Written by: Will A-Wang

As early as April this year, Citigroup's GPS report on "Digital Dollars" suggested that 2025 would mark the "ChatGPT moment" for blockchain, with stablecoins igniting this transformation. Just six months later, this shift is unfolding at an astonishing pace. The listing of cryptocurrency companies, record-breaking financing, and technological breakthroughs all indicate that institutional adoption is accelerating.

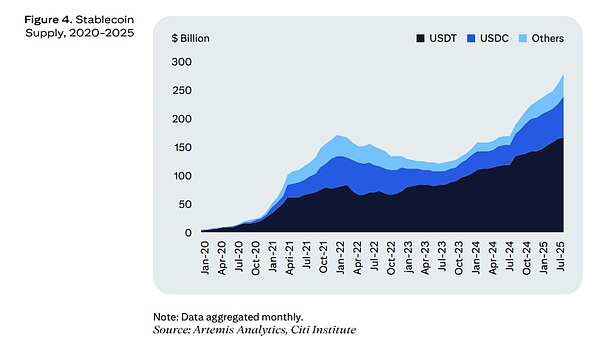

This summer, a wave of announcements followed, particularly from digital-native enterprises, which are increasingly introducing stablecoins into business and real-world scenarios. Meanwhile, existing stablecoin activities driven by the crypto ecosystem continue to expand—issuance has risen from about $200 billion at the beginning of 2025 to approximately $300 billion.

The growth of stablecoins is still primarily driven by three major forces:

Native crypto ecosystems;

E-commerce and digital-native enterprises;

Strong demand in offshore/international markets for holding US dollars.

Although Citigroup holds an optimistic view on the future use of stablecoins, it believes they will coexist long-term with other forms of on-chain currencies—especially bank tokens (tokenized deposits, deposit tokens, and their hybrid forms)—and evolve together. These forms collectively drive the broader expansion of on-chain financial markets.

This situation resembles the early days of the internet bubble in some ways. Skeptics once again claim that banks will be "disintermediated." However, Citigroup does not believe that crypto will destroy the existing system; rather, it is helping to reconstruct it. Stablecoins may become an important addition to the financial toolbox, especially for digital-native enterprises and investors, as well as families wishing to easily hold US dollars; but for many, bank tokens—deposit tokens, tokenized deposits, etc.—will be easier to integrate. With characteristics like "trust" and "privacy," bank tokens will still be the preferred choice for many enterprises. Citigroup believes that by 2030, the transaction volume of bank tokens may exceed that of stablecoins.

Currently, most mainstream enterprises remain in the "curious" stage regarding stablecoins, rather than "enthusiastically embracing" them; compared to the promotional rhetoric of the crypto industry, they care more about faster and cheaper payment experiences. In many countries, domestic consumer payments are functioning well: real-time, 24/7, low-cost. Cross-border payments, however, are another matter, although fintech and large banks are also making rapid progress in this area.

Citigroup believes that even if only a small portion of traditional channels shift to on-chain, by 2030, the turnover of bank tokens may exceed that of stablecoins. What we see is not a "battle of digital formats," but a continuous advancement towards smarter and faster finance.

As a result, we have compiled the Citi GPS: Stablecoins 2030, Web3 to Wall Street report, which examines the rapid evolution of stablecoins and their increasingly important role in the future monetary system. Importantly, the report describes the underlying logic behind Citigroup's forecast for stablecoin supply in 2030, as well as incorporating the circulation rate of stablecoins, which is insightful for the current chaotic statistics on stablecoin data in the market. At the same time, Citigroup's perspective on bank tokens from the banking industry's viewpoint is also highly relevant.

Key Points

In the April 2025 Citigroup GPS "Digital Dollar" report, we proposed that 2025 would be the "ChatGPT moment" for the large-scale adoption of blockchain by institutions. The situation over the past six months has confirmed this judgment: digital-native enterprises are leading the way in applying blockchain to "real-world" scenarios.

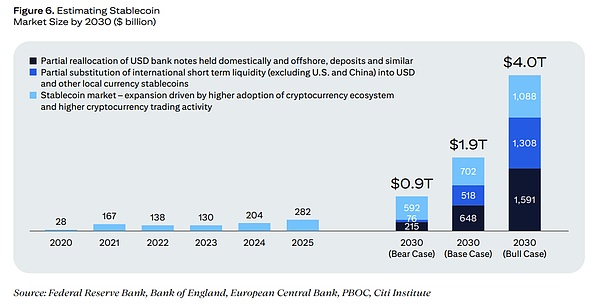

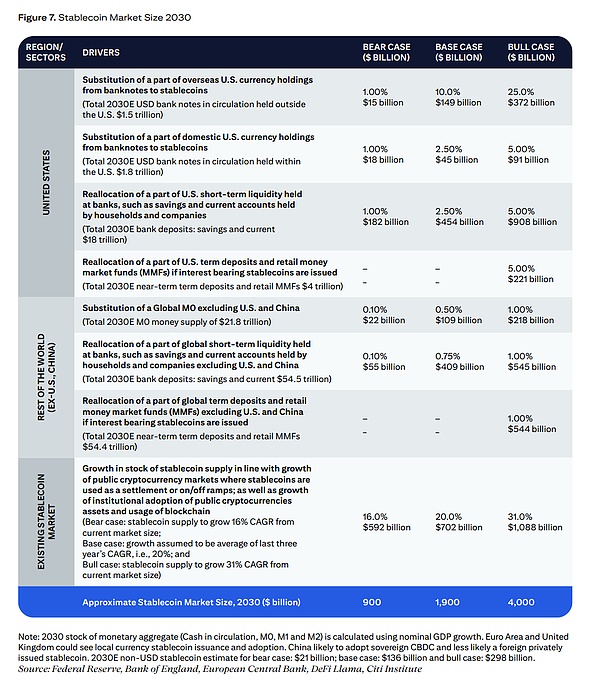

Given the rapid growth since the beginning of the year and the announcement of numerous new projects, we have raised our baseline forecast for stablecoin issuance in 2030 from $1.6 trillion to $1.9 trillion, and our bullish scenario from $3.7 trillion to $4.0 trillion.

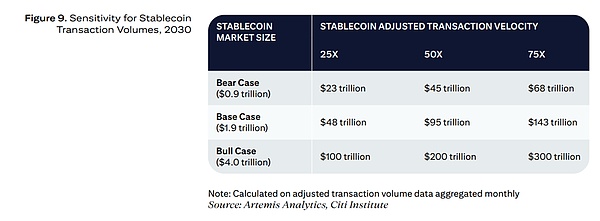

If the annual turnover rate of stablecoins is 50 times, stablecoins could support nearly $100 trillion in transaction volume by 2030 (baseline scenario). In a bullish scenario (market size of $4.0 trillion) at the same turnover rate, this corresponds to $200 trillion.

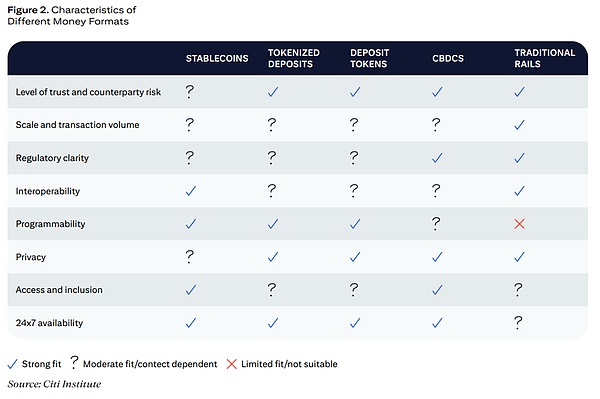

We believe the future ecosystem will allow stablecoins, tokenized deposits, deposit tokens, and central bank digital currencies (CBDCs) to coexist and thrive together. Different forms of currency will find their own "product-market fit" due to differences in trust, interoperability, and regulatory clarity.

