Original source: Mable, co-founder of Trends.fun

Original compilation: Ismay, kkk, BlockBeats

Editor's note: In this issue's interview, Mable, co-founder of the social protocol Trends, spoke with Leonard, CEO of the currently hottest Perp DEX Aster. They conducted a panoramic review from personal experiences to project strategies. Leonard's journey from a traditional investment banking technology position to a blockchain entrepreneur is itself a growth trajectory that traverses finance and Web3. In this interview, he systematically discusses how Aster started from perpetual contracts and gradually grew into a multi-chain comprehensive trading platform; how it attempts to design dark pools on-chain, balancing privacy and transparency; and how it seeks to find a balance between efficiency and fairness in token distribution, point programs, and buyback strategies.

In the interview, he candidly reviews the lessons from the XPL incident and shares his thoughts on Aster Chain, the market maker program, and future on-chain governance. The entire interview not only presents Aster's product philosophy and strategic layout but also reflects the balancing wisdom of Web3 entrepreneurship between compliance, privacy, and market demand, providing readers with a valuable perspective on understanding the development of the new generation of decentralized trading platforms.

Here is the full conversation:

Mable: Let's start with your background. How did you enter the crypto industry? How did you get to where you are today?

Leonard: This story is quite long. I started in the banking technology field. I was working in a technology position at an investment bank in Hong Kong, which no longer exists. Initially, I was involved in technical infrastructure, mainly responsible for building high-frequency trading systems. Later, I transitioned to being a risk engine programmer for the stock market, where I worked for about five years. After that, I entered the startup scene and founded a B2B fintech loan platform in Asia. But my first startup failed.

Mable: Around what year was that?

Leonard: Around 2015 or 2016. At that time, the concept of "Internet Plus" was very popular in China, where adding "Internet" to anything could turn it into a startup project. Everyone wanted to disrupt the financial industry. But later, regulatory pressures became too great, and some scams ruined the entire industry, leading to a downturn.

During that process, we were always thinking about whether there was a better way to do this, and that's when I came into contact with blockchain—around 2016, when Bitcoin was already established, and Ethereum had just emerged. I was initially attracted by ICOs, invested in a few projects, made some money on the first one, thought I was a genius, but then lost everything on the next few projects. However, it was this experience that sparked my genuine interest in technology.

We wondered if we could put all loan information on-chain. At that time, there was a debate about "permissioned chains" and "permissionless chains." I remember IBM launched a project called Hyperledger, and I started learning about it, trying to build a loan platform based on it.

Of course, looking back now, we chose the wrong direction; we should have gone with Ethereum. Later, I also tried to collaborate with gaming companies to integrate NFTs and tokens into games, but it was too early, and no one understood it, so it didn't work out.

After about a year of trying various directions, I eventually joined the DeFi project Injective Finance in 2019. There, I was exposed to many products and ideas. Later, when dYdX emerged, we began to conceive the possibility of building our own trading platform on-chain, which led to the first prototype of Aster, which later evolved into what Aster is today.

Crypto projects have been iterating through cycles: from dYdX to GMX to Hyperliquid. We experienced all these stages and continuously adjusted and experimented until we created something that the market truly needed.

Mable: How do you define Aster now? And what do you hope it will develop into in one to three years?

Leonard: A year is already a long time. If you had asked me this question two weeks ago, I might have given you a completely different answer. After all, in the crypto space, a year is too long. To the outside world, Aster is a multi-chain trading platform, a multi-chain DEX. But in my view, we are no longer a traditional perp DEX.

People associate Aster with the Binance ecosystem because we initially started from the BNB Chain and had CZ's help. But we are no longer just on the BNB Chain; we also support Arbitrum, OP, Linea, Solana, and will support more chains in the future.

We did start as a perp platform, but in the last two weeks, it has been our spot trading products that attracted a large number of new users because people can only buy Aster tokens through on-chain order book trading.

At the same time, we are also one of the largest yield asset providers on the BNB Chain, with products like USDS and aUSDT, allowing users to earn yields while trading.

