On Monday, the market trend has gradually repaired the previous negative sentiment. Whether it is geopolitical conflicts, expectations of Federal Reserve policies, or concerns about government shutdowns, the emotions are being gradually digested. In the past, the market generally viewed government shutdowns as negative events, but this time, due to the delay in the release of labor statistics data, there is an additional ten-day "buffer period." Moreover, if the shutdown increases, it could benefit the Federal Reserve's interest rate cuts, so in the short term, the market has gained some space for stable operation.

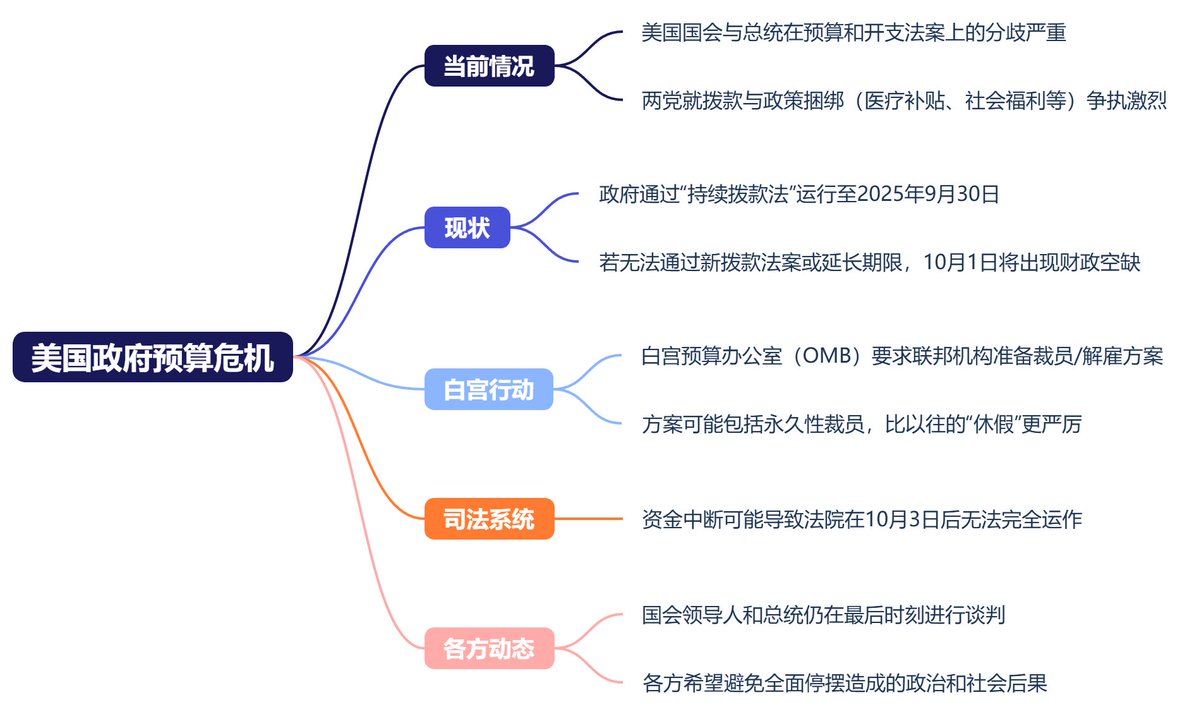

Currently, it seems likely that a partial government shutdown in the United States will occur around October 1, 2025. Non-core departments and general operations may be suspended, but key functions such as defense, security, and medical emergency services should continue. The trigger remains the deadlock between Congress and the President over budget appropriations and policy bundling, with the continuing appropriations act set to expire on September 30. If a new appropriations bill or a temporary extension cannot be passed before then, a shutdown will be triggered. Although both Congress and the White House hope to avoid the political and social risks of a full shutdown, time is running very short.

Historically, short-term shutdowns usually trigger risk-averse sentiment, with funds likely flowing into the dollar, U.S. Treasury bonds, and gold, while small-cap stocks and industries highly related to government contracts are most vulnerable to impact. If the shutdown lasts longer, it will not only drag down consumption and employment data but also increase the pressure on the Federal Reserve to cut interest rates in October, as the damage to the economy and labor market will force a policy shift sooner.

