Original Author: Sleepy.txt

Original Editor: Kaori

Original Source: Dongcha Beating

On September 18, 2025, the Federal Reserve announced a 25 basis point cut in the federal funds rate to a range of 4.00% to 4.25%. For most industries, this is a signal of easing, indicating lower financing costs and more abundant liquidity.

However, for stablecoin issuers, this cut marks the official countdown to the end of the easy profit margin model.

The turning point of the high-interest rate era has arrived. Since March 2022, the Federal Reserve has raised interest rates 11 consecutive times, pushing rates to a peak of 5.25% to 5.50%. This high-interest rate period has opened an unprecedented profit window for stablecoin issuers.

Now, with inflation receding, growth stagnating, and monetary policy shifting, the golden phase of the stablecoin industry is also coming to an end.

Countdown to the End of the Profit Margin Model

The core profit logic of stablecoins is extremely simple and direct: users exchange dollars for equivalent tokens, and issuers invest this money in short-term U.S. Treasury bonds or money market funds, earning money from the interest margin.

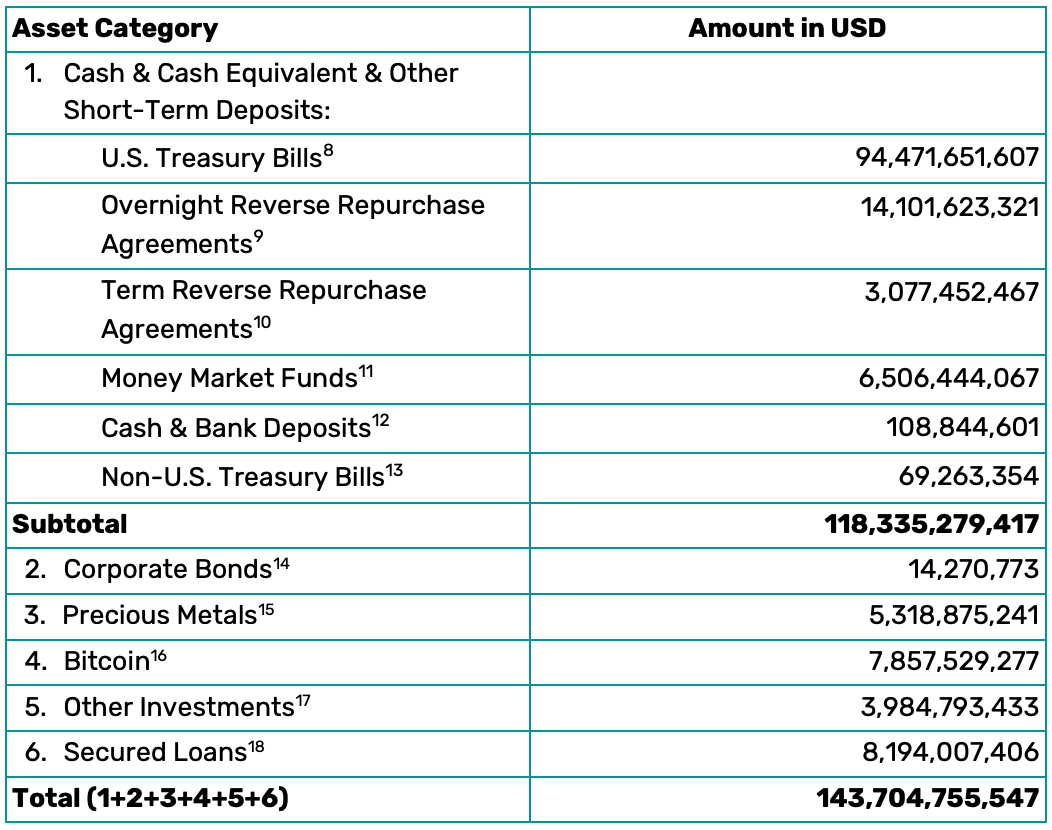

During the high-interest rate cycle, the returns from this model are astonishing. Tether is the most intuitive example, with its Q4 2024 reserve attestation report showing that the company's annual profit reached $13 billion, of which about $7 billion came from interest on Treasury bonds and repurchase agreements, accounting for more than half of total profits. It holds U.S. Treasury bonds worth as much as $90.87 billion, making up 82.5% of its total reserves.

Details of the reserves supporting the circulating fiat-valued Tether tokens | Source: Tether official attestation opinion and comprehensive reserve report

Another major stablecoin issuer, Circle, is in a similar situation. Although it has not disclosed the complete profit composition, from the reserve disclosures, Circle allocates about a quarter of its funds to short-term U.S. Treasury bonds, with the remainder primarily held in money market funds managed by BlackRock. When interest rates remain high, this is also a stable cash machine.

