In the past decade, the sharing economy has been one of the most representative innovations in global business. From the initial Airbnb turning idle rooms into hotels, to Uber transforming cars into taxis, and the explosion of local life services like WeWork and Didi, global users have realized for the first time that dormant resources can be transformed into usable value through the matchmaking and rule reconstruction of digital platforms.

Of course, this model also faces some challenges, such as trust issues, high commission rates, opaque user data, and inefficient capital flow. Today, RWA is injecting new vitality into the sharing economy, promising to address previous pain points.

RWA refers to the tokenization of tangible or intangible assets from the real world through blockchain technology, allowing them to be divided, traded, and managed like crypto assets. Each token represents a certain ownership or interest in that asset. According to the latest data from RWA.xyz, the total market value of global on-chain RWA assets has surpassed $30 billion, with traditional financial giants like BlackRock and Franklin Templeton deeply involved.

In this wave, Piggycell is taking everyday infrastructure as its entry point, digitizing the mobile power bank network into an investable asset, becoming a pioneer in the physical infrastructure RWA field.

Unlike other projects that start from scratch, Piggycell is an absolute leader in the shared mobile power bank sector in South Korea, holding a 95% market share. It has deployed over 13,000 charging stations nationwide, with more than 100,000 power bank devices and 4 million paying users.

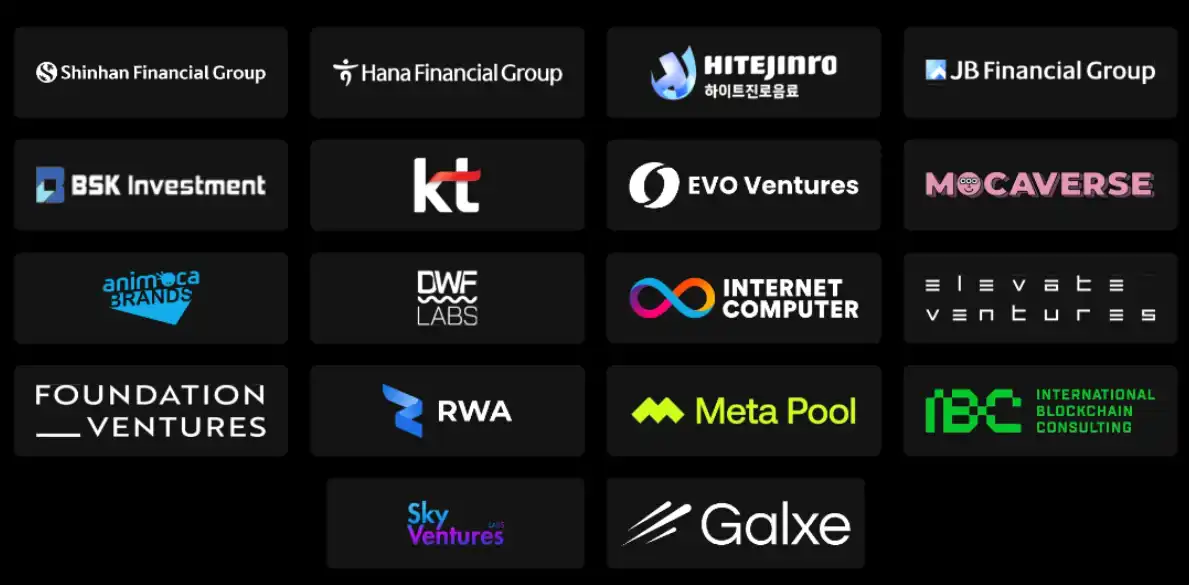

In a recent public test, Piggycell generated over 9.4 million on-chain records in just two weeks. Additionally, Piggycell completed a $10 million seed round financing, with investors including local Korean institutions like Shinhan Financial Group and Hana Financial Group, as well as top global Web3 investors like Animoca Brands and DWF Labs.

From a technical and background perspective, Piggycell has received high recognition from the industry and capital. Introducing blockchain technology on a solid business model and deep operational foundation is not merely a trend, but a means to enhance the transparency and efficiency of the entire system, bringing fundamental innovation to the sharing economy model.

Charging and Dominating Mining: Reshaping the Shared Power Bank Business

Piggycell does not attempt to recreate a blockchain version of shared power banks but starts from the more fundamental aspects of asset value confirmation and circulation. The business logic of the sharing economy is sound; the issue lies in the platformization and centralization of the mechanism design. If combined with the transparency of blockchain, the incentive mechanism of tokenization, and the automatic execution of smart contracts, it is possible to redefine the profit distribution model of the sharing economy.

Piggycell's Web3 transformation is not simply about adding a token but involves systematic design around three aspects: data confirmation, asset on-chain, and profit sharing, upgrading itself from a pure sharing platform to a composite protocol integrating RWA, DePIN, and the sharing economy.

Under the Web3 framework, Piggycell integrates blockchain reward mechanisms into the shared charging business, forming two core models: "Charge-to-Earn" and "Dominate-to-Earn," allowing both consumer behavior and infrastructure contributions to be converted into investment returns.

In traditional sharing models, users are the sole payers. However, Piggycell's Charge-to-Earn model allows users to earn a certain amount of PIGGY token rewards while renting power banks, in addition to completing the charging. The reward amount is distributed based on actual usage and the normal operating time of the devices, ensuring that incentives align with user behavior. This model transforms "daily consumption" into "asset accumulation," significantly enhancing user stickiness and sense of participation. Just as Play to Earn ignited the popularity of GameFi, Piggycell's Charge-to-Earn also has the potential to ignite DePIN.