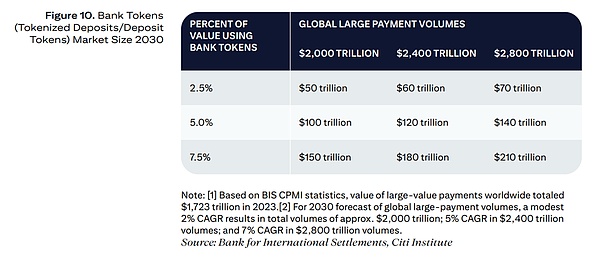

Bank tokens (tokenized deposits, deposit tokens, and similar tools) combine the "trust" of bank currency, familiarity, and regulatory protection, making them favored by many enterprises. By 2030, the transaction volume of bank tokens is expected to exceed that of stablecoins, with an estimated transaction volume range of $100–140 trillion.

The finance departments of large enterprises value "programmability": real-time settlement/reconciliation, compliance embedded in transaction processes, and reduced friction points. These needs can be met through both bank tokens and stablecoins.

On-chain currency assets are still primarily denominated in US dollars, creating incremental demand for US Treasury bonds; however, innovative hubs like Hong Kong and the UAE are also active—this is not just a "dollar story."

Our predictions for annual transaction volumes of stablecoins (baseline scenario of $100 trillion) and bank tokens (over $100 trillion) may seem large to outsiders, but relative to existing capital flows, they are still "small potatoes": Citigroup's payment business processes $5 trillion in transactions daily across more than 90 countries and regions, including 11 million daily instant transactions.

I. The Future of Currency

The momentum of stablecoins and on-chain currencies is no longer just a story of "unregulated finance" or "innovation showcases." In April of this year, Citigroup's GPS report on "Digital Dollars" suggested that stablecoins would make 2025 the "ChatGPT moment" for the large-scale adoption of blockchain by institutions.

1.1 Why Now?

In the United States, the recently passed "GENIUS Act" is a catalyst. On the day the Senate voted to pass the bill, Treasury Secretary Yellen tweeted in support, calling it "pro-innovation, pro-dollar, pro-consumer." The $3.7 trillion market forecast he cited is precisely the bullish scenario figure from our April 2025 Citigroup GPS "Digital Dollar" report.

"Recent reports predict that by the end of this decade, the stablecoin market could reach $3.7 trillion. The passage of the 'GENIUS Act' makes this scenario increasingly likely. A thriving stablecoin ecosystem will drive private sector demand for US Treasuries—stablecoins' reserve assets. This new demand is expected to lower government financing costs, help control national debt, and allow millions of new users worldwide to enter the dollar digital asset economy. This is a win-win-win situation for the private sector, the Treasury, and consumers, and it is the fruit of wise, pro-innovation legislation."

— Yellen, U.S. Treasury Secretary

Given the strong momentum over the past six months, we have revised our original forecasts, especially the baseline scenario. Now, we are more optimistic about the growth of stablecoins than we were 6–9 months ago. However, this does not mean we are bearish on other digital or on-chain currency forms. We do not believe there will be a "war" on-chain; rather, we believe multiple digital forms will thrive together.

1.2 No "One-Size-Fits-All" Paradigm

The way people travel can be likened to the flow of funds. In the 1960s, Japan built the Tōkaidō Shinkansen for the 1964 Tokyo Olympics, running parallel to existing railways. Several European countries also built high-speed rail, such as France's TGV, which similarly runs parallel to or overlaps with old tracks. In contrast, the United States focused on cars and planes. If trains are likened to stablecoins, then the TGV represents tokenized deposits.

Just as some countries will start anew, building new high-speed rail parallel to old systems, and others will embed new tracks into existing railways, or even focus solely on developing cars or aviation, the future of finance will unfold in a similar manner.

"Today, much of the crypto infrastructure will eventually fade into the background, just as the hardware/software of the internet era ultimately 'disappeared'… We are still in the 'dial-up' phase, but when blockchain enters the 'broadband era,' the focus will shift entirely. Five years from now, people will no longer discuss which chain, but only the results achieved and activities conducted on-chain."

— Dante Disparte, Chief Strategy Officer and Head of Global Policy and Operations at Circle

A common misconception is that there will ultimately be only 'one' form of digital or blockchain currency that prevails; this is a zero-sum race.

All on-chain currencies share a set of underlying benefits. Just as email is instant, borderless, and available 24/7, blockchain creates a settlement track for funds. Stablecoins or tokenized deposits possess characteristics of being "fast, cheap, always-on, programmable, and easily accessible."

Of course, the details are far more complex. In most domestic scenarios, there are many service providers that can offer real-time payments for consumers and small merchants; once it comes to cross-border transactions, the speed slows down. And communication or transfers based on the internet should not slow down due to borders. Digital-native or crypto-native companies have already outpaced traditional enterprises in implementing stablecoins. However, not all corporate treasury departments are ready for 24/7 operations, nor do all enterprises wish to obtain such flexibility.

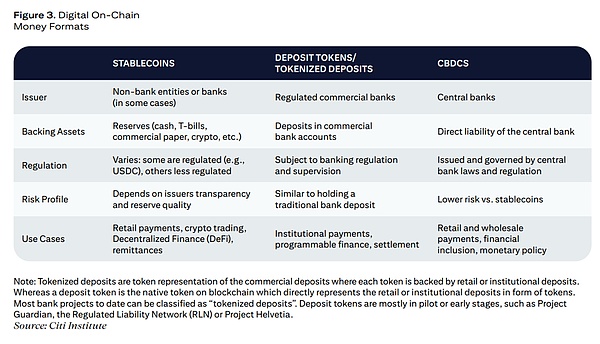

There are many forms of on-chain currency: central bank digital currencies (CBDCs), tokenized deposits, bank-issued stablecoins, deposit tokens… each achieving "always-on, programmable value transfer" in different ways.

Stablecoins are digital assets issued by private institutions, typically backed by high-quality short-term securities or cash-like assets, operating on public or permissionless chains; they are not legal tender, which is a stark difference from CBDCs.

Tokenized deposits are tokenized representations of commercial bank deposits, with each token backed by retail or institutional deposits; deposit tokens are native tokens on the blockchain that directly represent retail or institutional deposits themselves.

To date, most bank projects fall under the category of "tokenized deposits," while deposit tokens are still in pilot or early stages, such as Project Guardian, Regulated Liability Network (RLN), and Project Helvetia.

Multiple forms of on-chain currency will coexist long-term. Which one to use depends on dimensions such as "trust, interoperability, and regulatory clarity."

II. The Underlying Logic of Stablecoin Supply

2.1 Surge in Stablecoin Supply

In recent years, both the supply and trading volume of stablecoins have rapidly increased. As of September 2025, the total supply has risen from about $200 billion at the beginning of last year to $280 billion; the trading volume of stablecoins like USDC has also expanded accordingly.

Stablecoins were initially "invented" by centralized crypto exchanges like Bitfinex to create a "digital dollar" in the absence of formal bank accounts. Tether, as the first "digital dollar," provided a stable unit of account, unlocking liquidity between exchanges and playing a crucial role in bringing the crypto industry into the mainstream. Subsequently, Circle's USDC further spurred exponential growth in native blockchain financial products like Aave and Uniswap.

