volume of star cards is almost double that of Pokémon and carries a global fan economy and investment attributes; at the same time, other classic IPs like One Piece and Yu-Gi-Oh! also have large collector communities and mature secondary markets.

As these IPs gradually enter the Web 3 world, the market space for Exotic RWA will be further expanded, forming a diverse ecosystem covering sports, anime, and entertainment culture. This not only can drive the on-chain collectibles market to break through existing boundaries but may also become a new engine connecting fan economy and decentralized finance.

Reference:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。