Original Title: "In-Depth Analysis: PerpDEX Shuffle Moment, How Can Hyperliquid Play?"

Original Author: Biteye

Global Perpetual DEX Market Overview and Industry Transformation

The decentralized perpetual trading market is experiencing an unprecedented wave of growth and a reshaping of the competitive landscape. As of September 2025, the global perp DEX daily trading volume has surpassed $52 billion, a 530% increase since the beginning of the year, with a cumulative monthly trading volume reaching $13 trillion. This growth is driven by breakthroughs in technological innovation, an increase in user demand for decentralized financial products, and regulatory pressure on centralized trading platforms. The entire sector now occupies about 26% of the crypto derivatives market, achieving a qualitative leap from single-digit shares in 2024.

Perp DEX Total Trading Volume Changes https://defillama.com/perps

The rapid market differentiation is reshaping the competitive landscape. Traditional order book models (such as dYdX and Hyperliquid) dominate the professional trading space with precise price discovery and deep liquidity, while AMM models (such as GMX and Gains Network) attract retail users through instant liquidity and simplified operations. Emerging hybrid models (such as Jupiter Perps) attempt to combine the advantages of both, achieving seamless switching between order books and AMMs in high-speed environments through a keeper system. From a data performance perspective, order book models are gaining more market share, with Hyperliquid processing a cumulative trading volume of $2.76 trillion thanks to its CLOB architecture.

The Rise of Aster DEX and Market Impact

The protocol Aster, formed by the merger of APX Finance and Astherus, has achieved a leap from zero to a leading position in just a few weeks through a multi-chain aggregation strategy and support from YZi Labs, especially CZ. On the day of its token launch on September 17, it saw a 1650% increase, a first-day trading volume of $371 million, and an influx of 330,000 new wallet addresses, showcasing its strong market acquisition capability.

Aster's technological innovation is primarily reflected in the improvement of user experience. Its Simple mode offers up to 1001x leverage, far exceeding Hyperliquid's 40-50x, which, while risky, is highly attractive to speculators seeking high returns. The hidden order feature draws on the dark pool concept from traditional finance, effectively protecting large trades from MEV attacks. The yield integration feature allows users to use interest-bearing assets like asBNB as collateral, earning a base yield of 5-7% while trading, pushing the composability of DeFi to its limits.

From a data performance perspective, Aster's TVL surged from $370 million on September 14 to $1.735 billion, an increase of 328%, with the BNB Chain contributing 80% of the funds. Daily trading volume has repeatedly exceeded $20 billion, briefly surpassing Hyperliquid to become the largest perpetual DEX globally, with 24-hour fee revenue of $7.12 million. More importantly, Aster accumulated a cumulative perpetual trading volume of $19.383 billion in just a few months. Although it still lags behind Hyperliquid's $2.76 trillion, the growth rate is astonishing.

In community discussions, traders show a clear preference divide between the two platforms. Professional traders tend to favor Hyperliquid, believing its "one block confirmation" and deep liquidity are essential for professional trading. In contrast, cross-chain users and newcomers prefer Aster, as its multi-chain support without bridging and CEX-like user experience significantly lower the usage threshold.

Hyperliquid: Technologically Advanced but Under Market Share Pressure

As a pioneer in the perpetual DEX space, Hyperliquid has redefined the possibilities of on-chain derivatives trading through its innovative HyperCore architecture. HyperCore achieves a processing capacity of 200,000 orders per second and a latency of 0.2 seconds, surpassing many centralized trading platforms. With a cumulative perpetual trading volume of $2.765 trillion, a current open interest of $133.5 billion, and a 24-hour trading volume of $15.6 billion, these figures fully demonstrate the success of its technical architecture and user trust.

However, Hyperliquid is facing the challenge of a continuous decline in market share. Its share of the perpetual DEX market has dropped from 71% in May 2025 and 80% in August to the current 38%. This change is primarily due to the rapid rise of emerging competitors and the success of multi-chain strategies. Particularly in terms of daily trading volume and fee revenue, Hyperliquid has been surpassed multiple times by Aster DEX, a change that was previously unimaginable.

Perpdex Trading Volume Statistics perpetualpulse.xyz

Despite these challenges, Hyperliquid's advantages remain evident. It boasts the deepest liquidity, with spreads on major assets like BTC/ETH as low as 0.1-0.2 basis points; the most stable technical architecture, providing unparalleled certainty for traders with one block confirmation; and the most mature ecosystem, with over 100 projects building a complete DeFi infrastructure on its platform. More importantly, its deflationary token model uses 99% of protocol revenue for HYPE buybacks and burns, with an annualized revenue scale of $20.1 billion providing strong support for token value.

