Original Title: "What are the backgrounds of the 18 SOL treasury companies?"

Original Author: Deng Tong, Golden Finance

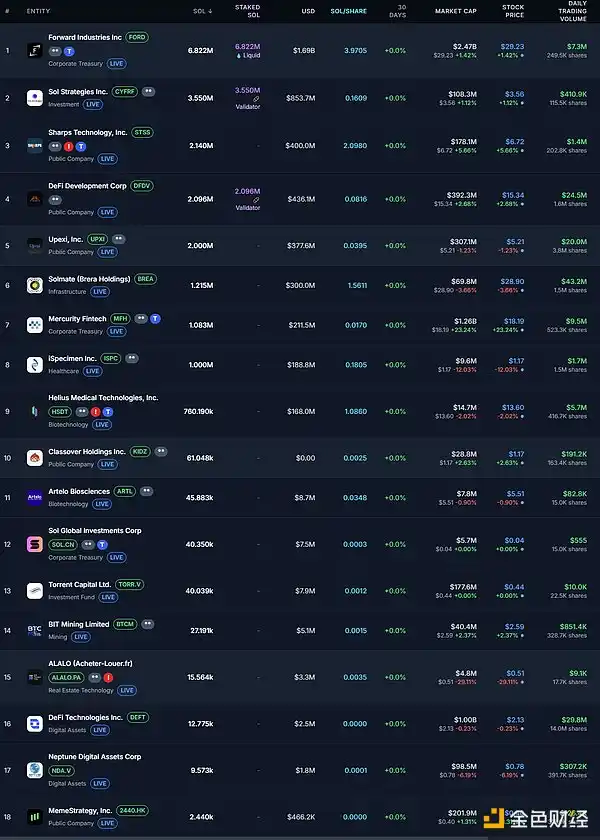

As of September 29, 2025, the 18 entities that have established Solana treasuries hold a total of 20.921 million SOL, accounting for 3.64% of the current total supply of SOL. Approximately 12.468 million SOL is used for staking, with an average staking yield of 7.7%, representing 2.168% of the total supply.

This article briefly describes the main business activities of the 18 companies holding SOL and their latest developments in the cryptocurrency field.

1. Forward Industries (FORD)

Forward Industries, Inc. (NASDAQ: FORD) was founded in 1961 and is headquartered in Hopatcong, New Jersey. Forward Industries and its subsidiaries are primarily engaged in the design, manufacturing, procurement, marketing, and distribution of carrying and protective solutions. The company operates through OEM distribution and design departments. The OEM distribution department procures and distributes carrying cases and other accessories for medical monitoring and diagnostic kits, as well as other portable electronic and non-electronic products, such as sports and leisure products, barcode scanners, GPS devices, tablets, and firearms. The design department provides hardware and software product design and engineering services. Forward Industries sells its products to original equipment manufacturers in the United States, Poland, Germany, China, and internationally.

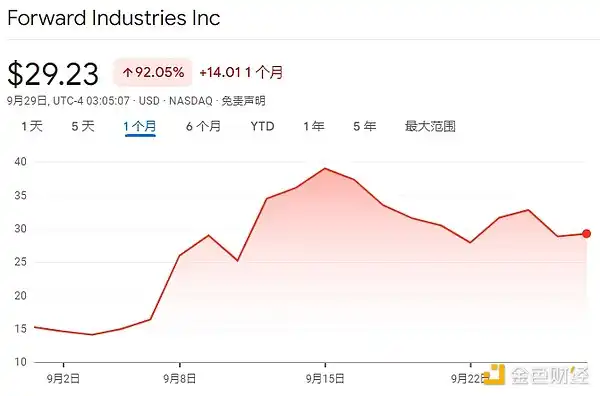

On September 22, Forward Industries announced a partnership with fintech company Superstate to tokenize Forward Industries (FORD) stock on Solana through Superstate's Opening Bell. If the plan proceeds, shareholders will be able to connect their common stock between brokerage accounts and Solana, potentially enabling round-the-clock trading, near-instant settlement, and new global liquidity pools.