However, when interest rate cuts come, this profit margin will be the first to be reduced.

We can do a simple calculation. Taking Tether as an example, according to its Q2 2025 attestation report, the company's exposure to U.S. Treasury bonds has reached $127 billion. For every 25 basis point decrease in interest rates, its annual interest income will decrease by approximately $318 million.

If we follow the market's general expectation that the Federal Reserve will cut rates 2-3 more times, totaling a 75 basis point cut, Tether's annual income will decrease by approximately $953 million.

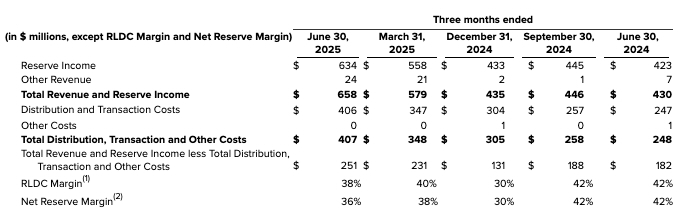

Circle's situation is equally sensitive. Its Q2 2025 financial report shows that the average circulation of USDC was $61 billion, with reserve income of $634 million. About 80% of the funds are allocated to short-term U.S. Treasury bonds. A 25 basis point cut means an annual income reduction of about $122 million; if the total cut reaches 75 basis points, the income decline will amount to $366 million.

The problem is that Circle's adjusted EBITDA for the quarter was only $126 million. Once the profit margin shrinks, it is likely to slide from profit to loss.

More critically, there is no symmetrical relationship between the loss of profit margins and the expansion of scale.

In theory, a rate cut will increase market risk appetite, leading to increased trading activity, and the circulation scale of stablecoins may also expand accordingly. However, the extent of this growth is far from enough to fill the gap left by the profit margin.

Taking Circle as an example, with the current fund size, a 25 basis point rate cut would reduce income by about $122 million. To make up for this loss, the management scale must increase by 6%, equivalent to an additional $3.7 billion. If the total cut reaches 75 basis points, Circle would need to expand by 21%, or an additional $12.6 billion, to maintain its current income level.

This asymmetry reveals the fundamental fragility of the profit margin model; once the high-interest rate environment fades, the dividend cycle of this track will also come to an end.

Greater pressure comes from the rise of dividend-paying stablecoins, as more and more institutions begin to launch products that can distribute dividends to users, cutting a portion of the profit margin that originally belonged to issuers.

This trend directly compresses the profit space of traditional stablecoins and forces issuers to accelerate the search for new business models.

From Money Market Funds to Global Financial Service Providers

After the profit margin model reaches its end, stablecoin issuers must undergo a fundamental transformation, shifting from money market fund-like operations to global financial service providers. The core idea is to shift the income focus from a single profit margin to broader and more sustainable financial services.

Several giants have already begun to take action, as they have always had keen instincts and have explored different paths. From these attempts, three distinct transformation directions can be observed.

Circle: The Didi of the Financial World

Circle is attempting a complete transformation, and its goal can be understood through an intuitive analogy: Didi.

Didi does not own cars but can connect drivers and passengers; similarly, the Circle Payment Network (CPN) does not directly handle funds but aims to weave together banks and financial institutions worldwide.

Traditional cross-border payments are like a travel market without Didi; you need to hail a cab on the street, not knowing when the driver will arrive, how much it will cost, or what problems you might encounter on the way. What CPN aims to do is provide a real-time scheduling system for global capital flows.

Circle co-founder Jeremy Allaire stated in an interview that they are "building one of the largest financial networks in history." Although this statement may sound somewhat exaggerated, it reflects Circle's ambition.

The design of CPN also has its clever aspects; since it does not directly hold funds, it does not need to apply for currency transmission licenses in every country. By positioning itself as a technology service provider, it can allocate more resources to product innovation rather than getting bogged down in compliance costs. With a light asset model and a heavy network focus, Circle can expand rapidly.

However, the core of the financial industry is trust. To gain recognition from traditional institutions, Circle has invited four global major banks—Santander, Deutsche Bank, Société Générale, and Standard Chartered—to serve as advisors. For CPN, these names serve as endorsements.

From a profit model perspective, Circle is shifting from earning profit margins to collecting tolls. For every transaction processed through CPN, Circle can charge network fees. This ties revenue to transaction volume rather than relying on interest rates. Even in a zero-interest-rate environment, as long as there is capital flow, there will be income.

However, this transformation story is still in its very early stages. CPN officially launched in May of this year, and currently, there are only four active payment channels. Although more than 100 financial institutions are waiting to connect, revenue remains limited so far. According to Circle's Q2 2025 financial report, the company's total revenue was $658 million, of which $634 million came from reserve interest, while other income (including CPN) was only $24 million, accounting for about 3.6%.