From the perspective of user quality, Hyperliquid demonstrates higher user value. Among its 825,000 daily active addresses, the monthly active users reach 3.651 million, with an open interest to trading volume ratio (OI/Volume) of 287%, far exceeding the industry average. This metric indicates that Hyperliquid's users are more likely to have genuine risk-hedging needs rather than engaging in short-term speculative trading. In contrast, Aster's ratio is only 12%, and while it has higher daily trading volume, user behavior leans more towards short-term arbitrage.

In response to competitive pressure, Hyperliquid is also actively adjusting its strategy. The upcoming HIP-3 (permissionless perpetual market) will allow anyone to deploy custom perpetual contracts, potentially bringing innovative products like RWA perpetuals and AI computing futures, reigniting ecosystem vitality. The launch of the USDH native stablecoin will further enhance its financial infrastructure, expected to manage $5.5 billion in funds, with 95% of the revenue used for HYPE buybacks, significantly strengthening the token's value support.

In this intense market competition environment, Hyperliquid's true moat lies not just in the technology itself, but in the complete ecosystem built around the core protocol. From an initial pure perpetual trading platform to a comprehensive DeFi ecosystem with over 100 projects, Hyperliquid has formed a self-sustaining financial infrastructure. This ecosystem includes full-stack solutions from infrastructure, DeFi protocols, to application layers, with each component contributing to the overall value accumulation and user stickiness of the network.

Based on this context, this article will delve into the core projects and innovative applications within the Hyperliquid ecosystem, exploring how these projects build sustainable competitive advantages for Hyperliquid in the fierce market competition and how they collectively shape the future of decentralized derivatives trading.

In-Depth Analysis of Hyperliquid Core Ecosystem Projects

1. Kinetiq - The Pillar of Liquidity Staking Ecosystem (TVL: $1.757 billion)

Kinetiq's position in the Hyperliquid ecosystem is unshakeable, with its $1.757 billion TVL accounting for about 78% of the entire ecosystem, becoming the core hub of capital flow within the ecosystem. As the "Jito" of this ecosystem, Kinetiq redefines the validator delegation mechanism through its innovative StakeHub algorithm, achieving unprecedented efficiency and yield optimization.

The core of the StakeHub algorithm lies in the precise design of a multi-dimensional scoring system. This system provides real-time scoring for over 100 active validators, dynamically adjusting capital allocation strategies based on indicators such as reliability (40% weight), security (25% weight), economic performance (15% weight), governance participation (10% weight), and operational history (10% weight). This algorithm not only considers the historical performance of validators but also predicts their future stability, continuously optimizing allocation weights through machine learning models to ensure delegated funds always flow to the highest quality validators.

Kinetiq Node Operation Status https://kinetiq.xyz/validators

The protocol's revenue structure is extremely rich and competitively leading in the market. The base PoS rewards yield approximately 2.3% annualized return, which is already at the upper end among similar LST projects. StakeHub optimization provides an additional 0.2-0.5% enhanced yield by avoiding underperforming validators, and MEV revenue contributes about 1% annualized yield, derived from the MEV capture mechanism of the Hyperliquid network. Even more attractive are the integration rewards with other DeFi protocols, which can provide a variable bonus of 6-8%, allowing total yields to reach 10-12%, making it highly competitive in the current DeFi environment.

In terms of user experience, Kinetiq achieves extreme simplification. Users stake HYPE to receive kHYPE tokens, enjoying a slight premium of 1:0.996, reflecting the market's additional valuation of liquidity staking tokens and confidence in the protocol's security. The unstaking mechanism is designed with a 7-day safety delay and a 0.1% fee, ensuring network security while providing users with a reasonable exit mechanism.

Kinetiq has surged from a TVL of $458 million in July to the current $1.81 billion, tripling in just two months. This growth is primarily attributed to the integration effect of the Pendle protocol, which creates additional liquidity demand and yield strategies for kHYPE through the PT/YT separation mechanism.

Kinetiq TVL Growth https://defillama.com/protocol/tvl/kinetiq

The upcoming $KNTQ governance token provides an important tool for decentralized governance and long-term value creation for the protocol. It is expected that 30-50% of the token supply will be distributed to the community through airdrops, with priority allocation for point holders, early users, and kHYPE stakers. The core functions of $KNTQ include voting on protocol upgrades, decision-making on MEV routing strategies, and planning authority for the HIP-3 market, which will further enhance the protocol's decentralization and community engagement.

