Original Author: Thejaswini M A

Original Translation: Luffy, Foresight News

The birth of Exchange-Traded Funds (ETFs) stemmed from a crisis. On "Black Monday" in 1987, the Dow Jones Industrial Average plummeted over 20% in a single day. Regulators and market participants realized they needed more reliable investment tools. Mutual funds could only be traded after the market closed each day, leaving investors helpless during market panic.

ETFs emerged as a key solution to this problem. This "basket of securities" could be traded like individual stocks, providing instant liquidity during market turmoil.

ETFs simplified index investing, offering broad market exposure at low fee advantages. Their original design was "no intervention, highly transparent," tracking indices rather than attempting to outperform them. The first successful ETF launched in 1993—the S&P 500 Index ETF—became the largest fund globally with its promise of "precisely tracking the S&P 500."

The initial ETFs were purely a good idea. If you wanted to invest in "the entire stock market" but were unwilling to research individual stocks or pay high management fees for a fund manager, it was the optimal choice.

A Paradigm Shift: The Arrival of Memecoin ETFs

In September 2025, Wall Street crossed a new threshold: packaging Memecoins as regulated investment products and charging a 1.5% annual fee for it.

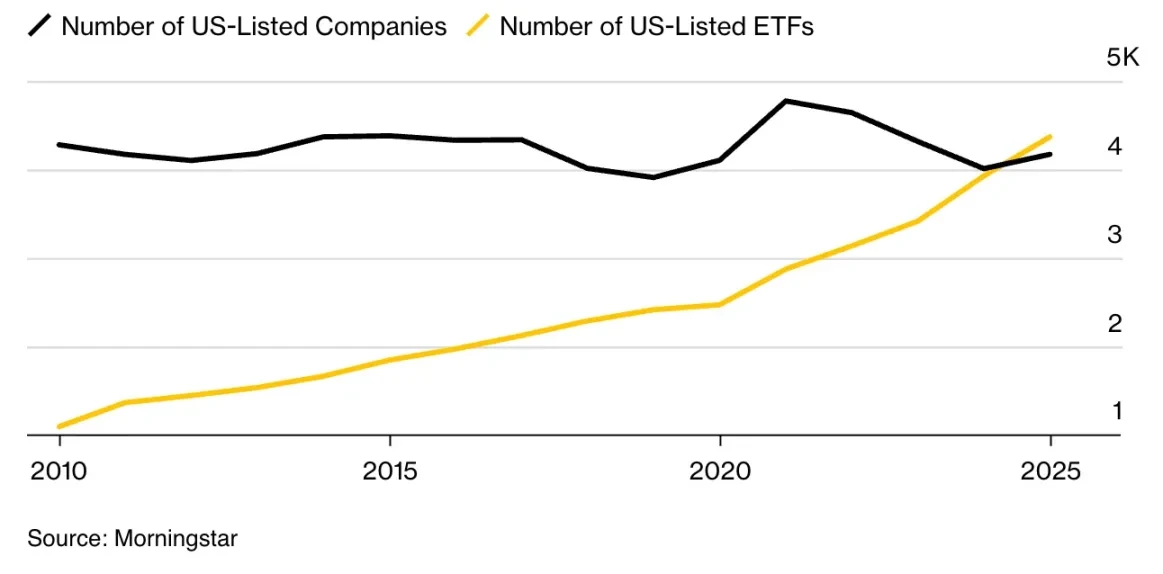

ETFs have evolved from "tools for simplifying investment" to "complex vehicles that can package any strategy." The methods of investing—combining, hedging, timing—are endless, but the number of investable companies is limited.

Today, the number of ETFs in the U.S. market has exceeded 4,300, while there are only about 4,200 publicly listed companies. The share of ETFs among all investment tools has risen from 9% a decade ago to 25%, marking the first time in market history that "the number of funds exceeds the number of stocks."

This has given rise to a fundamental problem: the surplus of choices has not empowered investors but rather paralyzed them. Today's funds cover every conceivable theme, trend, and even political stance, blurring the lines between serious long-term investment and entertainment-driven speculation, making it nearly impossible to distinguish between "products designed to accumulate wealth" and "products designed to ride the hype."

Wait… this anxiety completely misses the point; the Dogecoin ETF is not a distortion of the cryptocurrency mission.

For 15 years, cryptocurrencies have been questioned as "virtual currencies with no value backing." Traditional finance labels us as "speculators addicted to worthless tokens," asserting that we can never build anything real, gain institutional recognition, or deserve serious regulatory treatment.

And now, they are trying to extract value from our "joke-like assets."

The crypto industry has created a new category of value that traditional finance cannot ignore, cannot kill, and ultimately cannot stay out of. The fact that Dogecoin can have its own ETF before half of the Fortune 500 companies is the strongest proof of the dominance of cryptocurrency culture.

