Hotcoin Research | September 15-19, 2025

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $4.11 trillion, with BTC accounting for 56.91%, which is $2.34 trillion. The market cap of stablecoins is $290.7 billion, with a 7-day increase of 1.47%. For the first time in three months, there has been a weekly data decline, with USDT accounting for 58.9%.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: ASTER with a 7-day increase of 558.56%, IMX with a 7-day increase of 61.74%, M with a 7-day increase of 31.85%, AVNT with a 7-day increase of 285.91%, and DRIFT with a 7-day increase of 52.16%.

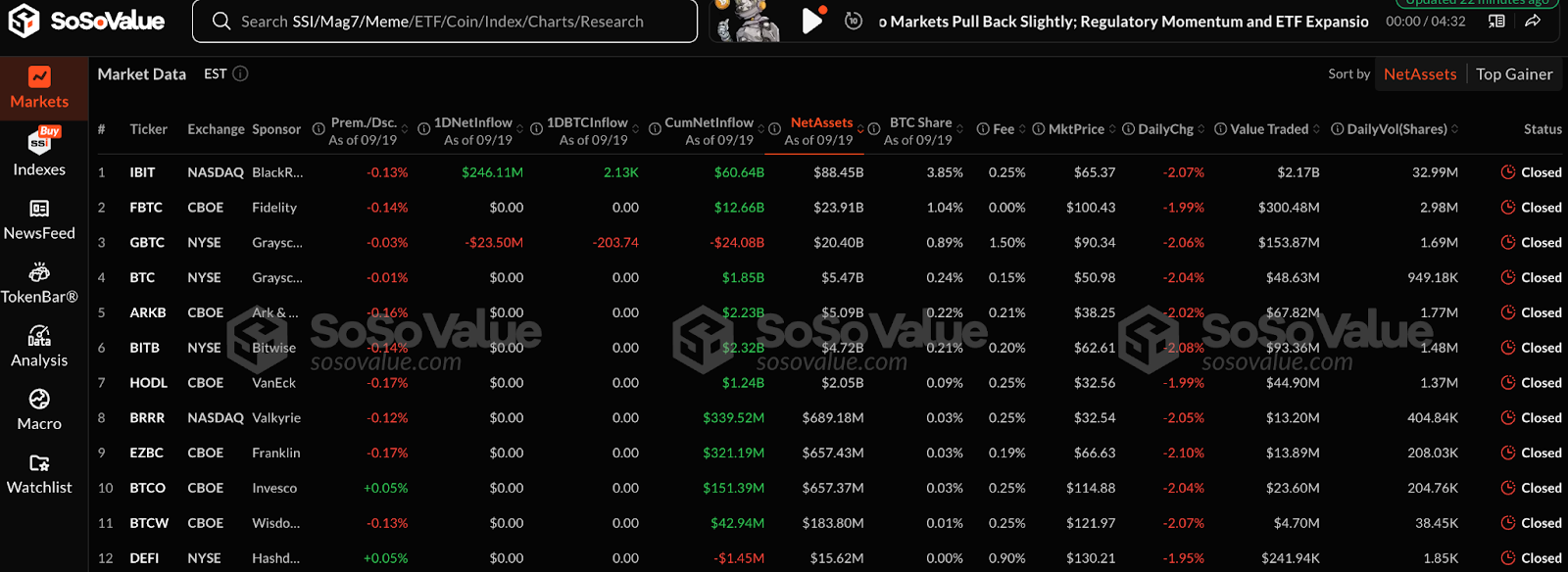

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $886.7 million; the net inflow for Ethereum spot ETFs in the U.S. was $557.2 million.

Market Forecast (September 22-26) :

The current RSI index is 47.89, indicating a neutral position. The Fear and Greed Index is at 49 (maintaining neutrality). Notably, the Altcoin Season Index is at 86 (higher than last week's index), indicating a FOMO range.

BTC core range: $113,400-120,000

ETH core range: $4,438-4,956

SOL core range: $217-260

For short-term traders, it is recommended to:

Focus on key price levels: Closely monitor the aforementioned support and resistance levels. A drop below support (such as BTC $113,400, ETH $4,438, SOL $217) requires caution for short-term pullback risks. A breakout above resistance (such as BTC $117,000, SOL $250) may open further upward space.

Manage risks: Be sure to set stop-loss orders. After an interest rate cut, overbought conditions can easily lead to pullbacks. Short-term trading is volatile, so avoid blindly chasing prices.

For long-term investors, it is recommended to:

Buy on dips: If the market pulls back to key support levels (such as around BTC $115,000, ETH in the $4,060-$4,438 range, SOL around $217), consider buying quality assets in batches.

Be patient: Long-term investments should not be swayed by short-term fluctuations. Ignore short-term market noise and maintain a dollar-cost averaging or holding strategy.

