$TREE Huge benefits, yet surprisingly little discussion in the Chinese market.

First, the facts: On September 25, Treehouse, in collaboration with FalconX, launched the first Ethereum staking rate forward contract (TESR FRA).

Now, let's break it down one by one👇

1/ Who is FalconX?

A brief summary of FalconX:

First, it is an institutional crypto trading platform valued at $8 billion, with a total funding of $430 million.

Second, it is backed by top institutions such as the Singapore Sovereign Wealth Fund, B Capital, and Tiger Global.

Additionally, FalconX is a CFTC-registered swap dealer, possessing compliance qualifications at the level of traditional finance, enabling them to bring crypto derivatives to the mainstream institutional market.

2/ Why is this so important?

After the Ethereum merge, staking yields became the network's "native interest rate." However, the problem is that this rate will fluctuate. For institutions managing billions of dollars, this uncertainty represents risk.

Traditional finance has benchmark rates like LIBOR and SOFR, around which a massive derivatives market has been built. The crypto world has always lacked this infrastructure—until now.

TESR provides a version of the answer:

Institutions can lock in future staking yields

Hedge against the risk of declining staking yields

Or speculate on the rise of staking yields

How big is the potential of this product?

Referring to traditional finance, interest rate derivatives are one of the largest financial markets. Now the crypto market finally has its own "interest rate curve," around which TESR can build:

Interest rate swaps

Structured yield products

More complex fixed-income instruments

3/ How is the market responding?

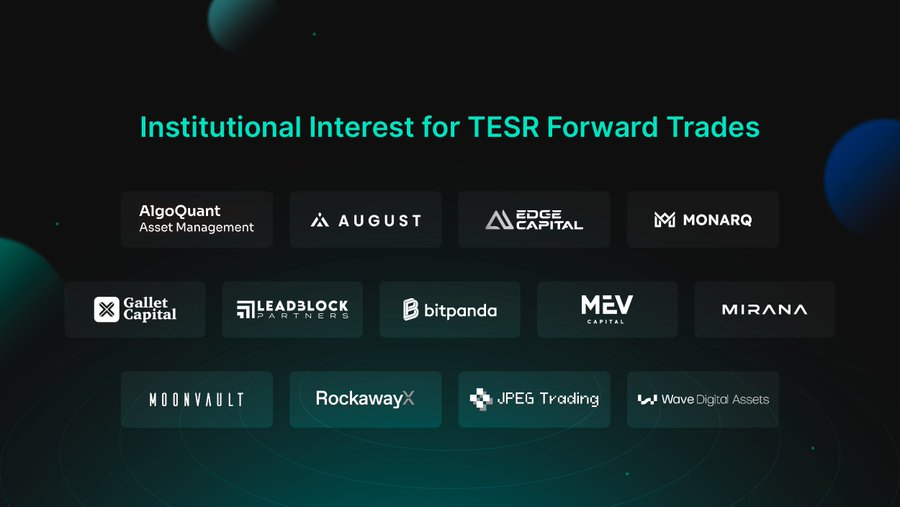

A range of leading institutional investors and hedge funds, including Algoquant, August, Edge Capital, Monarq, Gallet Capital, LeadBlock, BitPanda, MEV Capital, Mirana, Moonvault, RockawayX, Wave Digital Assets, and JPEG Trading, are participating in or expressing interest in trading the newly launched forward rate agreement market.

These are not small players. Edge Capital manages billions in assets, and Monarq is a top crypto quant fund. Their participation indicates that this product indeed addresses a real demand.

More importantly, this is not a one-time proof of concept, but a continuously operating real-time market. Next, we are likely to see more derivatives innovations based on TESR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。