1. Current Status of the Stablecoin Market

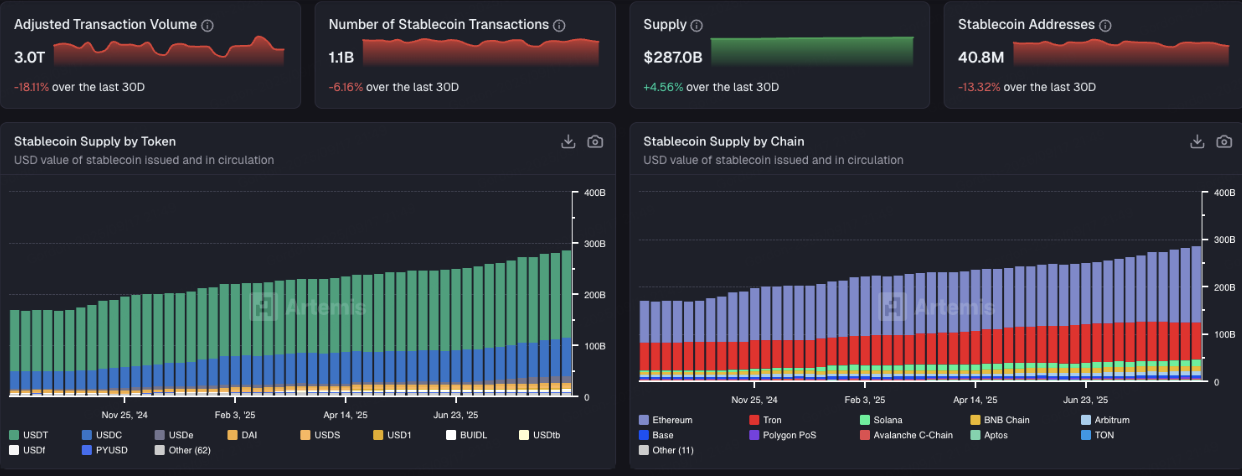

With the gradual implementation of stablecoin regulatory frameworks, stablecoins have grown to become the core infrastructure of the crypto financial system and even cross-border payment networks over the past year. Whether for individual investors' trading needs or traditional institutions exploring clearing, capital flow, and compliance pilots, stablecoins are playing the role of "digital dollars." As of September 2025, the total circulation of stablecoins has reached $287 billion, with a clear oligopolistic market structure: Tether's USDT accounts for about 59.6% of the market share, with a market capitalization exceeding $170.9 billion; Circle's USDC ranks second with a 25% share and a market capitalization of $74.2 billion. Together, they occupy nearly 85% of the market share. At the same time, emerging stablecoins such as USDe, USDS, USD1, and USDf have also rapidly risen to join the mainstream ranks.

