Today's homework is much easier for me to write. As news broke that Trump plans to permanently lay off federal employees, the market's attention has shifted from the government shutdown to the increased expectations of a Federal Reserve rate cut in October. This has been clearly stated in the weekly report. Trump has initiated a cunning layoff strategy by leveraging the Democrats' refusal to approve the budget. On one hand, he aims to reduce labor data through layoffs, forcing the Federal Reserve to consider further rate cuts.

On the other hand, he attributes the layoffs to the Democrats' budget refusal, achieving two goals with one action. Although layoffs may cause some functional departments to pause, the Federal Reserve and the tax department are still operational, and the military has not been affected. This will not impact Trump's strategies regarding tariffs and geopolitical issues; instead, the Federal Reserve has lost the data it relies on for assessment and can only rely on predictions.

The end result is that Trump artificially lowers the U.S. labor data, putting the Federal Reserve, which depends on labor data to decide on rate cuts, in a more complicated position. This should also be the main reason for the market's rise.

Looking at Bitcoin's data, the price increase has led to a rise in turnover rate. In the past two days, investors who bought the dip have been the main force behind the turnover, with the primary reason for buying being the bet that the government shutdown will aid the Federal Reserve's rate cut in October, without causing real negative impacts on the economy. Investors believe this is positively beneficial for the risk market.

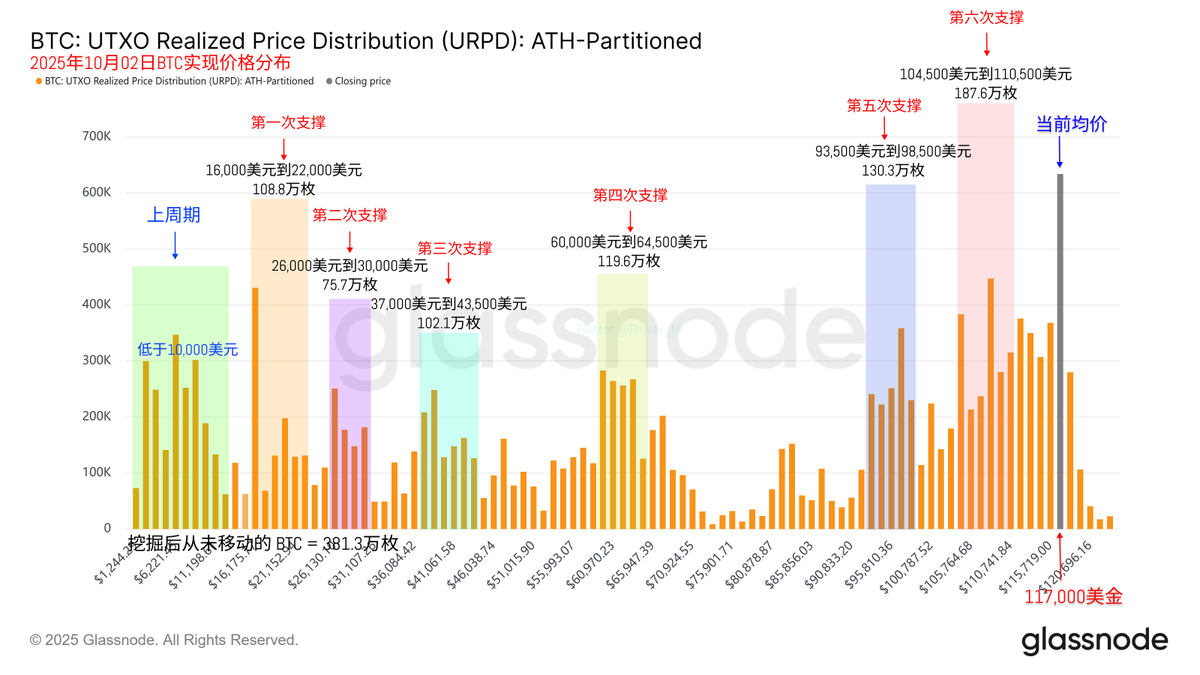

From the URPD data, the chip structure remains quite stable, with more investors concentrated around the $117,000 mark. Even when the price of $BTC fell below $110,000, there was no significant reduction in holdings, indicating that investor sentiment is very stable.

The specific impact of the shutdown will likely be known when the U.S. stock market opens next Monday, but from the current perspective, it should be a good thing.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。