Author: J.A.E

During Gary Gensler's era, the SEC used the "Howey Test" as a weapon to launch numerous enforcement actions against the crypto industry, issuing hefty fines that plunged the entire market into a "regulatory winter." However, with the new chairman Paul Atkins taking office, a silent yet profound regulatory revolution is underway—lawsuits are being withdrawn, dialogues are being initiated, and a framework for "innovation exemptions" is emerging.

The SEC is seeking a balance between investor protection and embracing technological innovation. This shift is not only a change in regulatory philosophy but could also become a key point for attracting institutional funds and accelerating the approval of spot ETFs.

From "Strict Enforcement" to "Innovation Exemptions": A Historic Shift in Regulatory Strategy

Under the leadership of former chairman Gary Gensler, known for his hardline stance, the SEC became infamous for its rigid and "strict enforcement" measures. The most notable feature of this period was the frequent application of the "Howey Test" to classify crypto assets as securities. Since taking office in 2021, Gary Gensler initiated over 2,700 enforcement actions, with fines exceeding $21 billion, and publicly stated that the crypto industry was "fraught with fraud and abuse."

The method of regulatory enforcement created significant uncertainty within the industry. Major lawsuits against giants like Coinbase and Ripple exemplified the market's turmoil. Particularly in the Ripple case, the SEC applied the Howey Test, originating from 1946, as a legal standard for regulating crypto assets, and the court ruled that different types of XRP sales could affect its classification as a security, leading various crypto institutions to feel anxious, resulting in many crypto products being "shut out" from U.S. users.

However, the SEC's intensive enforcement strategy not only proved ineffective but also caused ongoing harm to the market. The lack of clear regulatory guidance made each enforcement action full of "surprises," leading to systemic risks and an unpredictable market environment, which became a barrier for new funds and players entering the space. Ironically, the previous SEC repeatedly emphasized "investor protection," yet created a more volatile and fragile market, contradicting the very purpose of the SEC's existence.