So now, we have gradually evolved from a simple perp project into a comprehensive multi-chain trading platform, aiming to enhance user capital efficiency—you can deposit money to earn yields while using those assets as collateral to participate in more strategies.

In the future, we hope to support more chains and more assets, reconstructing all mainstream products and experiences from CEX on-chain, thereby creating a complete and composable DEX product matrix.

Many people compare us to other projects like dYdX or GMX. But our real competitors are not other DEXs; they are CEXs themselves. What we aim to create is an on-chain version of Binance. Ultimately, we hope that one day we can surpass Binance—our largest investor.

Within a year, we hope to replicate 80% of the product experience found on CEXs but reconstruct it entirely on-chain. Five years from now, I hope the entire DEX industry can surpass CEXs, and we will be one of the leaders in that space.

Mable: There has always been a narrative in the market that Binance strongly supports Aster, even treating it as a "weapon" against Hyperliquid. So if you had to describe Aster in one sentence, what is its core value proposition compared to CEX or other DEXs?

Leonard: I think the most fundamental point is that our entire infrastructure is built entirely on-chain, which gives us the fundamental advantages of "self-custody" and "transparency." This is our biggest difference from CEXs.

Additionally, as a DEX, we have greater flexibility in our governance model. CEXs are very inefficient when it comes to listing new tokens or adjusting products because their processes are too centralized, approvals are slow, and there are many risk control processes. On-chain governance can evolve continuously with the needs of the community and the market.

You see projects like pump.fun, which may take years to test out new models, but these ideas originally came from the community. Ultimately, the products that remain will be those with the best market fit in their design.

That is the beauty of decentralization.

And we have been building our products in this direction from day one, so I believe on-chain trading platforms can find their market fit direction more quickly.

Of course, from the perspective of a startup, we are also more flexible and responsive. CEXs have more resources, but DEXs are closer to the community and more agile. For example, when launching new tokens or products, we can do it faster.

Mable: So are you suggesting that future new markets or new tokens will be decided through governance voting?

Leonard: This is one of the directions we are seriously considering.

But we also need to balance the fact that in the early stages of the project, for the sake of execution efficiency, we have indeed retained a certain degree of centralized control. This is to ensure that decisions can be implemented promptly and maximize benefits for the project and the community.

However, we are also "pragmatists." We know that in the future, we will gradually transition towards decentralized governance—once the entire system matures and we find a clear business model, we will gradually release control and allow the community to participate in governance.

Mable: I completely agree; gradual decentralization is a process. And it is indeed more efficient to be a bit centralized in the early stages—many projects now have one address with voting rights exceeding 50%, making governance merely a formality.

Leonard: Right, so we also have to take governance step by step.

Mable: We will talk about your "dark pool design" later, but I want to ask a personal question first—besides Aster, which DEX do you personally like the most?

Leonard: This question is too easy; of course, it's Hyperliquid.

In fact, I have tried almost all products. You could say these projects have indeed opened a new era for Orderbook perp DEXs. But the real OGs are still projects like GMX, which laid the foundation for later LP models and market-making frameworks.

However, I think there are also some interesting projects that are not yet well-known, like Surf Protocol. I have tried it myself; they also have products with a thousand times leverage, similar to us, but they use a completely different profit distribution model—users only need to pay fees when they make money, which is quite interesting.

Also, I really like JoJo on Base; I love their UI. It's that kind of feeling where you look at it and think, "Wow, that's cool."

I feel that the entire perp product space is becoming increasingly homogenized. Everyone is chasing after feature additions; if you release a user-attracting feature, others can immediately copy it. After all, Web3 is a world where everything is public, and many things have a low barrier to copying. So the core of competition becomes "what exactly are you specialized in?" Some teams excel at high leverage, while others focus on oracle-driven LP models. Ultimately, everyone has their strengths, and it's really hard to say who is better.

Aster's Dark Pool Design

Mable: Let's talk about your dark pool design. The hidden orders on Aster do not reveal direction or quantity. So the question arises, do users have a way to verify whether these orders were matched fairly afterward? Do you provide any kind of public record?

