CoinW Research Institute

Key Points

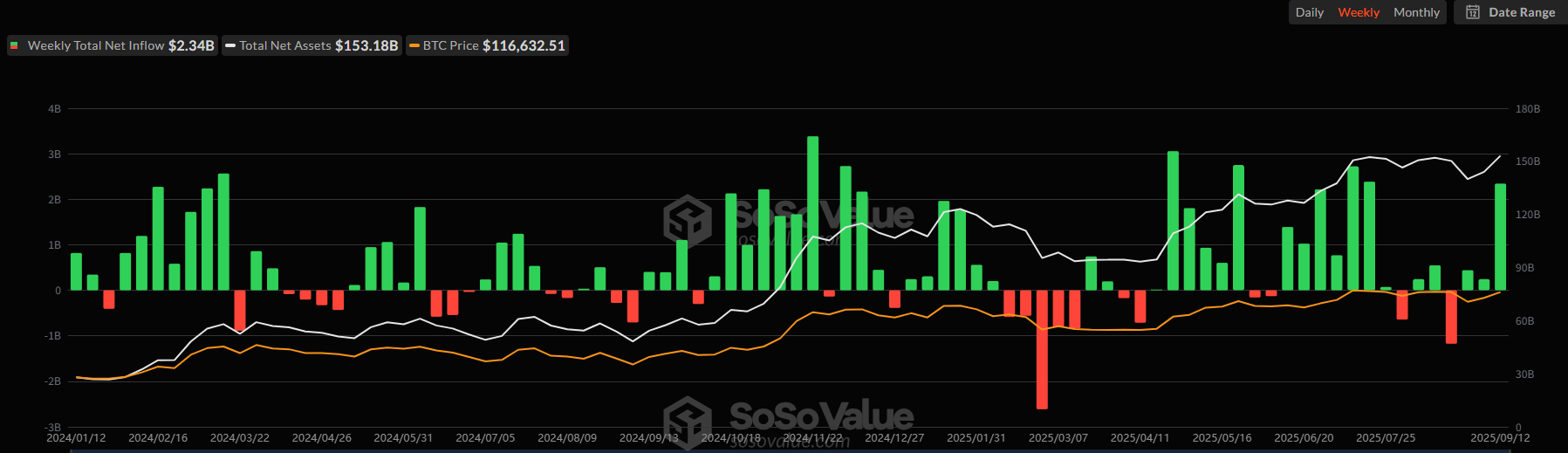

The total market capitalization of cryptocurrencies is $4.13 trillion, up from $4.06 trillion last week, with a weekly increase of 1.72%. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $56.83 billion, with a net inflow of $2.34 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $13.36 billion, with a net inflow of $638 million this week.

