┈┈➤Why Focus on RWA

╰┈✦The First Half of 2026 May Not Be a Bear Market

The biggest difference in this market cycle is the significant misalignment between the halving cycle (4-year cycle) and the macro cycle.

In the past three market cycles, the halving cycle and the macro cycle were roughly aligned, but as this year's halving cycle is about to end, the interest rate cut cycle is just beginning.

This will lead to a phase in 2026 where liquidity is relatively abundant, but market expectations for cryptocurrencies are weakening.

Therefore, the first half of 2026 may not necessarily be a bear market.

On one hand, because interest rates were raised in the first half of 2018 and the first half of 2022. But the first half of 2026 is likely to be within a rate-cutting cycle.

On the other hand, the first half of this four-year cycle often brings new narratives.

Brother Bee has mentioned this four or five times, but it needs to be emphasized again. Don't forget:

In the first half of 2018, the mainnet launches of EOS and TRON triggered a small wave of public chain enthusiasm.

In the first half of 2022, the emergence of StepN sparked a small wave of X to EARN enthusiasm.

This suggests that there may be new narratives in the first half of 2026.

Against the backdrop of relatively ample macro liquidity and the approval of crypto ETFs, RWA may become the theme of this phase. Because RWA is the track most correlated with the macro environment and ETFs.

╰┈✦RWA is a Long-Term Narrative

As a financial product that integrates Web3 and Web2, RWA itself is a long-term narrative.

┈┈➤Why Focus on OpenEden

╰┈✦High Recognition and Deep Cooperation with Compliance & Traditional Finance

▌ Comprehensive Compliance

All products of OpenEden meet institutional-level standards and are fully compliant with regulations.

For example, the US dollar stablecoin OpenDollar ($USDO) launched by OpenEden is the world's first regulated yield-bearing stablecoin. $USDO is backed by U.S. Treasury bonds and issued under the Bermuda Digital Asset Business Act (DABA) license.

▌ Consistently Highly Rated by Top Global Financial Rating Agencies

OpenEden's TBILL fund has received high recognition from global financial rating agencies.

◆ The world's number one rating agency—S&P: Rated TBILL as "AA+f/S1+". Here, "AA+" is just below "AAA" and indicates a very high financial capability rating. "f" indicates it is a fund rating. "S1+" is the highest stability rating. Overall, S&P's rating of the TBILL fund is close to top-tier.

◆ The world's number two rating agency—Moody's: Rated TBILL as "A-bf". Here, "Aa" indicates very high quality and low credit risk, just below "Aaa". "bf" indicates it is a bond fund.

◆ The globally renowned rating agency—Fitch: Rated TBILL as "AA+", indicating very high credit quality, just below "AAA".

These three financial institutions account for 95% of the global financial rating market share and have consistently given TBILL a near-top rating.

This is the world's first tokenized treasury fund to receive consistently high ratings from top global institutions.

▌ Deep Cooperation with BNY Mellon

OpenEden has established deep cooperation with BNY Mellon.

The original text on BNY's official website states, "OpenEden chooses BNY to provide investment management and custody services for its tokenized U.S. Treasury ($TBILL) fund."

From the wording, it can be seen that OpenEden holds a certain proactive position in the cooperation.

As the world's largest custodian bank, BNY has a custody asset scale of up to $46.6 trillion and is globally recognized as a leader and pioneer in custody services.

The cooperation between BNY and OpenEden reflects the high recognition of global traditional financial institutions for Web3, RWA, and especially OpenEden.

╰┈✦Strong Web3 Background, Cooperation, and Foundation

▌ Binance Background

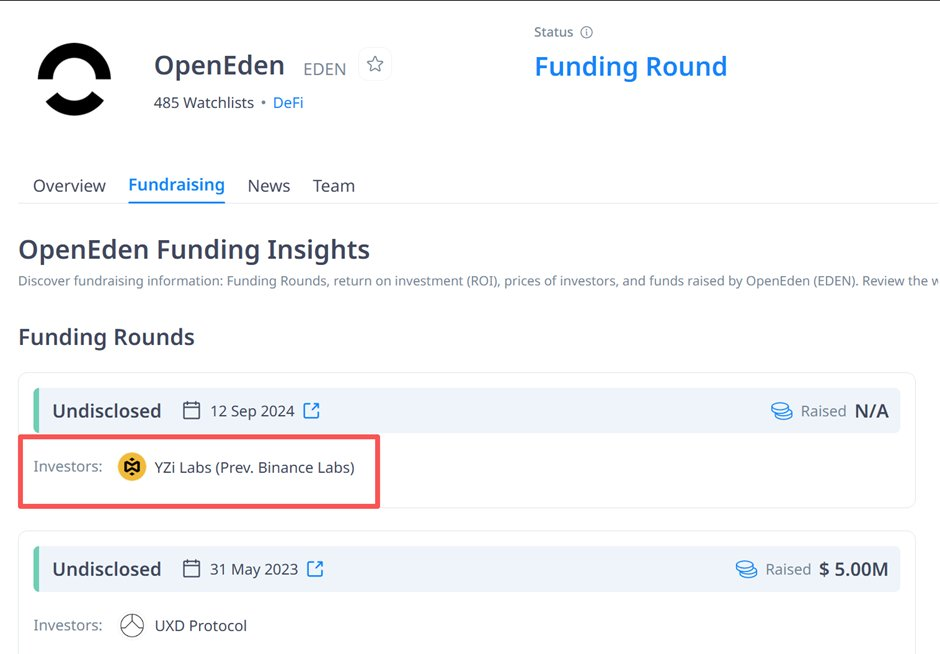

First, OpenEden received investment from YZi Labs (formerly Binance Labs) in 2024.

