CoinW Research Institute

Key Points

The total market capitalization of global cryptocurrencies is $4.21 trillion, up from $4.13 trillion last week, representing a 1.9% increase this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.7 billion, with a net inflow of $886 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $13.92 billion, with a net inflow of $556 million this week.

The total market capitalization of stablecoins is $298.6 billion, with USDT's market cap at $172 billion, accounting for 57.6% of the total stablecoin market cap; followed by USDC with a market cap of $73.9 billion, accounting for 24.74%; and DAI with a market cap of $5.36 billion, accounting for 1.79%.

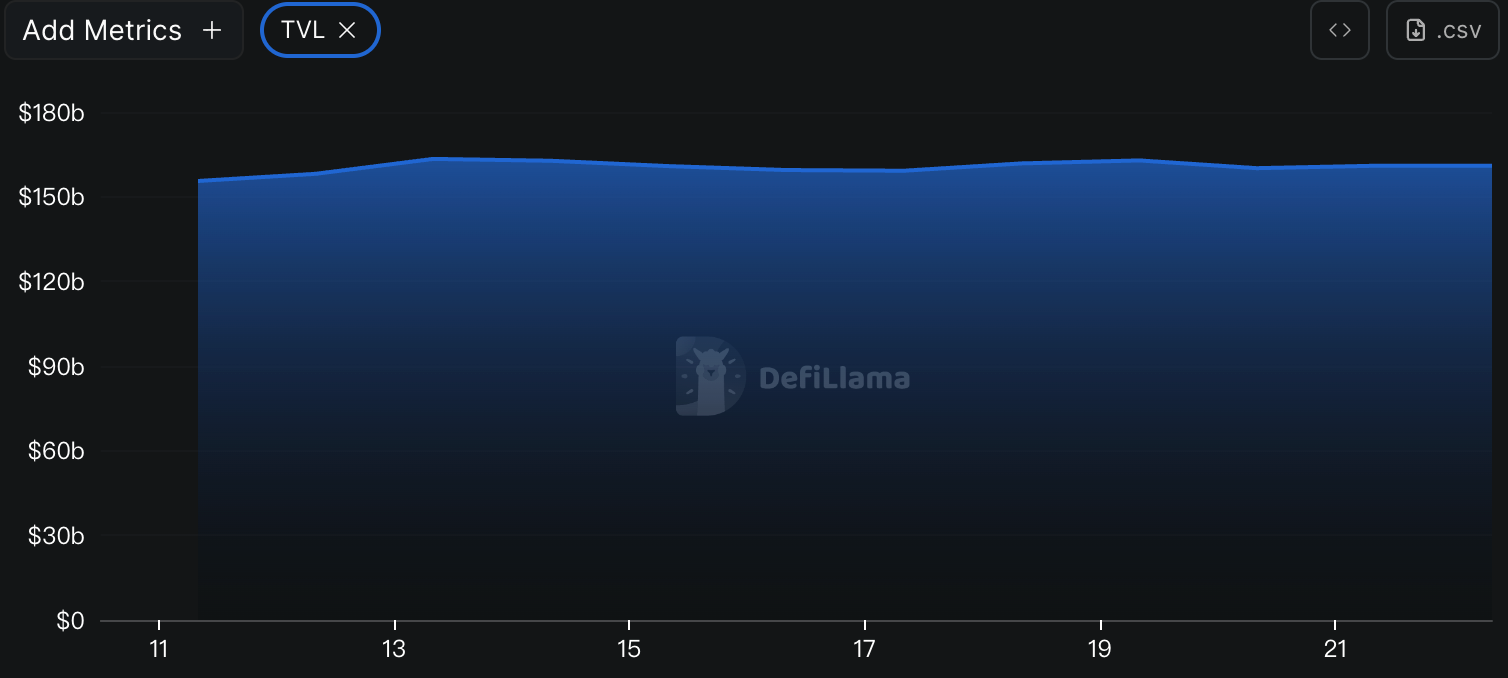

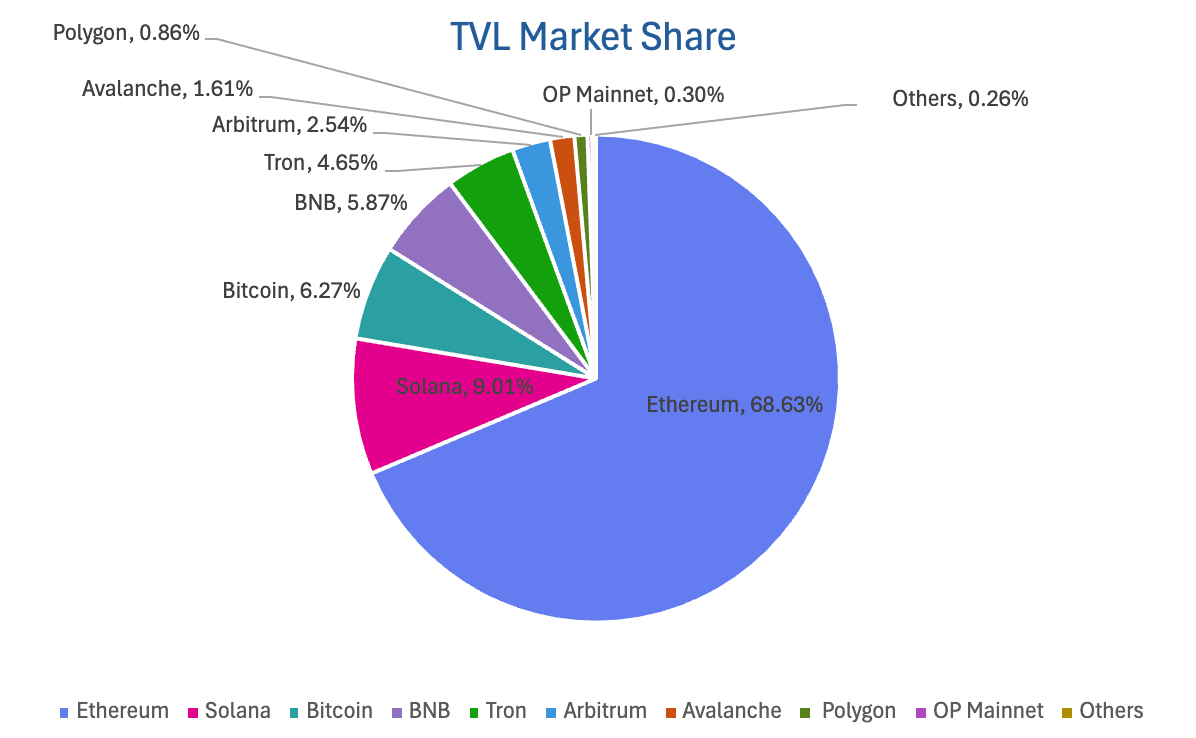

According to DeFiLlama, the total TVL of DeFi this week is $160.9 billion, down from $162.1 billion last week, a decrease of approximately 0.74%. By public chain, the top three chains by TVL are Ethereum at 68.63%; Solana at 9.01%; and Bitcoin at 6.27%.

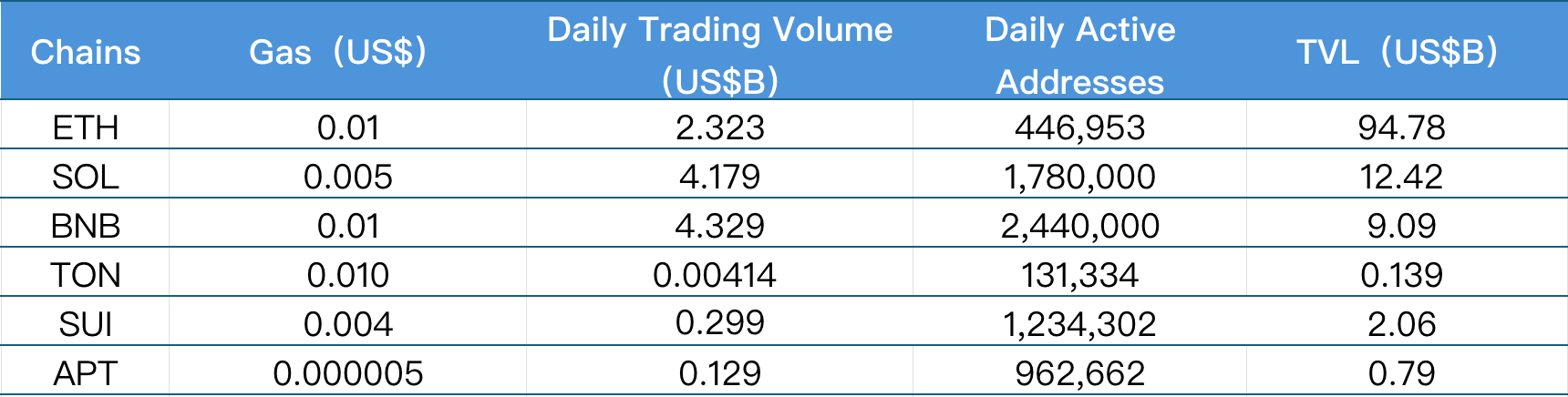

This week, public chain data shows significant differentiation: only Solana (+21.84%) and BNB chain (+24.8%) saw increases in daily trading volume, while others declined, with Ethereum experiencing a smaller drop (-7.08%) and Ton (-17.2%), Sui (-38.98%), and Aptos (-35.5%) seeing larger declines; in terms of transaction fees, BNB and Ton remained stable, Ethereum decreased by 50%, while Solana and Sui decreased by 36.97% and 23.5%, respectively, and Aptos increased by 359%. In daily active addresses, Ethereum (-1.97%) and Solana (-30.2%) declined, while others increased, with Sui showing the largest increase (+76.08%), and BNB, Ton, and Aptos growing by 4.27%, 13.31%, and 14.55%, respectively. In terms of TVL, only BNB saw the largest increase (+18.29%), while Solana slightly decreased (-4.44%), with others showing little fluctuation (Ethereum -0.67%, Ton -0.71%, Sui -0.63%, Aptos +0.13%).

New project focus: Senpi is an AI-based "OnchainGPT" platform, positioned as a mentor, advisor, and assistant for on-chain autonomous trading, helping users discover investment opportunities, execute automated trades, and enhance market insights. SHIFT is a trading platform that tokenizes the value of traditional stocks and ETFs, aiming to connect global capital markets with DeFi liquidity. Kvants is a decentralized asset management platform that provides institutional-level investment opportunities for retail investors using AI-driven quantitative trading strategies.

Table of Contents

Key Points

Table of Contents

I. Market Overview

Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-chain Data

Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Increase This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

- Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

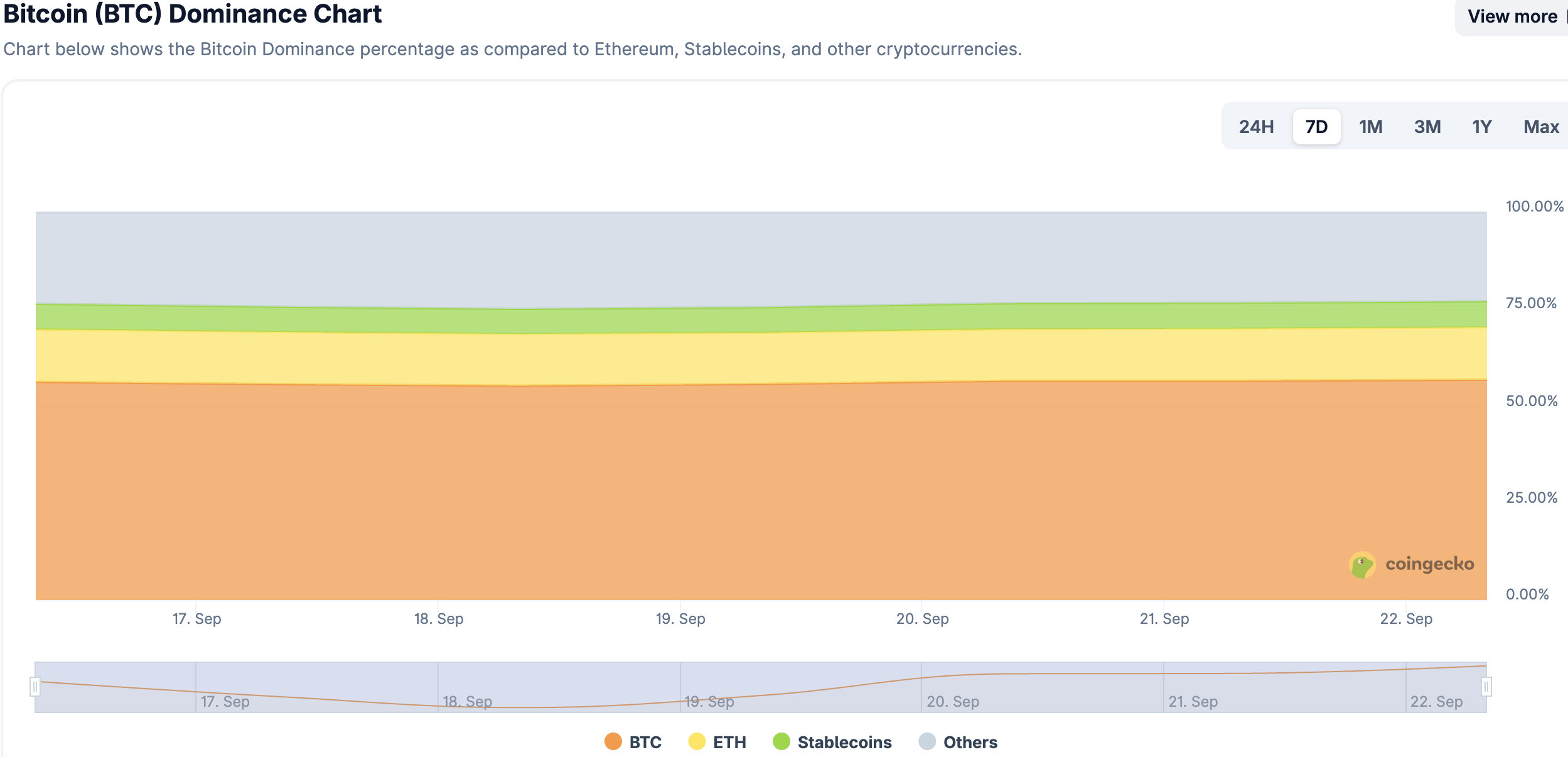

The total market capitalization of global cryptocurrencies is $4.21 trillion, up from $4.13 trillion last week, representing a 1.9% increase this week.

Data Source: cryptorank

Data as of September 21, 2025

As of the time of writing, the market cap of Bitcoin is $2.28 trillion, accounting for 54.2% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $289.6 billion, accounting for 6.88% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of September 21, 2025

- Fear Index

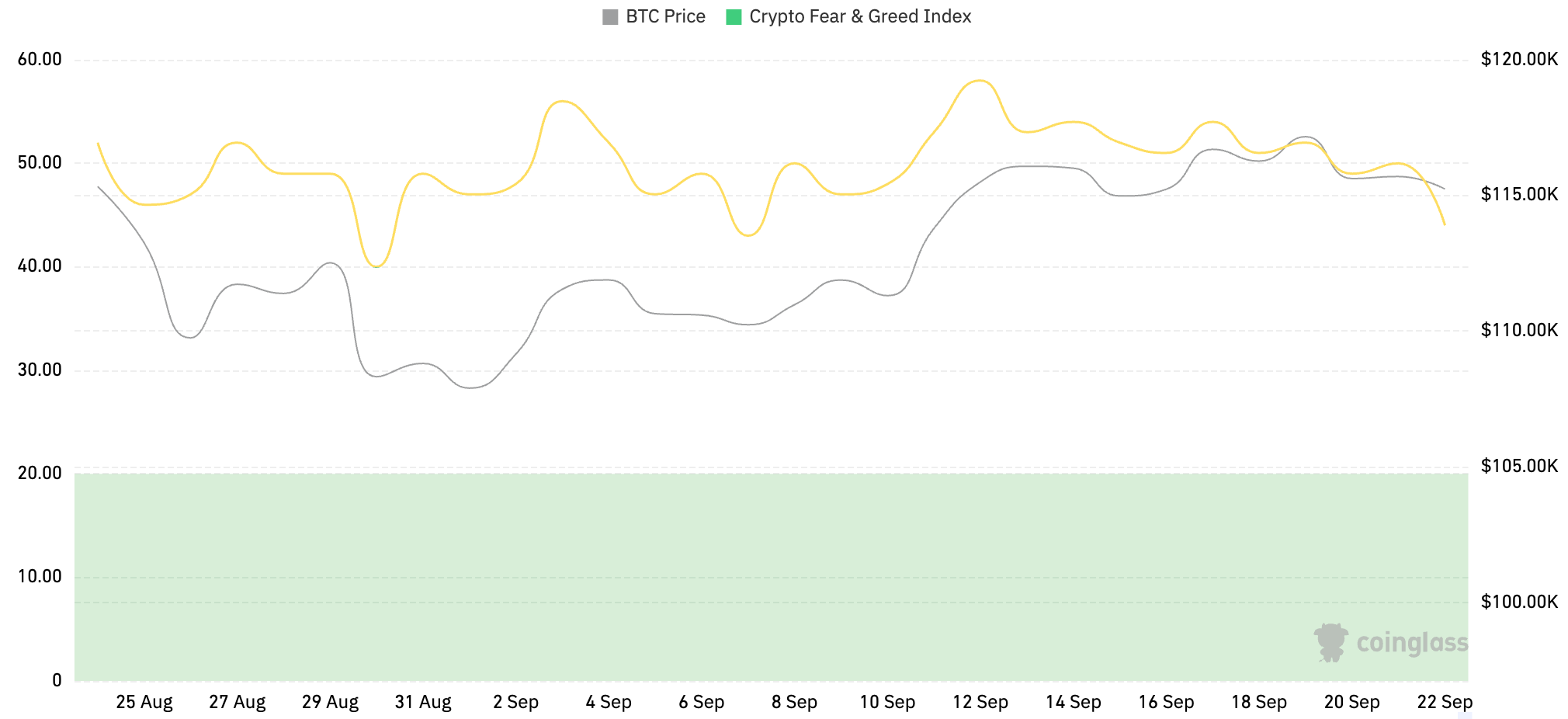

The cryptocurrency fear index is 44, indicating a neutral sentiment.