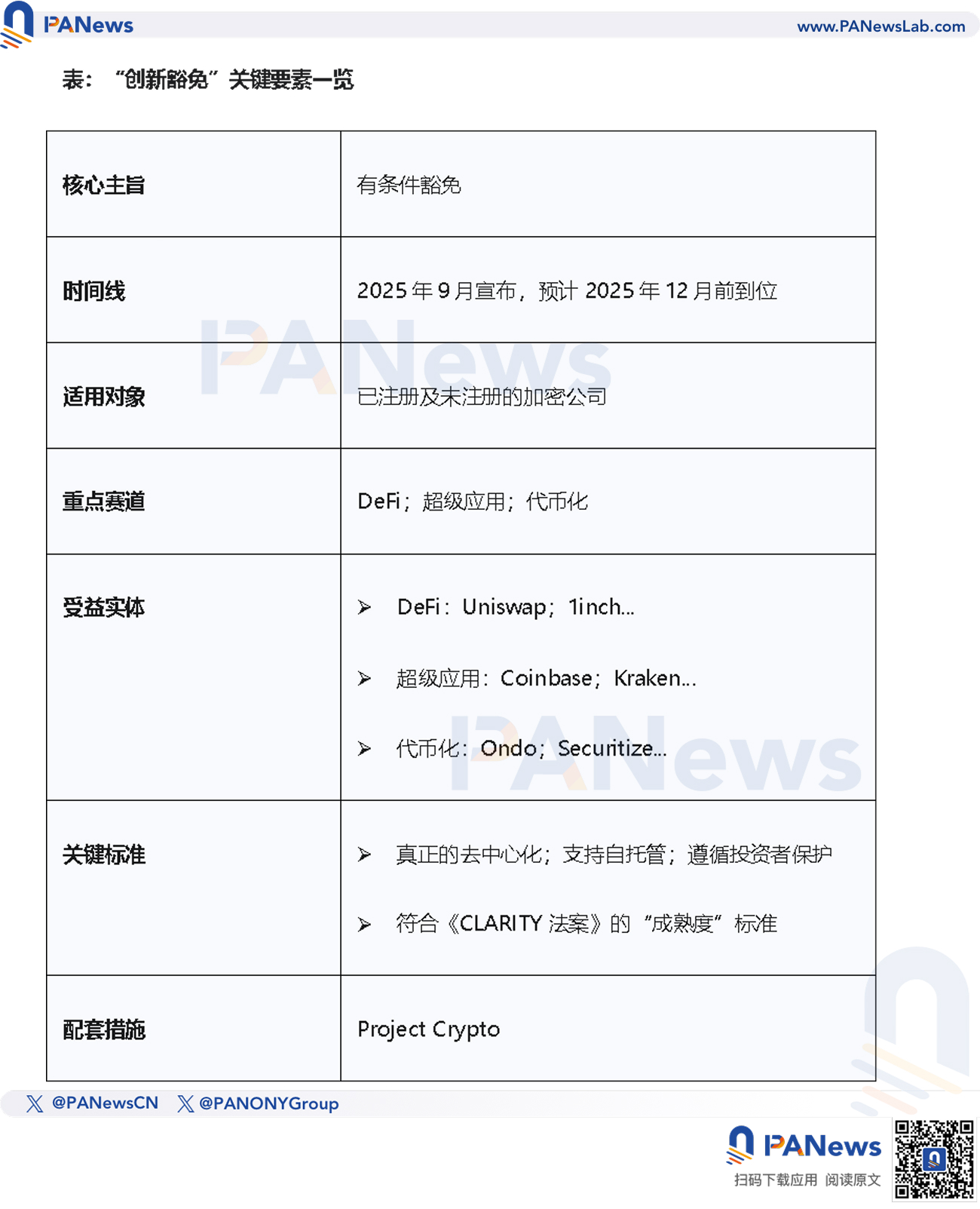

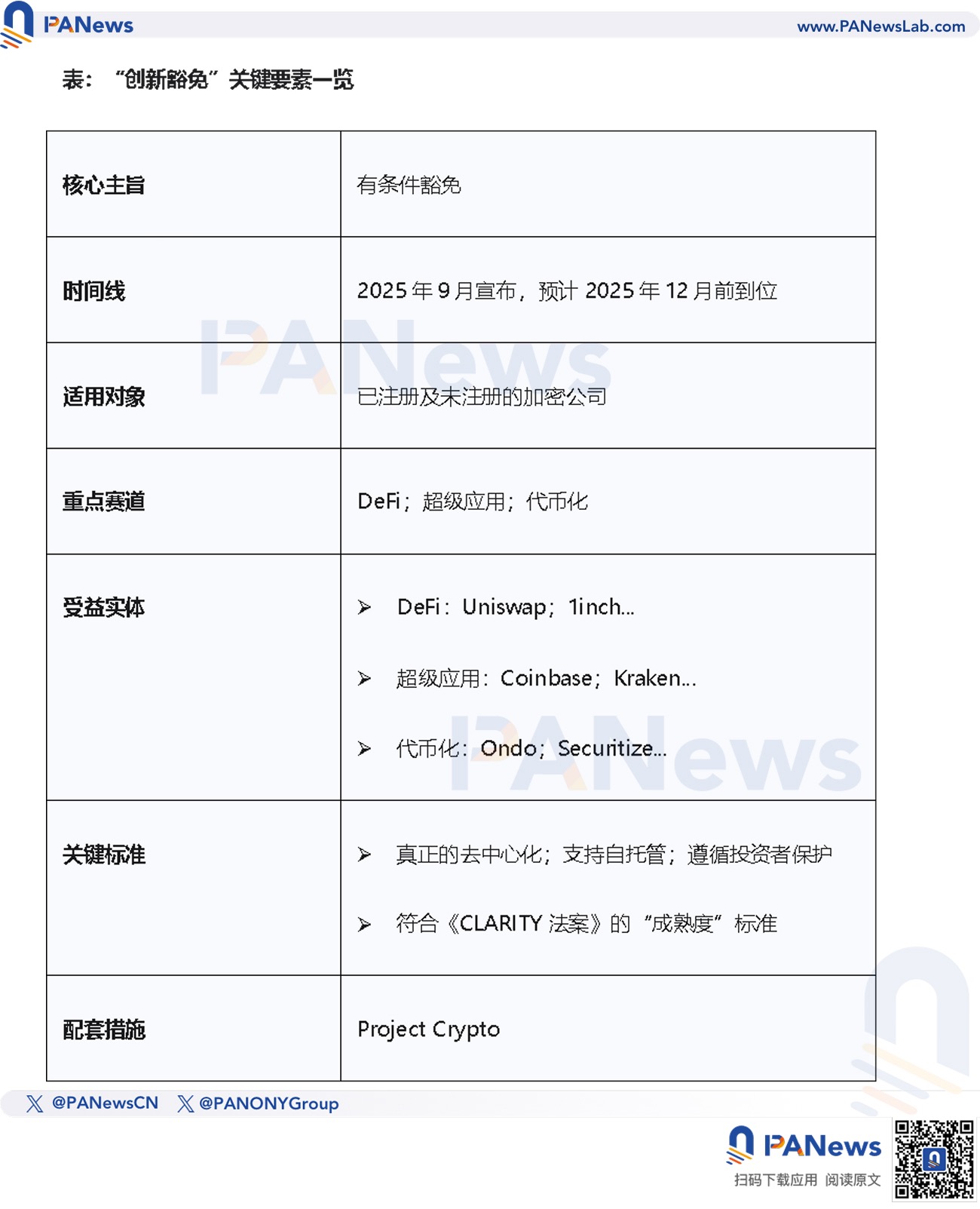

After the appointment of new chairman Paul Atkins, the regulatory direction has undergone a 360-degree shift. He first withdrew multiple lawsuits against several crypto entities, including Coinbase and Binance, and established a dedicated crypto task force, launching "Project Crypto" as a statement of the current SEC's governance, marking a significant correction of past regulatory approaches. Compared to Gary Gensler, Paul Atkins advocates for collaboration and focuses on prioritizing the establishment of formal rules.

The SEC is transitioning from an old-fashioned enforcer to a proactive coordinator that listens to industry opinions. Its actions of withdrawing lawsuits and inviting industry dialogue signal an end to confrontation, which will help rebuild market trust and encourage local technological innovation.

Full Analysis of the "Innovation Exemption" Regulatory Framework

The core of the "innovation exemption" proposal is not a blanket deregulation but a targeted and conditional exemption aimed at alleviating overly burdensome regulatory requirements. This proposal will grant crypto institutions "conditional exemptions," allowing them to offer new products and services without immediately facing excessively heavy or incompatible mandatory regulatory rules. This framework will apply to both registered and unregistered entities, providing a structured path for innovation.

The new framework recognizes that the securities rules used in traditional markets are not suitable for the rapidly evolving crypto market. Therefore, the SEC is shifting towards a more thoughtful, risk-based regulatory approach. "Conditional exemptions" mean that compliance requirements will be implemented in phases and linked to the maturity and risk profile of the projects, effectively creating a more complex regulatory model than the Howey Test.

Notably, the "innovation exemption" proposal may drive the vigorous development of three key areas in the crypto industry, thereby reducing legal uncertainty for startups: 1) It will provide a "safe harbor" for DeFi platforms and developers while focusing on the disclosure of standardized smart contracts; 2) It will promote the growth of "super app" entities, allowing them to trade multiple asset classes, including traditional securities and cryptocurrencies, under a single license; 3) It will support entities building tokenized securities ecosystems and explore regulatory sandboxes for token issuance.