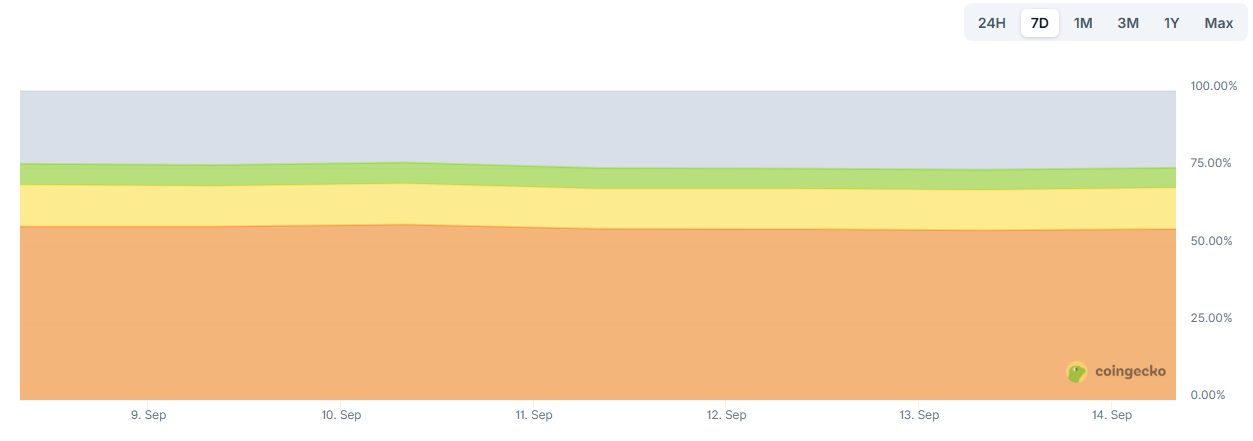

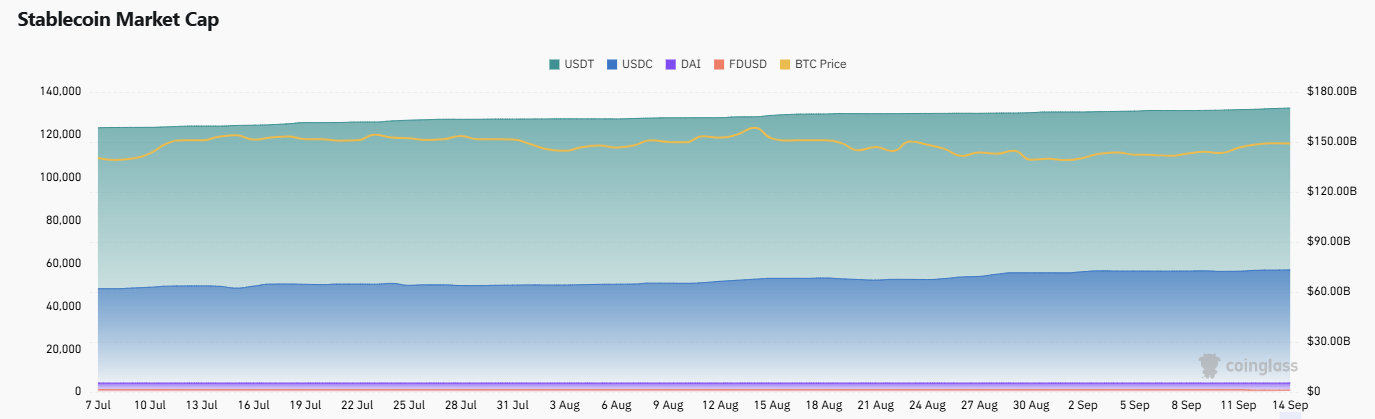

The total market capitalization of stablecoins is $293 billion, with USDT's market cap at $170.3 billion, accounting for 58.12% of the total stablecoin market cap; followed by USDC with a market cap of $73.21 billion, accounting for 24.99% of the total stablecoin market cap; and DAI with a market cap of $5.36 billion, accounting for 1.83% of the total stablecoin market cap.

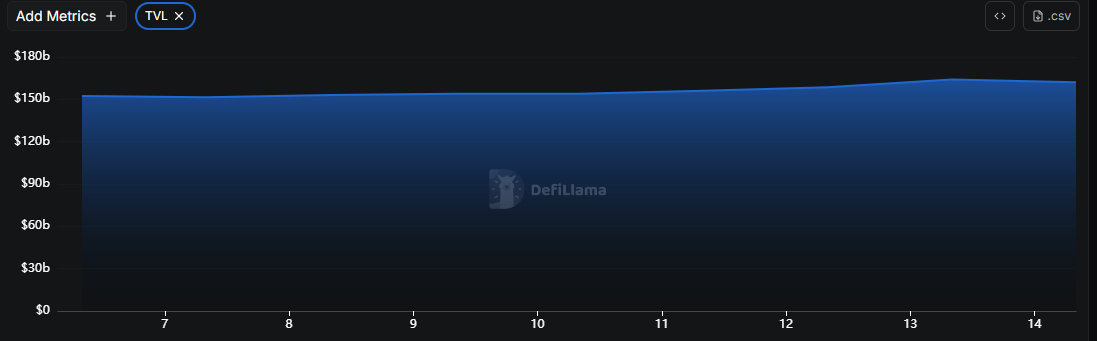

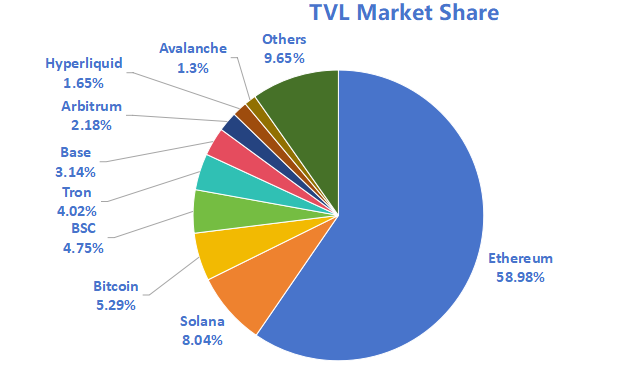

According to DeFiLlama, the total TVL of DeFi this week is $162.1 billion, up from $152.1 billion last week, with a weekly increase of 6.57%. By public chain, the top three chains by TVL are Ethereum at 59.98%; Solana at 8.04%; and Bitcoin at 5.29%.