— Ajit Tripathi, Head of Financial Institutions at Avail

Currently, the trading volume of stablecoins primarily originates from crypto trading and its derivative scenarios. The largest stablecoin, USDT, was born in 2014, launched on Ethereum in 2017 to enable its use in DeFi; in 2019, it expanded to the Tron network, known for its "fast and cheap" transactions and popularity in Asia.

The summer of 2025 is referred to as the "Summer of Stablecoins" in the industry. Stablecoin solutions focused on business, payments, and "real-world" use cases are rapidly gaining traction in the new quarter, and we expect this momentum to further drive issuance and trading volume in 2026 and beyond.

Institutional adoption of stablecoins is still in its infancy; if measured on a scale from 0 to 10, it would be about 0.5. However, we are indeed seeing serious and earnest interest from banks, asset management companies, and other financial institutions in this field.

— Catherine Gu, Head of Visa's Institutional Client Solutions

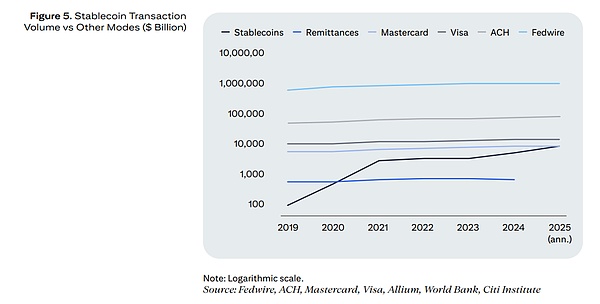

Stablecoin trading volume was once almost negligible, but it has now reached several trillion dollars annually, expanding at an astonishing rate compared to traditional payment systems. According to Visa's adjusted data, the monthly trading volume of stablecoins in August 2025 approached $1 trillion, nearly double the level from a year ago.

Today, stablecoins are no longer just tools for crypto trading; they are seen as infrastructure for "24/7 liquidity" and "real-time fund movement." However, their adoption—especially in the institutional sector—is still in its infancy.

"This year, the issuance of stablecoins has increased by 40%, thanks to executive orders, the 'GENIUS Act,' and major platforms eliminating friction and building confidence."

— David Cunningham, Head of Digital Asset Strategy/Partnerships at Citigroup

On July 31, 2025, SEC Chairman Paul S. Atkins announced "Project Crypto," an initiative for the SEC to modernize U.S. securities regulations to accommodate digital assets. This plan aims to implement the recommendations of the President's Working Group on Financial Markets' "Digital Asset Market Report" and establish a clear classification framework for crypto tokens as "securities, commodities, or others."

One proposal is to establish a "unified licensing system," similar to a super app, allowing companies to offer a full suite of digital financial services (trading, staking, lending, etc.) under a single regulatory umbrella. The SEC has also opened a "regulatory fast track" (innovation exemption) that allows companies to launch new technologies and business models without being constrained by old regulations; this exemption is centered on "principle-based compliance" and aligns with investor protection goals.

Tokenized securities have also become a focus, with SEC staff directed to collaborate with financial institutions that issue stocks, bonds, and funds directly on the blockchain, providing tailored exemptions where appropriate.

"Regulatory changes are unlocking large institutions. The door to bank liabilities moving onto public chains has opened, and tokenized cash will seamlessly connect with the tokenized funds that are already present."

— David Cunningham, Head of Digital Asset Strategy/Partnerships at Citigroup

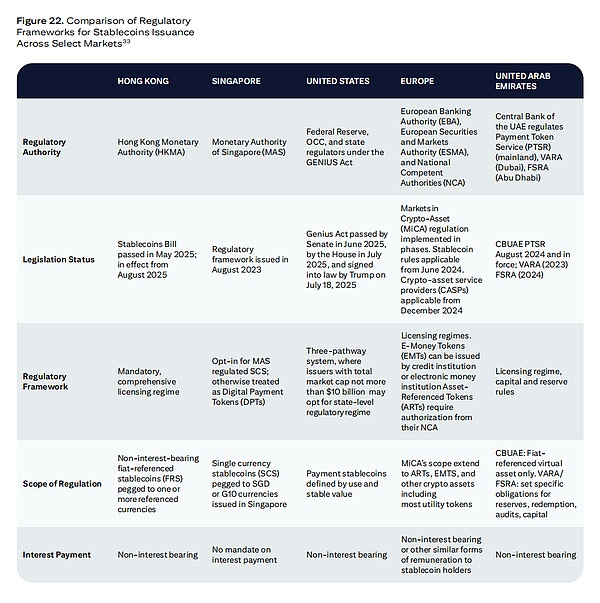

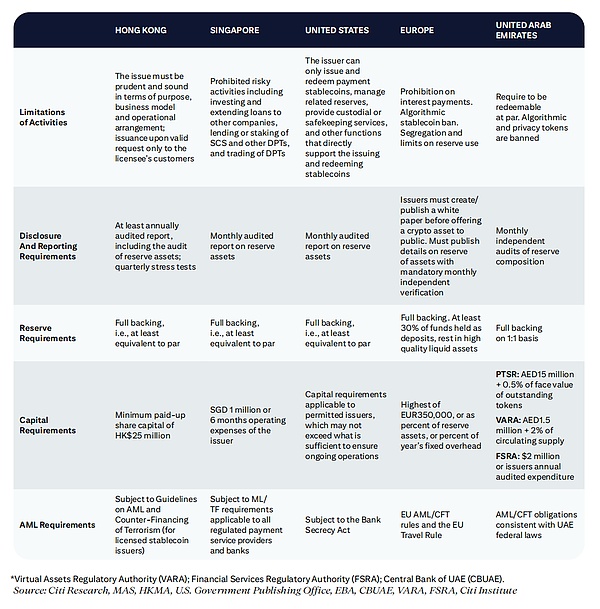

In the EU, the "Markets in Crypto-Assets Regulation" (MiCAR) will take effect in 2024, covering electronic money tokens. Central banks in Asia and the Middle East are also building regulatory sandboxes and stablecoin licensing systems to pave the way for further institutional adoption. For example, Hong Kong launched stablecoin licensing rules in August 2025 to enhance trust, transparency, and regulation.

In addition to regulation as a catalyst, several other factors are driving stablecoins and on-chain currencies into the mainstream:

Integration of Payment Networks: Major card organizations and payment processors are beginning to support settlements in stablecoins. This provides end users and merchants with a familiar on-ramp, allowing them to use stablecoins without overhauling existing systems.

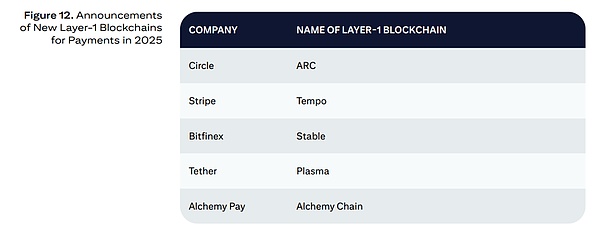

Next-Generation Layer-1 Public Chains: A new batch of public chains designed specifically for financial scenarios is being launched, emphasizing faster final settlements, lower fees, and enterprise-grade compliance features. For end users, there are more stablecoin networks to choose from, increasing competition and innovation while reducing reliance on a few legacy chains.

Bank-Issued Tokens: Banks are gradually launching tokenized deposits, although most currently operate in closed, institution-owned "silos." While interoperability is still lacking, they reflect a strong internal demand for digital currencies within traditional finance and provide enterprises with counterparty and reputational risks lower than public chain stablecoins. Some banks are also piloting deposit tokens and private stablecoins in other formats.

