Written by: Eric, Foresight News

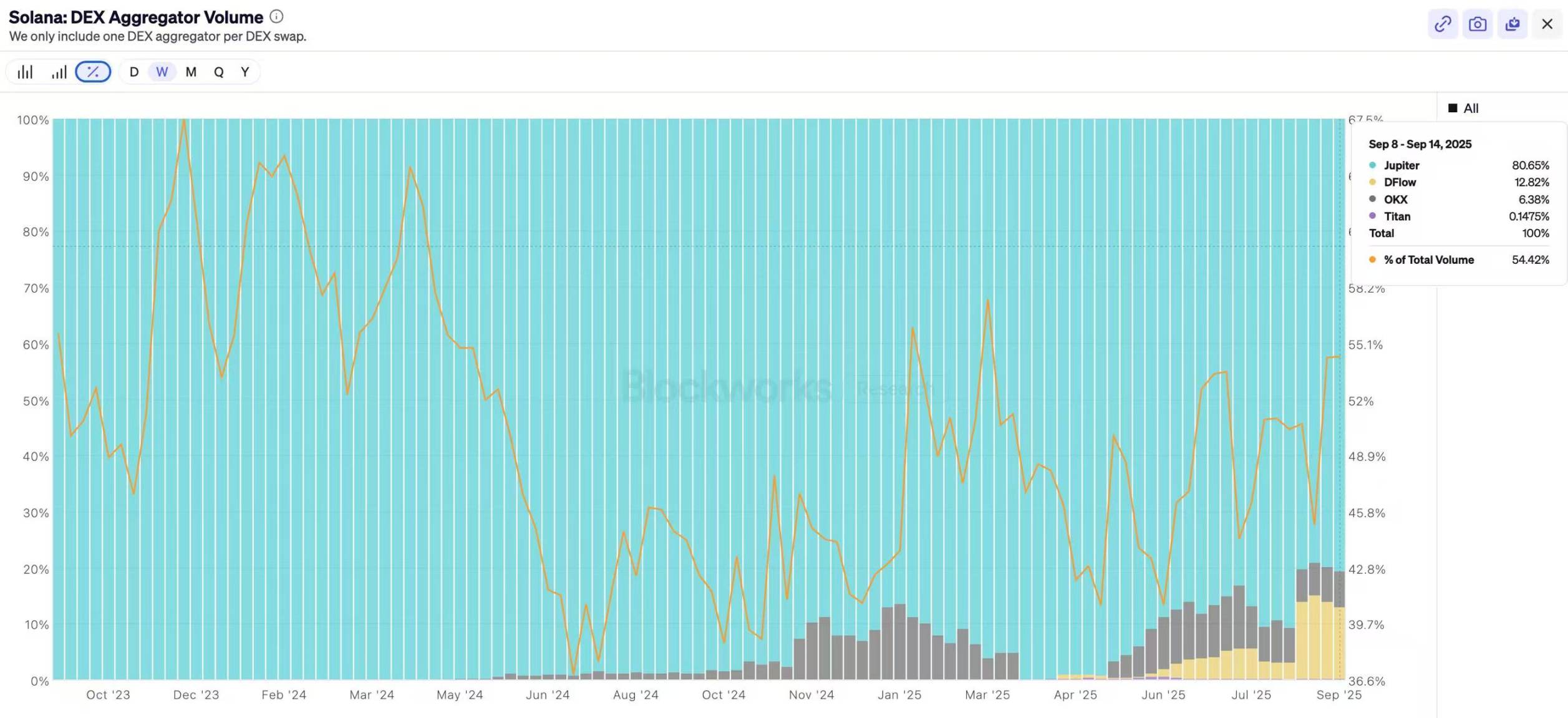

Since its launch in the fourth quarter of 2021, until the end of the first quarter of 2024, Jupiter has held 100% of the market share for DEX aggregators on Solana. Starting in the second quarter, the built-in aggregator in the OKX wallet has slightly captured some market share. In April of this year, DFlow began to appear in the statistical charts, and although its market share in April was just slightly above 0.6%, by last month, this figure had risen to nearly 8.5%. Over the past two weeks, DFlow's market share has stabilized above 10%.

In 2022 and 2023, DFlow completed two rounds of financing, raising $2 million and $5.5 million respectively, with investors including well-known market makers such as Cumberland DRW and Wintermute. DFlow's founder, Nitesh Nath, was previously a quantitative researcher at Cumberland DRW.