Source: Circle Q2 2025 Financial Report

In other words, while Circle's "toll" logic is clear, it will take time to truly support its valuation and stock price. Even under optimistic estimates, it may take 3 to 5 years for CPN to begin contributing revenue at scale. Until then, Circle still heavily relies on profit margins, and the impact of interest rate cuts remains an unavoidable challenge.

Looking further ahead, Circle is attempting to build a complete set of digital financial infrastructure. In addition to CPN, it is also developing programmable payments, digital identity, foreign exchange settlement, and other API services. According to market analysis, if Circle can attract 10,000 medium to large enterprise clients through these API services, each contributing $50,000 to $150,000 annually, this could bring Circle $500 million to $1.5 billion in annual revenue.

Currently, more than 30 fintech companies worldwide have joined this network, from Coins.ph in the Philippines to Flutterwave in Africa, from OpenPayd in Europe to dLocal in Latin America. Each additional node geometrically increases the value of the entire network.

This is the charm of the platform economy: significant upfront investment, but once network effects are established, a moat can be built.

Circle's transformation strategy reflects a profound business insight: in the digital age, the most scarce resource is not capital itself, but connection.

Tether: The Berkshire Hathaway of the Crypto World

If Buffett built his investment empire using the float of insurance companies, Tether is using the cash flow generated by stablecoins to lay out a cross-industry investment map, having started its "de-marginization" layout early.

Tether's strategy can be summarized in one word—reverse thinking.

Actively seeking new profit engines has allowed Tether to stand in a different position before the arrival of the interest rate cut cycle.

Tether's investment scope is broad, covering almost every imaginable field. Energy is one of the important sectors, with the company making significant bets on Bitcoin mining globally, aiming to form a closed loop. Bitcoin production requires mining, transactions require USDT, and the issuance of USDT creates new cash flow for Tether.

Gold is another core allocation for Tether, with the company holding $8.7 billion worth of physical gold in its reserves and investing over $200 million in Canadian gold mining companies. Tether CEO Paolo Ardoino even referred to gold as "the natural Bitcoin."

In traditional financial theory, the price of the dollar and gold often move inversely, while Tether, by holding both types of assets, effectively constructs a natural hedging portfolio. Regardless of the strength of the dollar, at least part of the assets can maintain their value.

What has surprised the outside world is Tether's involvement in commodity trade financing, a business that sounds quite "old-fashioned," yet has brought considerable returns to the company.

Tether uses its ample cash flow to provide short-term loans for raw material transportation. According to insiders, this business has reached billions of dollars in scale. As traditional banks are generally cautious or even avoid this market, Tether fills the gap and earns stable interest margin income.

From the perspective of investment portfolio theory, Tether's strategy aligns with Harry Markowitz's modern portfolio theory—do not put all your eggs in one basket.

By diversifying investments across different assets and industries, such as energy, gold, and commodity financing, Tether has significantly reduced its reliance on a single business. As a result, in Q2 2025, the company achieved a net profit of $4.9 billion, a substantial portion of which came from these diversified investments.

However, this strategy has also made Tether increasingly complex, making it difficult for outsiders to fully understand its operational logic.

Unlike Circle, which emphasizes a transparent operational approach, Tether's disclosures are often limited, deepening market concerns about the safety of its assets.

A deeper issue is that the core value of stablecoins lies in stability and transparency. When issuers diversify excessively, it raises questions about whether systemic risks will be introduced. If a significant loss occurs in one investment, will it affect the stability of USDT? These questions remain unresolved.

Even so, Tether's strategy still demonstrates a realistic judgment. In an industry full of uncertainties, planning ahead and diversifying risks is a form of survival wisdom.

Paxos: The Foxconn of the Stablecoin World

If Circle aims to be the Didi of the financial world and Tether is building the Berkshire Hathaway of the crypto world, then Paxos's role is more akin to Foxconn in the stablecoin world. Foxconn does not sell its own branded phones but manufactures for giants like Apple and Huawei; similarly, Paxos does not prioritize its own brand but provides a complete set of services for financial institutions to issue stablecoins.

This positioning shows resilience during the interest rate cut cycle. While Circle and Tether worry about shrinking profit margins, Paxos has long been accustomed to a revenue-sharing model with its clients. This seemingly disadvantageous arrangement actually builds a buffer for it.

Paxos's business philosophy can be summarized in one sentence: let professionals do professional things.

PayPal has 430 million users but lacks blockchain expertise; Standard Chartered has a global network but lacks stablecoin experience; Kraken understands cryptocurrencies but needs compliant stablecoin products. What Paxos aims to do is become the technical brain behind these giants.