Leonard: We do have the capability for post-verification, such as inviting a third party for independent auditing. Our matching engine can take snapshots, and all transactions can be replayed for verification. However, we currently do not have a "public verification" method.

But this is somewhat paradoxical—if you can infer the transaction content afterward, then the hidden mechanism loses its meaning. So we currently do not have a way for anyone to publicly verify it.

Of course, if anyone has a good solution, we welcome collaboration. We are continuously improving this part of the product design. If someone is working on privacy trading-related chains or features, feel free to contact us for cooperation. We also have some ideas, but we haven't fully figured them out yet.

Mable: You launched the dark pool design on the first day, so you must have a strong judgment about this direction, right?

Leonard: In fact, we have been thinking about this issue from the very beginning. In the TradFi world, the volume of dark pools and OTC trading far exceeds that of public trading markets.

Many people have discussed this with us, asking if there would be similar demand if we moved this system on-chain. This is actually a somewhat conflicting concept—everything on the blockchain is public, but financial transactions inherently have a "privacy preference."

Later, there happened to be a public conversation between CZ and James Wynn, where James mentioned that he was "liquidation hunted" on Hyperliquid because the trades were public. CZ replied that transactions on-chain should remain transparent. This debate inspired us.

We thought this might be an opportunity. Everyone is aware of this, so why not take the chance to try it out? So we basically worked through the night on development, and we launched this feature in about a week and a half. CZ is also our advisor, and Yzi Labs is an investor, so we felt this was a good entry point, and we went for it.

After launching, we did see users trying it out, but to be honest, the demand was not as large as we expected. We later realized that if someone really cares about trading privacy, they might find it more convenient to go to a CEX.

However, we haven't given up. We will continue to explore and test whether there are more suitable models for on-chain privacy trading and OTC. Our goal is to "validate without leaking market signals." We are still in the experimental stage, but currently, retail users' privacy preferences are not that strong.

Mable: This is actually similar to the dark pools in TradFi, which mainly serve institutions rather than ordinary traders. In other words, if you want this product to succeed, do you need to wait for more institutions to enter?

Leonard: That's right. The problem is that once institutions are involved, it brings an entire regulatory and compliance framework into play. The current anonymous, non-KYC status we have is actually a barrier for most institutions to enter.

We have talked to some institutions, and they have expressed interest, but they are stuck at this point and cannot enter. So I think if you want to start a new Web3 project now, you should seriously consider the direction of "permissioned mechanisms."

Although we are not currently working on this area, I do believe that in certain scenarios, adding a bit of "access control" layer could potentially be the answer to resolving the conflict between privacy and compliance.

I suspect that in the next 1-2 years, those prop trading high-frequency funds may start to test the waters.

Mable: Returning to Aster's token distribution, we currently see that 96% of the supply is concentrated in a few addresses on-chain. Can you explain the structure of these wallets?

Leonard: I have also seen discussions about this online, but that's not entirely accurate. We do not control all the tokens in these addresses.

