Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

The cryptocurrency market has generally warmed up after a slight fluctuation caused by macro data last week, showing a short-term rebound trend.

According to OKX market data, as of the time of writing, BTC has rebounded and broken through $114,000, currently reported at $113,931.7, with a slight increase of 0.09% in the last 24 hours. ETH has risen back above $4,100, reaching a daily high of $4,246, currently reported at $4,190, with a slight increase of 0.6% in the last 24 hours. In terms of other assets, SOL has stabilized at $200, reaching a high of $214, and has now fallen back to $209.73, with a slight decrease of 0.18% in the last 24 hours. BNB has returned to the $1,000 mark, currently reported at $1,023.7, with an increase of 1.24% in the last 24 hours.

In terms of sectors, according to SoSoValue data, as of September 30, the various sectors of the cryptocurrency market have shown mixed results. The CeFi sector rose by 2.33%, with Aster (ASTER) leading the way with an increase of 8.50%; the Layer 1 sector rose by 0.91%, with Avalanche (AVAX) increasing by 1.56%; the PayFi sector rose by 0.90%, with Dash (DASH) increasing by 5.18%; the Layer 2 sector rose by 0.12%, with Mantle (MNT) increasing by 6.72%. Additionally, the Meme sector fell by 0.89%, with BUILDon (B) rising against the trend by 13.82%; the DeFi sector fell by 0.97%, with Lido DAO (LDO) remaining relatively strong, increasing by 5.83%; the AI sector fell by 2.96%, but KAITO rose by 21.31%.

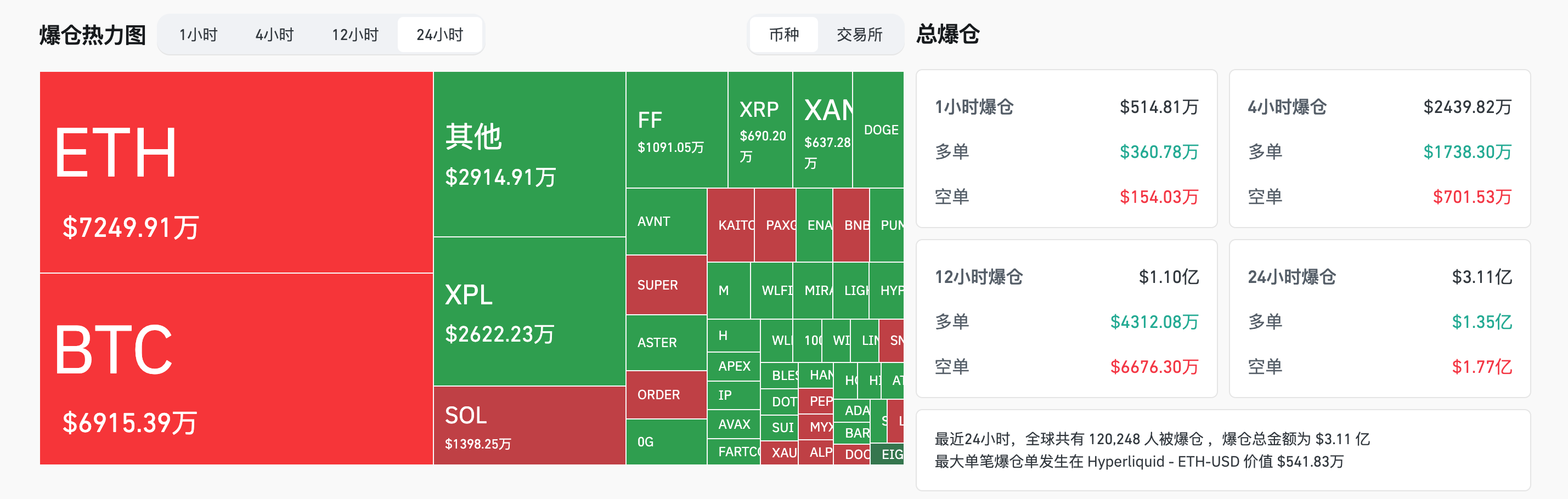

In the derivatives market, according to Coinglass statistics, over 120,000 people experienced liquidation in the past 24 hours, with a total liquidation amount of $311 million across the network, including $135 million in long positions and $177 million in short positions. The liquidation amount for ETH reached $72.49 million, making it a "disaster area" for liquidations; BTC and XPL followed closely, with liquidation amounts of $69.15 million and $26.22 million, respectively.