In the traditional model, stablecoin issuers bear all the risks and costs of technology, market, and regulation themselves. Paxos's contract manufacturing model leaves market and brand risks to clients while keeping technology and compliance risks in-house.

PayPal's PYUSD is a typical case. If it chose to build its own team, it might take years and hundreds of millions of dollars in investment, along with navigating complex approvals. With Paxos, PayPal can launch its product in just a few months, focusing its energy on user education and scenario expansion.

Interestingly, Paxos is building a "Stablecoin Federation."

In November 2024, Paxos launched the Global Dollar Network, with its core product being the USDG stablecoin. This network has the support of several well-known institutions, including Kraken, Robinhood, and Galaxy Digital.

Standard Chartered has become a reserve management partner, responsible for cash and custody. The idea behind this "federation" is that stablecoins from different brands share the same infrastructure, achieving interoperability, just like different brands of Android phones can run the same applications.

This thinking reflects an evolution in business models. Paxos does not pursue a single scale but shifts towards efficiency and ecosystem co-construction. Its core competitiveness lies not in how many users it has but in how much value it can create for its partners.

Its revenue structure also confirms this philosophy, with technology licensing fees, compliance service fees, operational management fees, and reserve income sharing forming a diversified source of income. This allows it to maintain stable cash flow even in a declining interest rate environment.

Looking deeper, Paxos attempts to redefine "infrastructure."

Traditional financial infrastructure is a pipeline, responsible only for the flow of funds; Paxos's platform, on the other hand, simultaneously undertakes value creation and distribution. This shift from pipeline to platform may become the prototype for the stablecoin industry in the future.

Of course, this model also has weaknesses. As a behind-the-scenes player, Paxos finds it difficult to establish direct user recognition and brand awareness. However, in an era that emphasizes division of labor, this invisibility can be an advantage, as it can provide services to any potential client without being seen as a competitor.

The Future of Stablecoin Enterprises

The attempts of several stablecoin giants have outlined possible directions for the industry, as stablecoins are transitioning from a single value storage tool to a broader financial infrastructure.

The first direction is payment networks.

Stablecoins are gradually becoming a new generation of clearing channels, comparable to traditional networks like SWIFT and Visa. Compared to traditional systems, payment networks based on stablecoins can achieve 24/7 global fund settlement, becoming the underlying infrastructure for cross-border payments.

Traditional cross-border payments require multiple intermediaries, with each step adding time and cost; stablecoin payment networks allow direct connections between supply and demand for funds. Circle's CPN is a reflection of this trend, attempting to create a global real-time settlement system that enables financial institutions to bypass the agent bank model.

On this basis, stablecoin enterprises are expanding into broader financial services. They are beginning to approach banking services, offering lending, custody, and clearing services, using stablecoins as an entry point into traditional finance. With the help of smart contracts, these services can reduce operational costs while enhancing transparency and automation.

More importantly, stablecoins are entering corporate treasury and trade scenarios, providing multinational companies with treasury management, supply chain finance, and international settlement solutions. Thus, stablecoins are evolving from a transaction medium aimed at retail users to enterprise-level payment and financing tools.

Asset management is another direction.

In the past, reserves were almost entirely invested in U.S. Treasury bonds, which are safe but offer limited returns. In a declining interest rate environment, issuers are beginning to explore more diversified allocations, hoping to find a balance between transparency and yield. Tether's investments in gold and commodities reflect this exploration. By diversifying reserve portfolios, issuers aim to ensure stability while allowing reserves themselves to become new profit engines.

This means that stablecoin enterprises are no longer satisfied with a marginal role in the financial system. Their goal is to become the core infrastructure of the new financial system. However, whether this ambition can be realized depends on finding a prudent balance between technological innovation, regulatory compliance, and business models.

Reshuffling is Imminent; Survival of the Fittest

The implementation of interest rate cuts has fully revealed the fragility of the profit margin model. The profit-making method relying on interest margins is becoming ineffective, and the stablecoin industry is at the brink of a reshuffle. Whether enterprises can survive depends on the speed of updating their business models and whether the transformation is thorough enough.

For issuers, transformation often means making unpopular decisions in the short term, but these decisions are crucial for long-term survival. This requires both courage and the ability to judge future trends.

The focus of competition may shift from the size of issuance to the strength of service capabilities. Those who can truly turn stablecoins into a financial service platform, rather than merely staying at the level of token issuance, are more likely to establish a foothold in the new landscape.

From this perspective, the Federal Reserve's interest rate cuts are not just a monetary policy adjustment; for the stablecoin industry, it also serves as a stress test. Those enterprises that can withstand this round will occupy a more important position in the future financial landscape; meanwhile, companies still relying on a single profit margin model may find their business is indeed not as easy as it once was.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。