Second, OpenEden collaborates with Binance and its custody institution Ceffu, making cUSDO the first yield-bearing digital asset that can be used as over-the-counter collateral for Binance trading. cUSDO is a compound interest version of USDO, accumulating returns internally. While ensuring risk-free returns, cUSDO has full #DeFi compatibility.

Third, OpenEden launched the Binance Wallet Booster event and confirmed the upcoming launch of Binance Spot.

▌ Web3 Ecosystem Cooperation and DeFi Integration

OpenEden has established cooperation with many Web3 projects, and its ecological products have been deployed across seven ecosystems: Arbitrum, Solana, Ethereum, XRPL (Ripple ecosystem), Base, Polyton, and BSC.

USDO has also been launched on multiple DeFi projects, including Pendle, Morpho Labs, Euler, Spectra, Napier Finance, Balancer, Upshift, and more.

▌ Founders Transitioning from Wall Street to Crypto

The founder of OpenEden—Jeremy Ng

@jeremyng777 previously worked at Goldman Sachs and Morgan Stanley in cross-asset derivatives innovation, management, and investment. He joined Gemini Exchange in 2020 as a director, general manager, and head of the Asia-Pacific region. He founded OpenEden in 2022.

Such a strong and rich background and experience reveal that he will be a successful "human ecological bridge" and "fusion agent" between TradFi and DeFi.

┈┈➤Can Retail Investors Participate in OpenEden: RWAFi Gameplay Launched

The biggest issue with RWA is that it is relatively distant from retail investors, making it difficult for them to understand the narrative of RWA and participate in the RWA ecosystem.

OpenEden has set low-threshold gameplay for retail investors to participate.

╰┈✦The Completed OpenEden Bills Points Activity

In March 2025, OpenEden launched the Bills points activity, completing the snapshot on September 15. Achieving 100,000 points qualifies for an airdrop.

A rough calculation shows that by participating continuously for 6 months, holding an average of less than $560 of USDO or cUSDO daily, or adding less than $120 of liquidity daily would meet the airdrop threshold. For most retail investors, this participation threshold is low enough.

╰┈✦OpenSeason Launches RWAFi

With the points activity ending, a new OpenSeason begins. Rewards will shift from points to direct token rewards.

▌ Curve Stablecoin Vault

Time: September 1, 2025 - March 1, 2026

Participation Method: Add liquidity using cUSDO + USDC in Curve.

▌ Pendle YT cUSDO Stablecoin Vault

Time: September 15, 2025 - November 20, 2025

Participation Method: Purchase YT cUSDO on Pendle.

For specific activity details, follow the official Twitter @OpenEden_X.

┈┈➤In Conclusion

OpenEden is set to have its TGE at the end of September. Compared to other RWA tokens, $EDEN is a new RWA token. Choosing to have its TGE during the Federal Reserve's interest rate cut may be a good timing.

On the other hand, although $EDEN is a new RWA token, OpenEden is a project that has been operating for at least three years.

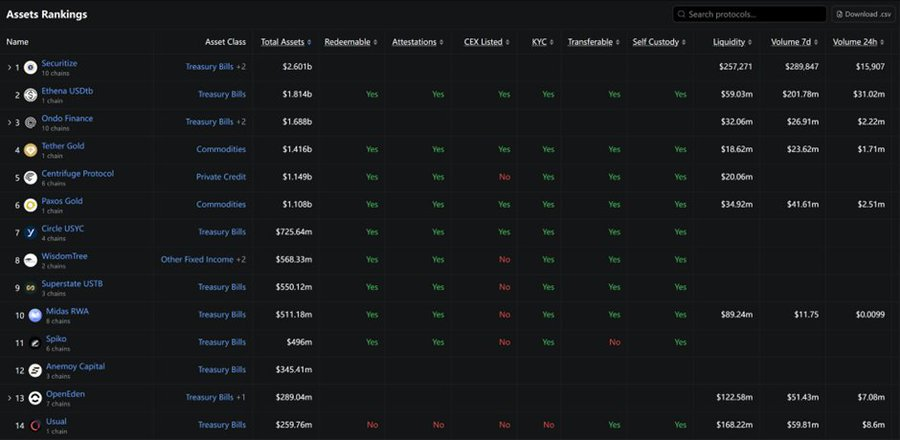

Currently, OpenEden's ecosystem covers multiple chains and is deployed across seven ecosystems. OpenEden's TVL exceeds $289 million, surpassing Usual's TVL, ranking 13th in RWA TVL.

The recognition and emphasis from traditional finance, the deep integration with the crypto industry, and the large TVL data scale… multidimensional information indicates that OpenEden will be a highly anticipated new star in RWA.

Moreover, this is RWAFi that retail investors can participate in…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。