The "Fear and Greed Index" displayed by Alternative.me has risen to 50 (neutral), a significant rebound from the previous 37 (fear); it has improved compared to last week's 43 and last month's 48, indicating a warming sentiment. As market sentiment warms up and prices stop falling and rebound, discussions about whether the "bull market is still ongoing" are also heating up. Odaily Planet Daily will summarize analysts' views and arguments regarding the future market trends.

What will be the future trend of BTC?

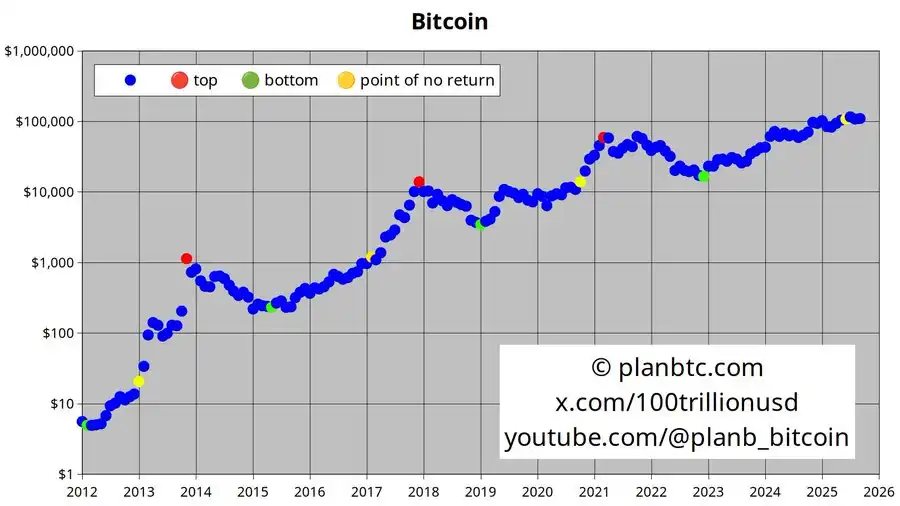

PlanB: The bull-bear dividing point was experienced in June 2025, and a long-term stable upward trend may be coming

Well-known analyst PlanB tweeted on X: As you know, I believe the BTC bull market has not ended and will continue. This could be a long-term stable upward trend without FOMO and crashes. We experienced the bull-bear dividing point in June 2025 (the yellow point in the image), similar to October 2020, February 2017, and January 2013.

XWIN Researcher Japan: The BTC bull market has not ended, and the recent pullback seems more like a "digestion period"

