Written by: Yokiiiya

Many people have this question: Why does something built on a "decentralized" blockchain become so "centralized" and require strict regulation?

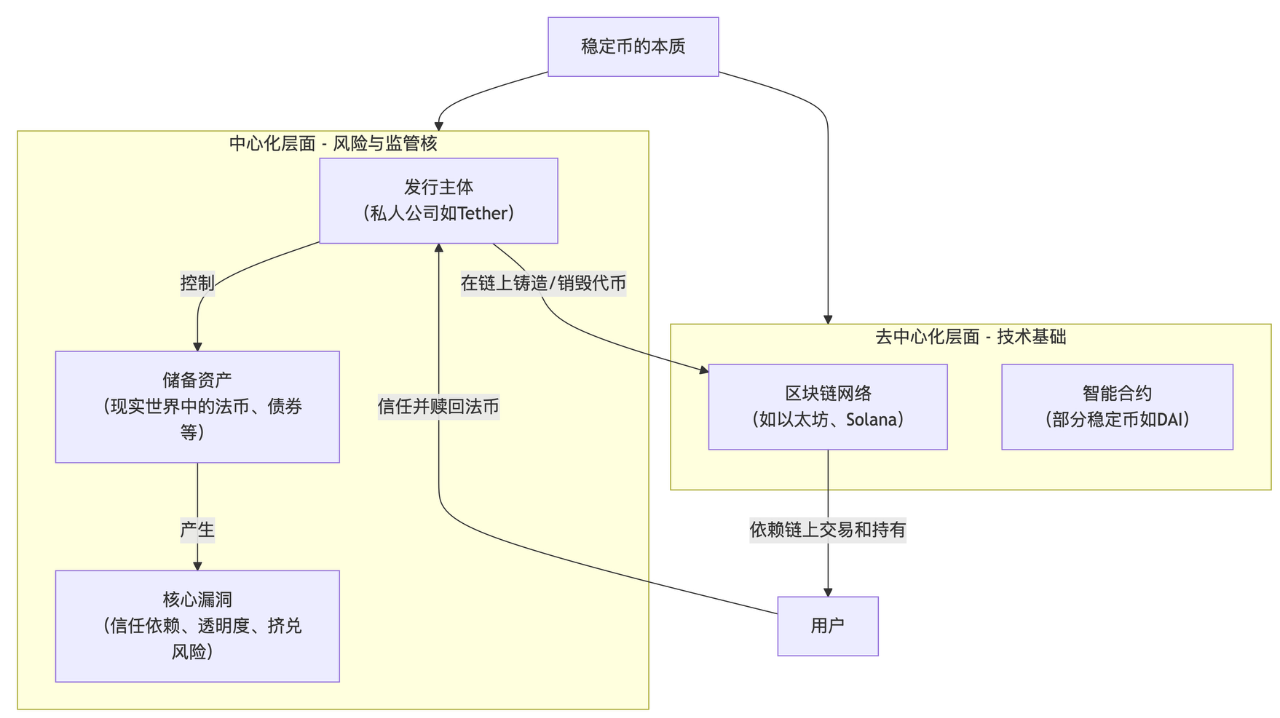

In simple terms, the answer is: Stablecoins are decentralized at the "transaction settlement" level, but highly centralized at the "issuance and endorsement" level. It is this centralization characteristic that brings risks and vulnerabilities that must be regulated.

A Hybrid of Centralization and Decentralization

1.1 Where is the "decentralization" of stablecoins reflected? — Transaction and Settlement Layer

Stablecoins operate on blockchains (such as Ethereum, Solana). This means:

- Peer-to-peer transactions: You can send stablecoins directly to anyone in the world without going through any bank or central authority.

- Transaction records are maintained and verified by a decentralized network of nodes, making them difficult to tamper with.

- Operates 24/7, not limited by the business hours of traditional banking systems.

At this level, it indeed inherits the decentralized characteristics of blockchain.

1.2 Where is the "centralization" reflected? — Issuance and Endorsement Layer

The reason stablecoins have "stability" is not because of the code, but because there is some centralized entity behind them that promises their value. This is the core of regulation.

You are not trusting the code, but companies like Tether and Circle.

1.2.1 Fiat-Collateralized (USDT, USDC, etc.): This is the most centralized model.

- A clearly defined issuing company (e.g., Tether issues USDT, Circle issues USDC).

- These companies promise that for every USDT issued, there is 1 dollar of reserve assets (or equivalent short-term government bonds, etc.) in their bank accounts to back it.

You need to trust this company:

- Is it really holding 1 dollar for every USDT issued? (Transparency and audit risk)

- Are the assets it holds safe? Are they cash or higher-risk corporate bonds? (Quality risk of reserve assets)

- When you want to exchange stablecoins back to real dollars, will it pay on time? (Redemption risk)

1.2.2 Crypto-Asset Collateralized (e.g., DAI): Relatively decentralized, but still has centralized components.

- It is generated automatically through smart contracts by users over-collateralizing other crypto assets (like ETH), without a centralized company saying "I will endorse it."

- However, its collateral includes a large amount of centralized stablecoins like USDC, which makes DAI indirectly dependent on the health of centralized entities.

1.2.3 Algorithmic Stablecoins: Attempting to be completely decentralized, but has been almost disproven.

- No collateral assets, relying entirely on algorithms and market arbitrage mechanisms to maintain the peg.

- Once the market loses confidence (like the UST/Luna incident), it can fall into a "death spiral" and collapse instantly.