On-chain data shows that the daily transaction volume of various public chains has generally increased this week, with Sui showing the most significant increase of 157.89% compared to last week, followed by Toncoin at 89.39%, Ethereum at 40.29%, Solana at 35.95%, BNBChain at 8.85%, and Aptos at 58.73%. In terms of transaction fees, aside from Ethereum increasing by 100% and Solana by 60%, other public chains showed little change; regarding daily active addresses, this week, except for Toncoin and Sui which saw a decline, all other public chains showed an upward trend, with Solana up 34.21%, Ethereum up 10.35%, BNBChain up 9.86%, and Aptos up 6.05%. In terms of TVL, except for Toncoin which decreased by 2.78% compared to last week, all other public chains showed an upward trend, with Solana up 12.95%, Ethereum up 4.48%, Sui up 5.61%, Aptos up 6.76%, and BNBChain up 2.40%.

Innovative projects of interest: Project0 is a universal, on-chain, permissionless multi-location unified margin protocol; Aerospace is a prediction market trading terminal aimed at providing users with a platform to participate in and trade various prediction markets; Bitty is a peer-to-pool lending platform based on Ethereum and Bitcoin, allowing users to borrow against NFTs and tokens.

Table of Contents

Key Points

I. Market Overview

Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Increase This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

The total market capitalization of cryptocurrencies is $4.13 trillion, up from $4.06 trillion last week, with a weekly increase of 1.72%.

Data Source: cryptorank

As of the time of writing, Bitcoin's market cap is $2.3 trillion, accounting for 55.56% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $293 billion, accounting for 7.09% of the total cryptocurrency market cap.

Data Source: coingeck

2. Fear Index

The cryptocurrency fear index is 52, indicating a neutral sentiment.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $56.83 billion, with a net inflow of $2.34 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $13.36 billion, with a net inflow of $638 million this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

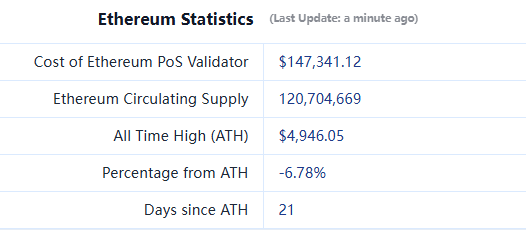

ETHUSD: Current price $4,605, historical highest price $4,946, down approximately 6.78% from the highest price.

ETHBTC: Currently at 0.040014, historical highest at 0.1238.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $162.1 billion, up from $152.1 billion last week, with a weekly increase of 6.57%.

Data Source: defillama

By public chain, the top three chains by TVL are Ethereum at 59.98%; Solana at 8.04%; and Bitcoin at 5.29%.