On September 17, Forward Industries announced it had submitted a $4 billion ATM plan to the U.S. SEC to fund its Solana financial strategy. The plan will be used for general corporate purposes, including continuing to execute the Solana strategy, purchasing income-generating assets, and other capital expenditures.

On September 8, Forward Industries announced a $1.65 billion private placement for its Solana treasury strategy.

Kyle Samani, Chairman of the Board of Forward Industries, stated that the company's series of actions strengthen their belief that Solana will occupy a core position in the capital markets and allow shareholders to directly participate in the future tokenized economy.

Since announcing the Solana treasury strategy, the company's stock price once soared to nearly $40, and as of the time of writing, it is reported at $29.23.

2. Sol Strategies (CFRF)

Sol Strategies is a Canadian publicly traded company focused on investment and infrastructure services within the Solana blockchain ecosystem. Founded in 2018, it was formerly known as Cypherpunk Holdings, with founder Antanas Guoga and CEO Leah Wald driving a complete transformation into the Solana space after taking office in 2024. On September 23, Leah Wald announced she would step down on October 1.

On September 24, SOL Strategies announced it had completed a $25 million private placement financing by selling common shares and common share purchase warrants under the Canadian Securities Administrators' listing issuer financing exemption requirements. Canaccord Genuity Corp. will act as the lead agent and exclusive bookrunner, with proceeds to be used for general corporate purposes and digital asset investments to drive SOL treasury growth.

On July 29, ARK Invest, led by Cathie Wood, announced it had chosen Canadian SOL Strategies as its exclusive Solana staking partner for its "Digital Asset Fund." Under the agreement, ARK Invest will migrate its validator node operations to SOL Strategies' staking infrastructure.

As news of the partnership with ARK continued to develop, the company's stock price rose from under $1 to a peak of over $9, and as of the time of writing, it is reported at $4.95.

3. Sharps Technology (STSS)

Sharps Technology was founded in 2017 by Alan R. Blackman and Barry B. Berler, focusing on the research and commercialization of smart safety syringes as medical devices.

On September 16, Sharps Technology announced a partnership with the community-driven platform BONK, intending to stake a portion of its held SOL tokens on the BonkSOL platform using BONK's liquid staking infrastructure to seek staking yields.

On September 11, Sharps Technology entered into a strategic partnership with Pudgy Penguins, aimed at enhancing exposure and connectivity for Solana digital asset management while accelerating institutional adoption of the Pudgy Penguins NFT series.

On August 25, Sharps Technology announced the completion of over $400 million in PIPE private placement financing, planning to establish the world's largest Solana (SOL) digital asset treasury. Investors include ParaFi, Pantera, Monarq, and others, and a letter of intent was signed with the Solana Foundation to purchase $50 million in SOL at a 15% discount to the 30-day average price.

After news of Sharps Technology's plans to establish a SOL treasury spread, its stock price peaked above $16 before retreating, and as of the time of writing, it is reported at $6.72.

4. DeFi Development (DFDV)

DeFi Development Corp. focuses on the blockchain and cryptocurrency sectors, originally founded as Janover Inc. in 2018 as a B2B fintech company operating a platform connecting commercial real estate borrowers and lenders. It was renamed DeFi Development Corp. in April 2025.

On September 24, DeFi Development announced it had been approved for a $100 million stock buyback.

On September 18, DeFi Development acquired an additional 62,745 SOL, valued at approximately $14.6 million, bringing the total amount of SOL held by the company to over 2 million.

On September 5, DeFi Development announced the launch of the ".dfdv" domain service, allowing individuals, projects, and institutions to register personalized digital identities under this domain to be used as digital wallet addresses.

On August 27, DeFi Development joined the stablecoin network Global Dollar Network.

After the name change in April this year, the company's stock price soared, peaking at $35, and as of the time of writing, it is reported at $15.34.