Conclusion:

Except for a few experimental projects, the "credit" of current mainstream stablecoins (which account for over 99% of the market share) comes from centralized issuing entities and the real-world assets they hold.

Core Vulnerabilities Brought by Centralization

It is precisely because of this centralization characteristic that stablecoins inherently have the following fatal vulnerabilities, which are the underlying logic of regulation:

2.1 Vulnerability One: Trust Dependency and Transparency Risk (Black Box of Reserve Assets)

- Logic: Users believe 1 USDT = 1 dollar based on trust in the Tether company. But if Tether does not hold enough reserves, or if the quality of the assets it holds is poor (for example, using commercial paper), or even makes false statements, then USDT would be worthless.

- Historical Case: Tether long concealed the fact that it lacked sufficient reserve assets and reached a settlement with the New York Attorney General's office, paying a hefty fine. This is a typical precursor to a "bank run"; if everyone demands redemption at the same time, the system will collapse.

2.2 Vulnerability Two: Redemption Risk and Financial Contagion Risk

- Logic: Issuers, in pursuit of profits, do not keep all their money in cash in the bank; they will purchase assets like U.S. Treasury bonds. While these assets are safe, they take time to liquidate.

- If a sudden large-scale redemption occurs, the issuer will have to sell Treasury bonds in the market to obtain cash.

- Massive sell-offs could disrupt traditional financial markets, drive up interest rates, and even trigger a liquidity crisis. This is like a "financial bomb" hidden in the crypto world, whose explosion could affect the traditional financial system (banks, funds, ordinary businesses).

This is why central banks like the Federal Reserve place great importance on stablecoin regulation, as it has "systemic importance."

2.3 Vulnerability Three: Illegal Activities and Sanction Evasion

- Logic: The pseudo-anonymity and global nature of blockchain, combined with the value stability of stablecoins, make them a "perfect tool" for money laundering, fraud, terrorist financing, and evading international sanctions.

- Regulatory Role: Enforcing issuers to implement strict KYC (Know Your Customer), AML (Anti-Money Laundering), and KYT (Know Your Transaction) procedures can effectively cut off illegal fund flows and protect the security of the financial system.

2.4 Vulnerability Four: Monopoly and Abuse of Market Power

- Logic: USDT and USDC have formed a duopoly. Their massive scale means:

- They can unilaterally freeze the assets of any address (for example, at the request of law enforcement). This gives centralized issuers immense power.

- Their decisions (such as which blockchains to support, adjusting reserve asset allocations) can have a significant impact on the entire crypto ecosystem.

Core of Regulation

The core logic of stablecoin regulation lies in its "systemic importance." It plays the role of a "medium of exchange," "measure of value," and "safe haven" in the cryptocurrency ecosystem. Its importance is mainly reflected in:

- Foundation of the Crypto Ecosystem: The vast majority of cryptocurrency transactions are denominated in stablecoins and serve as a safe haven during market volatility.

- Innovation in Global Payments and Remittances: Provides low-cost, high-speed cross-border payment solutions, enhancing financial inclusion.

- The Lifeblood of DeFi: It is the core underlying asset for activities like lending and trading in decentralized finance protocols.

- Catalyst for the Digital Transformation of Traditional Finance: It is the core settlement tool for the tokenization of real-world assets (RWA).

Priorities of Stablecoin Regulation Motivations and Policy Responses

1. Prevent Systemic Financial Risks (Highest Priority)

- Redemption Risk: If market panic triggers large-scale redemptions, issuing institutions may be forced to sell reserve assets (like U.S. Treasury bonds), which could affect the stability of traditional financial markets.

- Risk Transmission: The collapse of a major stablecoin could trigger large-scale liquidations of on-chain DeFi protocols like a domino effect, quickly spreading to traditional financial markets such as stocks and bonds through institutional investors, potentially triggering a global liquidity crisis.

Block Illegal Financial Activities: The global nature, quasi-anonymity, and peer-to-peer transmission characteristics of stablecoins make them easy to use for money laundering, terrorist financing, and evading sanctions. In 2023, the estimated scale of illegal transactions involving stablecoins reached $12 billion. Without strict KYC, KYT, and sanction screening compliance requirements, serious social and security issues could arise.

Maintain Monetary Sovereignty and Financial Stability: When dollar stablecoins issued by private companies are widely adopted in overseas markets, it creates a phenomenon of "shadow dollarization," which undermines the monetary sovereignty and effectiveness of monetary policy of other countries. For the issuing country itself (like the U.S.), if unregulated stablecoins are widely used for payments, their potential redemption risks could also threaten domestic financial stability.

Protect Consumer and Investor Rights: Early stablecoins frequently faced issues regarding the transparency of reserve assets. For example, Tether (USDT) was revealed in 2019 to be only 74% backed by real assets. Regulatory requirements for 100% adequate and high-liquidity reserve assets, regular audits, full disclosure, and granting stablecoin holders priority in repayment in the event of issuer bankruptcy are all aimed at protecting the interests of holders.

Comparison of Global Major Stablecoin Regulatory Innovation Solutions

Summary: The Underlying Logic of Regulation

The core logic of regulation is not aimed at the "blockchain" decentralized technology itself, but at the essential "centralized entity" in the issuance and endorsement process of stablecoins and the significant externality risks it may cause.

The future trend will be the continuous refinement of regulatory frameworks and the deep integration of compliance technologies.

The development of stablecoins is no longer a "barbaric growth" adventure, but a process of gradually integrating into the mainstream financial system under clear rules. For practitioners, compliance is no longer an option but a prerequisite for survival and development; for users, these changes mean a safer and more reliable digital financial environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。