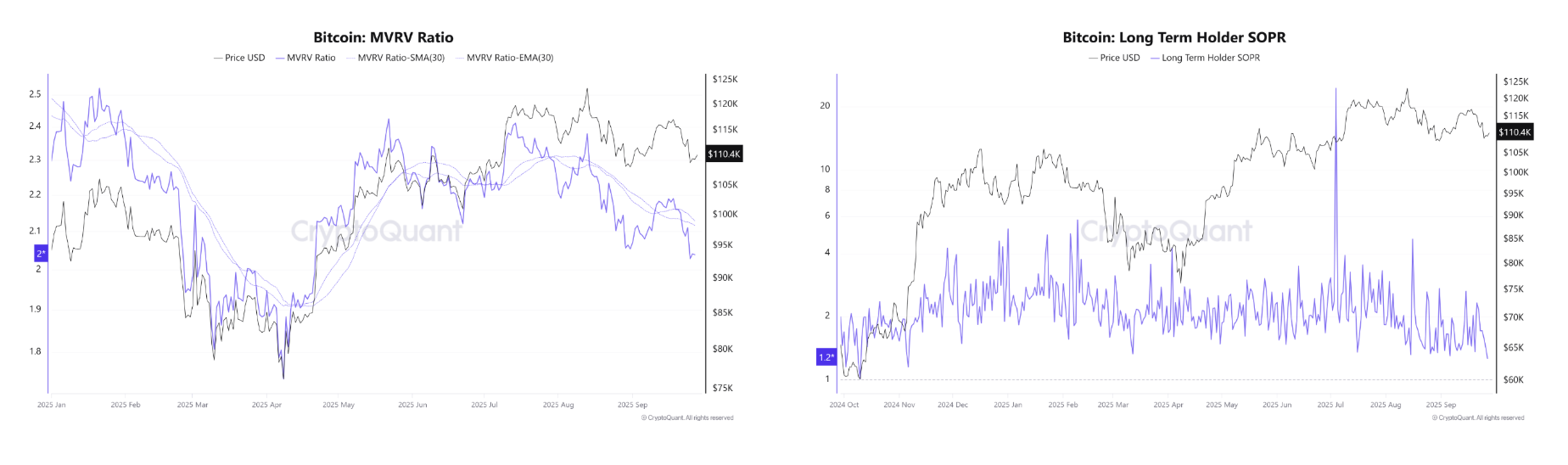

XWIN researcher Japan analyzed in a Cryptoquant article that despite the recent volatility causing unease among traders, on-chain data continues to indicate that the BTC bull market has not ended. The recent pullback in BTC does not appear to be the end of the rebound but rather a "digestion period" for the market. Although the market has cooled from an overheated state, investors are still enjoying healthy returns. Additionally, the market value to realized value (MVRV) ratio of BTC has dropped to 2, which may indicate that the market will enter an expansion phase after consolidation, and this cycle has not yet reached its end.

Bitunix Analyst: The start of a rate-cutting cycle may trigger asset bubbles, and the risk of government shutdown increases market volatility

Bitunix analysts stated: Recently, the Federal Reserve has restarted rate cuts to save weak employment while warning of overvalued stock markets; the U.S. faces a government shutdown risk on October 1, and Trump will meet with congressional leaders. Rate cut expectations are favorable for risk assets, but asset bubbles and political risks amplify short-term volatility, providing both funding support and adding downward uncertainty to the cryptocurrency market.

Mid-term rate cuts establish liquidity improvement to support risk assets. In the short term, concerns about asset bubbles and political risks from the shutdown will exacerbate vulnerabilities, making the market prone to sharp fluctuations—rapid declines followed by rebounds. In the cryptocurrency market, BTC faces pressure at $116,000; around $108,000 is an important liquidity support level, and $104,000 is a secondary bottom. Currently, it has fallen from $112,000–$113,000 to about $110,000, with short-term movements primarily in a range, and a breakout needs to be confirmed with significant capital inflow.

Strategy Suggestions:

A dovish policy is favorable in the mid-term, but Powell's reminders about bubbles and the risk of government shutdown mean that caution is still necessary in the short term. Sentiment is being pulled between "rate cut benefits" and "political + overvaluation risks," and traders should use liquidity and data as the main judgment axis. BTC has short-term support at $108,000—$106,000, with secondary support at $104,000. Resistance is at $118,000—$116,000, and after confirming a breakout, the target can be set at $120,000. Risk control suggestions include reducing leverage and entering and exiting in batches.