Data Source: CoinW Research Institute, defillama

Data as of September 14, 2025

6. On-Chain Data

Layer 1 Related Data

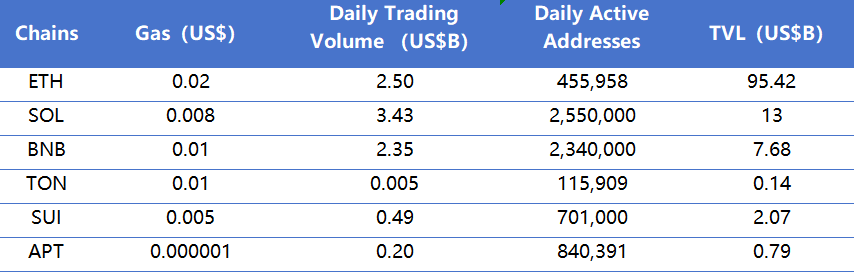

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily transaction volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of September 14, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, the daily transaction volume of various public chains has generally shown an upward trend, with Sui showing the most significant increase of 157.89% compared to last week, followed by Toncoin at 89.39%, Ethereum at 40.29%, Solana at 35.95%, BNBChain at 8.85%, and Aptos at 58.73%. In terms of transaction fees, aside from Ethereum increasing by 100% and Solana by 60%, other public chains showed little change.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of user trust in the platform. From the perspective of daily active addresses, this week, except for Toncoin and Sui which saw a decline, all other public chains showed an upward trend, with Solana up 34.21%, Ethereum up 10.35%, BNBChain up 9.86%, and Aptos up 6.05%. In terms of TVL, except for Toncoin which decreased by 2.78% compared to last week, all other public chains showed an upward trend, with Solana up 12.95%, Ethereum up 4.48%, Sui up 5.61%, Aptos up 6.76%, and BNBChain up 2.40%.

Layer 2 Related Data

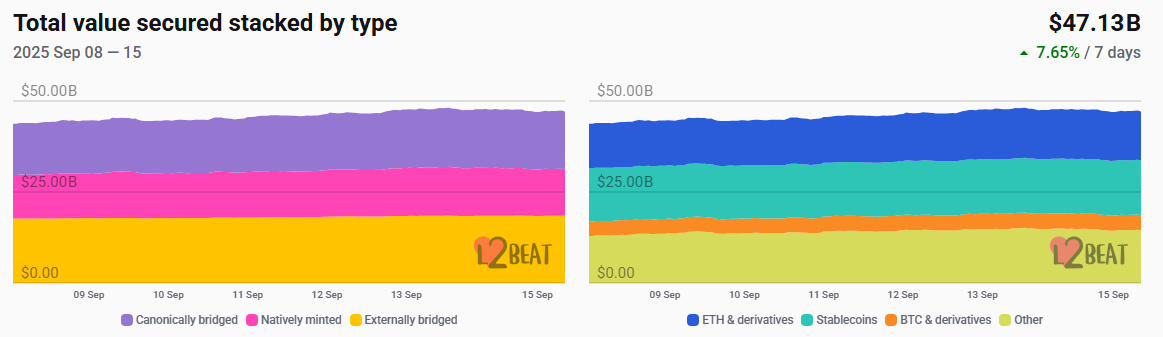

● According to L2Beat, the total TVL of Ethereum Layer 2 is $47.13 billion, up from $43.24 billion last week, with an overall increase of 7.65%.

Data Source: L2Beat

Data as of September 14, 2025

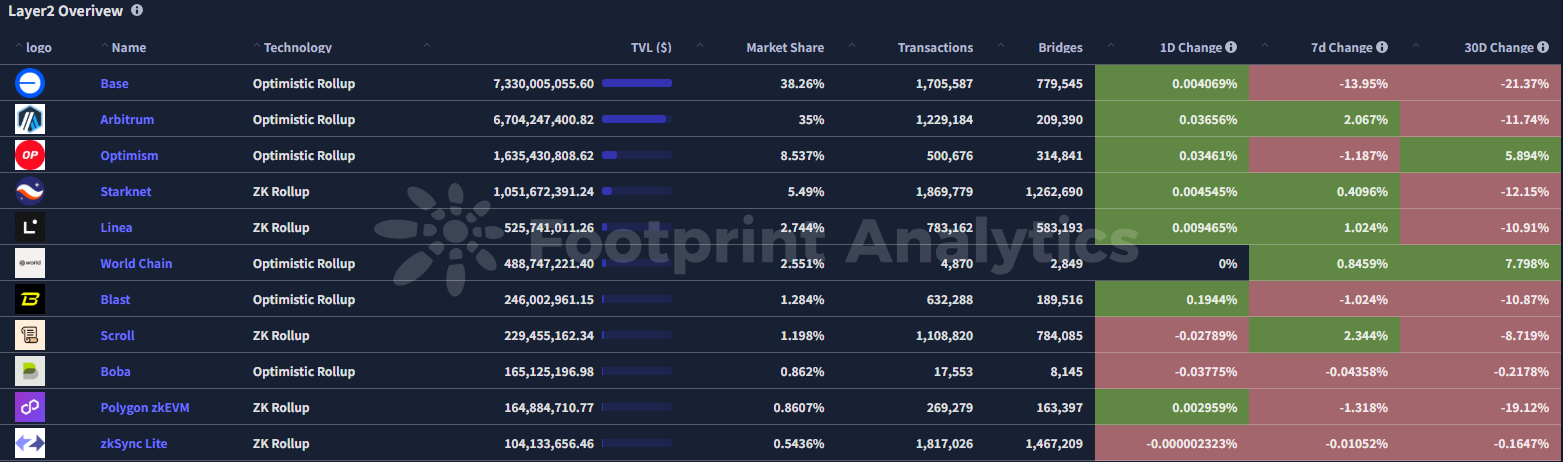

- Base and Arbitrum occupy the top positions with market shares of 38.26% and 35%, respectively, with Base still ranking first in Ethereum Layer 2 TVL this week.