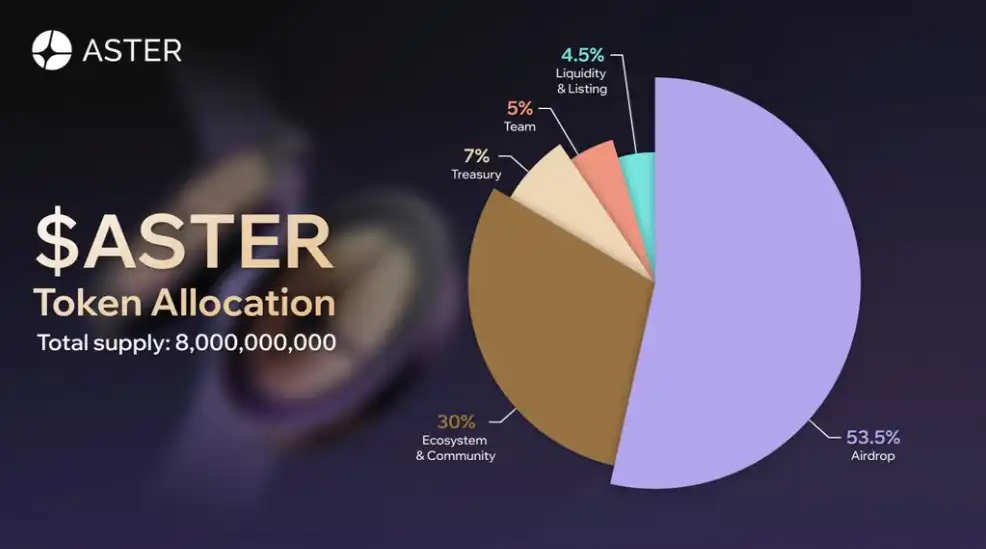

We do control a portion, but about 80% of the tokens are locked and can be verified on-chain, with a clear distribution: 50% is from airdrops, of which 8% is from the initial airdrop, and about 40% is directly sent to on-chain wallets, all of which are verifiable.

The largest wallet addresses actually include one that is an asset contract address used for users to conduct spot trading, so naturally, many tokens will be stored there.

After we opened withdrawals, a few large holders withdrew their tokens. We do not know who they are, but they chose not to sell directly in the trading contract; instead, they withdrew to their own addresses, indicating they might be long-term holders.

I understand everyone's concerns about the "96% concentration" figure, but in reality, at least 80% of the share is verifiable and transparently locked on-chain.

Currently, only about 10% is circulating, including the user conversion shares from APX. We initially provided old users with a 1:1 conversion, which accounted for about 10%; the initial airdrop accounted for about 8%; and there will be linear releases in the future, including marketing budgets, all of which are documented and can be verified on-chain.

The reason the contract address appears to control all tokens is that most trading activities occur within this contract, but in reality, many tokens belong to users.

Mable: So is Yzi Labs your only private equity investor at the moment?

Leonard: Yes, but they are just minority shareholders with a low ownership percentage. However, they have provided us with a lot of support.

Mable: Do they have any locked tokens? The community is quite concerned about this.

Leonard: We cannot disclose specific agreement details, but we can say that they have no intention of cashing out. They are not short on money and are not in a hurry to sell.

From the TGE until now, our performance in the BNB ecosystem has already proven the project's value. So even without mandatory lock-ups, they have no motivation to dump the market.

The tokens they can access come from a small portion of the 5% team allocation, which is completely transparent and can be checked on-chain. They invested in equity, not the tokens themselves.

Moreover, this portion is far less than their actual investment. You can think of it as a very small incentive share. But because the token has increased significantly since its launch, even a small piece of that 5% now appears to be a "considerable amount."

But in terms of token proportion, I think there is no need to worry too much. And from a motivational perspective, they have almost no reason to sell tokens now. However, we have confidentiality obligations regarding the specific agreements, so we cannot disclose too much.

What are the logic and plans for the second phase of the points program?

Mable: Since we are talking about tokens, let's also discuss your Genesis second phase points program. I remember you are currently running the points program and have just entered the second cycle. Can you briefly explain the design logic?

Leonard: Of course. This round of the points program actually started two weeks before the TGE and will last a total of four weeks.

We just finished the third week, with one week remaining. We will distribute 4% of the total supply in this round, aiming to allocate it as fairly and evenly as possible to everyone.

We particularly want to reward those users who genuinely participate in trading. After all, such activities will inevitably attract some users who come just to farm points, so we are continuously optimizing the rules to ensure that real traders, loyal users, and long-term holders can receive rewards.

We certainly cannot list all the criteria for judgment; otherwise, there will always be someone who finds loopholes. But for example, users with long holding times are usually real traders. We will also look at some other behavioral data to filter out accounts that are obviously farming points, trying to ensure that rewards go to genuine users.

From the results, this round of activities has been quite successful in terms of trading volume. After we announced the end time of the points activity and the total allocation, the platform's trading volume skyrocketed, even surpassing other projects, and at one point became the number one in trading volume among perp DEXs.