Alright, enough celebration; let's seriously examine the nature of this victory.

Why Would Anyone Pay a 1.5% Annual Fee for Something They Can "Buy for Free"?

The economic logic of the Memecoin ETF makes no sense to investors but is perfectly reasonable for Wall Street.

You can buy Dogecoin directly on Coinbase in just 5 minutes, with no ongoing fees; yet the REX-Osprey Dogecoin ETF offers the same exposure but charges a 1.5% annual fee. To put it in perspective, the fee for a Bitcoin ETF is only 0.25%. Why would anyone pay six times the cost for a Memecoin compared to "digital gold"?

The answer reveals the true target customers of such products. Bitcoin ETFs serve institutional investors and experienced wealth managers who need to comply with regulations but understand cryptocurrencies. They compete on fees because their clients have other options and know how to use them.

Memecoin ETFs, on the other hand, target retail investors who "saw Dogecoin on TikTok but don’t know how to buy it directly." What they are paying for is not market exposure but convenience and a stamp of legitimacy. These investors do not compare prices; they just want to click "buy" on the Robinhood App and get a taste of the Meme hype they often hear about.

The issuers are well aware of how absurd this is and know that customers could buy Dogecoin cheaper elsewhere. They are betting that most people won’t realize this or won’t want to bother with cryptocurrency exchanges and wallets. The 1.5% fee is essentially a tax on financial illiteracy, disguised as a facade of institutional legitimacy.

What Assets Deserve an ETF?

The traditional definition of an ETF is: "a regulated investment fund that holds a diversified portfolio of securities and trades on an exchange like a stock, providing broad market exposure while adhering to professional regulatory, custody standards, and transparent reporting mechanisms."

Classic models, such as ETFs tracking the S&P 500, hold hundreds of stocks across multiple sectors; even sector ETFs (like technology or healthcare) cover dozens of related stocks. They reduce risk through diversification while capturing market trends.

Now, consider the essence of Dogecoin: created in 2013 by copying Litecoin's code and adding a Meme dog logo, it was purely a cryptocurrency created for satire. It has no development team, no business plan, no revenue model, and no technological innovation; it has a fixed annual issuance of 5 billion tokens, deliberately designed as an inflationary model to mock Bitcoin's scarcity.

This token has no economic utility: it cannot be used to develop applications, cannot be staked for yield, and its only function is to exist as an internet Meme, occasionally pumped by celebrity tweets.

What Regulatory Loophole Created All This?

The path to the launch of this product exposes the real play of "financial innovation": technically compliant with legal texts but circumventing the regulatory spirit through regulatory arbitrage.