If Charge-to-Earn targets ordinary users, then Dominate-to-Earn incentivizes contributors to the infrastructure. Piggycell allows individuals and communities to control shared energy infrastructure through NFT-based ownership. NFTs represent the digital twin of each Piggycell node's physical device. Anyone can purchase an NFT linked to a mobile power bank in a specific geographic area, becoming a shareholder of that area's infrastructure. NFT holders can proportionally receive real cash flow dividends generated by the devices. For example, a user can purchase an NFT linked to a power bank near Seoul University, and as students regularly use that power bank, the NFT holder will receive PIGGY token rewards based on tracked power consumption.

This model allows ordinary people to participate in the physical infrastructure of the sharing economy with a low threshold, enjoying the long-term value brought by stable cash flow, breaking the traditional sharing economy's issue of opaque returns for asset contributors.

Despite the complexity of the underlying technology, Piggycell maintains a high level of usability in user experience, achieving Web2-level convenience. Users only need to scan the QR code on the charging station to borrow a mobile power bank, supporting mainstream payment methods like WeChat Pay, Kakao Pay, and Naver Pay. The app interface is intuitive and clear, displaying real-time charging progress, battery levels, and reward points. The entire process requires no app switching or additional operations, significantly lowering the usage threshold. After charging, users can return the device at any station, further enhancing convenience. This seamless experience breaks the stereotype that blockchain applications are complex and difficult to use, allowing ordinary users to easily participate in Web3.

Gaining Dual Recognition from the Market and Capital through Technical Strength, Global Expansion

Piggycell is not merely a concept existing in a white paper; it is a project that has been validated in both technical implementation and commercial practice.

In just two weeks during the testing phase, its on-chain system generated over 9.4 million transaction records. This is not just a numerical breakthrough; the deeper significance lies in the high-frequency usage scenarios of the shared power bank business, which impose stringent requirements on blockchain throughput and stability. Piggycell's system can handle millions of transactions, proving its reliability and scalability in technology.

Moreover, every user transaction and every profit distribution is recorded on-chain, validating the authenticity of Piggycell's decentralized vision and providing users with unprecedented transparency and trust. This practice makes Piggycell a truly data-supported DePIN and RWA project, sharply contrasting with those that remain at the conceptual stage.

As South Korea's largest shared power bank network, Piggycell has established a market share and user scale that leads its competitors. Its executives have clearly stated that Piggycell is not just a project existing in a white paper; it is a company that creates value through actual operational performance and stable cash flow.

Currently, Piggycell has attracted $10 million in seed round investment from listed Korean companies such as Shinhan Financial Group, Hana Financial Group, HiteJinro, JB Financial Group, and well-known Web3 institutions like Animoca Brands, DWF Labs, and Galxe.

Such a scale of financing not only provides ample funds for Piggycell's global expansion but also strongly endorses its innovative model and long-term growth potential from international investors. Moving forward, Piggycell will expand its decentralized energy infrastructure globally.

Reshaping the Sharing Economy with RWA Strategy, Piggycell is About to Launch TGE

According to the roadmap, Piggycell will launch an Energy-as-a-Service (EaaS) platform, a fully decentralized marketplace where individuals, small businesses, and even chain stores can register, lease, or sublease energy equipment, including mobile power banks, wall-mounted chargers, and mobile charging stations. This model empowers users with new roles, transforming them from passive consumers into active infrastructure providers. Through smart contracts, interactions between lessors and providers become transparent and automated, with a programmable fee structure and usage-based payment system ensuring fair distribution of interests among all parties. Additionally, the platform will introduce equipment health audits and insurance options to establish a reliable trust and verification system, ensuring the healthy operation of the entire market.

The potential of this model can be clearly evidenced by the practices of the well-known electric vehicle brand NIO. NIO's V2G technology allows electric vehicles to function as distributed energy storage units that can interact bidirectionally with the grid. This means users can charge their cars at lower electricity rates during the night and sell excess electricity back to the grid during peak rates, thus earning additional income.

If NIO's platform is combined with Piggycell's EaaS platform, it will bring broader prospects. When NIO users connect to Piggycell's platform, they can diversify their income by leasing the energy storage function of their vehicles during idle times to other scenarios needing mobile energy, such as outdoor activities or temporary stalls. This model creates additional income beyond selling electricity to the grid. More importantly, the Piggycell platform can connect with other services like navigation applications or electric vehicle delivery platforms through APIs, achieving cross-platform interoperability. This model not only reduces users' energy replenishment costs but also empowers them to profit from energy trading, turning their vehicles into energy assets with financial attributes.

In addition, Piggycell will leverage its robust on-chain data to accurately calculate carbon savings and green charging events. These verified activities can be linked to carbon credit issuance and sold or retired by individual users or businesses. Piggycell is expected to provide decentralized real-time ESG compliance and reporting solutions through this approach, becoming a prime example of ESG investment.

Currently, Piggycell has become the focus of the South Korean Web3 community, with the industry generally optimistic about its growth prospects under the RWA strategy. The official announcement states that Piggycell will hold a series of events during the Korea Blockchain Week (KBW) to engage deeply with the community.

At the same time, Piggycell plans to launch its TGE in the fourth quarter of this year, striving to provide global users with participation opportunities. With its robust cash flow and innovative on-chain empowerment, Piggycell sets a new benchmark for the commercialization and decentralization of physical infrastructure. In the future, as the RWA market develops and application scenarios expand, Piggycell is undoubtedly worth continued attention and anticipation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。