Bit Digital $100M Notes and Revenue Update Impact

Bit Digital has announced a proposed $100 million offering of convertible senior notes due 2030. Investors reacted nervously and shares fell because convertible debt can mean future share dilution and higher financial risk.

Bit Digital Moves $100M Into ETH Treasury Strategy

Ethereum treasury Bit Digital proposes raising $100 million with convertible senior notes due 2030. The company said the notes are senior, unsecured obligations and that underwriters may buy an extra $15 million to cover over-allotments. The company says the funding will support its ETH reserve strategy, a move that fits a growing trend of firms building Ethereum treasuries.

Source : X

Preliminary Financial Results

Alongside the offering, the firm gave preliminary results for the two months ended Aug. 31, 2025: revenue likely between $20.1 million and $22.2 million, cost of revenue (ex-depreciation) about $8.2–$9.0 million, and cash & cash equivalents estimated at roughly $163.7–$173.9 million.

Why Bit Digital Is Building an Ethereum Treasury (DAT Strategy)

The company has been accumulating ETH since June 2021. The company's $100M offering is described as intended to support its digital-asset strategy including ETH purchases, which matches a broader shift where corporates convert cash into crypto as a strategic reserve. They raise capital through equity sales, debt offerings, or convertible notes to buy cryptocurrencies like ETH, Bitcoin or even altcoins and sometimes stake or lend it to earn yield.

This move sits inside that trend; other public firms like BitMine Immersion and SharpLink Gaming have built big Ethereum treasuries in recent months. Firms say this gives shareholders exposure to blockchain growth, potential upside from ETH price appreciation, and staking/DeFi income streams.

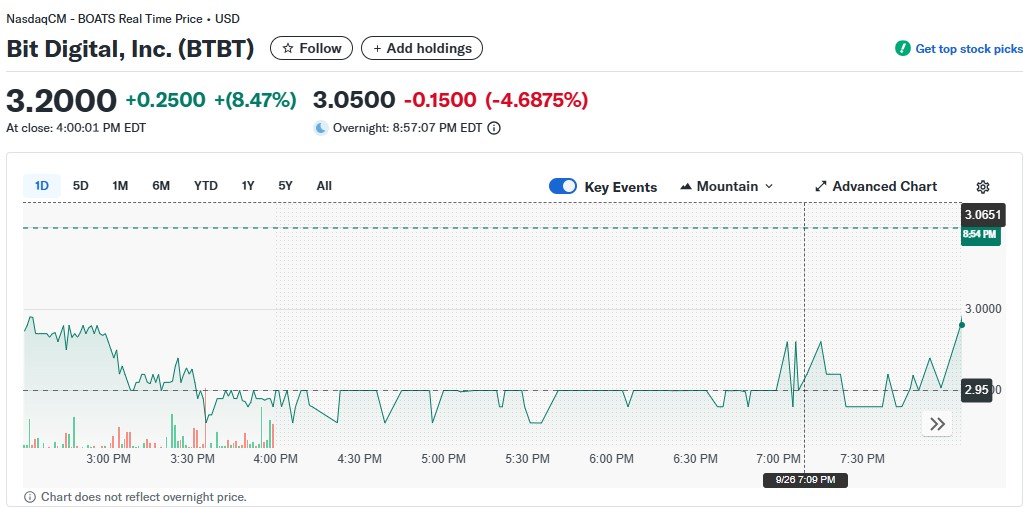

Share Price Drop — Market Response

Despite news of Bit Digital's massive offering plans, the company's shares saw a decline. The announcement pushed its shares lower in after-hours trading. The BTBT share is trading at 3.4 with a dip of 4%. Several market reports showed a drop after the convertible-note news, a common investor reaction when a company raises debt or dilution risk rises.

Source : Yahoo Finance

How this move could impact Ethereum and other corporate treasuries:

Demand signal : $100M aimed at Ether buying would add direct demand, which can be bullish for ETH price in the short term but relative to global Ether liquidity and exchange flows. The coin is trading at $4206 with a slight increase in the past 24hrs.

Market psychology : More companies raising funds to buy Ether reinforces the “Ethereum treasury” narrative and may encourage other firms to follow, increasing institutional demand.

Risk transmission : If Ether falls sharply, companies that funded purchases with debt (like convertible notes) could see their equity valuations compressed and their balance-sheet risk rise. That risk makes investors nervous and can depress stocks of ETH-treasury firms when markets turn.

Bit Digital is raising $100M through convertible notes as part of a wider industry move toward Ethereum treasuries. If the firm uses the money to buy and stake Ethereum, it joins other big public DATs — but that path brings both upside and real risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。