Author: FinTaxOwen Chen

As a globally renowned free trade port, Hong Kong's commercial appeal stems not only from its logistical convenience but also from its distinctive tax system. Among these, the "source of profits" taxation principle is the most representative: only profits derived from Hong Kong are subject to profits tax here.

This tax regulation provides a "zero tax burden" opportunity for offshore trade: as long as trade profits are recognized as "offshore," they can obtain tax exemption. However, this exemption is not automatically granted—the Hong Kong Inland Revenue Department (IRD) has established strict review thresholds. Therefore, whether a company can build a complete and convincing case to prove that its profits "do not originate from Hong Kong" becomes the decisive factor in whether it can enjoy the exemption.

1 Clearing the Fog: How Does the Tax Authority "Trace" Your Profit Source?

In Hong Kong's tax practice, how is the source of profits determined? The answer lies in a golden rule derived from case law: "Profits from sales contracts concluded in Hong Kong are subject to taxation in Hong Kong." This seemingly simple principle places the burden of proof entirely on the shoulders of companies applying for offshore exemptions—they must provide clear and compelling evidence to demonstrate that all core activities generating profits indeed occur outside of Hong Kong.

To implement this case law principle, the Hong Kong Inland Revenue Department systematically provided an official review framework in its published "Departmental Interpretation and Practice Notes No. 21" (DIPN-21). The core analytical tool of this framework is the well-known "Operations Test."

The so-called "Operations Test" focuses on penetrating the surface of business operations to explore the fundamental activities through which a company earns profits and trace the geographical location of these activities. It reminds us that trade profits do not arise from the isolated moment of signing a contract but are generated from a complete business chain: from upstream supplier development and negotiation to midstream market expansion and customer contracting, and finally to downstream logistics arrangements and payment settlements. Therefore, the tax authority's focus will not be limited to the contract itself but will conduct a panoramic examination of this series of business activities to determine whether the true value-adding activities driving profits are completed within or outside of Hong Kong.

Data Source: FinTax related cases; Image Source: Owen Chen

Moreover, based on the "Operations Test," the tax authority also adheres to another important principle—the "Totality of Facts." This principle requires reviewers to penetrate the formal appearance of business arrangements and strike at the commercial substance. A typical example: the signing location of a sales contract may be far away in Singapore, but if the tax authority investigates and finds that the core activities creating value—such as customer development, price negotiation, and terms revision—are all conducted by a team in Hong Kong, then the superficial effectiveness of this contract as "offshore evidence" will be fundamentally denied.

Classic Case Analysis: How the Magna Case Defines the Source of Profits for Hong Kong Profits Tax

"Magna Industrial Co Ltd v CIR" is a landmark case in Hong Kong tax law regarding the determination of the source of trade profits. The case examines the source of profits according to the "Operations Test" and profoundly reflects the judgment principle of the "Totality of Facts." This case provides crucial tax planning guidance for companies engaged in cross-border trade.

Case Background:

Magna is a Hong Kong trading company with a unique business model: it procures and stores engineering products in Hong Kong through subsidiaries, but its core sales activities are entirely conducted through an independent "export manager" network overseas. These agents are responsible for finding customers, promoting, negotiating, and signing sales contracts abroad. The Hong Kong office mainly handles order processing, invoicing, logistics arrangements, and payment collection. The focal point of the dispute is whether its profits of up to HKD 150 million originate from within or outside of Hong Kong.

Core Judgment: Application of the "Operations Test" and "Totality of Facts"

The core of this case lies in how the court applies the "Totality of Facts" and "Operations Test" to determine the source of profits. The court does not merely focus on the location of the sales contract but adopts a "broad and pragmatic" approach, comprehensively examining all business activities undertaken by the taxpayer to earn profits and exploring the "effective cause" of those profits.

In the Magna case, the court determined that although the logistical work in Hong Kong is indispensable, the activities that directly generate profits are the sales, promotion, and negotiation conducted by overseas agents. Without these overseas activities, the business in Hong Kong would be inconceivable. Therefore, the overseas sales activities are regarded as the "effective cause" of the profits.

Final Ruling and Insights:

Ultimately, the appellate court ruled that Magna's profits originated from outside of Hong Kong and were not subject to taxation in Hong Kong. This ruling established that when determining the source of profits, an "Operations Test" must be conducted across the entire profit chain, and a "comprehensive + factual" perspective must be adopted, while emphasizing the principle of "all or nothing" for Hong Kong profits tax (either fully taxable or fully exempt).

This case clearly indicates that the location of core activities generating profits (rather than the location of administrative support activities) is the key to determining tax liability.