It is not difficult for a newly emerging DEX aggregator to capture a portion of the market share through operations and marketing, but the emergence of DFlow indeed brings the possibility of greater profits for market makers while also providing users with better prices. To understand what DFlow is actually doing, we first need to discuss "conditional liquidity."

Conditional liquidity is a mechanism proposed by DFlow to differentiate the nature of order flow, which essentially introduces a third party called a "Segmenter" to determine whether the user placing the order is a human or a bot, and whether they are an ordinary user or a large institution with information advantages. The criteria for judgment are not mysterious; for example, orders placed after connecting a browser extension wallet or orders placed through the aggregator's frontend, as well as using tools like Cloudflare to determine if the transaction is made by a human. This way, DFlow can directly reject MEV transactions and provide differentiated services for different trading parties.

Unlike other aggregators, DFlow does not accept all incoming trades indiscriminately; instead, it assesses the user's category before deciding whether to accept the trade and how to accept it. In terms of "how to accept trades," DFlow also has a special design.

This special design is essentially "order flow monetization," a model that Robinhood used to become a popular brokerage. Simply put, Robinhood does not directly send users' trade orders to exchanges; instead, it provides user orders to large market makers, who then return a portion of the profit from the price spread back to Robinhood. This model is known as "payment for order flow (PFOF)."

Let’s take an example: Suppose stock A has a current bid price of $50 and an ask price of $50.25. At this time, Robinhood receives a buy order for 100 shares and a sell order for 100 shares. Normally, the buy order would execute at $50.25, while the sell order would execute at $50. However, if you have access to both orders, you could buy the sell order at $50.1 and then sell the stock you just bought at $50.15 to the buy order.

In this way, the seller sells for $10 more, the buyer saves $10, and as the intermediary, you earn a $5 spread, benefiting all three parties. Large market makers typically have vast amounts of cash and stocks on hand. Robinhood sends user orders directly to market makers, who can internally process them and share a portion of the profits from the price spread with Robinhood, which is also the direct reason why Robinhood does not charge trading fees.

At this point, we can more clearly understand DFlow's design philosophy, which captures the price differences that can exist even in DEXs. The Swap API provided by DFlow allows wallets to customize the price spreads for ordinary user orders (non-toxic order flow) and toxic order flows (including large institutional orders that may have advance knowledge of market trends), and it allows wallets connected to the API to earn a certain percentage of the price spread and choose whether to share the earnings with the trading users.

By optimizing execution prices based on the nature of order flow and price spreads, and minimizing losses for market makers caused by toxic order flows, various AMMs can achieve higher profits or reduce losses through DFlow. This incentivizes AMMs, especially the prop AMMs mentioned in my article “Quietly Capturing 40% of DEX Market Share: Unveiling the 'Invisible Champion' on Solana”, to offer better quotes.

DFlow offers two trading modes: Declarative Swaps and Imperative Swaps. Imperative Swaps execute trades using the computed best path directly, applicable for trades that need to be executed immediately or require a defined path. The Declarative Swaps process is relatively more complex; when a user wants to trade, DFlow first provides the possible "worst outcome" and maximum slippage based on quotes from "reliable" DEXs. If the user agrees, DFlow will first escrow the assets the user wants to trade through a contract, and then use the conditional liquidity mechanism to select the best quotes and paths for execution.

Declarative Swaps are built on conditional liquidity, requiring traders to be ordinary users; otherwise, the delayed quotes from market makers could be exploited by toxic order flows, leading to losses for the market makers. For ordinary users, since the trading volume is not large, even if the actual execution spread is slightly higher, it will not have a significant impact.

DFlow's conditional liquidity and Declarative Swaps mechanisms provide prop AMMs with an opportunity to enter the long-tail asset market. Due to the significant price volatility of long-tail assets, market makers can easily incur losses. DFlow's mechanism allows prop AMMs to participate in some relatively stable long-tail assets, providing better quotes during periods of low asset volatility through delayed quotes and order flow matching, and generating additional profits through proactive market making.

Previously, DFlow executed part of the orders for SOL purchased by DAT company Forward Industries, proving that its influence is gradually expanding. With close ties to market makers and the ability to offer better quotes than ordinary aggregators, DFlow's unique mechanism design will become a powerful tool for its expansion. However, as DeFi becomes increasingly specialized, whether we should celebrate or be concerned is another question worth pondering.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。