Pumping the market is the best promotion.

In just one week, the number of new users on the Aster platform has surpassed 710,000, with the perpetual contract trading volume in the past 24 hours reaching $21.112 billion, directly exceeding that of the established DeFi derivatives platform Hyperliquid by more than double. The platform's TVL has reached $1.744 billion, with a 24-hour income of $7.12 million, ranking just behind stablecoin giants Tether and Circle in the overall income leaderboard.

Aside from "Can ASTER still be bought?", "Can Aster still be farmed?" is also a frequently asked question.

There are 11 days left for Aster's second season airdrop, with the airdrop pool accounting for 4% of the supply, approximately 320 million ASTER tokens. This also means that as of the time of writing, based on a price of $2.3 for $ASTER, the S2 airdrop is valued at over $700 million. Against this backdrop, Rhythm BlockBeats has compiled the most essential airdrop strategies for Aster.

1. Aster × Backpack Hedging Arbitrage Strategy

This is currently the main strategy for farming points. The core steps involve placing opposite orders for the same asset on two trading platforms (such as Backpack and Aster) simultaneously, achieving "point farming + capturing fee differences."

The only point to note is: Aster uses "market orders" because Aster earns double points by taking orders.

The detailed steps involve placing a "limit order" to short $ASTER on Backpack to earn hanging order points; while on Aster, use a "market order" for immediate execution. Additionally, market order execution must be quick; otherwise, if one side is not executed, it may create a unilateral exposure.

Moreover, the weight of holding time and opening frequency needs to be managed by oneself. The longer the holding time, the higher the points, but the point cap is twice the weekly trading volume.

To prevent being witch-hunted, you can try modifying various parameters, such as opening amount, opening multiple, opening direction, etc. Do not always use the same set of parameters; otherwise, high-frequency hedging may trigger risk control and witch-hunting. Beginners should start with small amounts and gradually increase the multiple and amount after getting the hang of it.

2. Earning Funding Rates

This strategy further operates on the basis of arbitraging between two trading platforms to earn funding rates.

Here, the perpetual contract funding rate mechanism is mainly utilized. When the funding rate is positive, shorting the perpetual earns the funding rate; when the funding rate is negative, going long earns the funding rate. Generally, there will be a difference in funding rates between the two trading platforms. For example, the funding rate for $Aster on Binance has previously maintained around 0.1% to 0.4%, which annualizes to 0.6% to 2.4%.

Continue to hedge spot using the previous Backpack (limit order) + Aster (market order) method to earn points. The net profit is = point value + funding rate income - fee costs - slippage loss.