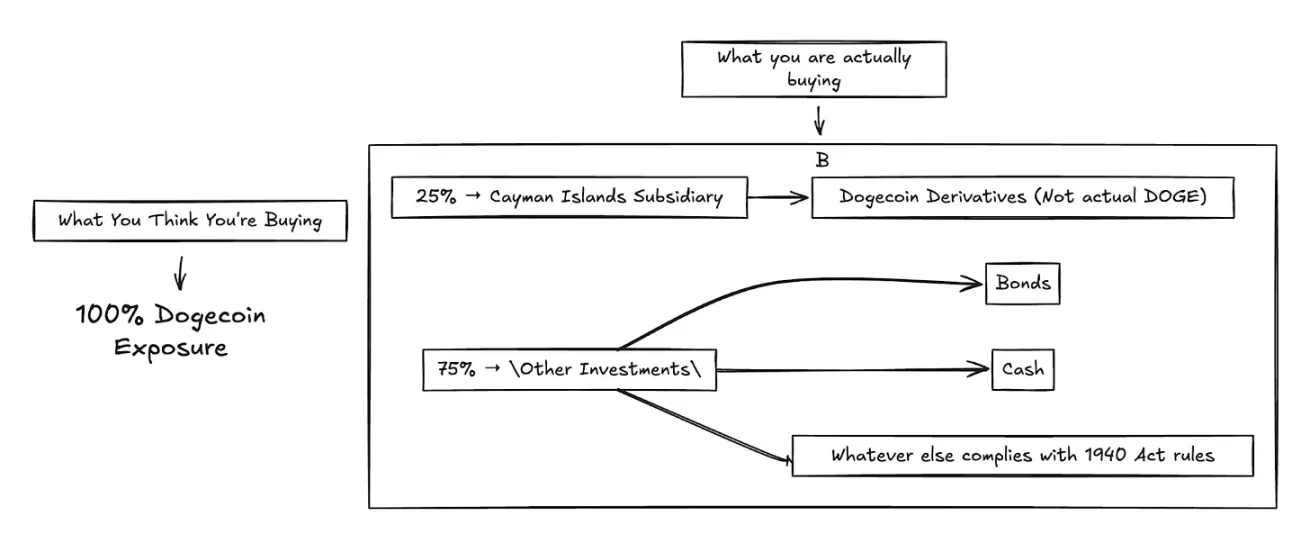

The REX-Osprey Dogecoin ETF (ticker: DOJE) was not listed under the 1933 Securities Act governing regulated commodity ETFs but instead used the framework of the 1940 Investment Company Act, a crucial choice. Under the 1940 Act, if the SEC does not object, the application will be automatically approved after 75 days, effectively a regulatory shortcut. But the problem is: this act was originally designed for "mutual funds that diversify investments across multiple assets," not for "speculative tools for a single Memecoin."

To meet the diversification requirement, DOJE cannot directly hold Dogecoin; instead, it gains exposure through derivatives via a Cayman Islands subsidiary, and the related holdings cannot exceed 25% of the assets. This results in an absurd outcome: a Dogecoin ETF can have at most 25% of its assets related to Dogecoin.

It fundamentally changes how investors actually purchase assets. ETFs that directly hold assets can accurately track prices, while using derivatives through offshore subsidiaries introduces tracking errors, counterparty risks, and complexities, leading to a disconnect between the fund's performance and the actual movement of Dogecoin.

This regulatory workaround also brings transparency issues: retail investors buying the Dogecoin ETF want direct exposure to the Meme hype on social platforms, but what they actually buy is a "complex derivatives portfolio": three-quarters of the investment has no relation to Dogecoin price movements, and returns will be diluted by the remaining 75% of the fund's holdings.

Worse still, this structure completely contradicts the protective intent of the 1940 Act. Congress established diversification rules to reduce risk through multi-asset allocation; yet Wall Street has exploited these rules to package high-risk speculation as a regulated product, evading the regulatory rigor that should have been in place. The regulatory framework not only fails to protect investors from risk but also uses "institutional legitimacy" to obscure new risks.

In contrast to Bitcoin ETFs, most Bitcoin ETFs (like ProShares BITO or Grayscale's spot Bitcoin ETF) use the 1933 Securities Act or other commodity fund frameworks, allowing direct exposure to Bitcoin (or through futures) without adhering to a 25% holding limit; they typically hold futures contracts directly or seek Bitcoin spot custody (once approved), allowing for more accurate tracking of Bitcoin prices.

The Dogecoin ETF represents a perfect storm of regulatory arbitrage. An ETF that "primarily does not invest in the underlying asset" holds an asset that "publicly claims to have no utility," listed under a 1940s act "originally designed to prevent such speculation." This is the most cynical manifestation of financial engineering, exploiting regulatory loopholes to create speculative products under the guise of investor protection.

Why the Obsession with Returns?

Wall Street no longer pretends to care about fundamentals but relentlessly chases returns, regardless of asset quality.

According to State Street Bank, the overweighting of stocks in institutional portfolios has reached its highest level since 2008. Investors are flocking to options income ETFs that promise monthly payouts, high-yield junk bonds, and cryptocurrency yield products that offer double-digit returns through derivatives.

Funds always chase returns first and ask questions later. When interest rates soared, investors decisively shifted from safe investment-grade bonds to high-yield corporate bonds; ETFs themed around AI, cryptocurrencies, and Meme assets are being launched at record speeds, catering to speculative demand rather than long-term value.

Risk appetite indicators are all in the green. Despite a macro environment full of uncertainty, the volatility index (VIX) remains low; after market volatility in early 2025, defensive sectors briefly attracted funds but quickly saw money flow back into high-risk, high-reward sectors like industrials, technology, and energy.

Wall Street has essentially concluded that in a world of unlimited liquidity and constant innovation, returns trump everything. As long as something can provide excess returns, investors will find reasons to buy, ignoring fundamentals or sustainability.

Are We Creating a Bubble?

What happens when the number of investment products exceeds the actual investable assets?

We have crossed the critical point of "more ETFs than stocks," marking a fundamental change in market structure. We are essentially "creating a synthetic market above the real market," with each layer adding fees, complexity, and potential failure points.

Matt Levine once pointed out: "As ETFs become more popular, technology reduces their implementation costs, and more previously customized trades will turn into standardized ETFs. The potential number of trading strategies far exceeds the number of stocks… In the long run, the potential market space for ETFs is limited by the infinite number of trading strategies, not the dwindling number of stocks."

The phenomenon of Memecoin ETFs accelerates this trend. Rex-Osprey has submitted applications for TRUMP Coin ETF and Bonk Coin ETF, along with traditional crypto asset ETFs like XRP and Solana; the SEC currently has 92 cryptocurrency ETF applications pending. The successful launch of each product generates demand for the next, regardless of whether the underlying asset has any real utility.

