Source: cryptoslate

Translation: Blockchain Knight

The rapid decline of the dollar has reignited the dream of "super Bitcoinization" among Bitcoin advocates.

However, there is little evidence to suggest that the demise of the dollar would mean victory for Bitcoin; rather, there are numerous signs pointing to widespread social chaos.

The Demise of the Dollar: Lessons from Currency Collapse

Fernando Nikolic, former vice president of Blockstream and a witness to Argentina's financial turmoil, warns that Bitcoin believers who anticipate the end of fiat currency do not understand what they are wishing for.

"Bitcoin players celebrating the collapse of the dollar have no idea what they are asking for… This is not liberation; it’s your grandmother having to eat cat food because her savings evaporated… The demise of the dollar does not mean victory for Bitcoin."

During a true currency collapse, basic necessities like water and food (rather than digital assets) become the only things of real value.

Many Americans fantasizing about a sudden transition to a Bitcoin economy have never actually experienced a real societal collapse.

Nikolic warns that reality is far more chaotic than they imagine, and they would not welcome the anticipated outcome of the dollar's demise.

Dismal Scenes Across the U.S. Point to a Stressed Fiat System

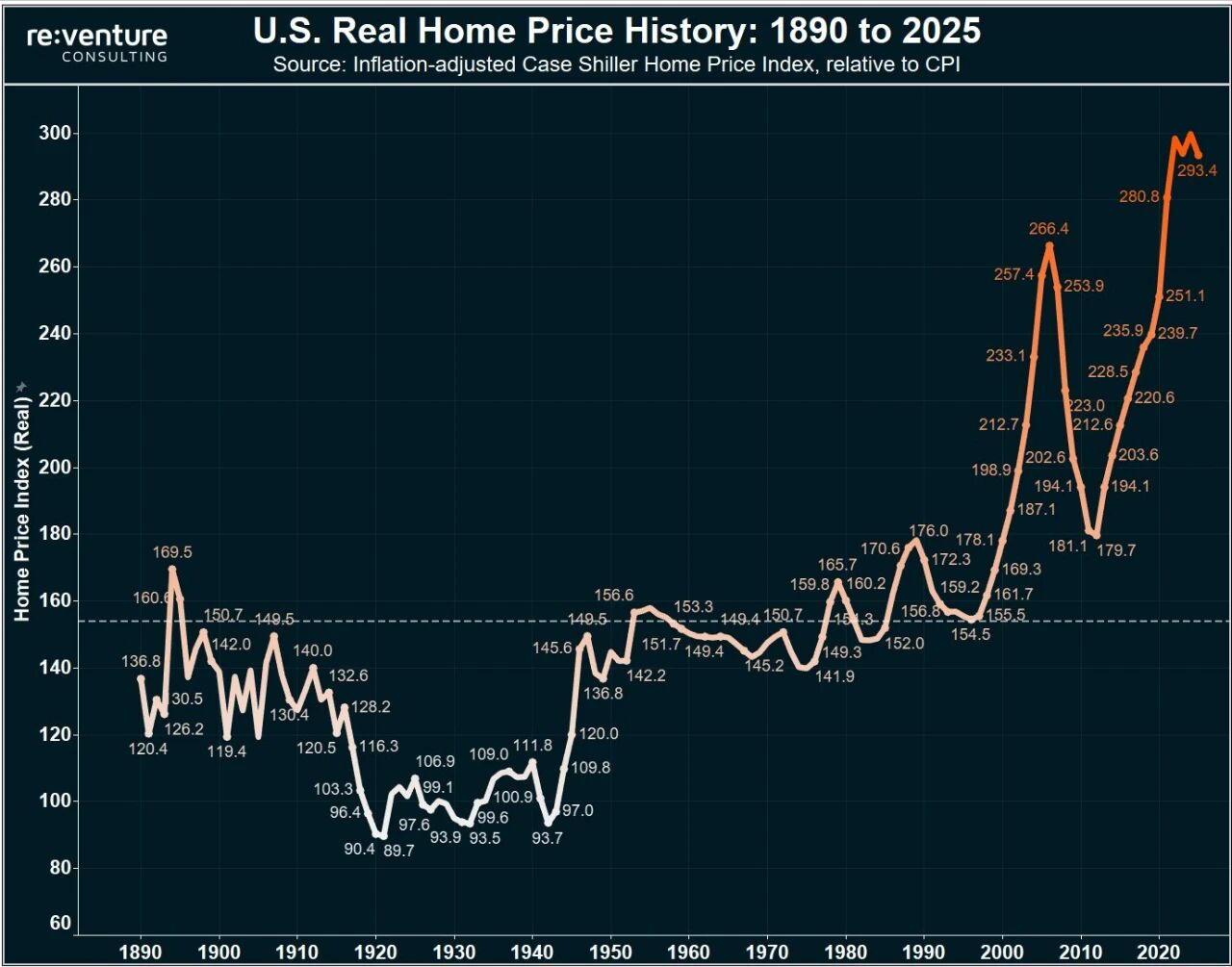

The U.S. housing market has never been so unattainable. The median price of single-family homes reached an all-time high in 2025, with required income being double that of 2019.

The price-to-income ratio has hit a historic high, homeownership rates have fallen to historic lows, and millions of renters are spending 30% to 50% of their income on rent.

The imbalance between wages and rising housing costs means that most potential homebuyers are excluded from the market, and social pressure continues to mount.

To make matters worse, the U.S. unemployment rate slightly rose to 4.3% in August 2025, the highest level since the end of 2021, with a broader underemployment rate reaching 8.1%.

These figures mask the pain caused by the labor market's inability to keep pace with inflation or stagnant real wages.

Against the backdrop of rising unemployment and soaring housing prices, U.S. national debt surpassed $37 trillion in August 2025, more than double the size of the national economy.

Borrowing costs continue to rise, with interest payments on national debt even exceeding defense spending.

The Congressional Budget Office projects that due to borrowing and social spending expansion during the pandemic, debt levels will reach this milestone five years earlier than originally planned.

Adding $1 trillion in debt every five months is unsustainable and could drive up interest rates and crowd out investment.

When Fiat Fails, Bitcoin Will Not Automatically Win

The dollar index has fallen over 10% against major currencies this year, marking the steepest decline since 1973. This drop is related to unpredictable economic policies, protectionism, and expansionary tax cuts.

As the dollar depreciates, import prices rise, the purchasing power of the average American declines, inflation worsens, and household budgets tighten.

Depreciation further pressures housing, employment, and debt, exacerbating systemic vulnerabilities.

All these grim indicators paint a bleak picture of the foundations of the U.S. economy, while the dollar is often seen as a barometer for other economies around the world. If the world's strongest currency is under pressure, what does that mean for the entire fiat system?

Despite many Bitcoin advocates proclaiming "Bitcoin can solve this problem," the idea of super Bitcoinization (the belief that people will massively turn to Bitcoin when fiat fails) is a dangerous fantasy.

This perspective ignores historical and social realities. When currency collapses, trust evaporates, and basic survival needs replace abstract ideals.

Nikolic, rooted in the experience of Argentina's fiat currency collapse, testifies that the hope for so-called "liberation" is naive: collapse only means poverty, turmoil, and suffering.

When social safety nets and market norms disintegrate, financial chaos hits the most vulnerable the hardest.

Bitcoin may offer an alternative to inflationary fiat currencies, but the demise of the dollar does not bring freedom; it brings disaster and suffering for the majority.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。