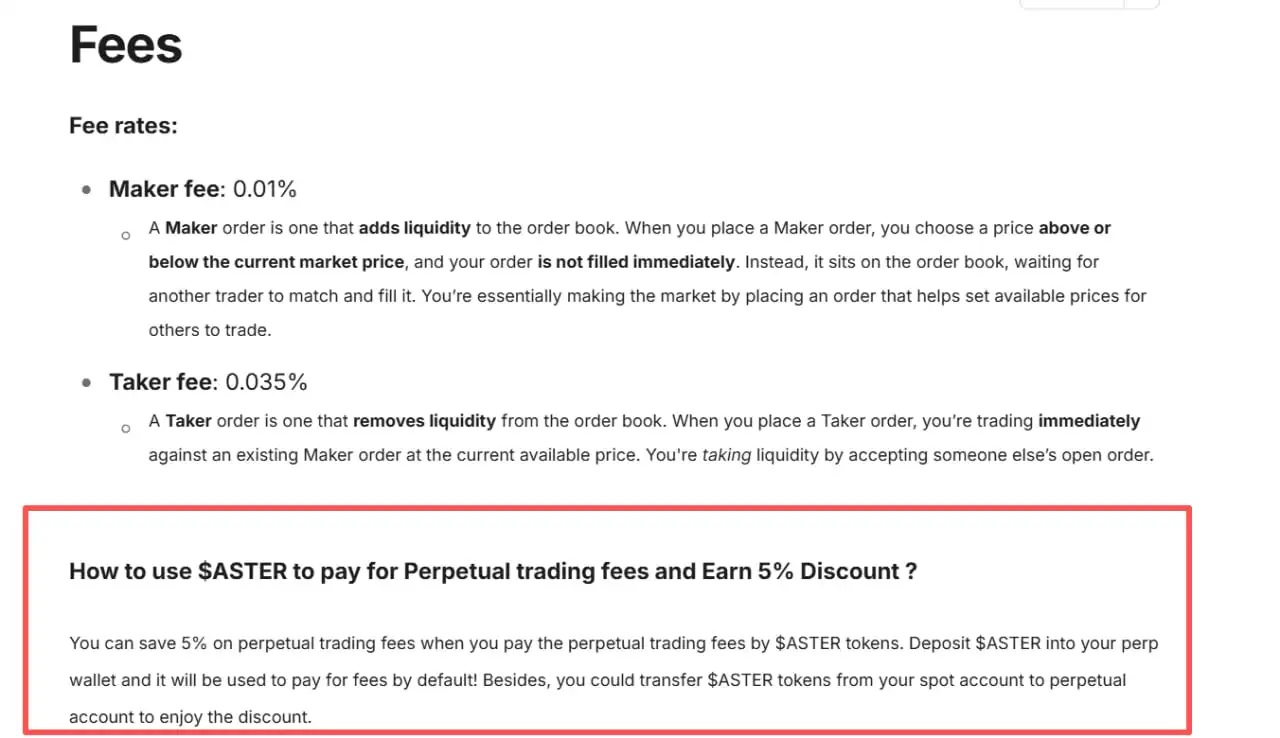

Be sure to consider the exchange's fee structure. Fees are usually divided into two types: Taker (market order): refers to orders that are executed immediately, with higher fees; Maker (limit order): refers to orders that are placed on the order book waiting to be executed, with lower fees.

Since real-time monitoring is required, this is suitable for experienced traders or using some funding rate bots. Pay attention to delays and reconciliations between multiple accounts and trading platforms. Funding rate arbitrage usually has a longer time span than point arbitrage, so do not neglect position management.

