Coin Stocks? RWA? How to Create Trading Pairs Between Cryptocurrencies and Stocks (Part Two)

Many people believe that RWA is simply coin stocks, either stocks increasing their narrative through cryptocurrency strategic reserves or stocks being put on-chain, but these are not the best ideas. I have previously discussed helping cryptocurrency companies go public; in fact, these are all very basic applications.

For stocks, especially those on NASDAQ, liquidity is much better than on-chain. For example, NVIDIA $NVDA has a daily trading volume of around $30 billion, while the highest daily trading volume I’ve seen for "NVIDIA" on-chain, which is Ondo, is only about $106 million, which is less than 1% of the stock's volume.

This means that putting stocks on-chain is itself a "pseudo-demand." Most traditional investors can open accounts with centralized brokers, and aside from some countries with currency controls, trading U.S. stocks is not difficult. So how much demand can there really be for traditional stocks that have already gone public on-chain?

Even if we consider helping cryptocurrency companies go public, while the demand may be greater than for U.S. stocks on-chain, the ceiling is still very limited. However, if we can achieve real-time trading pairs between cryptocurrencies and U.S. stocks, the implications would be much greater. This is the direction I am currently researching. As of now, in terms of compliance, there are no issues for professional investors, but for the vast majority of retail users (individual investors), there are no compliant pathways except in Switzerland and Germany.

I have made a hypothesis about the application scenario of coin stock trading pairs. Suppose a listed company has dividends, with a monthly dividend of 0.5% paid on the first of each month. Let’s say this company is called ABC, and the stock is called $ABC, and it has established a trading pair between ABC and $BNB. Why BNB?

Let’s assume that the BNB holding yield is 1% per month, with four distributions, but at irregular intervals. Then, within a natural month, users can already receive a 1% yield from BNB. If they exchange it for ABC the day before the ex-dividend date, they can enjoy the 0.5% dividend from ABC. After the dividend, they can exchange ABC back to BNB (or continue holding ABC).

Here, some may ask, isn’t it possible that the stock price will drop after the ex-dividend date? This issue can be mitigated by using CME to hedge and lock in the price of BNB exchanged for ABC, thus avoiding losses from a drop in ABC's price.

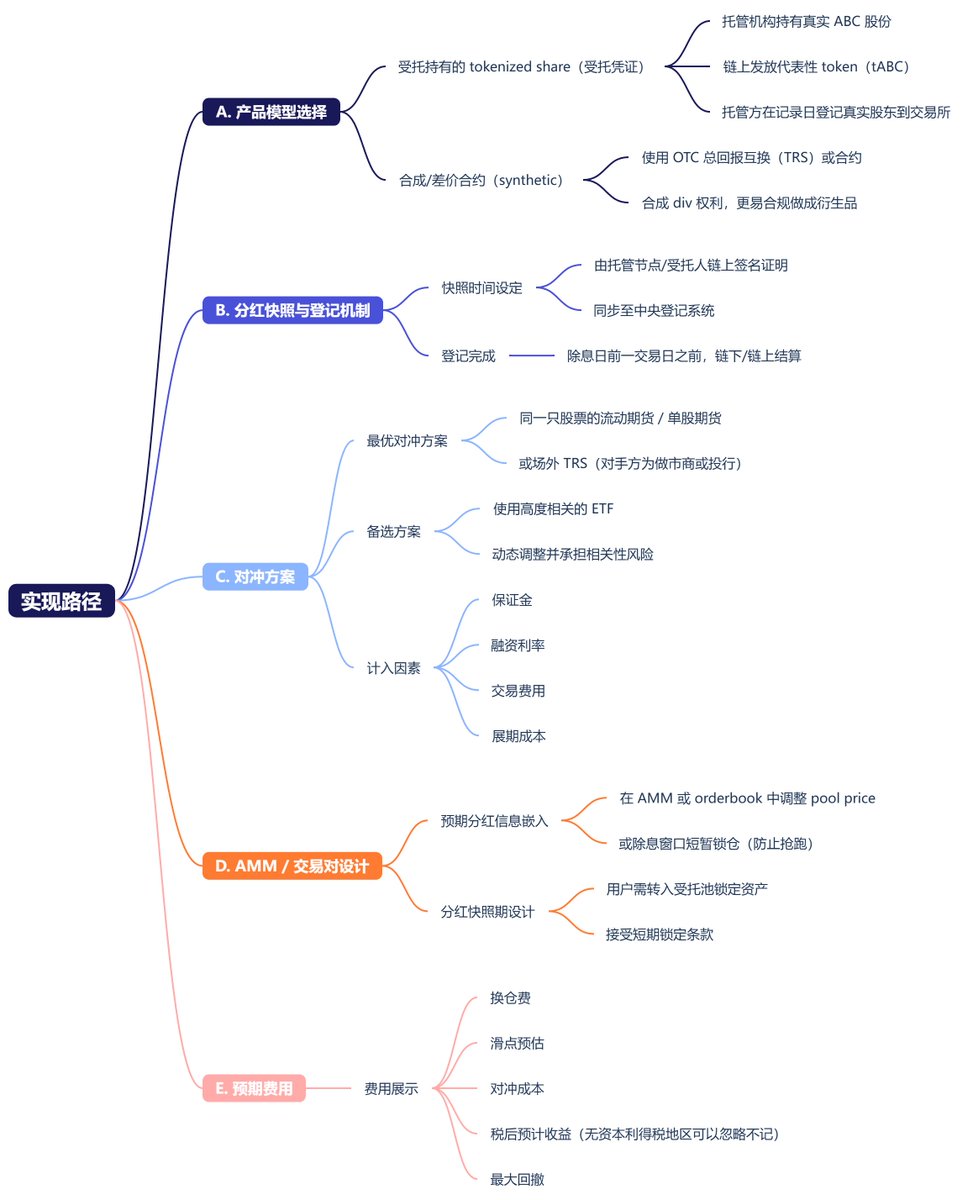

This sounds simple, but the logic of implementation is more complex. I have drawn a diagram to illustrate this.

I also considered that if it’s on-chain, there may be slippage and impermanent loss, which might not cover the 0.5% yield obtained by users. If it’s a centralized method, and a fee waiver plan is implemented, it should reduce friction.

Further thinking!! Very important!!!

Earlier, we assumed that ABC’s own ability to generate revenue could yield a monthly dividend of 0.5%. Now, what if the listed company or ETF essentially holds 100% of BNB, which can achieve a monthly yield of 1%, and this company uses all BNB earnings to distribute dividends to shareholders? Furthermore, if this company not only holds BNB but also quantifies BNB's earnings, resulting in a monthly yield of 3% (hypothetically), what effect would that have?

You must have thought of something smart!

This is the real application of coin stock trading pairs or RWA in my mind. It connects the liquidity between cryptocurrencies and listed companies (ETFs). This is the combination of real assets and virtual assets. Of course, this is still just a prototype, and there are many challenges and difficulties ahead, especially regarding compliance. Additionally, how to design a business profit model that allows stocks or ETFs to achieve a flywheel effect through dividends, while this flywheel needs to exceed the friction of trading pairs, are all details that need to be refined.

But as the saying goes, there are always more solutions than problems. The essence of this plan is dual settlement on-chain and off-chain. I have never worried about trouble; what I fear is going down the wrong path. As long as the path is not wrong, results will surely follow.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。