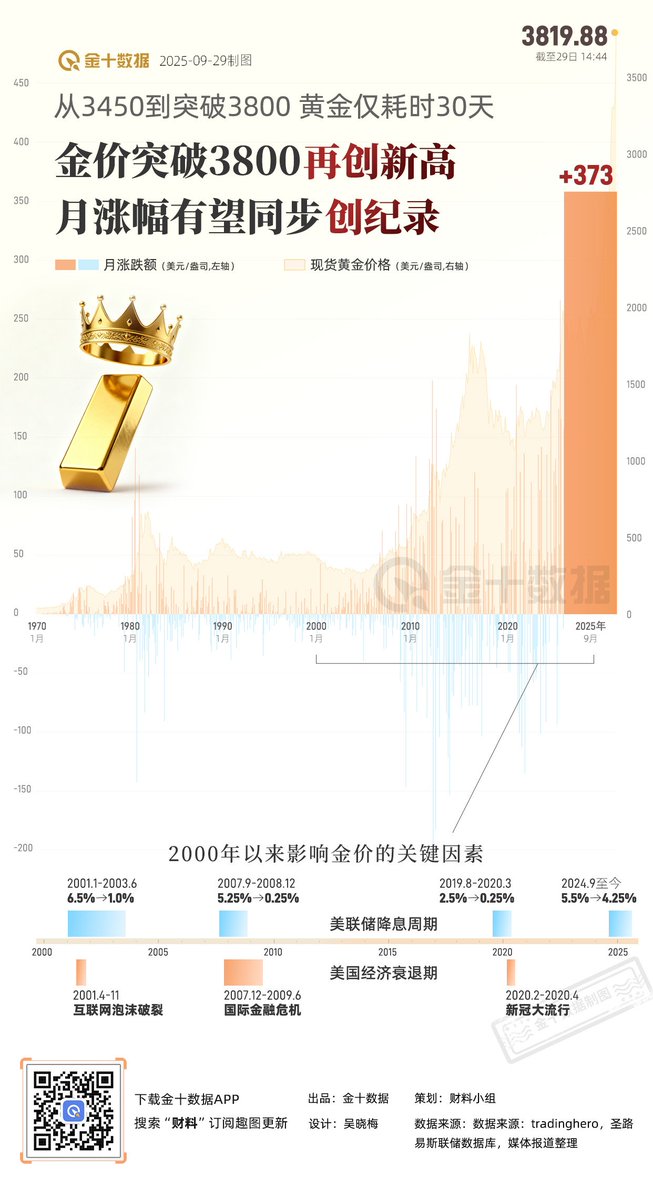

⚡️In less than a month, the gold price has surpassed $3,800, setting a new historical high!

Looking back over the past 50 years, the long cycles of gold often correspond to two types of scenarios—

1⃣ U.S. credit overextension: such as the stagflation of the 1970s and the financial crisis of 2008;

2⃣ Turning points in U.S. dollar interest rates: during interest rate cuts and debt expansion cycles, gold has always been the biggest beneficiary.

The current logic is that the upcoming rise in gold prices starting in mid-2024 is clearly driven by two overlapping forces:

1⃣ The U.S. fiscal deficit and interest burden are rapidly expanding, forcing the market to seek alternative credit;

2⃣ Real interest rates have peaked and are falling, reducing the holding costs of gold.

In an era of systemic risk, deterministic assets will be repeatedly re-evaluated.

Gold serves as a template; BTC/ETH and even on-chain stablecoins and RWA logically represent the same extension of credit on the same chain, all expected to be profitable in the next interest rate cut cycle!

In my opinion, in an era of excessive currency issuance, gold should continue to rise, until it reaches a point where an average person cannot afford 1g in a month—that will be the true end!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。