Ultimately, the tax authority's review logic always focuses on a fundamental question: where does the real value creation occur? Any arrangement that legally obscures the commercial substance carries significant tax risks under this penetrating review perspective. Therefore, the most visionary and prudent strategy is not to rely on post-facto explanations but to carefully plan from the outset of business operations to ensure that the commercial substance of the enterprise is solid and the legal form is impeccable.

2 Avoiding Red Lines: What "Hong Kong Footprints" Will Lock in Profit Attribution?

Once we deeply understand the tax authority's principle of "substance over form," the most common "minefields" on the path to offshore exemption become very clear. These business "footprints" left in Hong Kong are the focal point of the reviewers' attention. Once a company inadvertently steps into these areas, its application for offshore exemption will face significant challenges.

The foremost red line is establishing Hong Kong as a substantive global sales and trading hub. Imagine if a company's Hong Kong team deeply leads price negotiations, contract term discussions, and even finalizes contracts in Hong Kong for global clients; this means that the most critical "profit-generating" activities have indisputably taken place in Hong Kong. In the face of such strong evidence, any application for offshore exemption will be futile.

Another high-risk area involves substantial goods management and circulation. If a company rents a warehouse in Hong Kong, manages inventory, and directly ships to overseas customers from this base, it constitutes strong "onshore operational" evidence. The tax authority will determine that the company is not only making decisions in Hong Kong but also fulfilling contracts there, making it evident that Hong Kong is the source of profits.

Furthermore, the review will also trace back to the "brain" of the company—the location of the core decision-making team. If directors or executives are based in Hong Kong and make key business decisions regarding pricing strategies, contract terms, etc., then regardless of where the physical execution of the transaction occurs, the profits will be locked in Hong Kong.

Thus, it is clear that the key to successfully obtaining offshore exemption lies in constructing a clear, verifiable picture of offshore operations: that is, the company's core decision-making and key execution are clearly located outside of Hong Kong.

3 Common Pitfalls: Why a Single Factor Cannot Constitute a "Moat" for Offshore Status?

In the practical game of offshore exemption, the reasons for application failures often stem not from blatant violations but from blind spots in understanding tax law principles. Many seemingly foolproof "shortcuts" ultimately conceal traps for failure. Among them, the "employee paradox" is the most representative challenge.

On one hand, if a company does not hire any employees in Hong Kong, it seems to eliminate the risk of "onshore operations" from the source. However, this will immediately trigger the tax authority's soul-searching question about "commercial substance": where does the profit of a "shell" without employees come from? On the other hand, if a company hires employees in Hong Kong—even if their responsibilities are limited to administrative support—the tax authority will inevitably initiate a penetrating review to investigate whether their work in any form, even indirectly, supports core profit-generating activities. This choice between "having" and "not having" is undoubtedly a test of the company's structure and daily operations.

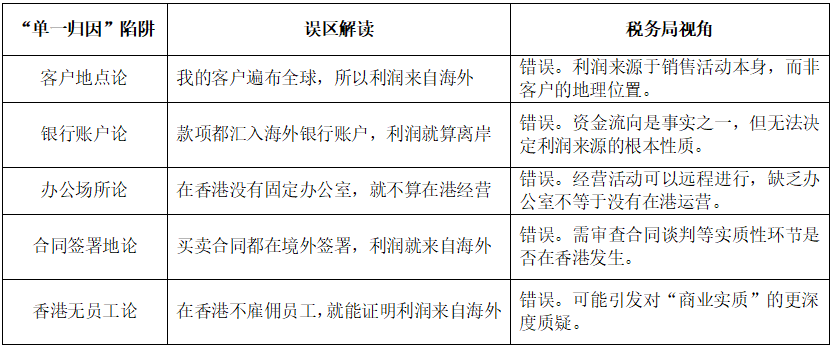

In addition, many companies easily fall into the "single factor determinism" fallacy, mistakenly believing that meeting a specific condition automatically grants them offshore status.

Common "single attribution" traps include:

Data Source: DIPN-21 (Departmental Interpretation And Practice Notes - No.21)

However, this misunderstanding directly contradicts the essence of the tax authority's review—the "Totality of Facts." Whether it is the geographical location of customers, the location of bank accounts, or even the signing location of contracts, in the eyes of the tax authority, these are merely fragments of facts that constitute the overall commercial picture, not decisive factors. The tax authority's review must inevitably cross single links and conduct a comprehensive, integrated assessment of the entire value chain; any exemption application based on partial facts cannot construct a complete compliance logic.

4 Conclusion: Compliance for the Long Haul, Professionalism for Victory

The above content is merely a brief introduction to Hong Kong's offshore profit exemption system and practical points. In fact, Hong Kong's offshore profit exemption is not a tax benefit that can be easily obtained; it requires profound tax knowledge, meticulous business planning, and precise operational execution. It tests not only the company's understanding of tax law but also its ability to build a compliant and sustainable international business model.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。