Interaction Method: Users can stake HYPE to receive kHYPE through kinetiq.xyz, supporting instant minting and a 7-day unlock period. The protocol also offers a kPoints reward system, distributing points weekly in preparation for the upcoming $KNTQ airdrop, with points earned based on multiple dimensions such as staking amount and holding duration.

2. Based - Mobile Super App and Ecosystem Entry

As the highest-grossing Builder application on Hyperliquid, Based generates approximately $90,300 in revenue every 24 hours, ranking first among all third-party applications. With a cumulative perpetual trading volume exceeding $16.699 billion and a 24-hour perpetual trading volume of $321 million, it accounts for about 7% of Hyperliquid's total trading volume, reflecting the high net worth characteristics and deep engagement of its user base. Its revenue model is based on Hyperliquid's Builder fee-sharing system, earning up to 0.1% from perpetual trades and 1% from spot trades, with most revenue returned to users as rebates through an affiliate marketing program, creating a sustainable incentive structure benefiting users, the platform, and Based. With a 7-day revenue of $2.22 million and a 30-day revenue of $6.71 million, these metrics not only demonstrate the robustness of its business model but also highlight its key role as a revenue contributor within the Hyperliquid ecosystem.

Based Trading Interface https://www.basedapp.io/

The tokenomics design of Based reflects a deep understanding of user behavior and innovative incentive mechanisms. The $PUP token, serving as an XP enhancement tool, completed its airdrop on August 22, 2025, with a total supply of 100 million tokens, of which 5% is allocated to early users and community contributors. The main function of $PUP is to enhance users' XP earning efficiency, providing a multiplier bonus of 25-60%, allowing holders to earn more rewards in trading, consumption, and other activities. $BASED, as the main governance token, will be distributed based on users' total XP, with the snapshot date set for September 20, 2025, where each $1 nominal trading volume in perpetual trades contributes 0.06 XP, and each $1 trading volume in spot trades contributes 0.30 XP (5x incentive), while Visa consumption contributes 4-6 points per $1 spent (converted to XP at TGE).

This dual-token mechanism cleverly combines short-term incentives ($PUP bonuses) and long-term governance ($BASED distribution), with $PUP holders essentially gaining "leverage" for the $BASED airdrop, further reinforcing user loyalty and ecosystem stickiness. In the community, the circulating market value of $PUP is approximately $5 million, with a stable price around $0.05, indicating robust demand as a utility tool, while the expected supply of $BASED is 1 billion tokens, with 40% allocated to the community, anticipated to be fairly distributed to active users through the XP system.

Interaction Method: Users can download the mobile app or access the web terminal via based.markets, register an account using their email, and support one-click deposits of multi-chain assets. The trading interface is designed similarly to traditional financial applications, offering both spot and perpetual trading functions, and users can also apply for a Visa debit card (existing users should note the deactivation schedule in November) for fiat consumption. The XP system displays points progress in real-time, and $PUP holders can activate bonuses in their wallets to enhance reward efficiency.

3. Pendle - Yield Tokenization Protocol Giant

Pendle's successful deployment on HyperEVM marks the mature application of the yield tokenization concept within the Hyperliquid ecosystem, representing a new height in the complexity and innovation of DeFi products. The protocol separates yield-bearing assets like kHYPE into PT (Principal Token) and YT (Yield Token), providing investors with precise tools for fixed income investment and yield speculation. In just a few months, Pendle's TVL on HyperEVM has grown from zero to $12.3 billion, with a 30-day increase of 76.27%.

Pendle TVL Distribution Across Chains https://defillama.com/protocol/tvl/pendle

The synergistic effect between Pendle and Kinetiq is a key factor in its rapid success within the Hyperliquid ecosystem. This synergy is not only reflected in the complementary nature of the products but also in the creation of new value capture mechanisms. By tokenizing kHYPE into PT and YT, Pendle provides liquidity staking users with more diversified yield strategy options while creating new earning pathways for Kinetiq's point system. Users holding YT-kHYPE can receive all the rewards from Kinetiq's point system without bearing the volatility risk of the principal; PT-kHYPE holders enjoy the certainty of fixed income, which can be used to build stable yield strategies.