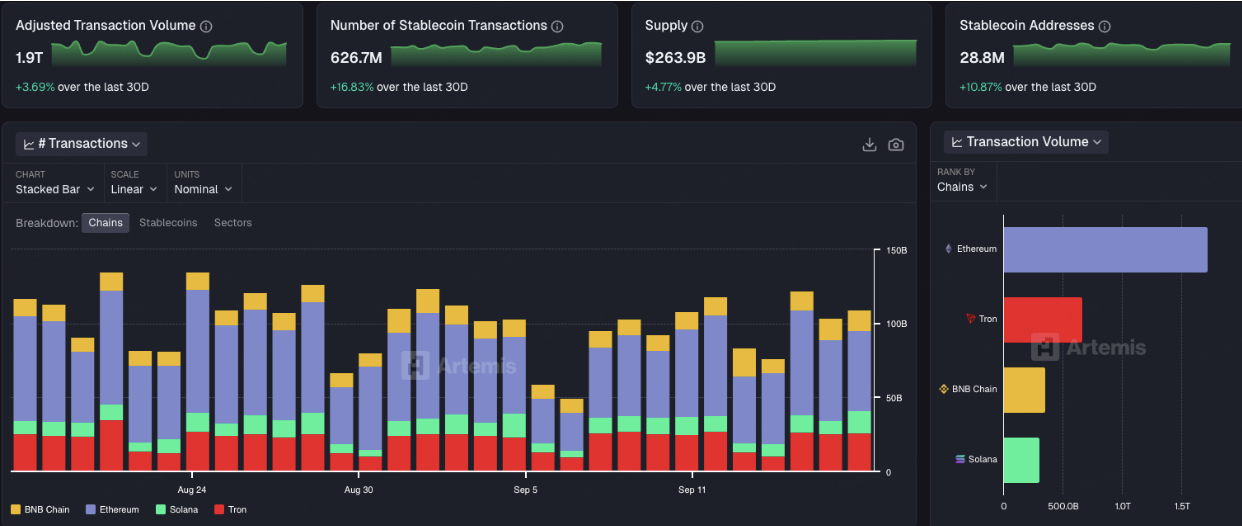

Accompanying the rapid expansion of stablecoins, underlying public chains have also become the biggest beneficiaries. In just the past month, the on-chain transaction volume of stablecoins has approached 626 million transactions, with Ethereum, Tron, Solana, and BNB Chain dominating. For example, on Tron, there were approximately 69.8 million on-chain stablecoin transactions, with an average transaction fee ranging from $0.14 to $0.25, resulting in monthly fee income from stablecoins alone reaching as high as $9.7 million to $17.4 million. However, this portion of revenue is unrelated to the stablecoin issuers and is entirely captured by the public chains. For a long time, the issuance and circulation of stablecoins have been highly dependent on networks like Ethereum, Tron, and Solana, which provide trading environments and security guarantees. However, as transaction volumes expand and application scenarios broaden, the value distribution issues of the dependency model have become increasingly prominent. Every transaction fee generated from stablecoin transfers is captured by the underlying network, while issuers can hardly share in the profits. For instance, on Tron, the annual revenue from stablecoin transaction fees alone can reach over $100 million, but the issuers' earnings are zero.

This asymmetric value distribution pattern has prompted stablecoin issuers to accelerate their exploration of independent public chain strategies. Circle launched the Arc blockchain in 2025, emphasizing compliance and payment optimization; Tether has successively released two dedicated stablecoin chains, Plasma and Stable, aiming to reclaim the value that originally flowed to Ethereum and Tron back to its own system; the Converge project promoted by the Ethena team has also entered the testnet phase, focusing on a new stablecoin ecosystem that integrates "DeFi and compliance." With the implementation of these projects, the stablecoin industry is entering a new phase of "token-public chain dual drive," where the patterns of value capture and ecosystem construction will be redefined.

2. Why Stablecoin Issuers Are Building Their Own Public Chains

The collective launch of public chains by stablecoin issuers is fundamentally about shifting from value dependency to value capture. By enhancing public chain performance and strengthening compliance, they aim to provide a dedicated public chain for on-chain users of their stablecoins, thereby expanding revenue sources and opening up new business models. The motivations can be summarized in the following four aspects:

**1. Breaking Free from Public Chain Dependency, Enhancing Value Capture

**For stablecoin issuers like Tether and Circle, the more users and transactions there are, the higher the revenue from external public chains, while their own incremental revenue is nearly zero. This imbalance in value capture has become one of the constraints on the expansion of stablecoins. By building their own chains, issuers can fully control the underlying architecture, not only optimizing the stablecoin trading experience but also ensuring that every transaction fee and ecological dividend flows into their own system.

**2. Optimizing Experience and Lowering Barriers

**Under the existing model, users need to hold tokens like ETH or TRX to pay for Gas, which is inconvenient. A dedicated chain can allow stablecoins to serve as Gas, enabling users to complete transfers and payments without needing to hold additional tokens.

**3. Enhancing Compliance Capabilities, Smoothly Connecting with Institutions

**Compliance has become a necessary option for industry development. A self-owned public chain can embed regulatory nodes, blacklists, and auditing functions to meet AML/KYC requirements, lowering the access threshold for institutions and banks and enhancing policy friendliness.

**4. Expanding Business Models and Ecosystems

**In the past, stablecoin profits mainly relied on reserve interest. After issuing public chains, they can achieve diversified growth through transaction fees, ecological applications, and developer networks. For example, Arc emphasizes cross-currency settlement, Stable and Plasma focus on payment networks, and Converge explores the DeFi + compliance path.

3. Current Stablecoin Public Chains by Issuers

Tether's Dual Public Chain Strategy: Plasma and Stable

As the world's largest stablecoin issuer, Tether launched both Plasma and Stable projects in 2025, intending to further build its own stablecoin public chain system through dual deployment. Stable targets institutions and cross-border settlements, while Plasma focuses on retail and small payments.

Plasma is a Bitcoin sidechain designed specifically for stablecoin payments, having secured $24 million in funding from Tether's parent company Bitfinex and Framework. The governance token XPL has been listed for pre-trading on major exchanges, with a market capitalization of about $6.5 billion, and is expected to officially launch on September 25. Its biggest highlight is zero transaction fees for USDT transfers, with multiple rounds of USDT staking activities being quickly snapped up, indicating its market popularity. Plasma's uniqueness lies in inheriting UTXO security by using the Bitcoin mainnet as the final settlement layer while being compatible with EVM for seamless smart contract migration. Additionally, Plasma supports native privacy features, allowing users to choose to hide addresses and amounts, and introduces BTC through permissionless bridging for low-slippage exchanges and BTC-collateralized stablecoin lending.