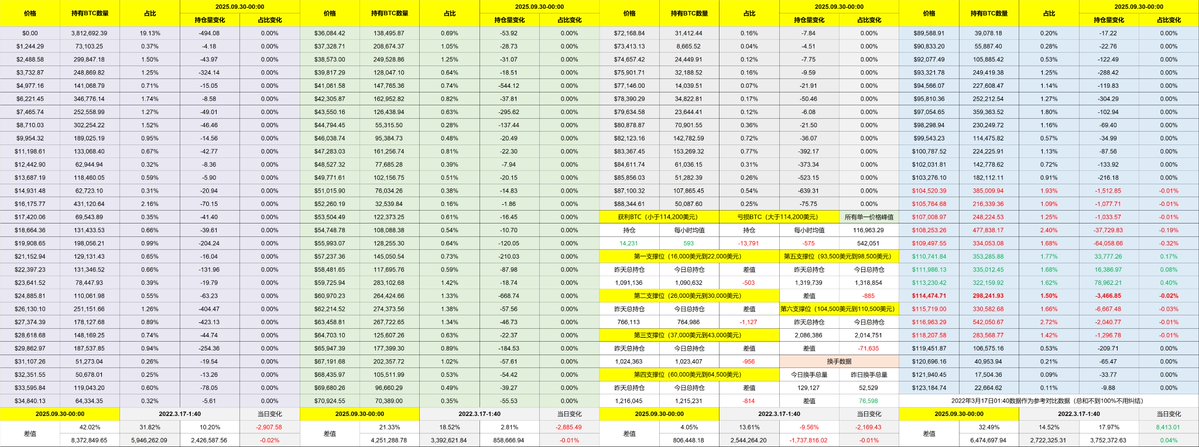

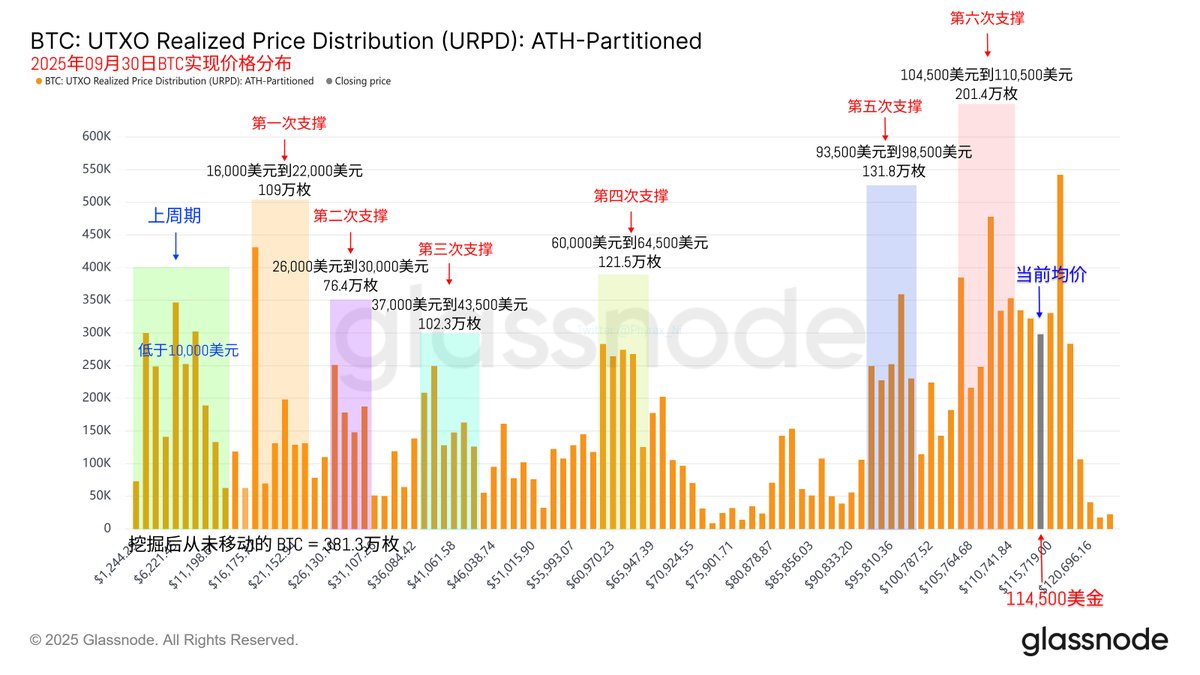

Looking back at Bitcoin's data, although the turnover rate increased on Monday, it was not very exaggerated. Especially from the perspective of the chip structure, it is still mainly the turnover of short-term holders. The price increase has led many investors who bottomed out over the weekend to exit, which is a normal chip exchange, while earlier investors have not reacted.

From the URPD data, it is also clear that the current chip distribution is still very orderly, with no panic among loss-making investors, and the turnover of bottom-fishing investors is very smooth, successfully passing through the support level.

Next, we will see which comes first: the shutdown or the labor data. If the shutdown comes first, it might not be a bad thing.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。