Whether it's PAX Gold or Tether Gold, which have reached historic highs in market capitalization, or the stock tokens that various platforms are gradually launching, Real World Assets (RWA) seem to be moving onto the blockchain at an unprecedented speed.

Especially as traditional finance (TradFi) institutions begin to place their bets, from the increasingly robust markets for gold tokens and U.S. stock tokens to the trillion-dollar forecasts from financial giants like BlackRock and Citigroup, and even Nasdaq's entry into the space, RWA is not only the next important narrative for DeFi but may also become a historic vehicle connecting crypto to the real world.

For this reason, before exploring this trend, we should perhaps return to the basics and answer a fundamental question:

Why does Web3 and Crypto urgently need RWA?

The Inevitable Breakthrough of DeFi

Since Compound and Uniswap ignited the DeFi summer in 2020, the entire crypto world has seen significant development, with the types and volumes of on-chain assets achieving rapid cold starts and exponential expansion in the native asset cycle.

According to DeFiLlama statistics, as of the time of writing, the total value locked (TVL) in DeFi across the network exceeds $160 billion, approaching the historical peak level of around $178 billion in November 2022.

Source: DeFiLlama

Within this billion-dollar empire, lending and staking protocols represented by Aave, MakerDAO, and Lido not only contribute a major share of funds but also become the key infrastructure upon which countless DeFi Lego protocols rely. It can be said that the vast majority of decentralized trading and derivatives protocols today are built on the credit systems of these underlying lending protocols.

In the early stages of DeFi development, the "internal cycle" of native assets was undoubtedly a highly ingenious design—it not only addressed the seed funding needs for ecological cold starts but also greatly stimulated various boundary-less innovations in the crypto world to enhance capital efficiency. However, the limitations of this "internal cycle" model have become increasingly apparent:

- First, there is the issue of asset homogeneity, with collateral highly concentrated in a few mainstream crypto assets, leading to high systemic risk. Once the prices of core assets fluctuate dramatically, it can easily trigger a chain liquidation;

- Second, there is the limitation of growth ceilings. The scale of DeFi is always constrained by the total market capitalization and volatility of the native crypto market, making it difficult to break through its dimensional wall;

In other words, relying solely on the internal cycle of native assets, DeFi has found it difficult to break through the ceiling. To introduce more stable value anchors, DeFi must look outward and focus on real-world assets.

It is against this backdrop that the narrative of RWA (Real World Assets) has emerged. RWA, short for Real World Assets, aims to bring real-world assets such as real estate, U.S. Treasury bonds, consumer credit, U.S. stocks, and artworks onto the blockchain through tokenization, in order to release liquidity and improve trading efficiency.

Objectively speaking, the current DeFi and Web3 markets still have a significant gap compared to traditional financial markets, but the emergence of RWA tokenization brings new hope for Web3 to enter the next trillion-dollar market.

This is also the necessary path for DeFi to transition from "internal cycles" to "external cycles," from native self-prosperity to mainstream adoption.

Fueling the Fire: RWA Practices from Gold to U.S. Stocks

Now that we have clarified the necessity of RWA, let's take a look at the current market situation— the RWA market is currently showing a vigorous momentum, with the most mature and typical representative being tokenized gold.