We have ranked first in daily trading volume for three or four consecutive days.

Mable: In the third season, do you hope everyone will try other things, or does it not matter?

Leonard: Of course, we hope everyone will migrate their spot trading activities to our platform and tell us what features they really want. Because many people are currently testing, and we have received a lot of feedback. Although sometimes it sounds a bit harsh, we still take it very seriously.

Because now we are very clear about what we want to do. So in the new season, we hope everyone will experience our spot products and tell us which assets they want to see listed and what features they hope to add.

Mable: However, the liquidity for spot trading pairs probably won't be able to trade as many other assets as on Aster, right?

Leonard: Yes, currently we only have some mainstream assets, like BTC and ETH. We hope to collaborate with more issuing platforms to provide liquidity for early projects, which is a direction we have already tried and will continue to pursue, such as the asset generation process and early asset liquidity.

Because we mentioned that one of the cores of the entire Adventure Index is how to launch new assets more quickly. If we can also quickly provide liquidity for these assets, then the entire process will be very efficient, which is what the market truly needs. So we will continue to push this matter across different projects.

Mable: Regarding the rewards for the second season, will the actual distribution wait until the end of the third season to be released together, or is there another arrangement?

Leonard: Our idea is this: after the second season, the amount of points and allocation you can receive will be clearly and transparently displayed to everyone. As for the specific distribution method, we are still designing it to consider what would be the most appropriate.

For example, we cannot only consider new participants; we also need to take into account existing token holders. People will worry that if we immediately dump 4% of the rewards into the market, it could create significant selling pressure. Therefore, the project team will definitely have some room for adjustment in the release pace. But the amount you can receive will be immediately made public and transparent to everyone after the second season ends.

Mable: So will there be a unlocking plan or something similar?

Leonard: We are indeed researching the possibility of doing this and will design a plan based on the situation, and we will announce it soon—after all, there is only one week left, so everyone will know very soon.

This is also a key point we are considering: how to find a balance between the interests of existing holders and the incentives for new users. So I think in the next two or three days, we will make a final decision and release an announcement.

Mable: I saw that people in the community were discussing this, but no one gave a clear answer, so I thought it would be better to ask you directly during the live broadcast. So before entering the third season, you currently have not made any incentive measures for spot trading, right? As for the current trading volume distribution among perpetuals, spot, and some high-risk products you just mentioned, how is it looking?

Leonard: Perpetual contracts still account for the vast majority, as the current market trading demand is primarily concentrated in this area.

Over 90% of the trading volume is in perpetual contracts, with more than 80% concentrated in BTC perpetual contracts. So that's roughly how the trading volume distribution looks.

Mable: Interestingly, BNB is actually not among them. I originally thought BNB would at least have a similar proportion to Ethereum in perpetual trading.**

Leonard: I think this is because for those who really want to trade BNB, Binance's own products are already very mature. In other markets, the demand for BNB is not that high, so the trading volume is relatively low.

Mable: I feel like I've asked enough about the tokens. Let's talk about the XPL incident. I know there are some details you may not be able to disclose, but within the scope you can share, could you walk us through what happened at that time? For example, the pricing configuration error of the XPL perpetual index caused the price to spike to $4, resulting in losses for some users. Can you tell everyone about the post-incident review process?

Leonard: Regarding this experience, some very smart people later summarized the issues on Twitter. I believe our biggest mistake was that it got stuck in "pre-market mode."

If it were a regular perpetual contract, it would automatically follow the correct index price, and there wouldn't be a situation where the price spikes and deviates from the market price. However, pre-market perpetuals inherently carry such risks—because their pricing can only rely on the internal order book, not the prices from the public market. In other words, during the pre-market phase, there is no external price source; we can only derive the price from our internal order book. When we adjusted the configuration, we mistakenly derived an incorrect price from the internal order book.

We quickly discovered this error and immediately switched it back to the regular perpetual mode, restoring normalcy. It was our mistake, and we quickly made the decision to fully compensate the affected users, absorbing the losses ourselves. Because at that time, there was no better solution to this problem. It also reminded us again that pre-market products carry higher risks.

