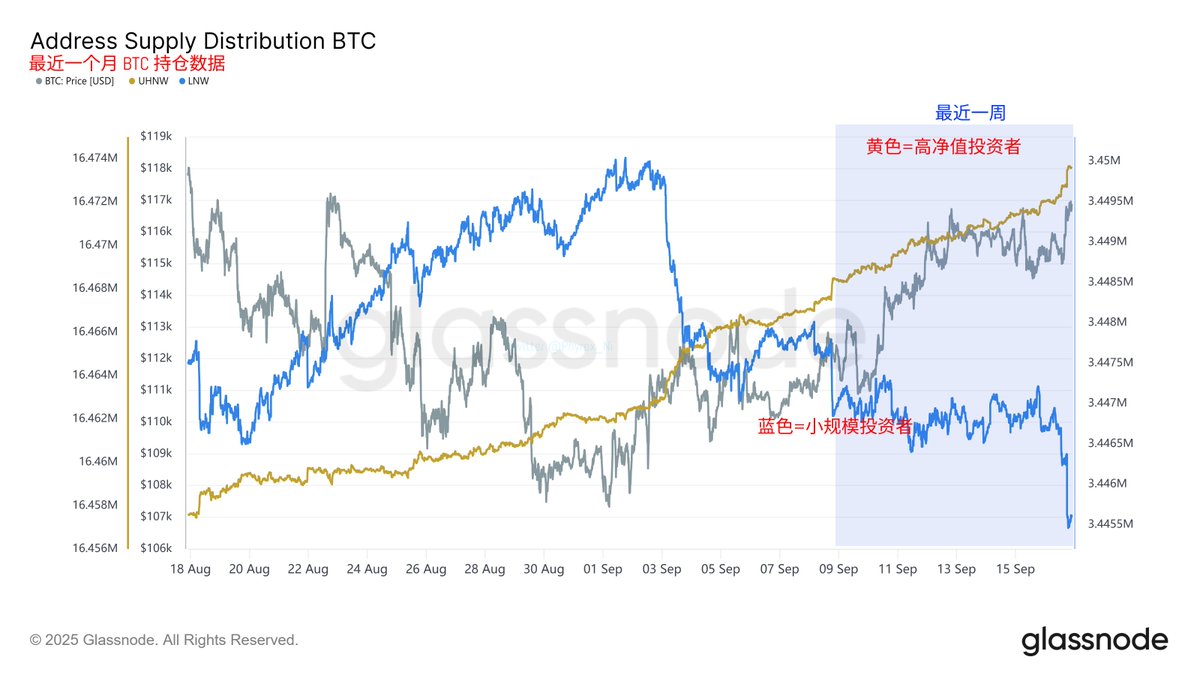

Next is the data on user position distribution. Last week, we observed that high-net-worth investors holding more than 10 BTC were increasing their positions, while small-scale investors holding less than 10 BTC were reducing theirs. This trend has become even more pronounced now; as the price of BTC rises, small-scale investors are experiencing a larger scale of reduction in their holdings.

It is unclear whether this is due to unfavorable expectations regarding interest rate cuts or if they are preparing to exchange BTC for other investment assets. Overall, high-net-worth investors are still resolutely increasing their positions. Currently, high-net-worth investors hold over 16.473 million BTC, while small-scale investors hold only 3.445 million BTC.

The data clearly shows that more BTC is flowing into the hands of high-net-worth investors, while small-scale investors hold BTC mainly for short-term profits. Therefore, as the price of BTC increases, their holdings tend to decrease.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。