_Data Source: _footprint_

Data as of September 14, 2025

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $293 billion. Among them, USDT has a market cap of $170.3 billion, accounting for 58.12% of the total stablecoin market cap; followed by USDC with a market cap of $73.21 billion, accounting for 24.99% of the total stablecoin market cap; and DAI with a market cap of $5.36 billion, accounting for 1.83% of the total stablecoin market cap.

Data Source: CoinW Research Institute, Coinglass

Data as of September 14, 2025

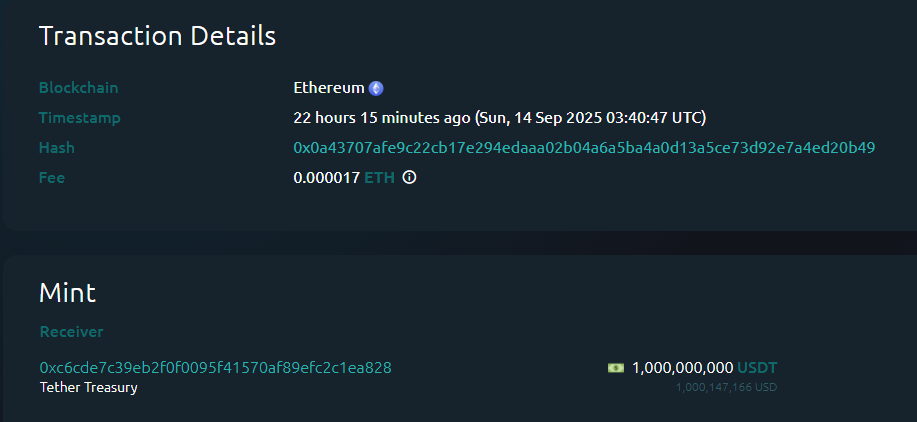

According to Whale Alert data, this week the USDC Treasury has issued a total of 2.4 billion USDC, and the Tether Treasury has issued a total of 2 billion USDT, with a total issuance of stablecoins this week amounting to 4.4 billion, up from 3.244 billion last week, representing an increase of approximately 35.64% in stablecoin issuance this week.

Data Source: Whale Alert

Data as of September 14, 2025

II. This Week's Hot Money Trends

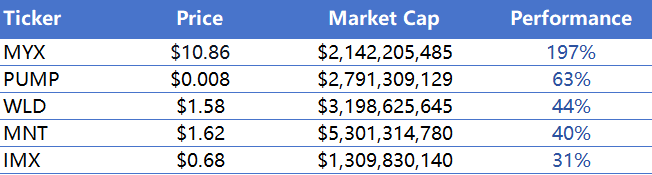

1. Top Five VC Coins and Meme Coins by Increase This Week

The top five VC coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of September 14, 2025

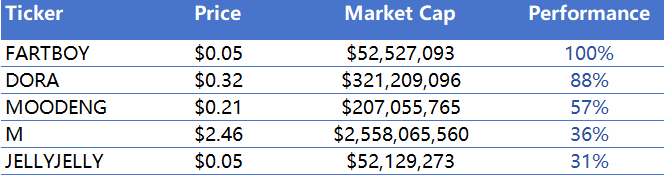

The top five Meme coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of September 14, 2025

2. New Project Insights

Project 0 is a universal, on-chain, permissionless multi-location unified margin protocol. As a decentralized, trustless prime broker, Project 0 helps users efficiently manage their entire DeFi portfolio by providing unified margin and risk management, eliminating inefficiencies in capital usage.

Aerospace is a prediction market trading terminal aimed at providing users with a platform to participate in and trade various prediction markets. This project is based on the Solana ecosystem and supports real-time trading, allowing users to invest and trade on the outcomes of future events.