In the future, we will take some improvement measures. First, even for pre-market perpetuals, we can obtain oracle prices through external pre-market data, such as referencing pre-market data from trading platforms like Binance, rather than relying solely on the internal order book. If we had such a mechanism at that time, this incident could have been completely avoided.

Of course, as long as it is a pre-market, there will inevitably be risks. If there is a lack of external price signals and insufficient liquidity, there is always the possibility of similar price deviations occurring. Therefore, we need to find a balance in two aspects: on one hand, we need to assess whether we have enough capability to manage this risk; on the other hand, we need to see how much demand the market has for this product. If the market truly needs it, we must enhance risk control measures to ensure the robustness of the system and avoid making the same mistake again.

Mable: Regarding the oracle issue, I actually have a related question. I remember you planned to launch tokenized stock products. So where will the price or data sources for these assets come from? Do you plan to provide 24/7 trading?

Leonard: The oracle we are currently using comes from sources like Pyth. Currently, due to the limitations of the oracle itself, we cannot achieve 24/7 trading. For example, when there is no data, we cannot continuously provide prices. We can use a method similar to "pre-market," meaning that when there are no oracle quotes, we derive prices from the internal order book.

But the problem with this method is that we can only limit trading to a certain price range. However, this actually loses its meaning—if the volatility is restricted to ±2%, people usually won't have trading interest; but once real volatility occurs, trading demand is at its highest, and at that time, due to strict risk control, normal trading cannot occur, which poses a significant risk to users.

So, currently, we cannot provide trading services for tokenized stocks during after-hours. Unless we can find better oracles that can cover longer time periods. For example, we are currently researching some index-type assets whose futures are traded on multiple markets, so the oracle can provide price data close to 23 hours a day. Taking the Nasdaq index as an example, we can continuously obtain market data through the futures market. If it is such an asset, we may open trading close to 24 hours. But if it is a single stock, we are still limited by the reality that the oracle itself cannot provide prices around the clock.

Will Aster buy back?

Mable: I remember someone mentioned in another interview that you might have a buyback plan. How frequently will such measures generally be implemented?

Leonard: I think we don't want to commit to a fixed timetable for now. We prefer to give the project or operational team more autonomy over the use of income. That said, we will indeed conduct buybacks and allocate a certain percentage of income to it. However, the specific amounts and frequency will be announced later. But it is certain that we will not design it as a fixed, completely predictable mechanism. Compared to some other projects, we will retain more flexibility to optimize allocation based on income conditions.

Mable: Yes, in fact, on this issue, different founders have very different views. For example, the founders of Pengu believe that buybacks are not the best use of funds, and they only do it because of external expectations and pressures, considering it an industry norm. On the other hand, people from Pyth believe that all income should be 100% reinvested into the tokens, which is their firm stance. I know your answer now does not represent Aster's final decision, but in terms of philosophy, how do you view this execution logic?

Leonard: Personally, I am a more pragmatic person, and I believe the best answer often lies between the two extremes. Extreme solutions are difficult to apply in all situations. Sometimes, using 100% of the income for buybacks may be the optimal solution, but at other times, allocating a larger proportion for project development may be more beneficial.

So the key is to maintain flexibility. As we conduct one or two buybacks, the community will gradually build trust, believing that we are using funds in a good and responsible manner. Ultimately, as the project matures, we can also make the mechanism more automated and standardized. I have a background in traditional finance and have read a lot of related materials, so I tend to be rational and cautious on this point.

When I was younger, I read many investment-related books, so I understand why some people say buybacks are not necessarily the optimal choice. Because it is essentially somewhat like dividends; when an institution chooses to distribute dividends, it usually means there is no better way to utilize that capital. For projects like ours, we indeed have many opportunities to use funds in more valuable ways, such as investing in teams and partnerships to drive further growth.