This is reminiscent of the subprime mortgage crisis in 2008: at that time, Wall Street repackaged derivatives into new derivatives until financial products became completely disconnected from the underlying assets; today, we are simply replacing "mortgages" with "attention and cultural phenomena."

The market appears to be more liquid than it actually is because multiple products are trading around the same underlying asset. However, when a crisis hits, these products will move in sync, and the so-called liquidity will evaporate in an instant.

What Does the Memecoin ETF Mean?

The deeper story is that finance has evolved into a "comprehensive attention-capturing mechanism," where anything that can trigger price fluctuations can be monetized.

The listing of ETFs reinforces itself through network effects. A month before DOJE's listing, Dogecoin's price rose 15% due to "expectations of institutional funds entering"; the price increase attracted more attention, which in turn generated more Memes, enhancing cultural influence, and providing legitimacy for more financial products, with success breeding imitation.

Traditional finance monetizes productive assets like factories, technology, and cash flow; modern finance can monetize anything that drives prices, such as narratives and Memes. The ETF wrapper transforms cultural speculation into institutional products, extracting fees from the communities that originally created these phenomena.

The more fundamental question is: is this innovation or plunder? Is the financialization of Memes creating new value, or is it merely extracting value from spontaneous cultural movements by layering institutional costs?

Internet culture has already created immense economic value: advertising revenue, peripheral sales, platform traffic, creator economies…

I have been pondering what drives the valuations of these companies to reach billions of dollars in 2025. Recently, I even ordered matcha from a coffee roastery in Bangalore; not because I liked the taste of this green powder, but because matcha has become a ritualistic symbol of "efficiency and serene luxury," making me feel like I am part of a global health aesthetic.

This is the state of internet culture: a series of "participation fees" disguised as lifestyle choices. Monetization opportunities are everywhere, ranging from the absurd to the cleverly innovative, encompassing all.

Take the hot topics of 2025 as an example. The "Kiss Cam" incident involving Coldplay turned an awkward moment between two people into a corporate resignation scandal, and Gwyneth Paltrow inexplicably became a "temporary spokesperson"; the entire internet erupted over "Can 100 men defeat a gorilla?"; the Labubu blind box craze turned a $30 collectible into "an identity symbol that people scramble for in stores."

Then there’s the language barrier I can never cross. Gen Z slang updates too quickly. Last week, someone said my outfit was "bussin," and I genuinely didn’t know whether to be angry or happy; clearly, it’s a compliment? My nephew tried to explain that "rizz" means "charisma," but then he started talking about words like "skibidi" and "Ohio," and I suddenly realized I was completely out of touch. Honestly, I’m trying to keep up, but every time I attempt to use these words correctly, I feel so cliché. It’s a total déjà vu of "millennials trying too hard," which is not the style I want.

Just minutes after the news of Taylor Swift and Travis Kelce's engagement broke, the entire marketing world pivoted: from Walmart to Lego to Starbucks, all brands immediately jumped on this hot topic.

The key is that this cultural momentum itself is an economic engine. When Katy Perry undertakes an 11-minute space flight, the internet debates it for a week; this attention can be converted into advertising revenue, brand exposure, and cultural capital, with dozens of monetization methods available; when a couple on TikTok makes "pookie" a trending word, a complete ecosystem of "pookie playlists and pookie merchandise" immediately emerges.

Internet culture creates immense economic value through creator economies, peripheral sales, and platform traffic, "capable of driving stock prices faster than earnings reports." If Elon Musk's tweet can add billions to Dogecoin's market cap, and if Tesla's valuation is more influenced by cultural momentum than fundamentals, then "cultural phenomena" are legitimate economic forces that deserve the same institutional packaging as other asset classes.

The ETF "wrapper" does not extract value from the community. It formalizes existing value, allowing those previously excluded to participate. Retired individuals in Ohio can now access internet culture through their 401(k) pensions without needing to learn about cryptocurrency wallets or browse Discord communities.

But on the flip side: this retired individual might also lose a significant portion of their retirement savings on "abandoned internet jokes." A mere 1.5% annual fee would consume $1,500 each year on a $100,000 investment. Moreover, due to regulatory requirements, the ETF can have at most 25% exposure related to Dogecoin, meaning this retiree might not even get the "cultural exposure" they wanted.

"Financial accessibility" without financial education is dangerous. Making speculative assets easier to purchase does not reduce their risks; it merely blinds those "who do not understand what they are buying" to the risks involved.

However, the financialization of Memes may strengthen communities rather than plunder them. When cultural movements receive institutional investment support, they gain stability and resources.

If internet culture can drive prices, it becomes an asset class; if social momentum can create volatility, it becomes a tradable asset. ETFs are merely vehicles that convert cultural energy into institutional products.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。