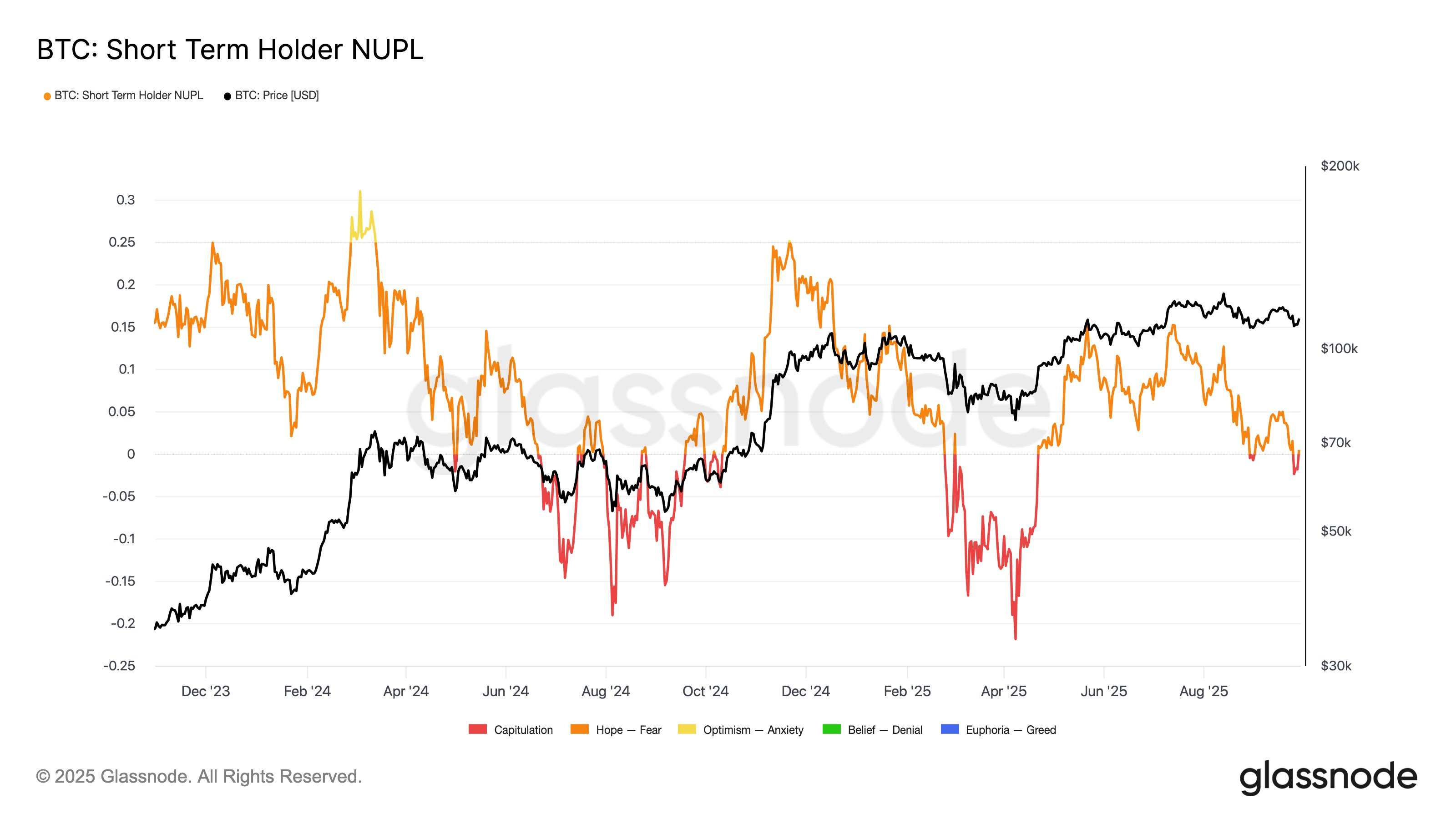

Glassnode: BTC short-term holders are experiencing losses, and the market may enter a reset phase.

Glassnode released data on X indicating that the NUPL (Net Unrealized Profit/Loss) metric for BTC short-term holders has entered the loss zone, indicating that recent buyers are under pressure. Historical data shows that surrender events among short-term holders often mark the market's entry into a reset phase, usually laying the foundation for a new round of asset accumulation.

Murphy: BTC enters a pricing channel between the yellow line and the green line

On-chain data analyst Murphy stated that BTC is temporarily supported at the green line position (about $108,000) in the MVRV extreme pricing range. The trend of BTC has shown a trend decay and has entered the next pricing channel, where the price operates between the yellow line and the green line.

Murphy believes there are two possible scenarios ahead:

- Continue to oscillate within this channel, with the lower support level being the green line (currently about $108,000), and the upper resistance levels at $113,000 and $117,000.

- If it cannot break through the resistance level, the price may enter between the green line and the blue line during the next pullback.

Among them, $113,000 is the average cost line for short-term investors holding for less than 3 months. If the rebound cannot hold above this level, the probability of the second scenario will increase.

Conclusion

The warming sentiment is just the first step; what truly determines the market direction is the repair of on-chain structures and the clarity of policy implementation.

After this round of rebound, the divergence between bulls and bears has become more intense. Whether BTC can break through $116,000 remains to be observed, while the Federal Reserve's rate-cut narrative and political variables may become catalysts for the next phase of market strength or reversal. In the face of uncertainty, being prudent may be more important than being passionate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。