Another very important factor is that the token price will directly affect the efficiency of buybacks. If we simply use an automated algorithm to execute buybacks while the price is high, the effect may be counterproductive. Sometimes it may be effective, but it often distorts market expectations and pushes the price higher.

So I think there are two key points:

First, the proportion of buybacks and how much of the income should be used for buybacks should be flexibly adjusted based on the project's stage, rather than being fixed.

Second, I believe that in terms of execution, it does not need to be 100% transparent; otherwise, it may reduce efficiency. However, after the buyback is completed, all information must be publicly transparent, recorded on-chain, and available for everyone to supervise. Otherwise, it will become a gimmick: you announce a buyback, but no one knows where you bought back from or how much was bought back, which is meaningless.

Therefore, we need a certain degree of flexibility in execution; but afterwards, all data must be transparent and verifiable to ensure that the outside world can clearly see what we have actually done.

Mable: So you might disclose something like this: for this quarter, you decide to use only 30% of the income for buybacks, while clearly explaining why the remaining funds need to be used for other purposes. This logic is very reasonable.

Leonard: Exactly, and we can adjust at any time. If the community provides strong feedback and presents reasonable opinions, we can completely change our approach. It is precisely because we did not fix the proportion from the beginning that we have this flexibility to continuously optimize over time.

Mable: Yes, especially as your market cap grows, it is impossible to satisfy everyone; you always have to find a balance. I believe you are already experiencing this situation.

Leonard: Indeed, our scale is growing rapidly, and we are constantly learning.

Mable: I want to talk about the product itself again. I looked at your existing features, and you mentioned earlier that you hope to gradually provide more features and services similar to centralized trading platforms. However, you already have grid trading functionality. Why did you prioritize launching this feature?

Leonard: In fact, we launched this feature quite early, during the internal testing phase of the trading platform. Clearly, this is a very practical feature, especially for those who are not particularly professional traders. If they only want to run a certain strategy, this tool is very convenient. It is also great for the trading platform, as it can provide such functionality from the beginning, ensuring a good user experience.

Not only is it about fee revenue, but more importantly, it is about liquidity. Because most retail users, if not given such tools, often only place market orders, directly taking the market price. But if you equip them with such tools, they will trade using limit orders, which not only allows them to run strategies but also turns them into liquidity providers. So this is actually a win-win situation: retail users can run strategies while also providing liquidity to the market. This is why we launched this feature early on and have continued to develop it to this day.

Mable: So what is the current user profile of your trading users like? I guess you also pay attention to data such as IP distribution, right?

Leonard: Previously, our IPs were mostly concentrated in Asia. Of course, we basically self-host this information and do not need to grasp all the information of every user. Just from the overall IP usage, before the TGE, users mainly came from Asia. But after the TGE, we have clearly felt an increasing interest from the Western world. We can also see on Twitter that more and more users speaking English and European languages are discussing us. So we can say that the user composition is changing.

Mable: I heard that some external teams are using your API and data, and it seems that someone has provided feedback about data format issues. Do you have any improvement plans in this regard?

Leonard: Yes, we have received a lot of feedback on this. Our team is almost working around the clock to address these issues. If we sometimes fail to respond promptly, we apologize, but we are indeed gradually clearing technical debt. Everyone can join our Discord at any time, or directly DM me, or contact us through our official Twitter account. In fact, after the TGS, some developers proactively reached out to us with some very valuable technical improvement suggestions. For example, one long-standing issue that has troubled us is the slow recharge speed of Solana contracts. Later, some developers volunteered to help, and now we have formed a small group that directly interfaces with our team to research solutions.

We are now releasing updates almost three times a day to ensure that system improvements can be implemented as quickly as possible. I think everyone will soon see significant improvements. If there is anything else that troubles you, please let us know; we sincerely hope to fix it as soon as possible.

How to build Aster Chain?

Mable: Yes, if there are still needs on the Solana side, we will definitely help you resolve them. I think this is similar to the situation with Arbitrum or other chains; everyone should be very interested in collaborating with you. I want to change the topic. You mentioned Aster Chain in another interview; can you talk more about it? What role do you expect this chain to play in the future?