Data Source: coinglass

Data as of September 21, 2025

- ETF Inflow and Outflow Data

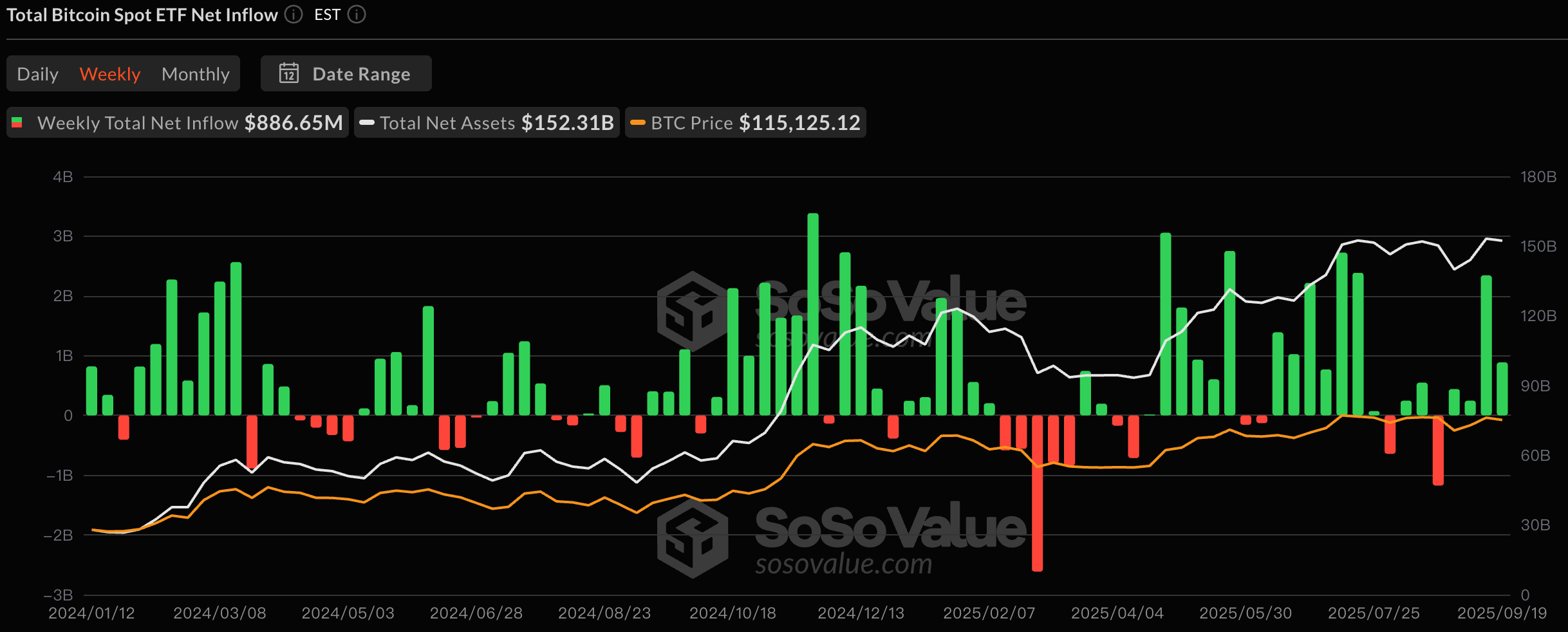

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.7 billion, with a net inflow of $886 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $13.92 billion, with a net inflow of $556 million this week.

Data Source: sosovalue

Data as of September 21, 2025

- ETH/BTC and ETH/USD Exchange Rates

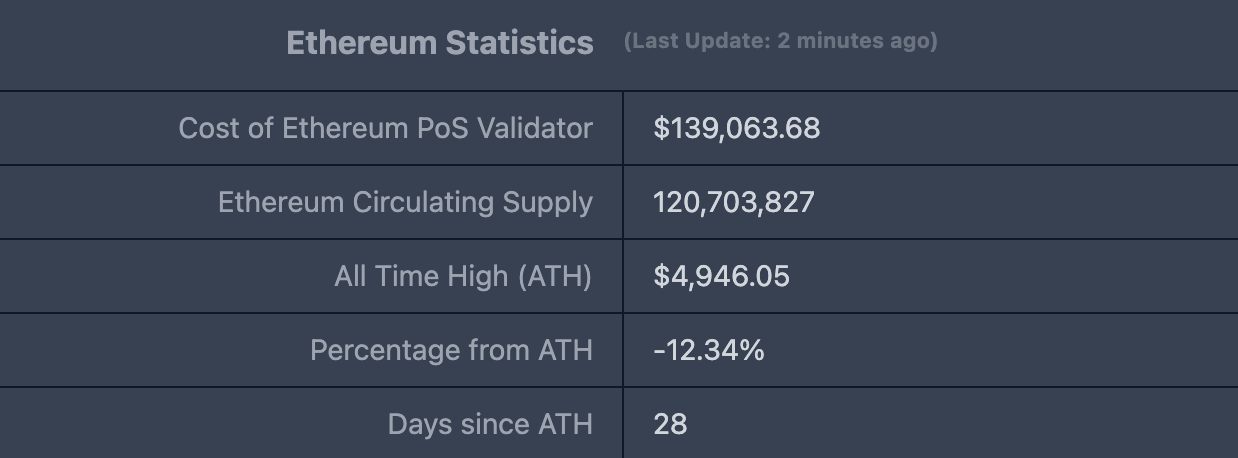

ETHUSD: Current price $4,348.70, historical highest price $4,878.26, approximately 12.34% down from the highest price.

ETHBTC: Currently at 0.037899, historical highest at 0.1238.