3. Depositing to Convert to USDF

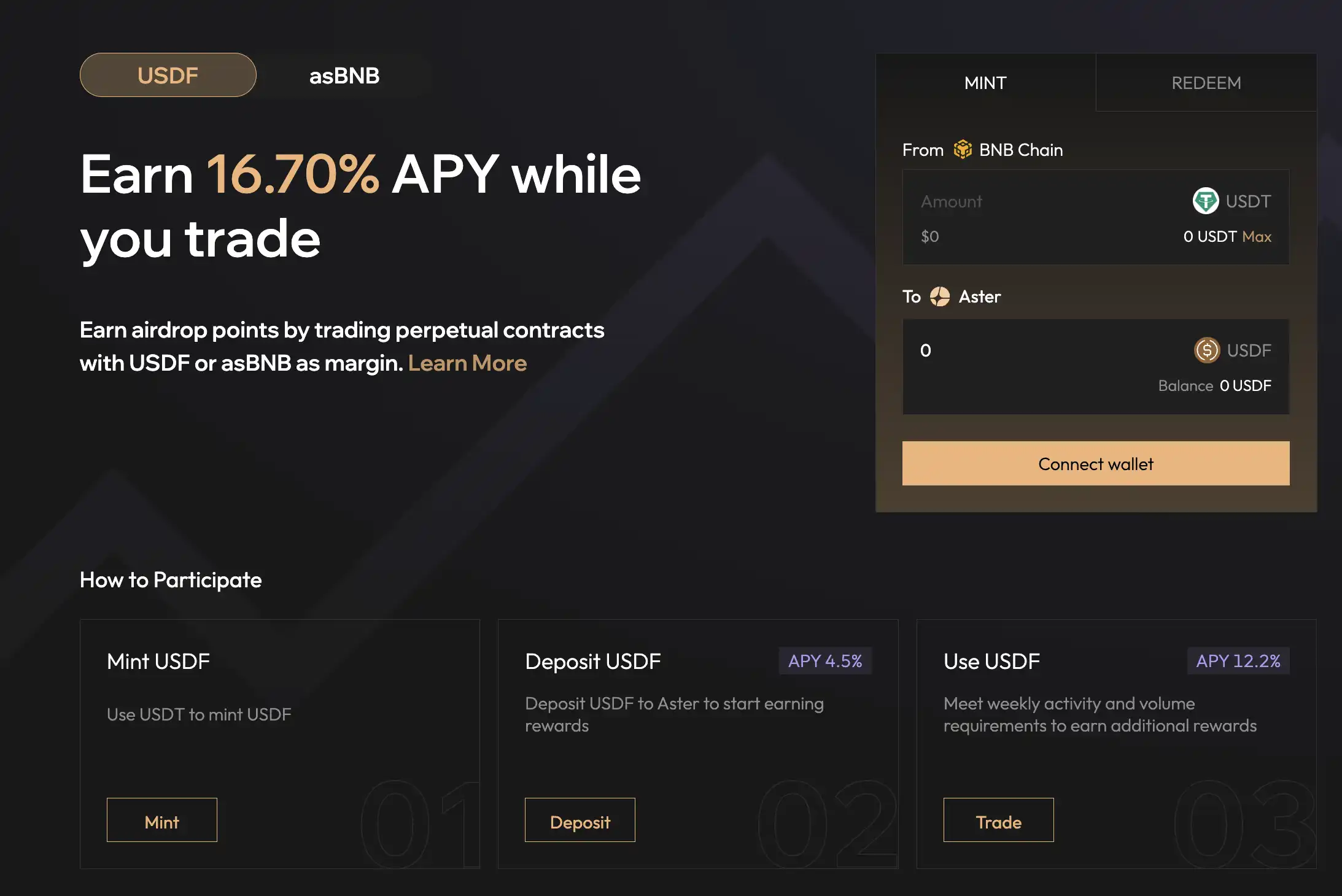

In addition to the previously discussed hedging and funding rate strategies, Aster also offers a relatively "low-risk, passive income" method based on the "Trade & Earn" system of USDF and asBNB. This product continues the experience of Aster's predecessor in staking asset liquidity, essentially combining "trading" and "wealth management," allowing users to remain active in trading while enjoying stable annualized returns.

Currently, USDF offers approximately 16.7% annualized yield (APY), with two ways to participate: one is deposit rewards; as long as your account holds more than 1 USDF, interest will be generated automatically; the second is trading rewards, which have slightly higher requirements, requiring users to be active for at least 2 days a week and have a cumulative trading volume exceeding 2000 USDT. Once the conditions are met, the system will distribute rewards uniformly in the following week, directly credited to the trading account and automatically reinvested.