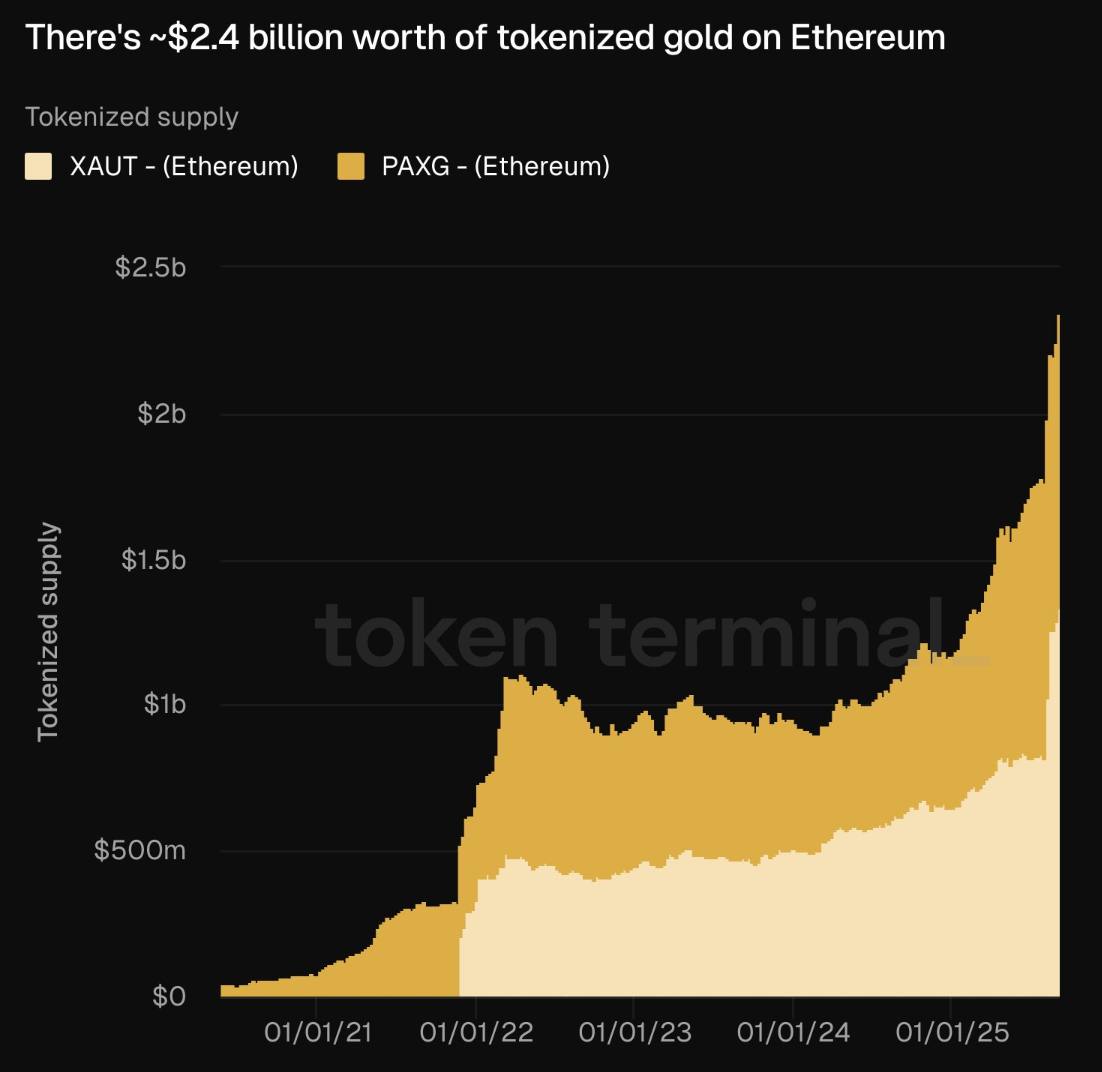

According to Token Terminal data, there is currently approximately $2.4 billion worth of tokenized gold (including XAUT and PAXG) on Ethereum. So far this year, the supply of tokenized gold has grown by about 100%, reflecting not only user demand for on-chain safe-haven assets but also proving the feasibility of the RWA model.

Source: Token Terminal

What is even more noteworthy is that traditional financial authorities are also beginning to accelerate their layout in RWA tokenization.

According to the Financial Times, the World Gold Council (WGC) is actively seeking to launch an officially recognized digital form of gold, stating, "We are trying to establish a standardized digital layer for gold so that various financial products used in other markets can also be applied to the gold market." This move could fundamentally change the physical gold market in London, which is worth $900 billion.

Of course, objectively speaking, compared to the $231 billion gold ETF market and the estimated $27.4 trillion total market value of physical gold, tokenized gold is indeed just getting started, but precisely because of this, its future growth potential is immeasurable.

In addition, tokenizing mainstream financial assets such as U.S. Treasury bonds and U.S. stocks is becoming one of the hottest directions in the RWA space. Leading projects like Ondo Finance have successfully brought the yields of short-term U.S. Treasury bonds onto the blockchain, providing crypto users with a compliant and stable source of income.

Tokenizing U.S. stocks has also become a recent trend, offering global users a 24/7 unobstructed channel to participate in the value growth of top global companies. From Ondo Finance to Robinhood to MyStonks, more and more institutions are bringing popular stocks like Apple and Tesla onto the blockchain, injecting richer asset types into the DeFi ecosystem.

Currently, mainstream Web3 wallets are also beginning to integrate tokenized U.S. stocks and gold as RWA assets. For example, imToken now supports holding and managing stock tokens provided by Ondo Finance, such as Apple (AAPL) and Tesla (TSLA), with the token value anchored to its underlying assets and co-custodied by top financial institutions like J.P. Morgan to ensure compliance and security of the assets.

Whether it's the booming gold tokens or the poised stock tokens, RWA is no longer an experimental fringe but is stepping into the spotlight as a mainstream narrative.

RWA, the Historic Vehicle of Crypto

From a data perspective, the RWA narrative is undoubtedly the clearest Alpha direction for "blockchain+" in the next decade.

