Originally, I thought today's homework would be easy to write, but in reality, it was very difficult, mainly because $BTC dropped. Many friends are worried that there might be some risks. I also see that, as of now, I haven't found any negative information, and the US stock market next door is performing quite well. During the trading session, the Nasdaq even broke its historical high, and while the S&P is still a bit short, it's not far off.

It can be said that the US stock market is more closely related to macroeconomic factors, and its response to policies is quicker. That's why I believe that when the US market is rising, even though Bitcoin has seen some declines, it is likely not a systemic risk. Moreover, from the trend, the correlation between BTC and the Nasdaq is still quite high. Although I can't pinpoint the reason for the drop, I feel that as long as it is not a systemic risk, there shouldn't be much of a problem.

Tomorrow is the weekend, and liquidity will be worse, which could lead to greater volatility. In the coming week, there are no foreseeable key pieces of information, so the likelihood of BTC's movement being influenced by the US stock market is still the highest. I still have 20% of my long positions that I haven't exited.

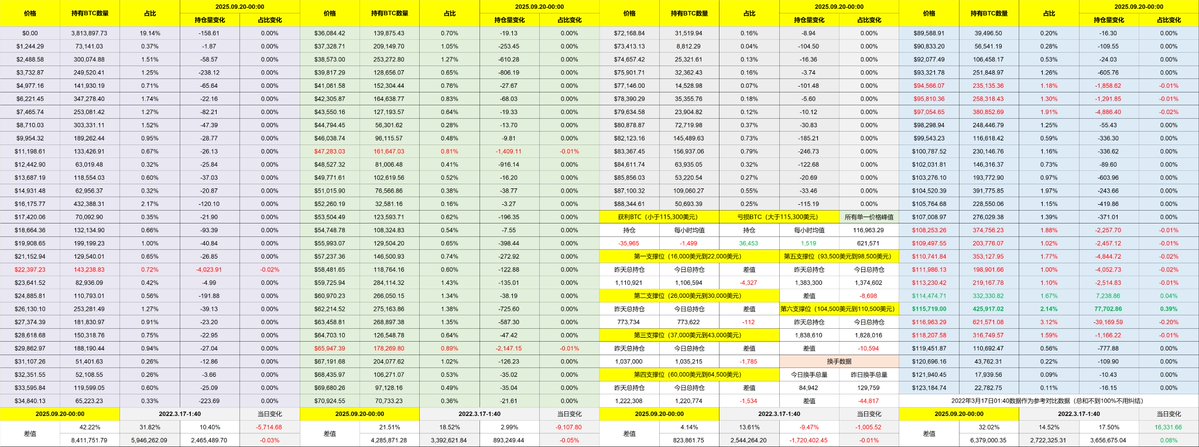

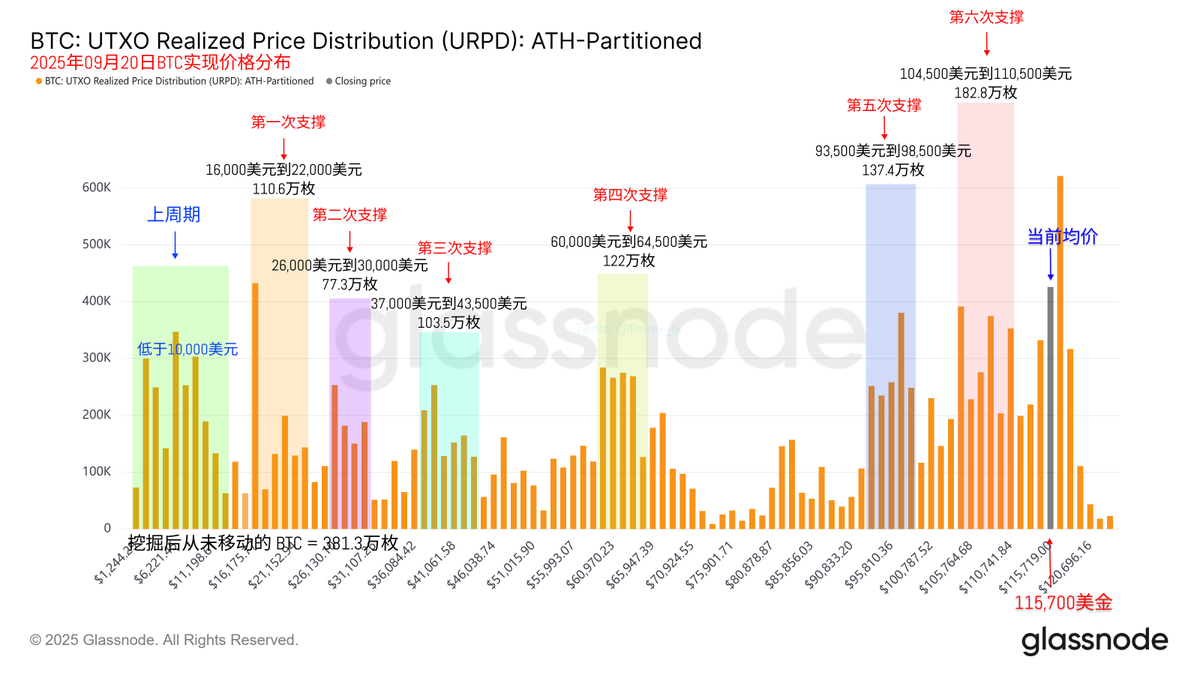

Looking back at Bitcoin's data, the turnover rate has actually decreased, which aligns with our expectations. For a long time, as long as there is no negative information, the lower the price of $BTC, the lower the turnover rate tends to be. This also indicates that low prices are unlikely to cause panic among investors, as more investors have transformed into long-term holders.

Other data seems normal, with a fairly balanced distribution of chips above $111,000, and I haven't seen any signs of panic. The only concern is the weekend mentioned earlier; I hope there won't be any unexpected issues when liquidity decreases. Let's hope for a stable weekend.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。