Institutional Market Infrastructure: The core infrastructure for issuing, storing, transferring, and settling digital currencies continues to improve, nearing production-level maturity, including exchange acceptance, custody integration, clearing, and settlement.

Growth of Tokenized Financial Assets: As more financial assets like bonds, stocks, and commodities are tokenized, there is a need for corresponding digital currencies for settlement. Stablecoins provide the necessary liquidity and interoperability, becoming the default settlement layer for the tokenized market.

2.2 Estimating the Stablecoin Market Size

In the April 2025 Citigroup GPS "Digital Dollar" report, we estimated that the stablecoin market could reach $1.6 trillion in the baseline scenario, $3.7 trillion in the bullish scenario, and $0.5 trillion in the bearish scenario by 2030. Since then, market momentum has further accelerated: issuance has expanded by over 20% in the past six months, with an increase of nearly 40% year-to-date. Driven by payment network integration, the launch of new public chains, and clearer regulatory frameworks in key markets, the ecosystem is showing strong momentum.

It is important to note that our more optimistic outlook on the future use of stablecoins does not imply a bearish stance on other forms of digital currency. As mentioned earlier in this chapter, we believe there will not be a "war on-chain," but rather a diverse ecosystem: stablecoins, tokenized deposits, deposit tokens, and central bank digital currencies (CBDCs) will each play their roles, catering to different scenarios and institutional preferences.

Considering the faster adoption by enterprises, financial institutions, and the payment ecosystem, we have raised our baseline scenario for 2030 to $1.9 trillion, the bullish scenario to $4.0 trillion, and the bearish scenario to $0.9 trillion.

The above forecast can be broken down into three main components:

- Reallocation of Short-Term Liquidity (45% of the baseline scenario)

In the $1.9 trillion baseline scenario forecast, nearly half comes from the substitution of U.S. and overseas deposits. We model the assumption that by 2030, 2.5% of deposits in the U.S. banking system will be replaced by stablecoins, driven by digital-native companies (including e-commerce) using them as payment methods and platform tokens. We assume that the growth rate of bank system deposits from 2025 to 2030 will align with nominal GDP, and the 2.5% substitution amount is roughly equivalent to the "half-year increment" of deposits in 2030. The baseline scenario takes 2.5%, while the bullish scenario doubles it to 5%; referencing the average of 5% for money market funds as a share of deposits from 1974 to 1984, which reached 13% a decade later.

Additionally, international deposits and liquidity will partially shift to stablecoins held offshore (in U.S. dollars or pegged currencies like the Hong Kong dollar or dirham). Globally (excluding the U.S. and China), we assume that by 2030, the issuance of stablecoins will be equivalent to 0.75% of deposits in various countries, matching the scale of domestic demand.

Historical reference: The offshore Eurodollar market expanded from $42 billion in 1970 to $925 billion in 1982, at one point rivaling the onshore dollar market. Dollar-denominated stablecoins may replicate this path, ultimately achieving a scale comparable to "offshore tokens" and "onshore tokens."

- Overall Growth of the Crypto Market (40% of the baseline scenario)

The baseline scenario continues the annual growth rate of approximately 20% for crypto-related stablecoins observed over the past three years. In the bullish scenario, driven by clearer regulations and institutional capital allocation to cryptocurrencies, the annual growth rate increases to 30%. The crypto market is highly volatile, and the issuance of related stablecoins fluctuates widely.

- Reallocation of Cash (nearly 15% of the baseline scenario)

The baseline scenario assumes that 10% of U.S. cash held overseas will be replaced by stablecoins. Referencing gold ETFs: with a lower friction investment method, their market share quickly captured 8% of investable gold bars and coins. Stablecoins, leveraging the convenience of digital channels and penetrating emerging/frontier markets, are expected to achieve a similar proportion.

In the U.S. domestic market, we assume that 2.5% of circulating cash will shift to stablecoins, corresponding to a projected 5% decline in the share of cash payments at POS from 2024 to 2030.

Globally (excluding the U.S. and China), we assume that 0.5% of local cash will convert to stablecoins, which is similar to the overall demand proportion of U.S. cash held overseas (8%). We believe that easier access to dollars through stablecoins will increase the demand for dollars and their equivalent assets; in some emerging/frontier economies with weak currencies and high inflation, the perception of dollar stablecoins as a "store of value" is particularly pronounced.

2.3 Measuring the Velocity of Stablecoin Circulation

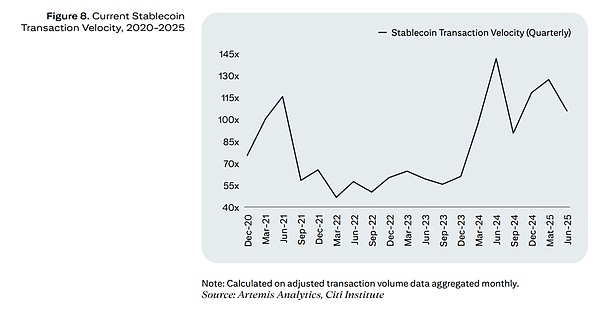

Currently, there is a significant disparity among data providers in estimating the "trading volume" and "transfer volume" of stablecoins: some only account for on-exchange transactions, while others track the total value of on-chain transfers; some further exclude automated rebalancing by smart contracts, internal aggregations, wash/robot trading, resulting in "adjusted" or "organic" trading volumes. On-chain analysis from Artemis Analytics shows that the adjusted trading volume of stablecoins was $7.6 trillion in 2023 and is expected to reach $18.4 trillion in 2024 (a year-on-year increase of +140%).

Historically, stablecoins have primarily been used for activities related to crypto trading. By using the annual average circulation as the denominator and Artemis's adjusted trading volume as the numerator, we can calculate that the circulation velocity in 2023 is approximately 60 times, and in 2024, it is about 113 times.

As enterprises, financial institutions, and asset management companies begin to adopt programmable currencies, stablecoins will be used for financial and commercial payments. It is difficult to precisely calculate where the velocity will land in the future, but the following chart provides a range of scenarios that we consider reasonable.

By 2023, under the baseline scenario (issuance of $1.9 trillion), if we assume a velocity of 50 times, the annual settlement volume of stablecoins could approach $100 trillion by 2030; in the bullish scenario (issuance of $4.0 trillion), it could reach $200 trillion at the same velocity. A velocity of 50 times is roughly equivalent to the recent average rate of traditional payment systems (52 times in 2023 and 54 times in 2024).

2.4 Assessing the Potential of Bank Tokens

Banks have launched blockchain-native deposits (deposit tokens), digital twins (tokenized deposits), and hybrid formats. Due to being in the very early stages, the market size for "bank tokens" can only be roughly estimated and may easily exceed that of stablecoins.

One significant advantage of bank tokens is that, for end users, there is often no need to start from scratch. As a direct digital representation of commercial bank money, they can be more easily integrated into existing treasury, ERP, and payment processes. The largest banks globally currently transfer $5–10 trillion daily through existing large payment systems. If only 1% of this volume migrates to "bank tokens," a single leading bank could achieve an annual volume of $12.5–25 trillion.

Although most bank tokens will likely operate on private or hybrid chains in the foreseeable future, thus lacking the interoperability and accessibility of stablecoins, their adoption will be rooted in corporate treasury and institutional cash flows rather than retail scenarios.

One top-down estimation method is to reference the Bank for International Settlements (BIS) global large payment data: a total of $17 trillion in 2023. If by 2030, 5% of such payments are completed through bank tokens, the corresponding annual transaction volume would fall within the range of $100–140 trillion. Large payments primarily refer to high-value wholesale payments processed through real-time gross settlement (RTGS) systems or hybrid systems, such as the Fedwire in the U.S. or CHAPS in the U.K.

