Today, I will finish the homework in advance and then start writing the weekly report. Although there has been some significant price fluctuation today, it is likely due to investors' expectations regarding a potential U.S. government shutdown. Currently, on Kalshi, the probability of a U.S. government shutdown on October 1st has risen to 83%. The mainstream expectation is that the shutdown will last no more than 10 days, with options for longer durations being relatively few.

I looked at historical data, and in most cases, the shutdowns lasted less than 14 days. Most investors still believe that the shutdown can be resolved within 10 days, with the most common expectation being a shutdown over a weekend. This is because if it extends beyond the weekend, Trump has already indicated that he might lay off a large number of federal employees. I suddenly thought, could this increase the unemployment rate and force the Federal Reserve to cut interest rates? It seems quite possible.

Moreover, if there is a shutdown, the non-farm payroll data from the Labor Department, which is scheduled for release on Friday, will not be published and will be delayed for possibly ten days. According to the market's ostrich mentality, this might alleviate market anxiety. The impact of the shutdown on the market was also discussed in yesterday's homework, and those interested can take a look.

In addition, Trump's plan to send nuclear submarines to Russia is another reason for market concern. Although Trump has repeatedly explained that the submarines will not be detected by Russia and that he will try not to use them, if Russia remains stubborn, Trump might not advise against a show of force, which could create significant trouble for the market. If Russia begins to use nuclear weapons, the market is likely to experience a "final drop."

Of course, I believe this will not be initiated unless absolutely necessary. Let's wait and see; I hope Russia does not act impulsively.

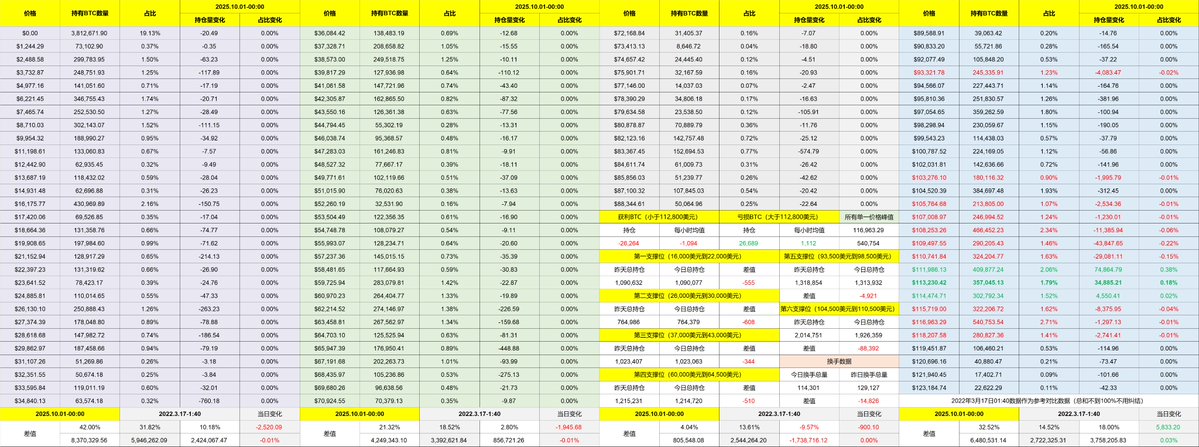

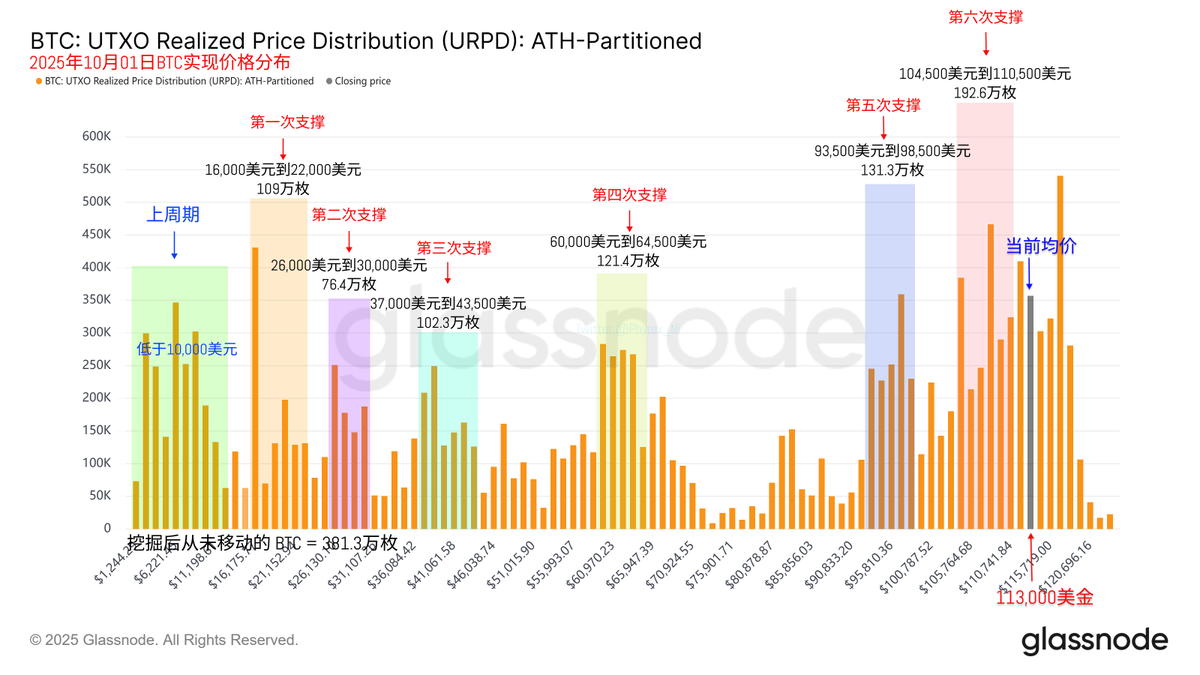

Returning to Bitcoin data, the turnover rate has not changed much. The slight decline in price is likely still due to investors' concerns about the U.S. shutdown. However, whether looking at the U.S. stock market or the price of $BTC, the temporary impact seems limited. If the U.S. does enter a shutdown tomorrow, it remains to be seen whether the market will fully anticipate a reduction in declines or continue to drop due to the shutdown. This is homework for everyone, and we should see the answer by next Monday.

Although the price of BTC has fallen, the overall chip distribution remains very healthy, and the support levels are also strong. However, it cannot be ruled out that the deepening conflicts caused by the shutdown could lead to increased panic among investors. In simple terms, if things can return to normal by next Monday, it is likely to be a weekend of consolidation. But if the shutdown continues into next week, it could indeed worsen market pessimism.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。