Leonard: We hope that all transactions on the chain can be transparent and verifiable while retaining a certain degree of transaction privacy. This is the goal of Aster Chain.

Some competitors invest a lot of resources in building a complete ecosystem on their own chains, but that is not the direction we want to focus on. We prefer to integrate with other chains and aggregate the credit of these transactions onto our chain, allowing everyone to verify. We are not saying that approach is bad; other projects are also doing an excellent job in building ecosystems. It's just that our focus is different—we are more concerned about the trading experience.

We hope to focus on providing a good trading environment and user experience for at least the next three to six months. The positioning of Aster Chain is to provide transparency and verifiability, rather than to create another "universal chain" to attract everyone to build on it. Frankly, I think there are already enough chains; we do not need another new L1.

But we do need a better decentralized trading experience. So I believe that is where the value of Aster Chain lies. Of course, the strategy may adjust over time, and there may be a shift in the future, but at least for now, we want to focus on building a better trading platform.

Mable: I understand. Just like Hyperliquid benefits from having its own chain, allowing it to collect gas fees and have protocol revenue. I guess you had similar considerations when starting out, right?

Leonard: Yes, I think in the long run, we may invest more in the chain itself. But in the short term, our focus is still on perfecting all trading functions. After all, building a complete ecosystem is a very large and complex project, and we do not want to be distracted at this stage. What we are best at and should focus on is building a fully functional trading platform with a user experience close to that of centralized trading platforms. As for the L1 ecosystem, that is something to consider in the future.

Mable: Right, I mean, if you have a lot of trades settled on Aster Chain, then you can basically earn protocol revenue, and this revenue won't flow to other L1s or other EVM chains. Is that the logic behind your considerations?

Leonard: There are two points. First, we are indeed placing trades on our own chain, but it is only running internally and has not been made public yet. It will consume gas, but it has not been fully launched. We hope to make this information public so that everyone can run nodes and verify. This is the goal we want to achieve. As for whether to build a complete ecosystem around it, that is not the primary task right now. We may do it in the future, but it is not the focus at the moment. We will consider that once we feel the platform is mature enough.

Mable: Do you have a market maker program? Can people apply to join?

Leonard: We do have a market maker program. If you go to our website documentation, there is a Market Maker Program page that details the requirements for trading volume, fees, and the incentive pool tokens they can earn, which are separate from other points systems. Interested parties can contact us directly via email; all the information is on that page.

Mable: Can you share how many market makers you currently have, or is that information not available for now?

Leonard: I won't disclose specific numbers. However, I can say that we have contacted many and have quite a few already onboard. Active market makers are actually dynamic; they become more active with higher trading volumes. If liquidity demand increases, more people will join.

Yes, they mainly provide credit trading, and they can only make money when there is liquidity demand. In the past two weeks, trading volume has been very high, and many are willing to pay for quality trades. There are many inquiries every day from people wanting to join the market maker program because they see the market liquidity and know they can make money by providing liquidity, so the demand is significant.

Mable: Right now, you only have a web and desktop version. Are you planning to develop a mobile app or distribute through other front ends?

Leonard: Actually, we do have a mobile version; we just may not have done enough promotion to let everyone know we have a complete product.

Mable: Oh, really?

Leonard: Yes, we have an Android version available for download on Google Play. The iOS version is still in the process of being approved for the App Store, but it is indeed already developed.

We are also collaborating with other wallets. For example, we are working with Trust Wallet and SafePal to help us build the front end. It's similar to what Base has done; Base and Phantom have also done similar things. We will soon launch with Trust Wallet, allowing everyone to start trading directly using Trust Wallet or SafePal. We are advancing with multiple partners, and if any wallets want to collaborate with us on the front end rather than just doing it for us, we welcome them to reach out. We are also looking for partners.

Because we support multiple chains, users do not need to transfer assets across chains first. For example, with Solana, you can deposit directly. So if there are listeners who want to collaborate with us on the front end, rather than just doing it for us, we warmly welcome you to contact us. We are actively seeking partners.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。