5. Upexi (UPXI)

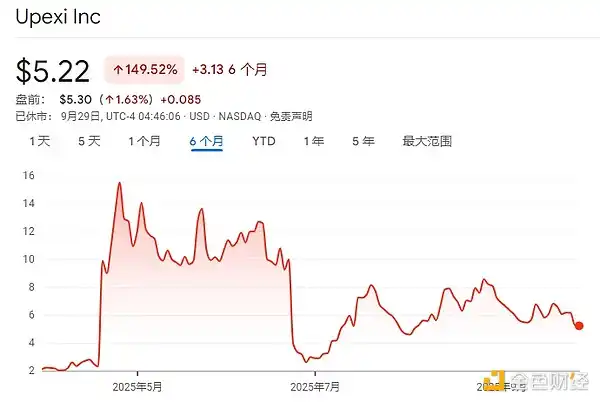

Upexi was founded in 2018, originally known as Grove, Inc., and was renamed Upexi, Inc. in August 2022. Upexi initially focused on the production and distribution of CBD from cannabis plant extracts, with its initial business centered on the production and sale of health and wellness products. Later, through a series of acquisitions, its business expanded into consumer brand operations, SaaS programmatic advertising technology, and other areas, with product lines spanning health care, pet care, and various consumer scenarios. Starting in 2025, the company began to focus on the Bitcoin and cryptocurrency sectors, establishing a digital currency holding company to capture investment opportunities in crypto assets. In April 2025, Upexi announced it had secured $100 million in financing led by well-known crypto market maker GSR, with approximately 95% allocated for establishing and operating Solana treasury reserves.

On August 12, BitMEX co-founder Arthur Hayes became the first member of Upexi's advisory board, which will drive strategic formulation, enhance market exposure, and attract more capital for Upexi's SOL treasury.

On May 13, Upexi announced it would use BitGo to custody its Solana assets, which have reached a scale of $1 billion, and engage in OTC trading and staking.

After news of establishing a SOL treasury emerged, Upexi's stock price soared from around $2 to a peak of nearly $16, before gradually retreating, and as of the time of writing, it is reported at $5.22.

6. Solmate (BREA)

Brera Holdings was established in 2022, originally known as Brera Holdings. Initially focused on multi-club operations as a sports holding company listed on NASDAQ, after the transformation, Solmate plans to accumulate and stake SOL while developing revenue-generating cryptocurrency infrastructure in the UAE, including deploying bare-metal servers configured as Solana validator nodes in Abu Dhabi.

On September 18, Brera Holdings announced its name change to Solmate and raised $300 million to launch a SOL treasury. Investors include UAE technology and blockchain consulting firm Pulsar Group, the Solana Foundation, RockawayX, and ARK Invest, with former Kraken Chief Legal Officer Marco Santori serving as CEO of Solmate.

The news of the transformation into a SOL treasury caused the company's stock price to soar from around $7 to over $26, and as of the time of writing, it is reported at $24.71.

7. Mercurity Fintech (MFH)

Mercurity Fintech is a blockchain-driven fintech group, established in July 2011.

On July 22, Mercurity Fintech Holding Inc. announced a share buyback plan of up to $10 million to enhance confidence in its Solana and Bitcoin financial strategies and to increase shareholder value.

On July 21, Mercurity Fintech Holding Inc. announced that it had signed a securities purchase agreement with institutional investors to raise $43.7 million through a registered direct offering. The funds will be used to advance the company's crypto financial strategy, including ecosystem staking, tokenized yield instruments, and the construction of institutional-grade on-chain financial infrastructure.

On July 21, Mercurity Fintech Holding Inc. announced a $200 million equity credit agreement with Solana Ventures Ltd. to launch a digital asset treasury strategy based on the Solana blockchain.

On June 11, Mercurity Fintech Holding Inc. announced plans to raise $800 million to establish a long-term Bitcoin reserve.

As of the time of writing, the company's stock price has risen to its highest point since the second half of 2018, reported at $18.19.

8. iSpecimen Inc. (ISPC)

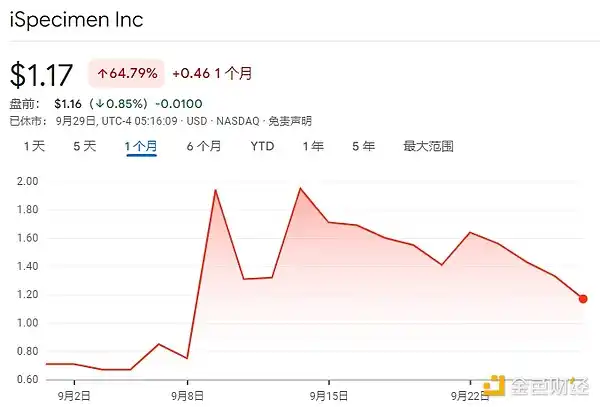

iSpecimen Inc. was founded in 2009 by Christopher Ianelli. iSpecimen operates an online marketplace that provides biological samples to life science researchers worldwide. The company develops and operates the iSpecimen marketplace, a proprietary online platform that connects medical researchers in need of subjects, samples, and data with hospitals, laboratories, and other organizations that possess these resources.