Pendle's product matrix continues to expand, showcasing its strategic intent for deep integration within the Hyperliquid ecosystem. In addition to the mainstream kHYPE market, the protocol has gradually supported the yield tokenization of endogenous yield assets such as feUSD, hwHLP, and beHYPE. Each new asset added creates new yield strategy combinations and arbitrage opportunities, further enhancing the activity and composability of the entire ecosystem. Especially with the emergence of more LSTs and yield-bearing assets, Pendle provides standardized yield separation tools for these assets, becoming an important bridge connecting different protocols.

Interaction Method: Users can access the protocol via app.pendle.finance, select the Hyperliquid network, and separate their yield-bearing assets like kHYPE into PT/YT or trade these tokenized yield products directly on the secondary market. The protocol provides intuitive yield curves and maturity date information to assist users in making investment decisions.

Pendle Yield Tokens on HyperEVM https://app.pendle.finance/trade/markets?chains=hyperevm

4. HyperLend - Core of Lending Infrastructure

HyperLend serves as the "credit bank" of the Hyperliquid ecosystem, playing a crucial role in the entire DeFi infrastructure by providing core support for liquidity circulation and capital efficiency enhancement within the ecosystem. The protocol adopts a market-validated Aave V3 fork architecture but has been deeply optimized and innovated for Hyperliquid's high-performance environment and unique asset characteristics. Its biggest technical breakthrough is concentrated in the HyperLoop feature, which achieves one-click leverage cycling through flash loans, providing advanced users with unprecedented capital efficiency tools while maintaining operational simplicity.

The architectural design of HyperLend reflects a delicate balance between risk management and capital efficiency. The protocol innovatively employs a dual-pool structure: a unified liquidity pool specifically handles efficient lending of core assets like HYPE, kHYPE, and USDC, significantly reducing trading slippage and improving capital utilization through a shared liquidity mechanism; the isolated risk pool specifically manages more volatile or higher-risk assets, supporting fully customizable risk parameter settings to ensure that risk events of a single asset do not affect the stability of the entire system.

The technical implementation of the HyperLoop feature showcases the ultimate application of DeFi composability and a significant enhancement in user experience. Users operate through a simple and intuitive interface, while the protocol automatically executes complex atomic operation sequences in the backend: first borrowing the target debt asset through the flash loan mechanism, then exchanging it for the yield asset the user wishes to hold via the built-in DEX aggregator, supplying that asset as collateral to the corresponding pool of the protocol, subsequently borrowing more debt assets based on the newly added collateral, and finally repaying the initial flash loan. The entire complex operation sequence is atomically completed within a single block, allowing users to easily achieve 3-5 times leverage without the complexity, time costs, and gas fees associated with multiple manual operations.

HyperLoop One-Click Cycle Loan Interface https://app.hyperlend.finance/hyperloop

From the perspective of asset composition and operational efficiency data, HyperLend demonstrates a healthy and stable development trend with good market adaptability. Its total TVL of $524 million is primarily composed of wstHYPE ($254 million, accounting for 48%) and native HYPE ($206 million, accounting for 39%). This asset distribution clearly reflects the importance of LSTs within the ecosystem and the strong demand for liquidity of the native token. The current total borrowing scale is $267 million, with an overall utilization rate of 48%, which is considered a healthy operational range among DeFi lending protocols, ensuring sufficient liquidity to meet withdrawal demands while optimizing capital utilization for reasonable yield returns.

HyperLend's Protocol Scale https://hyperlend.blockanalitica.com/

HyperLend's revenue model showcases a clear and sustainable ability to create commercial value. The protocol generates an annualized revenue of $15.89 million, with diversified and stable income sources, primarily including lending interest margin income, liquidation fee income, and flash loan fee income. Notably, its flash loan fee is set at 0.04%, significantly lower than Aave's standard rate of 0.09%. This competitive pricing strategy provides users with better cost efficiency while maintaining market competitiveness, helping to attract more high-frequency trading and arbitrage activities. The protocol has also designed a robust point system, which has been running for 22 consecutive weeks, accumulating points in preparation for the upcoming $HPL governance token airdrop, with 3.5% of the token supply reserved for Aave DAO.

Interaction Method: Users can connect their wallets through hyperlend.finance to earn interest on deposits, borrow funds, and utilize the HyperLoop one-click leverage feature. The interface is designed to be simple and intuitive, providing real-time interest rate information and risk indicators to help users make informed lending decisions.

5. Hyperbeat - DeFi Super Application (TVL: $387 million)

Hyperbeat positions itself as a one-stop DeFi center, offering a complete solution that encompasses staking, lending, yield optimization, and other diversified services. The protocol recently completed a $5.2 million seed round of financing, led by Electric Capital, with participation from well-known institutions such as Coinbase Ventures, Chapter One, and DCF God. This financing background reflects institutional investors' recognition of its business model and technical team.