The SEC also emphasizes that a key qualification for platforms to obtain "innovation exemptions" is that they must demonstrate "true decentralization" to prevent regulatory arbitrage by centralized entities.

Market Impact Outlook: Regulatory Thaw, Institutional Funds, and Spot ETFs

On September 2, 2025, the SEC and CFTC issued a "milestone" joint statement, clarifying that registered exchanges will be allowed to list and trade certain spot crypto products.

The long-standing conflict between the SEC and CFTC over jurisdiction regarding crypto assets has created a legal minefield for the industry, and the joint statement is the first step in resolving this contradiction. It confirms that the two regulatory bodies are coordinating their approaches to promote innovation, enhance transparency, and strengthen investor protection. This collaboration will provide exchanges and market participants with a more predictable and stable environment.

Additionally, the two agencies announced they would jointly hold a regulatory coordination roundtable on September 29, signaling that regulatory bodies will continue to move in the same direction.

Regulatory clarity is also key to guiding institutional participation. Once the ambiguity surrounding spot trading on regulated exchanges is eliminated, it will open the floodgates for institutional funds to flow into the crypto market.

The influx of institutional funds will fundamentally change market behavior and structure. In the past, the crypto market was typically dominated by retail speculation and offshore platforms. The entry of major exchanges like Nasdaq, NYSE, and CME, along with the accompanying institutional funds, will enhance market liquidity, reduce volatility, and make crypto assets a more reliable asset class for a broader investor base.

A warming regulatory environment will also accelerate the approval process for spot crypto ETFs. Currently, nearly 100% of spot crypto ETF applications are awaiting SEC approval. Such products will allow investors to gain exposure to crypto assets through traditional brokerage accounts, helping them integrate into the mainstream financial system.

The approval of spot ETFs is a key step in integrating crypto assets into the traditional financial system. It is not just about emerging investment products; it represents a fundamental shift in how crypto assets are accessed, legitimizing cryptocurrencies as a recognized asset class for millions of new investors and promoting broader institutional adoption and financial product innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。