2.5 Why Do We Need On-Chain Currency?

Payment and financial infrastructure continue to improve. A common narrative we see in many VC pitch decks and blogs regarding "on-chain currency and finance" is that traditional rails are slow (3–5 days), expensive (6% fees), opaque, and limited by "banking hours."

This type of "crypto/VC" criticism of traditional finance has its merits, but it overlooks many important details. Especially outside the U.S., many countries, whether wealthy or poor, have already established domestic real-time payment systems. Cross-border payments are indeed slower than domestic ones, but even in this area, settlement times have rapidly improved.

For large companies, existing scale and relationships have already brought favorable pricing—lower fees, narrower forex spreads, and sometimes even faster settlements. In such cases, stablecoins may not provide significant direct cost savings compared to existing arrangements.

As stablecoin issuance faces bank-like regulation, compliance, reporting, and reserve management obligations will increase, potentially aligning their cost structure and speed more closely with traditional banks; if reserve yields decline over time, issuers may be forced to raise platform fees, especially for high-volume activities, with some isolated cases already emerging.

High TPS demonstrates the ability of stablecoins to circulate rapidly, but it must be recognized that the "slowness" of traditional payment rails is not solely due to insufficient throughput; delays often stem from multi-layer compliance, checks, and settlement processes.

— Nick Ducoff, Head of Institutional Growth at the Solana Foundation

In the long run, the competitive advantage of stablecoins and on-chain currencies may rely less on narrow "transaction cost" advantages and more on programmability and real-time integration capabilities. Even in the short term, once the friction of converting on-chain/off-chain fiat is accounted for, the cost and speed advantages of stablecoins may diminish significantly.

Of course, the above perspective comes from a well-functioning monetary center. If you are a merchant or consumer in a frontier market, cross-border fund transfers may be slower and more expensive than those of counterparts in mature, liberalized financial centers. Small merchants or individual operators often struggle to receive payments on time, even domestic payments can be slow to settle. It is no wonder that businesses in Africa, Latin America, and Southeast Asia are increasingly trying to use stablecoins to pay suppliers, payroll, and for cross-border settlements.

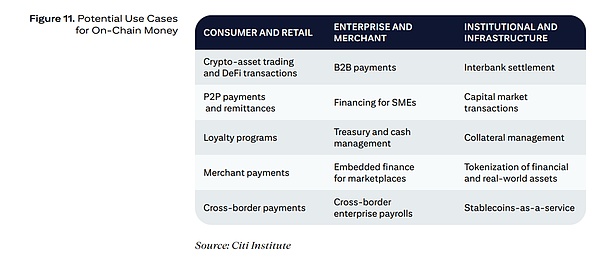

The following chart outlines the potential use cases for stablecoins and on-chain digital currencies.

Stablecoins have several key use cases in consumer and business payments. Although adoption is just beginning to accelerate, I am particularly excited about their potential as settlement currencies for capital market transactions.

— Matthew Blumenfeld, Global Head of Digital Assets at PwC

Collateral management is a killer application for stablecoins—enabling real-time, programmable settlement across asset classes. By releasing capital efficiency and freeing up balance sheets, it can create powerful ripple effects: providing more credit to businesses, injecting more liquidity into markets, and building a more resilient financial system.

— Caroline Pham, Acting Chair of the U.S. Commodity Futures Trading Commission (CFTC)

Among the many emerging use cases for stablecoins, cross-border B2B payments for small and medium-sized enterprises (SMEs) are the most compelling. For a long time, these businesses have not received adequate service when transferring funds across borders, especially SMEs in emerging markets. Stablecoins are expected to provide a smoother and more transparent mechanism for such payments. With models like the "stablecoin sandwich," the complexities of minting, transferring, and redeeming can be hidden behind familiar card or wallet interfaces, enhancing usability for end users.

Although the cost advantages of stablecoins vary by context, their value lies in reducing reconciliation burdens, minimizing intermediaries, and offering programmability. For traditional payment corridors that remain slow and fragmented, stablecoins can provide a streamlined experience that better matches digital-native processes.

— Ricardo Correia, Partner at Bain & Company

III. Impact on Enterprises

Until recently, stablecoins were still a niche product primarily used for crypto trading. However, they are now gaining a credible status—not merely speculative assets, but as infrastructure playing a key role in 24/7 capital movement and real-time liquidity.

3.1 Impact on Enterprises: Everything in Real-Time

Stablecoins provide a new way for global capital movement, with faster speeds, greater transparency, and stronger control. For CFOs and treasury managers facing cross-border liquidity and payment challenges, on-chain digital currencies offer practical solutions to the longstanding issue of "liquidity lag."

The biggest impact is the "real-time everything": cash is no longer idle in "cut-off windows" or multi-day settlement cycles. Companies can continuously allocate liquidity across subsidiaries, markets, and time zones, allowing treasury teams to optimize working capital on a rolling basis rather than at day-end, thereby compressing financial cycles—accounts receivable, accounts payable, payroll, and trade settlements can all be completed in real-time.

For large multinational corporations, the value lies in simplifying global liquidity management and embedding programmability into complex treasury operations. Stablecoins and other on-chain currencies allow funds to move instantaneously between subsidiaries, bypassing cut-off points, reducing reliance on correspondent banking networks, and enabling more efficient supply chain financing and just-in-time working capital, seamlessly integrating with ERP systems.

Despite the numerous advantages of stablecoins, the incremental benefits in speed and cost for large companies may be far less than what external observers envision: they already enjoy favorable banking terms, low fees, and have established liquidity pools and credit lines globally; at the same time, they are highly concerned about regulatory, reputational, and audit risks, making them more likely to prefer "bank tokens" over public-chain-based stablecoins.

For small and medium-sized enterprises, the impact of stablecoins and on-chain currencies may be more transformative. These businesses often face higher costs, slower settlement cycles, and difficulty accessing international banking services. On-chain currencies help level the playing field, providing near-instant, low-cost payments, improving cash flow management, and reducing reliance on intermediaries.

3.2 Will Enterprises Become Stablecoin Issuers?

The appeal of stablecoins is increasing for digital-native companies and large merchants, providing them with the opportunity to embed payments more deeply into their platforms and ecosystems.

The bigger question is about the future of large tech companies and financial services—how will the landscape evolve if commercial enterprises begin to venture into finance?

— Caroline Pham, Acting Chair of the U.S. Commodity Futures Trading Commission (CFTC)

PayPal launched its own stablecoin, PayPal USD, in 2023. Global players like Walmart and Amazon are also exploring the issuance of proprietary stablecoins, potentially shifting a significant volume of transactions from cash and credit card rails to their own digital payment infrastructure. Potential driving factors include:

Operational Simplification: Smoother cross-border transactions, reducing reliance on complex correspondent banking relationships.

Market Access: Reaching underserved markets with weak traditional banking infrastructure.

Cost Reduction: Lowering transaction fees, especially for high-volume cross-border payments.

Control and Flexibility: Greater control over funds, customer data, and payment experiences, enabling the launch of innovative financial services within the corporate ecosystem.

Loyalty and Engagement: Deep integration with loyalty programs, rewards, and targeted discounts to enhance customer stickiness.

New Revenue Streams: Opportunities for reserve yield income and monetization of value-added services.