Stable is a payment-oriented Layer 1 blockchain specifically designed for USDT, supported by Bitfinex and USDT0, with Tether CEO Paolo Ardoino serving as an advisor. Its core positioning is to allow USDT to integrate more naturally into global payments, cross-border settlements, and institutional clearing scenarios. The biggest highlight of Stable is its native Gas for USDT, allowing users to initiate transactions without holding platform tokens, with peer-to-peer transfers completely free of Gas, significantly lowering the usage threshold. The network adopts StableBFT consensus, achieving block times of 0.7 seconds with one confirmation, and will introduce parallel processing and DAG architecture in the future to support tens of thousands of TPS, catering to both small payments and institutional clearing. Enterprises can obtain exclusive block space through GuaranteedBlockspace and use Confidential Transfer for compliant privacy transfers. Stable is EVM-compatible, providing SDKs and APIs for easy application migration; the wallet supports bank card binding, social login, and easy-to-read addresses, optimizing the Web2 experience. Its strategy is to attract users with zero Gas fees and simplified experiences, using free transfers as a draw, gradually expanding into cross-border payments, corporate finance, DeFi micropayments, and merchant acquiring, building a core payment network for USDT and occupying a hub position after forming network effects.

The Most Compliant Stablecoin Public Chain: Arc

Arc is a Layer 1 blockchain launched by Circle specifically designed for stablecoin payments and RWA assets. Its core features include using USDC as native Gas and being fully EVM-compatible, while providing specially designed Paymaster channels that allow enterprises to use other stablecoins or tokenized fiat currencies to pay for Gas, flexibly supporting diverse payment needs.

Arc's biggest advantage lies in its strong foundation in traditional finance, backed by Circle, which gives it a natural compliance advantage, allowing enterprises to operate in a regulated environment with controllable risks and regulatory compliance. To meet institutional needs, Arc has designed a series of exclusive financial tools, including the ability to tokenize traditional assets like real estate and equity, as well as solutions for building enterprise-level digital payment systems. This not only lowers the entry barriers for traditional enterprises into blockchain but also provides a safe and efficient financial infrastructure for institutions that require compliance guarantees.

DeFi + Stablecoin Public Chain: Converge

Converge is a RWA stablecoin public chain jointly created by Ethena Labs and Securitize. It focuses on establishing a settlement public chain that meets the compliance needs of financial institutions while fully leveraging the decentralized advantages of DeFi. Its core design highlights include high performance: collaborating with Arbitrum and Celestia to push performance limits to achieve block times of milliseconds, thereby reducing cross-chain asset wear costs. High compliance: USDe and USDtb are used as transaction fees, with USDtb relying on stablecoins guaranteed by the BUIDL fund to achieve high compliance. High security: introducing Securitize's regulatory technology module and a unique validator network (CVN), with staking through Ethena's ENA token to ensure network security. CVN adopts a permissioned validator model (PoS) and combines KYC/KYB mechanisms to ensure validators meet compliance requirements. This design is particularly aimed at institutional users, meeting their needs for risk management and compliance.

4. Future Development

From a long-term perspective, the collective launch of self-built public chains by stablecoin issuers will undoubtedly impact the positions of established public chains like Ethereum and Tron. Relying on the native design of stablecoins, these new chains exhibit unique advantages in their mechanisms: such as zero-fee transactions, using stablecoins directly as gas, and tailored clearing and channel solutions for institutional users. This highly vertical architecture not only lowers the barriers for user migration but also significantly enhances capital flow efficiency. The recent popularity of multiple staking activities on Plasma is a typical signal, indicating that market interest in this new type of chain is rapidly gathering. More importantly, stablecoin issuers already possess strong compliance and security systems, and this "built-in credit" background and design will greatly enhance their acceptance among traditional financial institutions, driving further inflows of institutional capital.

However, in reality, self-built public chains will not completely replace established public chains like Ethereum and Tron in the short term. A more reasonable structure is one of complementary division of labor: stablecoin public chains focus more on deterministic settlement and large-scale payment flows, providing stable and efficient infrastructure; while ETH, SOL, and others remain the core stage for innovative applications, complex financial instruments, and open ecosystems. Given that the ecosystem of established public chains like Ethereum is already highly diversified, it is difficult to shake it in the short term. The biggest potential variable may lie with TRON, whose stablecoin share heavily relies on USDT. Once Tether's dominant Stable chain matures, the core advantages that TRON relies on for survival will be weakened. Overall, the emergence of stablecoin public chains marks the entry of the crypto market into a new phase of "stablecoin-public chain dual drive," which could reshape the global payment and clearing systems and may force traditional finance to redefine its role, potentially becoming a key turning point in the evolution of global financial infrastructure in the coming years.

Risk Warning:

The above information is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no express or implied representations or warranties regarding the accuracy, adequacy, effectiveness, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial management) are inherently highly speculative and carry significant risk of loss. Past performance, hypothetical results, or simulated data do not necessarily represent future results. The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully assess whether participating in such investments is suitable for you based on your investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。