On September 4, iSpecimen Inc. (ISPC) announced that several cryptocurrency companies had approached it with investment opportunities. The company is planning to establish a $200 million digital asset repository aimed at diversifying its balance sheet and supporting growth plans through tokenized real-world assets and top-ranking cryptocurrencies.

After launching the SOL treasury, the company's stock price rose from below $1 to a peak of nearly $2, and as of the time of writing, it is reported at $1.17.

9. Helius Medical Technologies, Inc. (HSDT)

Helius Medical Technologies, Inc. is a neurotechnology company focused on neurological health, founded in 2014.

On September 22, Helius Medical Technologies, Inc. announced its initial purchase of SOL as part of its digital asset repository strategy. The company currently holds over 760,190 SOL, with an average cost basis of $231.

On September 15, Solana infrastructure provider Helius secured over $500 million in financing, led by Pantera Capital and Summer Capital, to establish a SOL treasury company. Joseph Chee, Chairman of Summer Capital and Vice Chairman of AMINA Bank AG, will serve as Executive Chairman, while Cosmo Jiang, General Partner at Pantera Capital, will act as a board observer, and Dan Morehead, Founder and Executive Partner at Pantera Capital, will serve as an advisor.

Since launching the SOL treasury plan, Helius's stock price has risen from around $7 to over $24.

10. Classover Holdings Inc. (KIDZ)

Classover Holdings Inc. was established in 2020 and is an education company that primarily provides online interactive live courses for K-12 students in the U.S. and globally, delivering its educational services through online real-time interactive private tutoring and group classes.

On May 1, Classover signed a $400 million equity purchase agreement with Solana Strategies Holdings LLC to launch a SOL-based financial strategy.

After launching the SOL treasury reserve strategy, the company's stock price rose from under $2 to over $7, but has since declined, reported at $1.17 as of the time of writing.

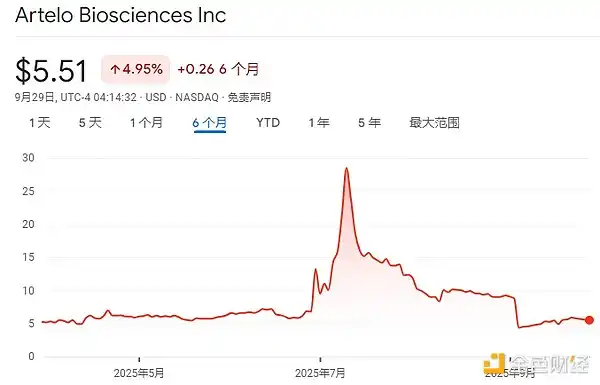

11. Artelo Biosciences (ARTL)

Artelo Biosciences is a clinical-stage biopharmaceutical company founded in May 2011.

In August 2025, Artelo Biosciences announced the completion of a $9.475 million private placement financing to launch its Solana reserve strategy. Bartosz Lipiński, former Engineering Director at Solana Labs, is participating as a technical partner, with asset custody and DeFi execution services provided by CUBE. Additionally, the Artelo board has approved a gradual expansion of the strategic investment scale.

On September 9, Artelo Biosciences announced a public offering of 640,924 shares of common stock at a price of $4.40 per share, raising approximately $3 million.

Artelo's stock price once peaked at nearly $30, and as of the time of writing, it is reported at $5.51.