Data Source: ratiogang

Data as of September 21, 2025

- Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $160.9 billion, down from $162.1 billion last week, a decrease of approximately 0.74%.

Data Source: defillama

Data as of September 21, 2025

By public chain, the top three chains by TVL are Ethereum at 68.63%; Solana at 9.01%; and Bitcoin at 6.27%.

Data Source: CoinW Research Institute, defillama

Data as of September 21, 2025

- On-chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APTOS based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of September 21, 2025

Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily trading volume, this week only Solana (+21.84%) and BNB chain (+24.8%) saw increases, while other chains declined. Ethereum (-7.08%) had a smaller drop; other chains including Ton (-17.2%), Sui (-38.98%), and Aptos (-35.5%) saw similar declines. In terms of transaction fees, this week BNB chain and Ton chain remained stable compared to last week; Ethereum decreased by 50%, while Solana and Sui decreased by 36.97% and 23.5%, respectively; Aptos increased by 359%.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, this week only Ethereum (-1.97%) and Solana (-30.2%) saw declines, while other chains increased. Sui had the largest increase at 76.08%; other chains had similar increases, with BNB (4.27%), Ton (13.31%), and Aptos (14.55%). In terms of TVL, this week Solana decreased by 4.44%, while BNB increased by 18.29%; other chains showed little change, with Ethereum (-0.67%), Ton (-0.71%), Sui (-0.63%), and Aptos (+0.13%).

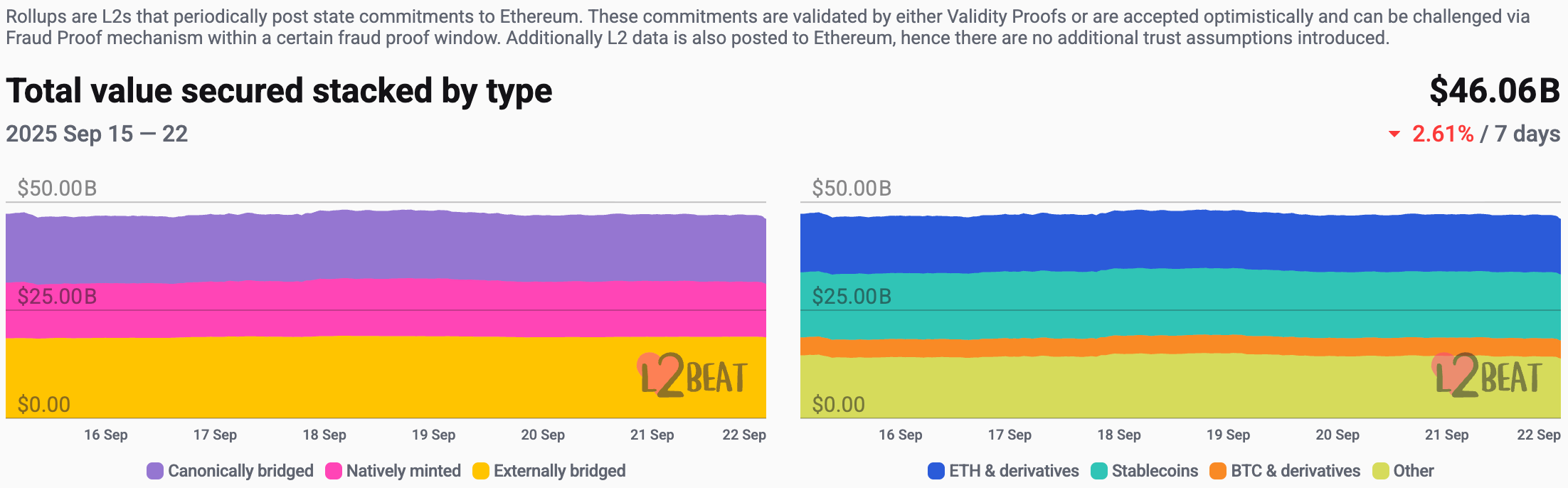

Layer 2 Related Data

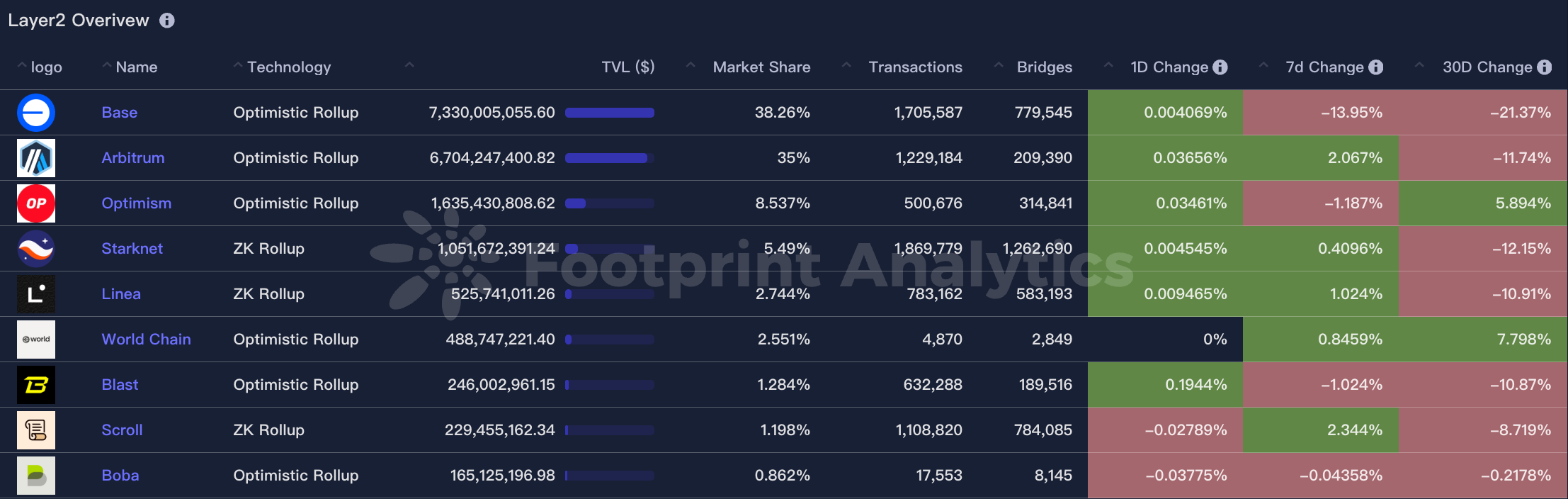

According to L2Beat, the total TVL of Ethereum Layer 2 is $46.04 billion, down 2.3% from last week ($47.13 billion).