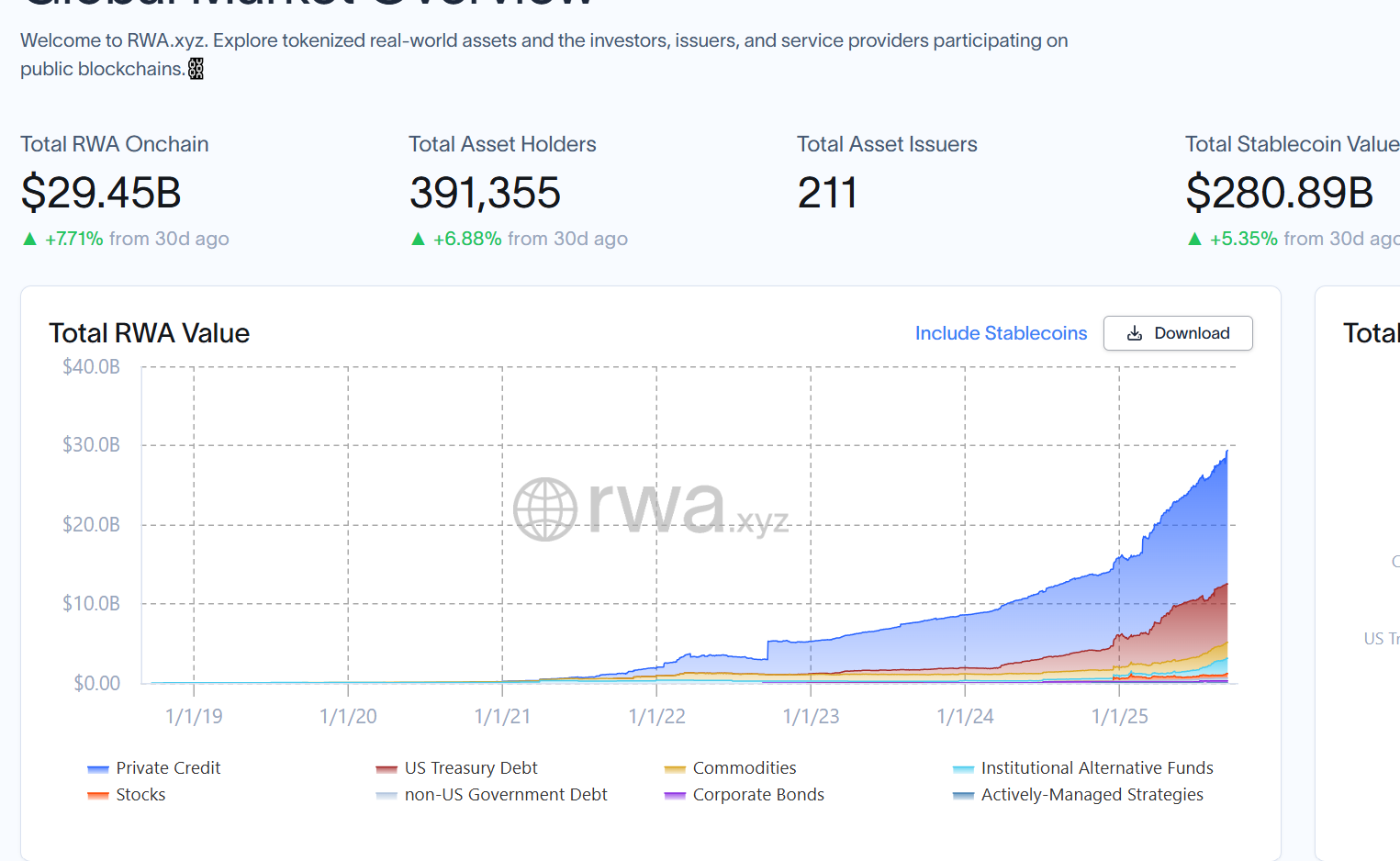

RWA research platform rwa.xyz reports that the total market size of RWA is nearly $30 billion, with BlackRock predicting that the market value of tokenized assets will reach $10 trillion by 2030.

In other words, in the next seven years, the potential growth space of the RWA narrative could exceed 300 times.

These numbers are not baseless; they are based on a simple fact: the total value of global real-world assets (real estate, stocks, bonds, credit, etc.) is worth trillions of dollars. Even if only a tiny portion is tokenized, it will bring an unprecedented flood of value to the blockchain world.

Source: rwa.xyz

In this transformation of capital flow, Ethereum is undoubtedly the core battleground— from technological maturity, asset security, to the completeness of the DeFi protocol ecosystem, it far surpasses other public chains. For this reason, Ethereum co-founder Joseph Lubin even stated that RWA will be one of the biggest engines driving the growth of the Ethereum ecosystem in the next decade.

It can be said that from the tokenization of U.S. Treasury bonds (like Ondo Finance) to on-chain financing of private credit (like Centrifuge), various RWA projects are blossoming.

The true significance of RWA goes far beyond simple asset tokenization; it marks the emergence of a financial paradigm shift that may simultaneously reshape the underlying structures of both DeFi and traditional finance:

- For DeFi: RWA introduces stable, low-correlation, and cash-flow-generating high-quality collateral. This not only fundamentally addresses the systemic risks of DeFi's "internal cycle" but also brings unprecedented asset diversity and market depth;

- For traditional finance: RWA can "activate" illiquid assets such as real estate and private equity, achieving ownership fragmentation and efficient circulation through tokenization, greatly improving capital efficiency and creating entirely new markets;

- For the entire ecosystem: Ethereum, as the absolute main battleground of this revolution, is evolving into a "global unified settlement layer";

Essentially, RWA represents a narrative of "incremental capital," which not only provides DeFi with more stable, low-correlation high-quality collateral but also signifies the first true handshake between the blockchain world and the real financial system.

In the next decade, RWA may become a decisive turning point for Crypto to enter the real economy and achieve mainstream adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。