3.3 E-commerce Giants Prepare for the Issuance of Hong Kong Dollar Stablecoins

Hong Kong passed stablecoin legislation on May 21, 2025, which will officially take effect on August 1. The Hong Kong Monetary Authority (HKMA) has begun public consultations on a more detailed regulatory framework for stablecoins. Three early participants have been trialing in the HKMA's regulatory sandbox for about a year.

Potential use cases, in addition to digital asset-related businesses, also cover retail and B2B payments, cross-border goods trade settlements, and more. E-commerce giants like JD.com are actively researching the issuance of their own Hong Kong dollar stablecoins as part of their broader digital payment and ecosystem strategy. Self-issued stablecoins can enable seamless, low-cost transactions within their online marketplaces and enhance user stickiness.

Market participants are also eagerly anticipating the launch of renminbi/offshore renminbi stablecoins. If realized, this would become another infrastructure for the internationalization of the renminbi. Some policy observers remain cautious about the emergence of renminbi stablecoins in the short term. Licensing timeline: Citigroup's research team expects that with the passage of Hong Kong's stablecoin bill in May 2025, the first batch of sandbox participants will be granted formal licenses to issue fiat-backed stablecoins in the first quarter of 2026.

IV. Impact on the Crypto Ecosystem

4.1 The Race to Build a New Generation of Layer-1 Public Chains

In recent months, a large number of new players have entered the Layer-1 public chain space: fintech companies like Circle and Stripe, exchange-related projects such as Bitfinex and Tether, and payment specialists like Alchemy Pay have all joined the fray.

Existing Layer-1 chains still fall short in terms of true settlement finality—most rely on the economic finality of staked asset values or are in a probabilistic finality stage, meaning there is always a slight chance that transactions can be rolled back. The lack of definitive finality is a concern for institutional finance.

— Gordon Liao, Chief Economist and Research Director at Circle

The purpose of the new public chain boom is not simply to add another chain, but to seize the high ground of the next generation of payment infrastructure: achieving institutional-level settlement finality while creating a foundation for global, uninterrupted capital flow.

If we can integrate TradeFi tokenization with stablecoins on the same settlement layer, the opportunities will be immense. We will enhance the velocity of money circulation—making every business and consumer, no matter where they are, more economically active.

— Simon Taylor, Head of Go-To-Market at Tempo

Building a Layer-1 chain can also bring strategic benefits beyond technology and finance:

Network Control: Set fee models, block speeds, and governance rules independently, without relying on others' networks.

Scenario-Specific Optimization: Customize for specific needs such as payments, compliance, or high-frequency micropayments, rather than using a generic chain.

Capture Ecosystem Value: Host wallets, merchants, dApps, and developers, thus gaining a voice in the entire value chain and application growth.

Deeper User and Data Insights: Own on-chain transaction data, enabling advanced analytics and monetization.

Strategic Independence and Resilience: Reduce reliance on external public chains, ensuring flexibility, competitive advantage, and global scalability.

However, building a sustainable Layer-1 also faces challenges: attracting enough users, developers, and liquidity; achieving multi-network interoperability; and preventing security vulnerabilities while maintaining performance.

4.2 The Stablecoin Ecosystem and Upcoming Fragmentation

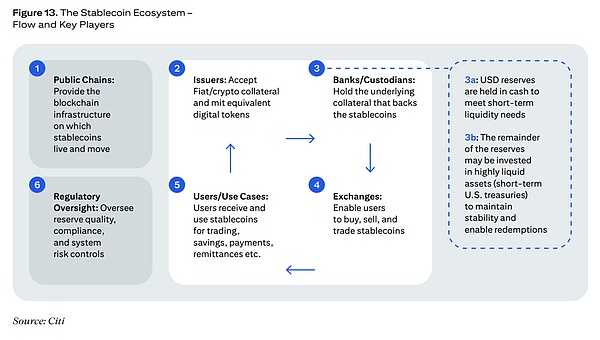

The stablecoin ecosystem spans multiple roles, including public blockchains, issuers, custodians, exchanges, end users, and regulators, with each party playing different functions in issuance, circulation, and supervision.

Stablecoins share certain similarities with the credit card industry—high network effects and strong positive feedback. The current stablecoin issuance market is essentially a "dual oligopoly," similar to today's card organizations. However, its underlying infrastructure is scattered across multiple blockchains, institutional custodians, and regulatory jurisdictions.

We believe that as regulatory clarity improves, this ecosystem is on the brink of significant change, creating opportunities for new entrants. While the global or offshore market may still have a dual oligopoly in issuance, new players will undoubtedly emerge in regional clusters and currency corridors.

Interoperability requires a "trinity" of technology, regulation, and common standards: technology provides a clearing/acceptance layer connecting multiple issuers and venues; regulation provides a trust framework… The key is to create a unified redemption network and a consistent rulebook to avoid fragmentation that exacerbates systemic friction.

— Nicole Sandler, Chief Ecosystem Officer and Head of Corporate and Regulatory Affairs at Ubyx

Large stablecoins (such as USDT and USDC) are typically issued simultaneously on multiple public chains (Ethereum, Tron, Solana, etc.). This "multi-chain coexistence" makes the underlying chains themselves battlegrounds for transaction volume, liquidity supply, and developer competition. Network competition will determine where and how stablecoins are used, thereby affecting liquidity patterns, adoption speed, and interoperability.

For end users, healthy competition between issuers and underlying chains is expected to bring innovative dividends in speed, cost, and programmability. However, stablecoins (like payment networks) rely on scale and liquidity; extreme fragmentation could lead to a loss of homogeneity and liquidity, hindering widespread adoption. This may spur more interoperability solutions and cross-chain bridges, but it also raises the risk of hacking and capital loss.

V. Impact on the Banking Industry

5.1 The Banking Industry in the Era of Stablecoins

The rise of on-chain currencies (especially stablecoins) does not mean the end of traditional banks. Innovation does not always equal replacement—more often, it means integration.

In the early 2000s, platforms like PayPal emerged with "faster, more digital" payments, raising concerns that "traditional financial institutions would be left behind," but the industry ultimately adapted: banks upgraded products and modernized infrastructure to provide the compliance, settlement, and liquidity layers needed for these platforms to expand. Today, many of those "disruptors" have become clients and partners of the banking system.

A similar script is playing out in the stablecoin space: new rails are being laid, but banks remain the cornerstone of "trusted, regulated" capital flows. Banks have unique advantages: regulatory trust, deep customer relationships, and access to deposit-backed collateral. However, to remain competitive, banks must modernize traditional structural models and lead in the tokenized currency market and settlement innovations.

Earlier this year, in Citigroup's GPS report on "Digital Dollars," we pointed out that banks can seize the following new opportunities within the stablecoin ecosystem:

Directly act as stablecoin issuers

Provide custody and reserve management services

Offer treasury brokerage and foreign exchange services

Provide liquidity and cash management services

Embed stablecoins into merchant payments and treasury management

We have seen large stablecoin issuers rely on regulated banks to safeguard reserves, provide foreign exchange and cash management, and serve as fiat entry and exit channels. As stablecoin adoption expands, these connections will only deepen. While technology is powerful, trusted integration remains key—this is the unique value of financial institutions: ensuring that "digital dollars" circulate with the same confidence, oversight, and regulatory protection as any traditional payment rail.

As enterprises plan for the financial future, one thing is clear: stablecoins have taken root. They are not a passing trend but a new set of digital rails—faster, more flexible, and compatible with traditional banking services. Just as the evolution from paper to electronic, from batch to real-time occurred, the role of banks has not been eliminated but has evolved once again.