Understanding Now

Review of Major Events of the Week

SEC approves multi-cryptocurrency ETFs: This is the first ETF in the U.S. covering multiple mainstream cryptocurrencies (Bitcoin, ETH, XRP, SOL, ADA). More importantly, the SEC has significantly shortened the ETF listing review period (from 240 days to 75 days). This means that the speed of cryptocurrency ETF listings will significantly accelerate in the future, and more similar products are expected to emerge, providing a more convenient channel for traditional financial markets to invest in cryptocurrencies, which is a major long-term positive;

Forward Industries invests heavily in SOL: This Nasdaq-listed company plans to raise $4 billion through a new issuance, primarily to increase its holdings of Solana (SOL) tokens. This is not its first large purchase of SOL, having previously acquired $1.58 billion worth of SOL. This reflects the strong confidence and strategic layout of traditional listed companies in specific crypto assets, which may attract more institutional attention to SOL;

Coinbase user data leak incident disclosed: This incident resulted in the leakage of sensitive information such as names, addresses, identification documents, and bank account details of 69,461 users. The cause was not a breach of Coinbase's own system, but rather hackers bribing its outsourced customer service personnel in India;

On September 15, Native Markets won the Hyperliquid stablecoin USDH bidding and has been granted the use of the USDH code on Hyperliquid;

On September 19, PayPal's dollar stablecoin PYUSD expanded to the Aptos public chain through LayerZero, further enhancing its stablecoin ecosystem.

Macroeconomics

On September 18, according to CME's "FedWatch" data, the probability of the Federal Reserve cutting interest rates by 25 basis points in October is 87.7%, while the probability of maintaining rates is 12.3%;

On September 18, the Hong Kong Monetary Authority lowered the benchmark interest rate by 25 basis points to 4.50%, following the Federal Reserve's overnight rate cut of 25 basis points;

On September 18, the Federal Reserve lowered the benchmark interest rate by 25 basis points to 4.00%-4.25%, in line with market expectations, resuming the rate cuts that had been paused since last December;

On September 17, the Bank of Canada announced a 25 basis point cut to the overnight rate target, aligning with market expectations;

On September 18, the number of initial jobless claims in the U.S. for the week ending September 13 was 231,000, with an expectation of 240,000, and the previous value was revised from 263,000 to 264,000.

ETF

According to statistics, from September 15 to September 19, the net inflow for U.S. Bitcoin spot ETFs was $886.7 million; as of September 19, GBTC (Grayscale) had a total outflow of $24.034 billion, currently holding $20.421 billion, while IBIT (BlackRock) currently holds $88.093 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $152.49 billion.

The net inflow for U.S. Ethereum spot ETFs was $557.2 million.

Envisioning the Future

Upcoming Events

Korea Blockchain Week 2025 will be held in South Korea from September 22 to 28;

ETHGlobal New Delhi will take place in New Delhi, India from September 26 to 28, 2025;

TON Dev Bootcamp will be held on September 27 from 1:00 PM to 6:00 PM in Macau. This event is a Web3 launch day for developers, where participants can learn about TG mini-program development and TON smart contracts, with the official TON team providing instruction and a professor from the University of Macau sharing insights;

TOKEN2049 Singapore 2025 will be held in Singapore from October 1 to 2, 2025.

Project Progress

OSL Group has been included in the FTSE Asia Pacific Small Cap Index, effective September 22;

Coinbase will launch index futures trading including Nvidia and BlackRock Bitcoin ETFs on September 22. This index combines leading tech stocks with BlackRock's spot Bitcoin and Ethereum ETFs, covering Coinbase's own stock as well as stocks from Apple, Microsoft, Alphabet (Google's parent company), Amazon, Nvidia, Meta, and Tesla. The index will use an equal-weight calculation method, with each of the 10 components accounting for 10% of the index;

DWF Labs' stablecoin project Falcon Finance plans to conduct a community public sale of FF tokens on BuidlPad from September 22 to 23, aiming to raise $4 million;

Huma Finance's second part of the first quarter airdrop will start on September 26 at 9:00 PM, with the claim deadline set for October 26 at 9:00 PM.

Important Events

On September 25 at 8:30 PM, the U.S. will announce the number of initial jobless claims for the week ending September 20 (in thousands);

On September 26 at 8:30 PM, the U.S. will announce the year-on-year core PCE price index for August.

Token Unlocks

Venom (VENOM) will unlock 59.27 million tokens on September 25, valued at approximately $8.95 million, accounting for 2.28% of the circulating supply;

Jupiter (JUP) will unlock 53.47 million tokens on September 28, valued at approximately $28.22 million, accounting for 1.75% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers will also interact with you live, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。