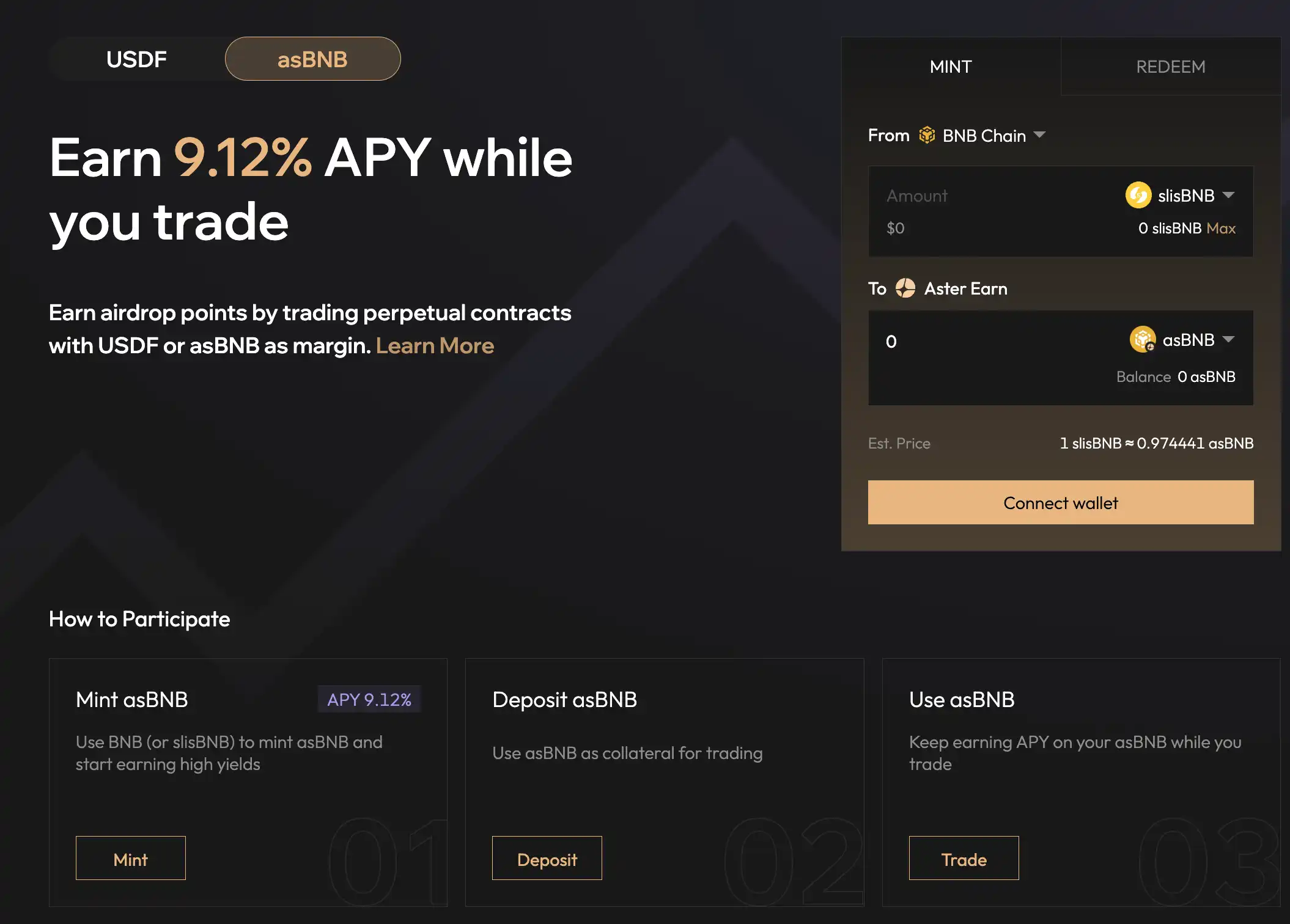

In addition to USDF, Aster also provides asBNB, which serves a similar purpose and logic as USDF. Users can exchange BNB or slisBNB for asBNB to use as margin while enjoying approximately 9.1% annualized yield.

Furthermore, Aster has incorporated a "double points" mechanism into its incentive design. If you choose to use USDF or asBNB as margin, your trading points will receive a doubling bonus, and the weekly trading volume point cap will be raised to double. This makes using these two assets almost essential for players pursuing airdrop points or rebate rewards, effectively stacking interest income and point advantages while trading.

Additionally, holding $ASTER provides a 5% fee discount, so it's best to hold a certain amount of $ASTER in each wallet.

4. Team Bonuses

Individual players can only earn limited rewards by farming points, but if you can form a "team" and expand your network through invitations, you can leverage the points generated by others' trades and further enhance your share in the overall network through team rankings. In the long run, the points earned by a single account through its own trading may be far less than the total contribution of an active team, so "invitation + team" will become the key to differentiating players in the later stages.

The core logic is to integrate the power around you into a team through "referrals" and "team contributions" to boost your points.

Specifically, the invitation rewards are divided into two levels: if you invite a first-level user, you can earn 10% of the Rh points they generate; if it's a second-level user (i.e., a user invited by your invitee), you can earn 5% of the points. However, it's important to note that this sharing only applies to their trading point earnings, excluding referral points and team points themselves, avoiding the "infinite nesting" situation.

Aster has also introduced the concept of team points. This can be understood as a team, where each team's points will be settled on T+1, compared horizontally with other teams. Before the final distribution of points, the system will also make some "fairness adjustments," including limiting large holders' monopolies and smoothing out abnormal fluctuations. In other words, team rewards are not just about "the more people I invite, the better," but rather a comprehensive evaluation of "team activity" + "overall contribution ratio."

Ultimately, these scores will be converted weekly into your share of the overall platform points pool, directly determining how much reward you can receive in the upcoming $ASTER airdrop distribution. Simply put: the invitation relationship gives you a stable 10% / 5% share; team points determine whether you can squeeze into the top of the leaderboard for higher additional rewards.

There are 11 days left for Aster's second season airdrop, with the airdrop pool accounting for 4% of the supply, approximately 320 million ASTER tokens, and as of the time of writing, the S2 airdrop is valued at over $700 million.

In the face of such massive user growth and a complex points ecosystem, the Aster team has also made it clear: professional market makers will be excluded from the Rh points system and will not qualify for the $ASTER token airdrop. Currently, pure spot holding and trading are not included in the points system for the second phase of Rh points calculation, but this does not mean that spot trading is without value—it's not hard to infer from the official statements that the airdrop rules for the third quarter will likely reintegrate spot trading into the points calculation.

Therefore, at present, there are still many opportunities for retail investors. However, it should be noted that the market is currently overheated, with FOMO sentiment on the rise, and scripts are rampant in the market. The timing of the second season airdrop distribution is also uncertain, so competition is still quite fierce, and users need to manage their risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。