5.2 The Threat of Deposit Disintermediation

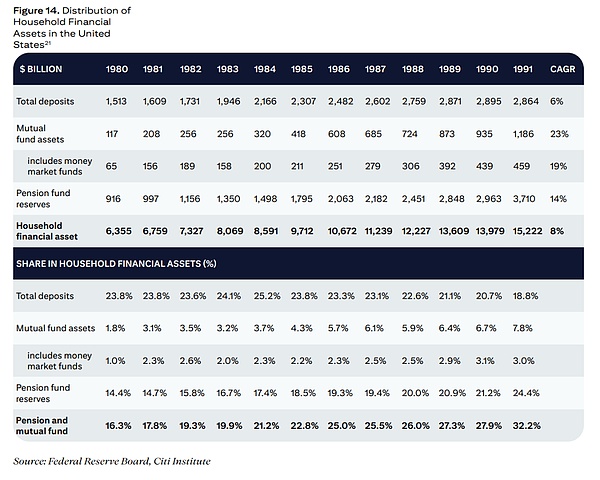

The rise of stablecoins and other on-chain currencies has sparked market concerns about the "disintermediation" of traditional bank deposits, reminiscent of the impact of money market funds (MMFs) in the 1980s. The following chart shows that the proportion of bank deposits in U.S. household financial assets fell from 23.8% in 1980 to 18.8% in 1991; during the same period, the share of mutual funds (including money market funds) rose from 1.8% to 7.8%.

In terms of growth rates, the compound annual growth rate (CAGR) of bank deposits from 1980 to 1991 was 6%, lower than the 8% growth of total household financial assets and GDP during the same period. In contrast, the CAGR of money market funds (MMFs) during the same period was as high as 19%, despite the base effect. If the growth rate of bank deposits could match that of overall financial assets, it could theoretically add about $760 billion to the banking system's deposit base.

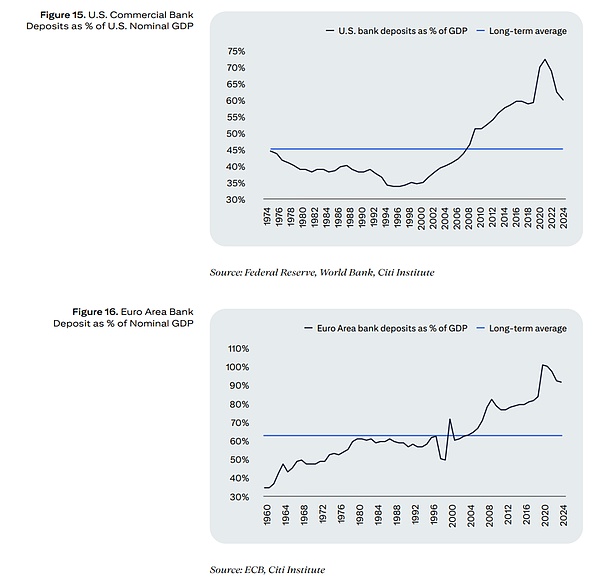

Longer-term data shows that in 1974, U.S. commercial bank deposits accounted for 45% of GDP, but this fell by 11 percentage points to 34% by 1994-1995 due to the rise of money market funds; this ratio rebounded to 70% in the 2020s due to multiple rounds of quantitative easing. Between 1970 and 2025, the deposit-to-GDP ratio in the EU and the UK fluctuated between 50% and 90%.

5.3 Narrow Banking 2.0

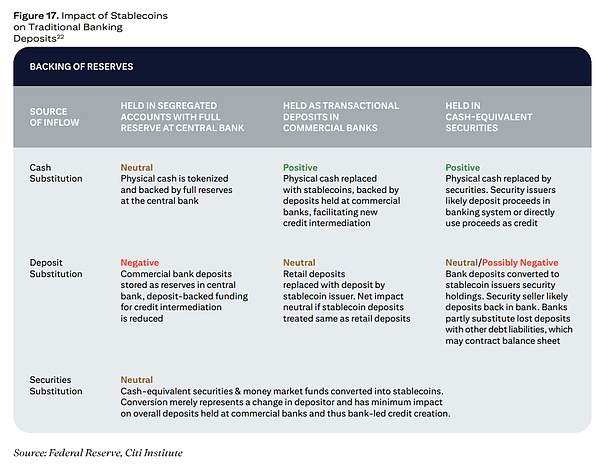

The rise of stablecoins backed by reserve assets brings the risk of deposit "disintermediation": cash, deposits, or securities may flow from the traditional banking system into stablecoin structures. The systemic impact depends on where the reserve assets are ultimately held.

At a macro level, stablecoins may evolve into "narrow banks"—concentrating funds in highly liquid, low-risk assets, thereby weakening banks' ability to extend credit. At least in the transitional phase, this could limit loan issuance and hinder economic growth, making the location and method of holding reserve assets crucial.

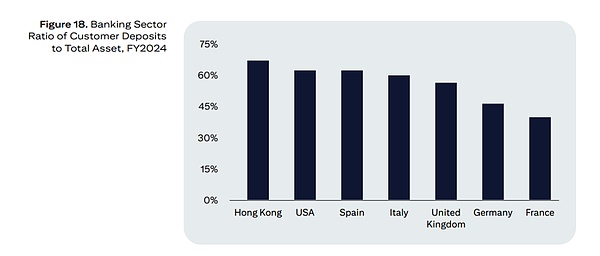

Globally, small savings banks and community banks tend to rely more on public deposits, thus facing a higher risk of deposit "disintermediation" compared to large banks.

VI. Impact on the US Dollar

6.1 Stablecoins May Extend Dollar Hegemony

Given the demand for the dollar in wholesale and financial transactions—especially in jurisdictions with significant currency volatility—stablecoins are expected to play the role of "Eurodollars 2.0." Therefore, we anticipate that the world of stablecoins will still be dominated by the dollar in the coming years. Our baseline scenario for stablecoin supply by 2030 assumes that about 90% will be dollar-denominated, which, while lower than today's nearly 100%, still represents an absolute majority.

Dollar-backed stablecoins represent the next wave of innovation in the payments space, and policymakers should encourage their adoption to solidify the dollar's dominance in the digital age.

— "White House Digital Asset Report" (July 2025)

The rise of dollar-based stablecoins may continue the dollar's hegemony, as individuals seek to use them to hedge against the erosion of purchasing power in unstable and high-inflation economies; this also helps reinforce the dollar's dominant position on the global stage and creates net new demand for dollar-denominated risk-free assets both domestically and internationally.

Stablecoin issuers must purchase US Treasury securities or equivalent low-risk assets for every stablecoin issued to ensure the safety of the underlying collateral. In our baseline issuance scenario, it is expected that over $1 trillion in US Treasury purchases will be added by 2030. At that time, the amount of US Treasuries held by stablecoin issuers may exceed that of any single jurisdiction today. For reference, the current US short-term Treasury market is about $6 trillion, while the overall US Treasury market is approximately $29 trillion.

However, the comprehensive expansion of dollar dominance may have adverse effects on weak and volatile emerging and developing economies:

Currency Substitution and Loss of Monetary Policy Sovereignty: The substitution of local currencies with dollar stablecoins will reduce demand for local currencies, deepening reliance on the dollar. As demand for local currencies shrinks, central banks may lose effective control over interest rates, inflation targets, and other monetary policy tools; the convenience and dominance of dollar stablecoins may also undermine the advancement of local central bank digital currencies (CBDCs).

Volatility of Capital Flows: During crises, stablecoins can quickly flow out, potentially undermining exchange rate peg systems and causing shocks in foreign exchange and financing markets. Widely used stablecoins will run parallel to traditional currencies, creating a parallel financial system that leads to market fragmentation and financial instability. Emerging/developing markets with insufficient foreign exchange liquidity will face higher exchange rate volatility, as stablecoins provide a convenient exit route to dollars.