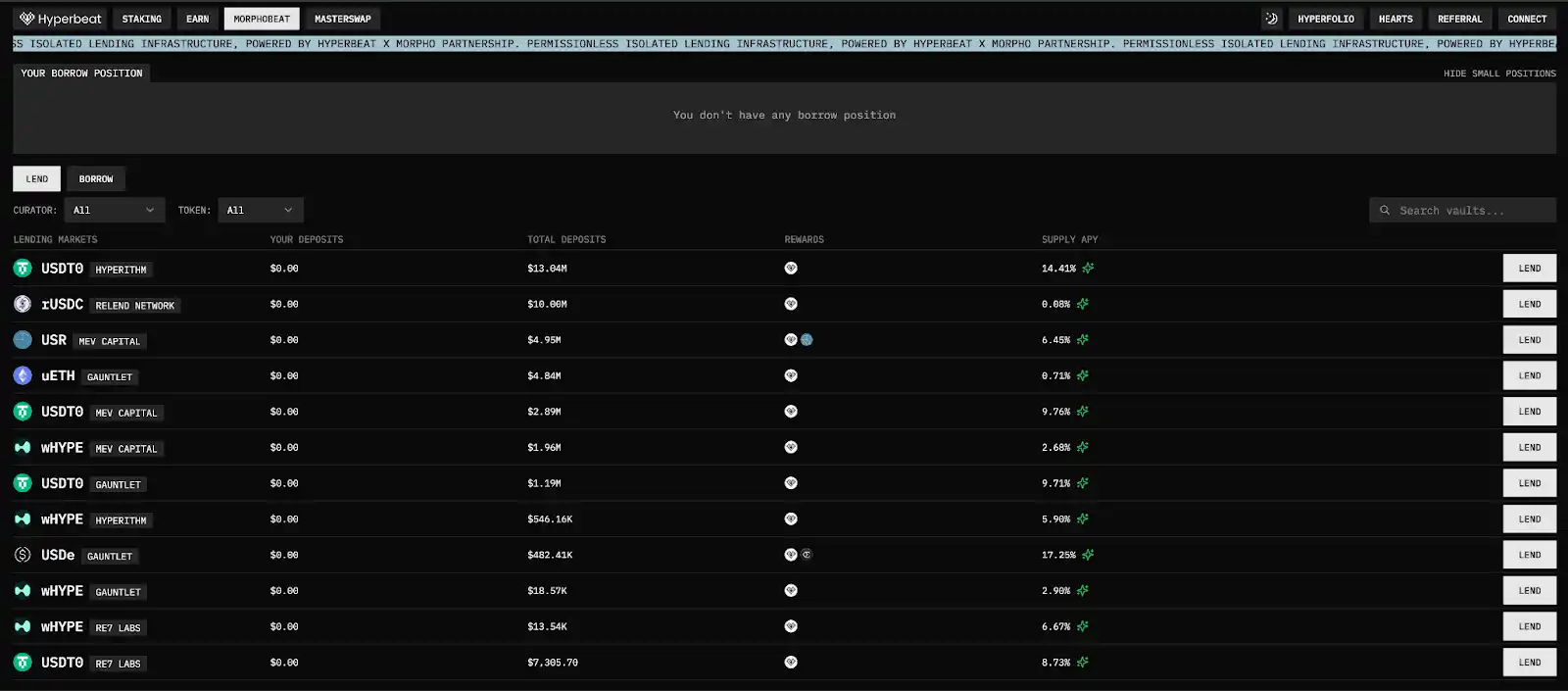

The product matrix design of Hyperbeat embodies a deep integration concept within the ecosystem. The beHYPE liquid staking module provides a reducible security model and supports governance participation; the Morphobeat lending market is optimized based on the Morpho protocol, specifically targeting yield-bearing assets like LSTs; the yield vault achieves automated yield optimization through the Meta-Yield strategy, diversifying risks across multiple protocols. Its cross-chain integration capability allows it to deploy on multiple chains like Arbitrum, currently holding a TVL of $28.92 million on Arbitrum, expanding its user base and asset management scale.

