Yesterday we talked about the bullish psychological defense line at 110,000. Today, it has already fallen below that price, so currently, the bulls have been pushed to the edge of a cliff. Whether the bulls have any hope depends on whether they can regain the 110,000 level tomorrow.

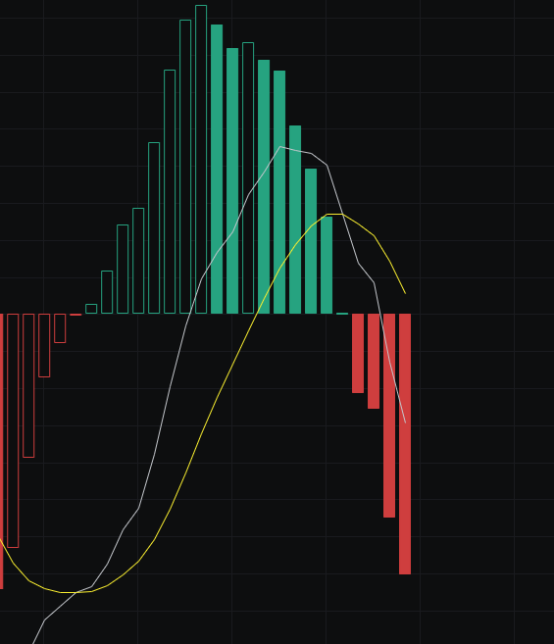

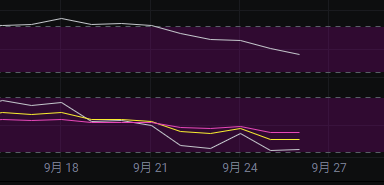

From the MACD perspective, the energy bars continue to decline, and both the fast and slow lines are moving downward, indicating that the bears have not yet fully released their pressure.

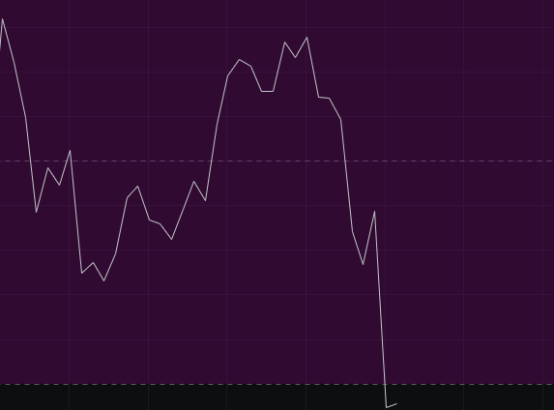

From the CCI perspective, following yesterday's bearish close, it has now fallen below -100, indicating that the market is primarily bearish moving forward.

From the OBV perspective, since there was no bullish close yesterday, the fast line failed to regain its position above the slow line, extinguishing the last hope for the bulls. Fortunately, the slow line is still in a flat phase, so we will see whether it trends upward or downward in the future.

From the KDJ perspective, it has now entered the oversold area. For a price increase, it will need to consolidate for a few days.

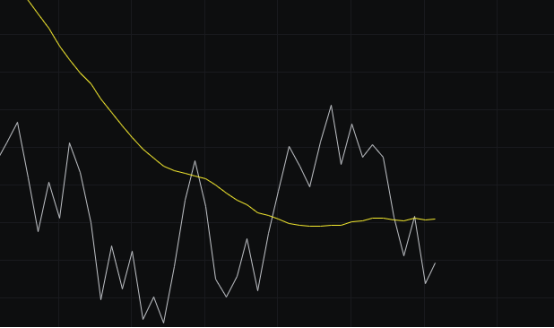

From the MFI and RSI perspectives, both indicators are currently trending downward, showing a downward arrangement. However, today is currently a bullish candle, which may break the downward trend.

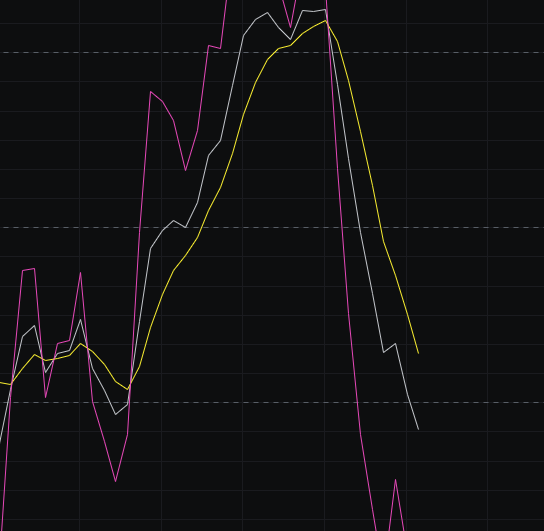

From the moving average perspective, the price has now fallen below 120, and there is no moving average support below. Now we need to watch the trends of the 30 and 120 lines; if both lines move downward, the trend will be bearish; otherwise, the bulls will still have a chance to breathe.

From the Bollinger Bands perspective, yesterday we discussed two potential trends: one is a transition from a wide range to a narrow range, and the other is a transition from a wide range to a downward trend. With yesterday's bearish candle hitting below the lower band, the wide range has directly turned into a downward trend. However, to confirm a downward trend, we need consecutive bearish candles. Therefore, the only opportunity for the bulls is to have at least one bullish candle in the remaining three days of this week.

In summary: Currently, the market is in a bearish phase, and the only indicator friendly to the bulls is the OBV. For the bulls to have any future potential, they need to produce bullish candles in the coming days to disrupt the downward channel of the Bollinger Bands, and then adjust strategies based on the specific market movements.

Thus, the bulls' goal in the coming days is to secure bullish closes to stabilize morale, ideally pushing the price back to 110,000. Today's support is at 107,500-105,000, and resistance is at 110,000-111,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。