Inflation Management and Exchange Rate Pressure: As the influence of dollar stablecoins rises, local prices in emerging and developing economies will become more sensitive to US monetary policy, weakening central banks' ability to manage domestic inflation. Defending local currencies against rising demand for dollar stablecoins may deplete foreign exchange reserves and increase macroeconomic vulnerability.

6.2 Beyond the US—The Global Stablecoin Craze

On-chain currencies are reshaping global finance. Although the stablecoin market today is still overwhelmingly dominated by dollar-denominated assets, other jurisdictions are accelerating the launch of local solutions.

Hong Kong will implement a stablecoin licensing system in August 2025, with the first licenses expected to be issued in early 2026.

The UAE is preparing a dirham-pegged stablecoin supported by major institutions in Abu Dhabi.

China is also exploring the launch of a renminbi-backed stablecoin, although some observers remain cautious about its short-term rollout.

The UK's Financial Conduct Authority (FCA) announced a proposal for the issuance of a pound stablecoin in May 2025.

Japan has already issued licenses for fully collateralized yen stablecoins.

In Europe, the European Central Bank (ECB) continues to advance its digital euro (CBDC) project, indicating a regional preference for public sector CBDCs over private stablecoins.

The logic behind this global layout is clear: policymakers and financial institutions view local stablecoins as an important means to maintain monetary sovereignty, reduce reliance on the dollar, and ensure that digital innovation benefits rather than bypasses the local banking system; it is also a defensive measure to prevent falling behind in the global financial innovation and digital asset race.

Despite the acceleration of diversification, the dollar is expected to maintain its dominant position in stablecoin pricing for the foreseeable future. Global trade, finance, and commodity settlements still primarily use the dollar, and issuers have the strongest demand for dollar-denominated instruments. Local currency stablecoins and CBDCs will expand in scenarios focused on domestic payments and financial inclusion, but the allure of the dollar is sufficient for dollar stablecoins to continue serving as market anchors.

VII. Challenges to Widespread Adoption

7.1 Challenges to Overcome for Broader Adoption

Institutional-level large-scale applications still need to address the following challenges: the robustness, security, and rigorous stress testing of underlying technologies are essential.

- Fragmentation and Interoperability: The on-chain currency ecosystem is becoming increasingly fragmented, and seamless interaction between different formats and networks is crucial for widespread adoption. Liquidity providers, exchange pools, and P2P markets will play key roles in interoperability; use cases also need to go beyond simple cross-border transfers to build a resilient and scalable liquidity ecosystem.

Only when stablecoins can seamlessly interoperate with existing financial tools and systems can they enter the mainstream; otherwise, they are like loyalty points—useful in isolation but never truly universal.

— Biswarup Chatterjee, Global Partner and Innovation Head at Citigroup

- Privacy and Anonymity: For public chains, how to balance transaction transparency with privacy protection remains a key concern for institutions. Various privacy protection solutions are being tested for different scenarios.

As institutional adoption increases, the transparency and auditability of stablecoin reserves will come under greater scrutiny. Reserve backing proofs can be issued in real-time on-chain, with visibility far exceeding that of traditional balance sheets.

— Ash Morgan, Head of RWA and Stablecoins at the Ethereum Foundation

- Scalability, Liquidity, and Trust: For large transactions in capital markets, the scalability and liquidity of existing stablecoins may still be insufficient, making enterprises cautious about settling large amounts in stablecoins. Additionally, trust in privately issued non-bank entities is also a concern, leading many enterprises to prefer banks and regulated financial intermediaries for high-value settlements.

Innovation must coexist with security as a priority; this is not a trade-off but a coexistence.

— Caroline Pham, Acting Chair of the CFTC

Accounting Treatment: If stablecoins can be recognized as "cash equivalents" under accounting standards (IAS 7), it would be a breakthrough catalyst; otherwise, they would be classified as financial instruments under IAS 32, reducing their appeal to treasury departments. The SEC has updated its staff guidance, indicating that stablecoins can be classified as cash equivalents if they meet the "guaranteed redemption mechanism" requirement; however, in practice, redemptions are often only available to verified financial accounts, meeting minimum amounts and located in approved jurisdictions, not accessible to everyone.

System Integration and Organizational Inertia: Transitioning from batch processing to real-time operations requires significant adjustments to treasury processes, liquidity management, and netting arrangements; integration with existing accounting and ERP systems also presents operational hurdles.

Geopolitical Considerations: The advancement of stablecoins and CBDCs has geopolitical implications, particularly concerning the role of the dollar in global trade finance. Strategic divergence among countries may lead to fragmentation in the global payment landscape.

7.2 Addressing Privacy and Anonymity Issues

Privacy has become one of the core concerns in the evolution of stablecoins and public chains. While transparency is a significant advantage of these systems, it also presents fundamental challenges for individuals and businesses. Most public chains only possess "pseudonymous" characteristics (i.e., hiding real identities with alphanumeric addresses), but transaction details (amounts, times, counterpart addresses) remain publicly visible.

For businesses, the visibility of on-chain transactions may expose sensitive data such as pricing, vendor terms, and salaries, which not only undermines competitiveness but may also violate confidentiality obligations. Regulators are increasingly focused on privacy, ensuring that customers' personally identifiable information (PII) is not inadvertently disclosed. Even at the user level, trust in the financial system often relies on the assurance that "balances and activities are not subject to public scrutiny."

These limitations have prompted individuals and businesses to turn to private chains, especially in financial transactions. Private chains can provide greater control over data disclosure but typically at the cost of openness and interoperability.

"Privacy remains one of the biggest barriers to institutional adoption of public chains, but powerful solutions are emerging—zero-knowledge proofs (ZKP), trusted execution environments, fully homomorphic encryption, and privacy-focused Layer 2 solutions. These technologies can shield sensitive data while allowing financial institutions to meet compliance requirements."

— David Walsh, Head of Enterprise Business at the Ethereum Foundation

A growing ecosystem of solutions is emerging to address these challenges while retaining the advantages of public chains. Zero-knowledge proofs (ZKP) are one of the most prominent technologies. Shielded pools using protocols like ZCash can also facilitate transactions within encrypted funds, making wallet addresses, amounts, and transaction histories untraceable. Other methods include hybrid and permissioned layers that allow for selective disclosure of private data during audits or compliance while keeping it hidden from the public.

A promising path for protecting privacy on public chains is zero-knowledge proofs (ZKP): they can verify transactions without revealing underlying data. For enterprise use cases, ZKP can create a privacy-protecting verification layer between counterparties while maintaining the integrity of the consensus mechanism. By embedding privacy directly into the protocol's virtual machine rather than patching it afterward, organizations can achieve "foundational" rather than "patchwork" solutions. Consensus rules can verify transactions while keeping details encrypted.

However, this technology still needs to mature significantly before large-scale deployment. Current solutions must undergo rigorous stress testing to meet enterprise-level reliability, scalability, and regulatory expectations. Privacy frameworks must be verifiable, allowing regulators to confirm specific transactions without compromising user confidentiality. Additionally, to integrate into a broader financial ecosystem, interoperability and compliance capabilities must be built in from the outset.

Currently, several financial institutions are participating in pilot programs, and public chains with built-in privacy features are gradually approaching the prospects for large-scale enterprise adoption—potentially achievable within the next two to three years.

— Biser Dimitrov, Citigroup Digital Assets Technology Department

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。