Data Source: L2Beat

Data as of September 21, 2025

Base and Arbitrum occupy the top positions with market shares of 38.26% and 35%, respectively. Base's market share has slightly decreased over the past week, while Arbitrum's has increased.

Data Source: footprint

Data as of September 21, 2025

- Stablecoin Market Cap and Issuance

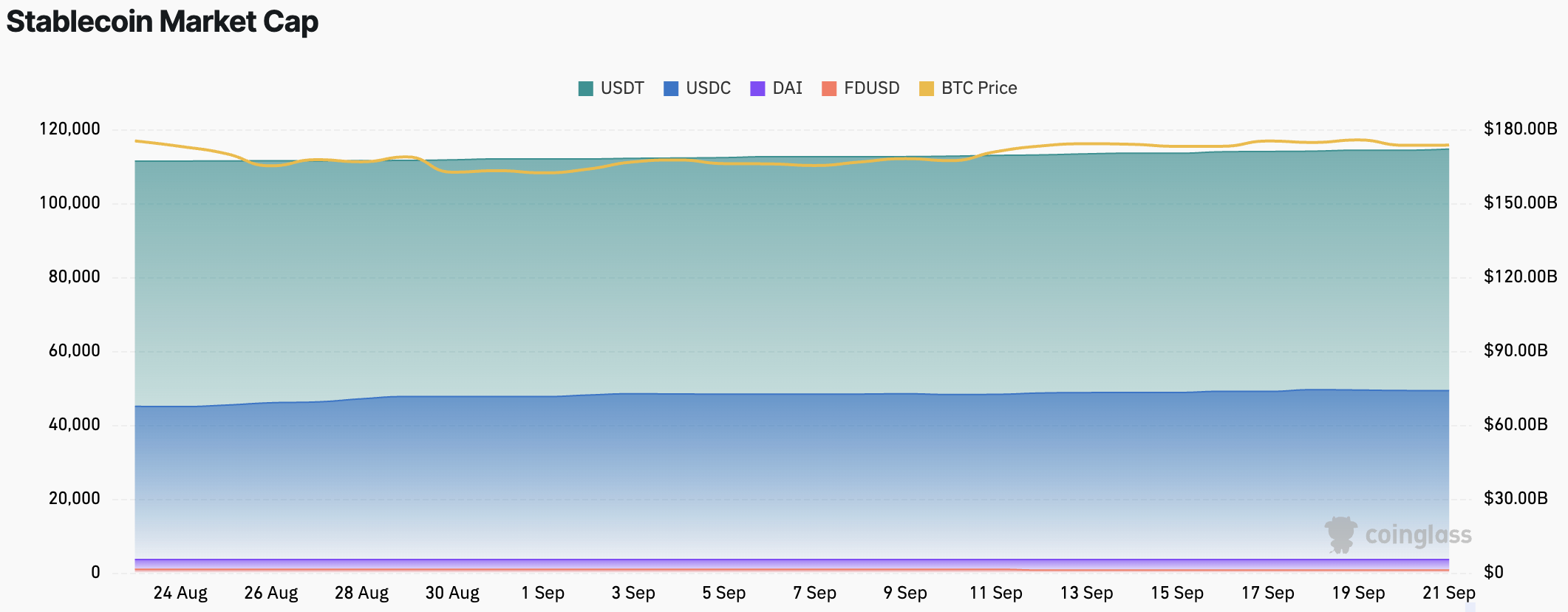

According to Coinglass data, the total market cap of stablecoins is $298.6 billion, with USDT's market cap at $172 billion, accounting for 57.6% of the total stablecoin market cap; followed by USDC with a market cap of $73.9 billion, accounting for 24.74%; and DAI with a market cap of $5.36 billion, accounting for 1.79%.