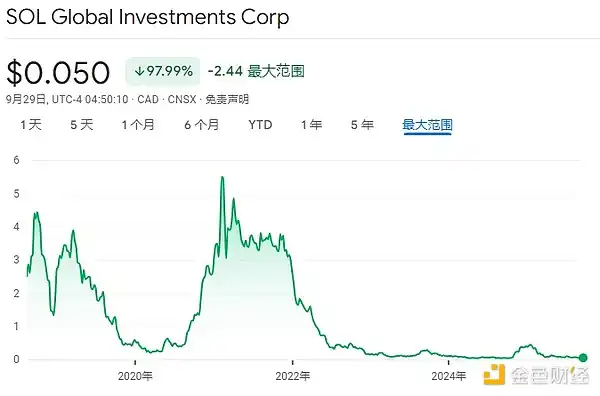

12. Sol Global Investments Corp

Sol Global Investments Corp is a Canadian company focused on institutional investment in the Solana ecosystem, formerly known as Scythian Biosciences Corp. In October 2018, Scythian Biosciences Corp. announced its name change to Sol Global Investments Corp.

Since 2022, the company's stock price has gradually declined, and as of the time of writing, Sol Global's stock price is reported at $0.050.

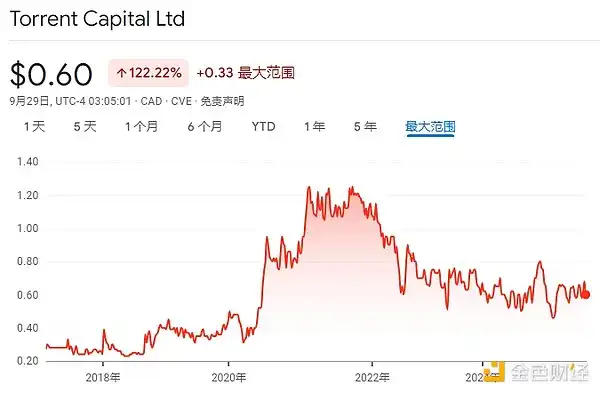

13. Torrent Capital Ltd. (TORR.V)

Torrent Capital Ltd. was established in 2017 and primarily manages a portfolio of Canadian small-cap stocks, focusing on securities of public and private companies. In January 2025, the company announced the creation of a cryptocurrency portfolio and its initial purchase of SOL.

As of the time of writing, Torrent Capital's stock price is reported at $0.60.

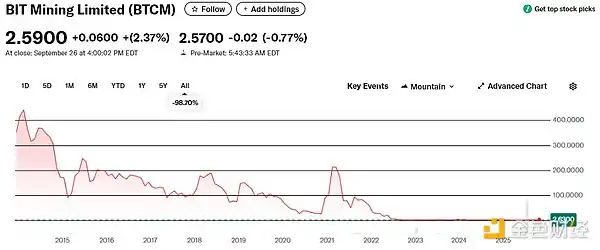

14. BIT Mining Limited (BTCM)

BIT Mining Limited was formerly known as 500.com Limited, which was an online lottery service provider established in 2001. In April 2021, it decided to change its English name to "BIT Mining Limited," becoming a technology-driven cryptocurrency mining company with operations in cryptocurrency mining, data center operations, and mining machine manufacturing.

On September 11, BIT Mining Limited announced the additional purchase of 17,221 SOL to expand its growing SOL reserves. This brings the company's reserves to over 44,000 SOL, valued at approximately $9,950,000.

On August 26, BIT Mining Limited announced the launch of DOLAI—a dollar-backed stablecoin aimed at connecting AI agents, merchants, consumers, and institutional financial entities on the Solana chain, with plans to expand to broader multi-chain interoperability.

On July 10, Bit Mining announced that it would convert its cryptocurrency holdings to Solana, raising $200 to $300 million for its Solana strategy.

As of the time of writing, Bit Mining's stock price is reported at $2.59.

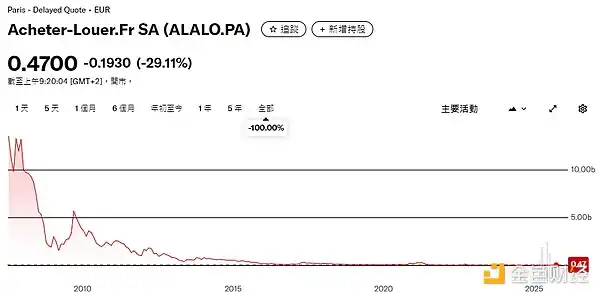

15. ALALO (Acheter-Louer.fr)

ALALO (Acheter-Louer.fr) is a French company primarily engaged in the global marketing and publishing of real estate advertisements.