Bitty is a peer-to-pool lending platform based on Ethereum and Bitcoin, allowing users to borrow against NFTs and tokens. Bitty enables users to participate in auctions and earn rewards within the Web3 ecosystem.

III. Industry News

1. Major Industry Events This Week

The OpenMind application has been launched for iOS and Android. Starting from September 10, the official will accept users on the waiting list to participate in the points activity for Season 1 every week.

Black Mirror announced that the first phase of the TGE airdrop distribution for MIRROR has been completed, with the initial 10% unlock completed. The lock-up and unlock portal will be launched soon, where users can access the remaining allocation, choose unlock preferences, and lock tokens.

Aster announced the opening of ASTER token airdrop queries, covering over 137,000 wallets.

Holoworld AI has launched the HOLO token staking feature, allowing users to stake to start earning Holo points in advance.

The AI automated asset market OWNAI announced that it will allocate 0.8% of the upcoming OAN token supply to its creators and the Kaito ecosystem, with 75% of the bonus pool allocated to the top 2000 creators on the leaderboard, and the remaining 25% allocated to the Kaito ecosystem.

2. Major Upcoming Events Next Week

OpenSea announced the launch of the new OpenSea Mobile app, integrating an AI-native trading experience, supporting multi-chain wallet, token, and NFT one-stop management. The platform will simultaneously launch the Flagship Collection, investing over a million dollars to acquire historical and emerging NFTs. Starting September 15, 50% of the platform fees will be used for the final reward phase before the TGE, allowing users to enhance treasure chest levels through trading, tasks, etc., to receive higher rewards. The OpenSea Foundation will announce the $SEA token TGE details in early October.

The decentralized trading platform Aster announced that the TGE for ASTER will be held on September 17, during which 7.04 million ASTER tokens will be airdropped to eligible users participating in the reward program. Additionally, the second phase of the Aster Genesis event has been launched, allowing users to earn Rh points through trading on Aster Pro, with points calculated weekly based on multiple dimensions, including trading volume, holding time, asset holdings, and team recommendations.

The DeFi protocol Resolv announced that the second quarter airdrop snapshot was taken on September 9. Points will be calculated retroactively, and users do not need to take any action. Claims will be open from September 19 to October 19. Rewards will be distributed in the form of stRESOLV, a transferable staking token that can accumulate value and enhance throughout the ecosystem. The second quarter has ended, and the next quarter will automatically begin with updated terms. The duration is from September 9, 2025, to December 9, 2025, with allocations accounting for 3% of the total token supply.

The ZK interoperability Layer1 Union announced that its mainnet is now live, and the U Drop airdrop is open for claims, with a deadline of September 18. Union combines consensus validation with zero-knowledge encryption to achieve interoperability, aiming to connect all chains, all virtual machines, and all ecosystems.

The Solana ecosystem liquidity protocol Meteora announced that it will conduct its TGE in October and has entered TGE preparation mode, aiming to complete TGE preparations as soon as possible.

3. Important Investments and Financing from Last Week

Inversion completed a seed financing round totaling $26.5 million, with investors including Dragonfly, Lightspeed Venture, ParaFi Capital, and others. Inversion is a blockchain platform based on Avalanche, dedicated to providing private equity solutions for traditional enterprises through cryptographic technology, helping them reduce costs, improve operational efficiency, and connect traditional industries with modern financial innovations. (September 8, 2025)

Gemini completed a $50 million private financing round and plans to go public on NASDAQ through an IPO, raising up to $317 million. Gemini is a digital asset exchange and custody service company, dedicated to providing users with cryptocurrency buying, selling, and storage services. As a highly compliant centralized trading platform, Gemini offers a secure digital asset trading experience for global users. (September 9, 2025)

Forward Industries completed a $1.65 billion private financing round, with investors including Galaxy Digital, Multicoin Capital, Jump Crypto, and others. Forward Industries (NASDAQ: FORD) is a global innovative design company focused on providing end-to-end services from product concept design to global supply chain logistics for leading enterprises worldwide, covering product design, manufacturing, procurement, and distribution. (September 11, 2025)

Reference Links:

Project 0, https://x.com/0dotxyz

Aerospace, https://x.com/aerospacetrade

Bitty, https://x.com/bitty_io

Inversion, https://x.com/inversion_cap

Gemini, https://x.com/gemini

Forward Industries, https://forwardindustries.com/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。