Hyperbeat's technological innovation is primarily reflected in its automated yield optimization strategy. The protocol automatically monitors yield rate changes across various DeFi protocols through smart contracts, dynamically adjusting capital allocation to achieve optimal returns. This "set-and-forget" user experience significantly lowers the technical barrier to participating in DeFi, making it particularly suitable for users who wish to earn DeFi yields without frequent operations. The Meta-Yield strategy also includes risk hedging mechanisms, reducing the risk of a single protocol by diversifying investments across multiple protocols while leveraging arbitrage opportunities to enhance overall returns.

Interaction Method: Users can access the multi-product dashboard via hyperbeat.org to perform one-stop DeFi operations such as staking, lending, and yield farming. The interface design focuses on user experience, providing yield estimates and risk alerts. The Hearts point system is nearing its end, with less than 12% of the remaining distribution, totaling 51 million Hearts points in preparation for the upcoming $BEAT token airdrop. The design of this point system encourages users to remain active across multiple product modules, earning points through staking, lending, and yield farming activities.

6. USDH - Native Stablecoin Infrastructure

USDH, as the upcoming native stablecoin of Hyperliquid, carries the important mission of enhancing the financial infrastructure of the ecosystem. Native Markets won the right to issue USDH in a community vote on September 14, 2025. The launch of USDH will fill the gap in native stablecoins within the Hyperliquid ecosystem, providing a more complete and autonomous financial infrastructure for the entire ecosystem.

The technical architecture of USDH reflects deep consideration for compliance and scalability. This stablecoin will be backed by U.S. Treasury bonds through traditional financial institutions such as Stripe Bridge and BlackRock, ensuring ample asset collateral and regulatory compliance. More importantly, USDH will achieve dual compatibility with HyperEVM ERC-20 and HyperCore HIP-1, allowing the stablecoin to flow seamlessly throughout the Hyperliquid ecosystem, serving as collateral and liquidity in DeFi protocols, as well as margin in perpetual trading, achieving true ecological native integration.

The launch of USDH is expected in Q4 2025, with specific progress depending on the completion of technical development and regulatory applications. As a crucial infrastructure of the ecosystem, the successful launch of USDH will have a profound impact on the entire Hyperliquid ecosystem, enhancing user experience and capital efficiency, and more importantly, strengthening the ecosystem's independence and sustainability. Especially in competition with external stablecoins like USDC, USDH's native advantages and yield-sharing mechanisms will provide it with unique competitiveness.

Ecosystem Data Overview and Development Outlook

The Hyperliquid ecosystem demonstrates strong growth momentum and a healthy development trend. The total TVL has reached $6.535 billion, with $2.37 billion locked in DeFi protocols and $4.165 billion in perpetual trading positions, achieving a perpetual trading volume of $651.6 billion within 30 days. User data shows high-quality characteristics: 308,000 monthly active users, an average position size of $162,000, and a 30-day retention rate of 67%, all of which far exceed those of similar platforms.

The ecosystem's greatest advantage lies in the deep synergy between protocols. The integration of Kinetiq and Pendle, the capital efficiency amplification of HyperLend, the internal circulation of Felix feUSD, and the mobile traffic introduction of Based create a powerful network effect. However, the decline in market share cannot be ignored. Hyperliquid's market share in the perpetual DEX market has dropped from 48.2% in August to 38.1% in September, primarily lost to competitors adopting multi-chain strategies and incentive mechanisms.

The launch of HIP-3 (permissionless perpetual market) will be an important turning point, allowing anyone to deploy custom perpetual contracts, expected to bring innovative products such as RWA perpetuals and AI computing futures. The native stablecoin USDH is expected to manage $5.5 billion in funds, with 95% of the revenue used for HYPE buybacks, generating an annualized revenue of $150-220 million, which will significantly enhance the token's value support.

The value capture mechanism design of the HYPE token is reasonable: 99% of protocol revenue is used for buyback and burn, with the current annualized buyback rate at approximately 8.7%. However, the linear release starting on November 29 will increase the supply by 71%, necessitating strong fundamental performance to offset supply pressure.

The Hyperliquid ecosystem is at a critical development juncture. Its success will depend on the combination of technological innovation and user experience, the balance between ecosystem openness and quality control, and the coordination of technical focus and diverse needs. The launches of HIP-3 and USDH will be important tests of its adaptability.

For investors, the ecosystem offers a rich array of investment opportunities, from stable yield LST protocols to high-risk early projects. The key is to understand the business models and risk factors of each protocol and to formulate reasonable strategies based on individual circumstances. The value of Hyperliquid lies not only in the success of individual protocols but also in the formation of the entire ecosystem's network effect. In this era full of opportunities and challenges, its continuous innovation capability and ability to create value for users will determine its long-term development prospects.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。