As of the time of writing, ALALO's stock price is reported at $0.47.

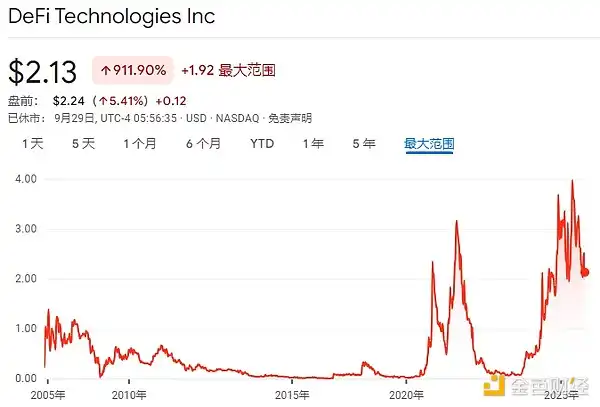

16. DeFi Technologies Inc. (DEFT)

The company was founded in 1986, originally known as Valour Inc., and was renamed DeFi Technologies Inc. in July 2023. The co-founders of the company include Olivier Francois Roussy Newton, Johan Wattenstrom, among others, with Olivier Francois Roussy Newton serving as CEO and Chairman. In July 2024, DeFi Technologies announced that it is expanding its crypto portfolio to include SOL in its treasury.

On September 24, DeFi Technologies' subsidiary Valour announced the launch of 13 cryptocurrency ETPs priced in Swedish Krona on the Swedish Spotlight stock market.

On September 18, Valour Digital Securities Limited, a subsidiary of DeFi Technologies, announced the launch of a physically-backed Bitcoin staking trading product called "1 Valour Bitcoin Physical Staking" on the London Stock Exchange platform, providing investors with unique exposure to Bitcoin staking returns, reportedly supported by physical Bitcoin at a 1:1 ratio.

On May 20, DeFi Technologies announced a strategic partnership with Fire Labs to launch a compliant stablecoin issued by a U.S. licensed bank, officially entering the realm of real-world assets (RWA).

After 2024, DeFi Technologies' stock price rose from around $0.4 to a peak of $4, and as of the time of writing, it is reported at $2.13.

17. Neptune Digital Assets Corp (NDA.V)

Neptune Digital Assets Corp was established in 2017 and is a Canadian blockchain company primarily engaged in cryptocurrency mining, proof-of-stake (PoS) staking, blockchain node operations, and decentralized finance (DeFi).

As of the time of writing, Neptune's stock price is reported at $0.75.

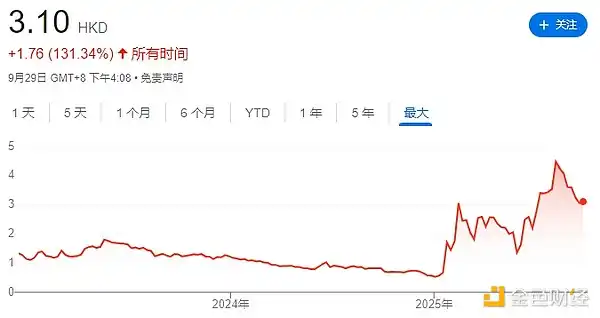

18. MemeStrategy, Inc. (2440.HK)

MemeStrategy, Inc. is an investment holding company primarily engaged in IoT application data transmission and processing services, as well as communication equipment business, while also focusing on investments in artificial intelligence, blockchain, and cultural sectors.

On August 2, the Hong Kong-listed company MemeStrategy announced a strategic partnership with Helio, a subsidiary of the cryptocurrency and stablecoin platform MoonPay, to support the issuance platform and token trading system Moonit.

On June 16, MemeStrategy announced an investment of HKD 2.907 million to purchase 2,440 SOL.

As of the time of writing, MemeStrategy's stock price is reported at $3.10.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。