Data Source: CoinW Research Institute, Coinglass

Data as of September 21, 2025

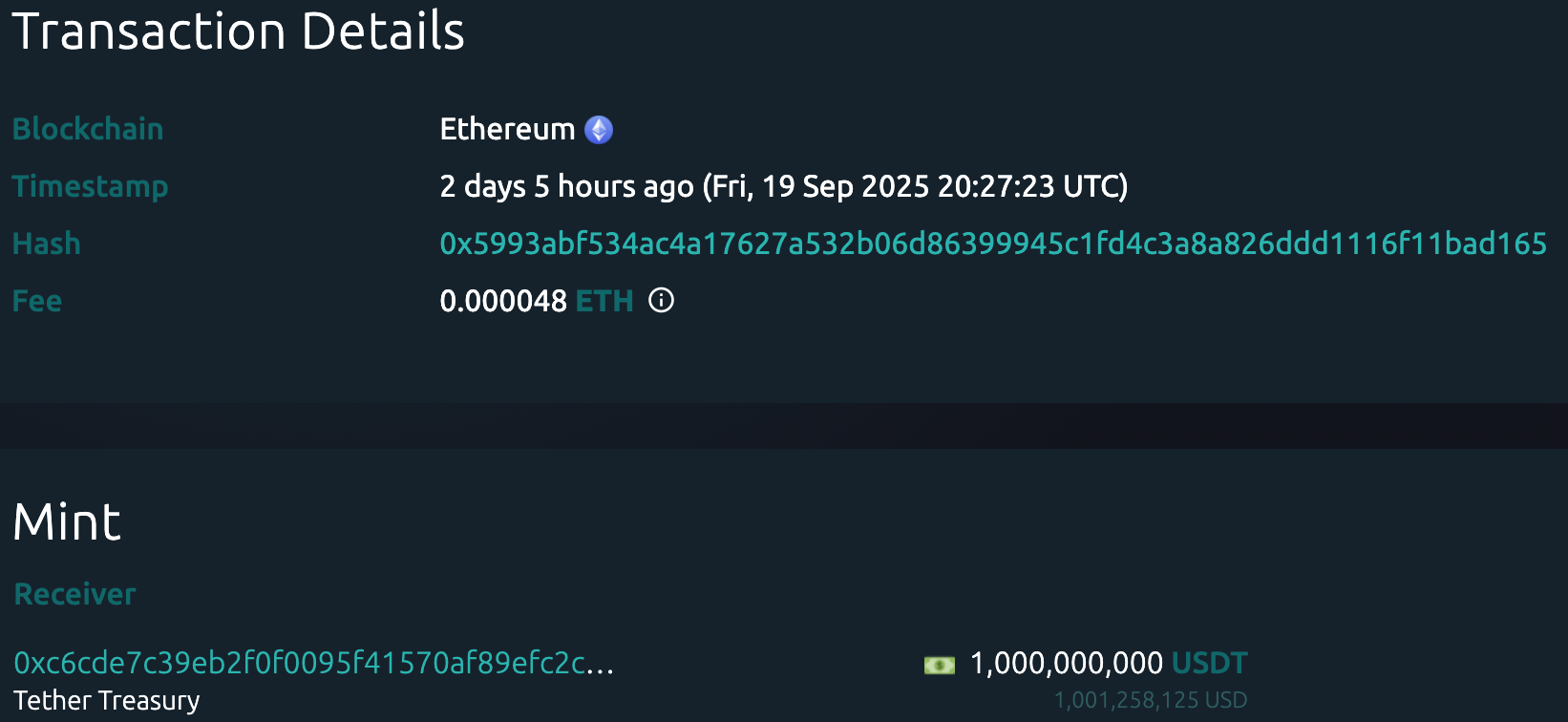

According to Whale Alert data, this week the USDC Treasury issued a total of 2.71 billion USDC, and Tether Treasury issued a total of 3 billion USDT this week. The total issuance of stablecoins this week is 5.71 billion, an increase of 29.77% compared to last week's total issuance of 4.4 billion.

Data Source: Whale Alert

Data as of September 21, 2025

II. This Week's Hot Money Trends

- Top Five VC Coins and Meme Coins by Increase This Week

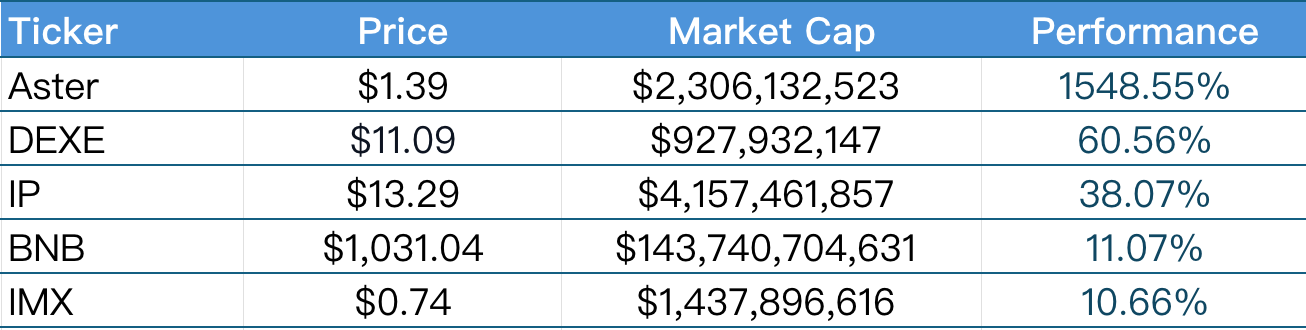

Top five VC coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of September 21, 2025

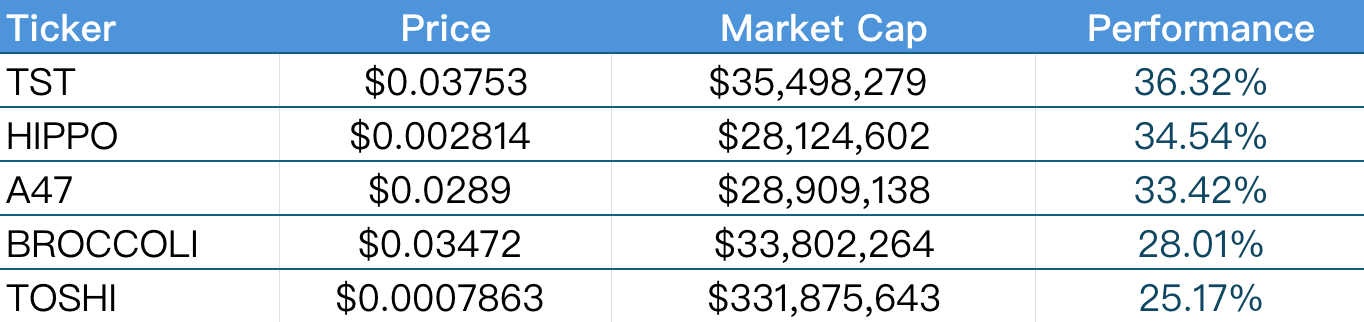

Top five Meme coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of September 21, 2025

- New Project Insights

Senpi is an AI-based "OnchainGPT" platform, positioned as a mentor, advisor, and assistant for on-chain autonomous trading, helping users discover investment opportunities, execute automated trades, and enhance market insights. The platform supports autonomous trading, limit orders, copy trading, real-time profit and loss tracking, market sentiment analysis, and risk control, using a non-custodial architecture to ensure users have complete control over their assets. Senpi has also built an open plugin ecosystem, allowing developers to create and deploy custom strategies and tools through the Eliza Skills Framework.

SHIFT is a trading platform that tokenizes the value of traditional stocks and ETFs, aiming to connect global capital markets with DeFi liquidity. Its Shift Stocks are fully backed by physical assets and can be freely traded or staked on decentralized exchanges, lending markets, and centralized exchanges. The platform's assets are held and audited by a licensed custodian in Europe, supporting redemption for cash, cryptocurrencies, or underlying assets.

Kvants is a decentralized asset management platform that provides institutional-level investment opportunities for retail investors using AI-driven quantitative trading strategies. Users can diversify their investments through tokenized strategies, and the KVAI token is used to pay fees, participate in governance, and incentivize the community. The platform has completed multiple rounds of financing, aiming to lower the barriers to quantitative trading and achieve broader investment participation.

III. Industry News

- Major Industry Events This Week

The leading AI project DeAgentAI in the Sui ecosystem officially launched its Genesis Airdrop on September 18, expected to be completed within 48 hours. At the same time, its main staking system will go live on September 22 at 15:00 UTC (23:00 Beijing time), including three major modules: a flexible pool with multiple reward mechanisms, a fixed-term pool offering up to 15 times returns for early users, and a community-exclusive arena based on Discord identities, aimed at enhancing user participation and ecosystem activity.

The Lombard ($BARD) token officially launched on September 18, 2025, and simultaneously initiated several airdrop and Token Generation Event (TGE) activities, including approximately 10 million BARD in airdrop rewards and an additional community incentive valued at 15,000 USDT, aimed at promoting early user participation and ecosystem activity.

The Maiga.ai (MAIGA) token officially launched on September 17, 2025, and simultaneously initiated several airdrop activities, with a total value of approximately 50,000 USDT. The airdrop targets early users and community members, aiming to incentivize active participation and promote the ecosystem.

The Dill ($DL) token officially launched on September 19, 2025, and simultaneously initiated community airdrop and TGE activities. The total airdrop amount is approximately 180 million $DL, released in three phases: 50% on TGE day, 40% after 30 days, and 10% after 90 days, aimed at incentivizing early users and community participation. Dill is a high-performance modular blockchain platform focused on solving scalability issues in decentralized networks, supporting high throughput and efficient data availability, and promoting ecosystem activity and long-term development through a token incentive mechanism.

0G Labs (Zero Gravity Labs) completed its $0G token Token Generation Event (TGE) on September 18, 2025, and simultaneously initiated an airdrop, with a total amount of approximately $88 million, targeting users active in the testnet, validator contributions, and community participation, aimed at incentivizing the community and promoting the development of the decentralized artificial intelligence operating system (DeAIOS) ecosystem.

- Major Upcoming Events Next Week

Plasma (XPL) officially announced that it will hold a Token Generation Event (TGE) on September 25, 2025, at 8:00 AM Eastern Time, and simultaneously launch the mainnet test version. This mainnet launch will introduce the native token $XPL, supporting zero-fee USDT transfers and integrating over 100 DeFi protocols (such as Aave, Euler, Fluid, Ethena, etc.). Plasma adopts the PlasmaBFT consensus mechanism, optimizing stablecoin liquidity and providing high throughput and low-latency services.

Meteora (MET) plans to hold a Token Generation Event (TGE) in October 2025 and simultaneously conduct a $MET token airdrop, accounting for approximately 15% of the total supply, targeting users who provide liquidity or trade in Season 2. The project has launched an Airdrop Claim tool to facilitate users in directly claiming tokens. After the TGE, Meteora will launch the $MET DAO to grant community governance rights and optimize liquidity pools and token flexibility through Dynamic Bonding Curve (DBC) and DAMM V2.

Kvants (KVAI) will hold a TGE on September 25, 2025, at 14:00 UTC, with 5% of the tokens immediately unlocked and the remainder released linearly over 10 months. Kvants is a decentralized asset management platform that uses AI-driven quantitative trading strategies to provide institutional-level investment opportunities for retail investors. The KVAI token is used to pay platform fees, participate in governance, and incentivize the community.

- Important Investments and Financing from Last Week

U.S. publicly listed company Helius Medical Technologies (NASDAQ: HSDT) announced the completion of over $500 million in PIPE financing, led by Pantera Capital and Summer Capital, with participation from Animoca Brands, HashKey Capital, and others. If all warrants are exercised, the financing scale may exceed $1.25 billion. Helius is a medical device company focused on neurotechnology and announced the launch of a SOL treasury strategy, planning to use Solana (SOL) as a primary reserve asset to explore on-chain DeFi yields. (September 15, 2025)

Digital asset platform Stablecore announced the completion of $20 million in financing, led by Norwest, with participation from Coinbase Ventures, Curql, BankTech Ventures, Bank of Utah, and others, covering over 290 banks and credit unions. Stablecore aims to provide stablecoins, tokenized deposits, and digital asset solutions for community and regional banks and credit unions in the U.S., seamlessly integrating into existing banking systems. This round of financing will be used to expand its customer base and team size, promoting traditional financial institutions' access to stablecoins and tokenized financial services. (September 16, 2025)

Mavryk Network, a Layer 1 blockchain platform focused on RWA tokenization, announced a $10 million strategic investment led by MultiBank Group. This financing will be used to expand its RWA tokenization program. Mavryk features a non-custodial nature, including on-chain protocol treasury and liquidity mining, and has developed a new RWA token standard and several decentralized exchanges (DEX) to support non-custodial trading and lending. Mavryk is also collaborating with MultiBank on a real estate asset tokenization project in the UAE and has received custodial support from Fireblocks, allowing users to trade and stake asset-backed tokens without managing private keys. (September 17, 2025)

African fintech company Kredete announced the completion of a $22 million Series A financing round, led by AfricInvest through its Cathay AfricInvest Innovation Fund (CAIF) and Financial Inclusion Vehicle (FIVE), with participation from Partech and follow-on investment from Polymorphic Capital, bringing the company's total funding to $24.75 million. Kredete focuses on helping African immigrants establish credit records and reduce remittance costs through stablecoin payments and credit-building services, with transfer fees as low as $1, significantly lower than traditional remittance services. (September 17, 2025)

IV. Reference Links

Helius Medical Technologies: https://heliusmedical.com/

Stablecore: https://stablecore.com/

Mavryk Network: https://mavryk.org/

Kredete: https://www.kredete.io/

Senpi: https://senpi.ai/

SHIFT: https://www.shiftrwa.xyz/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。